The growing popularity of cycling as a sport also contributes significantly to the market's expansion. As more individuals engage in cycling for fitness and leisure, particularly mountain biking and road cycling, the demand for specialized lighting solutions increases. For instance, mountain bicycles often require high-powered lights capable of illuminating trails under challenging conditions.

Cycling events play a significant role in driving the growth of the market by fostering increased participation in cycling and raising awareness about safety and visibility. These events, ranging from local races to international competitions, not only encourage cycling as a sport but also highlight the importance of equipping bicycles with proper lighting systems. As more cyclists participate in these events, the demand for high-quality bicycle lights rises, contributing to market expansion.

One of the primary impacts of cycling events is the promotion of safety standards among participants. Many organized cycling events require riders to use appropriate lighting, especially during early morning or evening rides when visibility is low. This requirement has led to an increased adoption of bicycle lights as participants seek to comply with safety regulations and enhance their visibility on the road. For instance, events like the Tour de France and various charity rides often emphasize the necessity of using lights, thereby influencing consumer behavior and driving sales in the market.

Moreover, cycling events often serve as platforms for manufacturers to showcase their latest products, including advanced lighting technologies. Companies frequently use these events to launch new models or innovative features, such as integrated smart technology that enhances visibility and safety. The exposure gained during these events can significantly boost brand recognition and consumer interest in specific lighting products. For example, brands like Garmin have introduced products like rearview radar-activated taillights during major cycling events, capitalizing on the attention these gatherings bring.

The rise of cycling tourism is another aspect where cycling events contribute to the growth of the bicycle lights industry. Events that attract tourists, such as scenic bike tours or multi-day cycling festivals, create a demand for high-quality lighting solutions among participants who may not be familiar with local riding conditions. According to statistics from the European Parliament, approximately 2.3 billion cycle tourism trips are planned annually in Europe, which underscores the potential market for bicycle lights tailored for tourists seeking enhanced safety during their rides.

Another key driver is the increasing adoption of electric bicycles (e-bikes), which are often equipped with integrated lighting systems. The surge in e-bike sales is linked to their convenience as an alternative mode of transportation amid growing urban congestion. In countries like China and Germany, where traffic congestion is a significant concern, more people are opting for bicycles as a practical solution for commuting. This trend not only boosts sales of e-bikes but also drives demand for compatible lighting systems.

Advancements in technology have led to the development of more efficient and durable lighting options, such as LED lights. These lights offer better visibility while being energy-efficient and rechargeable, appealing to environmentally conscious consumers. The shift towards lightweight and compact designs aligns with consumer preferences for modern bicycles, further enhancing the appeal of advanced bicycle lighting solutions. As urban mobility continues to evolve towards sustainable practices, the market is well-positioned for ongoing growth driven by these multifaceted applications and trends.

One of the primary challenges is the lack of infrastructure in many regions, particularly in developing countries. Poorly maintained roads, inadequate bike lanes, and insufficient lighting in urban areas can deter cyclists from riding at night or in low-light conditions, which directly impacts the demand for bicycle lights. Without a supportive infrastructure that encourages safe cycling practices, the adoption of bicycle lights may remain limited, restricting market growth.

Another challenge is the varying regulations regarding bicycle lighting across different regions. While some countries have stringent laws mandating the use of lights on bicycles, others lack clear regulations, leading to inconsistencies in market demand. For instance, in the U.S. and UK, regulations require specific types of lights for nighttime riding, while other regions may not have such requirements. This inconsistency can create confusion among consumers and manufacturers alike, potentially stifling innovation and investment in bicycle lighting solutions. Manufacturers may hesitate to introduce advanced products if they are unsure about the regulatory landscape in various markets.

Finally, competition from alternative lighting solutions poses a challenge for the bike lights industry. As technology evolves, cyclists may opt for multifunctional devices that combine lighting with other features such as GPS navigation or fitness tracking. This trend could divert attention from traditional bicycle lights, especially among tech-savvy consumers who prioritize multifunctionality over specific lighting needs. In addition, the rise of smart technology and IoT devices could lead to a preference for integrated systems rather than standalone bicycle lights, further complicating market dynamics.

Global Bicycle Lights Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, the analyst has segmented the global bicycle lights market report based on bicycle type, voltage, mounting type and region:Bicycle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Conventional

- E-Bicycle

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

- Up to 12V

- 36V

- 48V

Mounting Type Outlook (Revenue, USD Million, 2018 - 2030)

- Headlight

- Taillight

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Central & South America

- Brazil

- Middle East & Africa

- South Africa

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Trek Bicycle Corporation

- Knog

- Lupine Lighting Systems

- Princeton Tec

- Dinotte Lighting

- Garmin

- Lezyne

- Kryptonite

- Cygolite

- BBB Cycling

- Cateye Co., Ltd.

- Gaciron Technology

- Lord Benex International Co., Ltd.

- NiteRider Technical Lighting Systems

- Blackburn

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | November 2024 |

| Forecast Period | 2023 - 2030 |

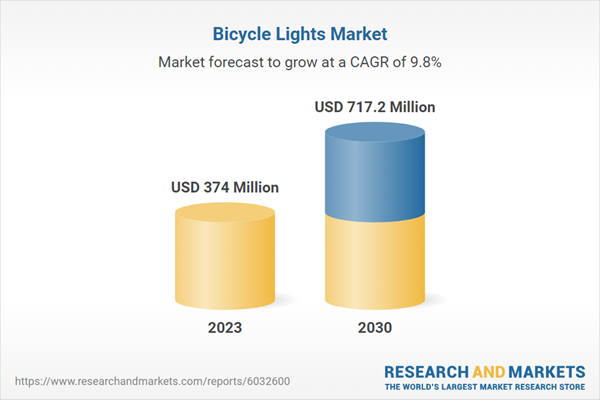

| Estimated Market Value ( USD | $ 374 Million |

| Forecasted Market Value ( USD | $ 717.2 Million |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |