The retail industry has been a key adopter of cloud logistics solutions due to the increasing demand for efficient inventory management, order fulfilment, and real-time supply chain visibility. The growth of e-commerce and the need for faster, more reliable deliveries have made cloud-based logistics services an essential part of the retail sector. Retailers use cloud logistics to streamline operations, optimize distribution networks, and improve customer satisfaction by ensuring faster and more accurate deliveries. Additionally, cloud solutions enable retailers to scale operations and adapt to shifting consumer demands in an increasingly competitive market. Thus, In 2023, the retail segment registered 23% revenue share in the market.

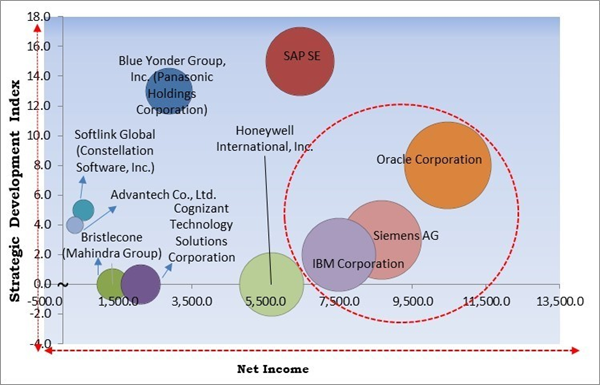

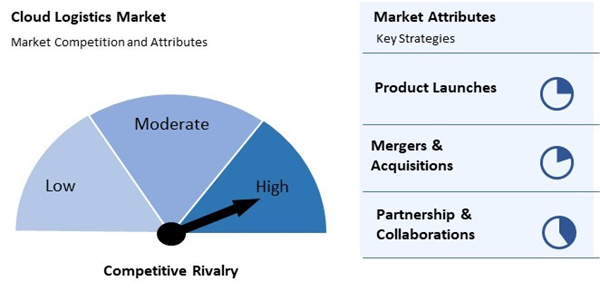

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2024, Blue Yonder Group, Inc. announced the partnership with Avon, a logistics technology firm to integrate AI into its supply chain, enhancing agility and sustainability. We're excited to support Avon's digital transformation, reflecting our shared values of inclusion, women empowerment, and equity. This partnership ensures Avon stays adaptable and competitive in a dynamic market. Additionally, In January, 2024, Softlink Global teamed up with Coimbatore Marine College, a maritime education and training company to integrate advanced industry tools and practices into their logistics education. This collaboration marks a major shift, emphasizing the need for academic programs to align with the evolving demands of the logistics sector.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Oracle Corporation, IBM Corporation, and Siemens AG are the forerunners in the Cloud Logistics Market. Companies such as Blue Yonder Group, Inc. SAP SE Honeywell International, Inc. are some of the key innovators in Cloud Logistics Market. In February, 2023, Oracle Corporation teamed up with Uber Technologies to boost Uber's innovation, market products, and profitability. The collaboration will leverage Oracle's advanced cloud technology and security to enhance Uber's global logistics and retail operations. Oracle will also become a key Uber for Business client.Market Growth Factors

The logistics industry increasingly adopts cloud-based solutions to streamline operations and improve efficiency. Cloud technology provides logistics companies with scalable, flexible inventory management and route optimization platforms. Logistics companies can manage large volumes of data from various sources in real time, reducing manual processes and errors.Additionally, Real-time data access and analytics have become crucial for modern supply chain management, driving the growth of cloud logistics solutions. Cloud platforms provide logistics companies with immediate access to vast amounts of data, enabling them to track shipments, monitor inventory levels, and adjust routes on the fly. Hence, the rising demand for real-time data access and analytics in supply chain management is propelling the market's growth.

Market Restraining Factors

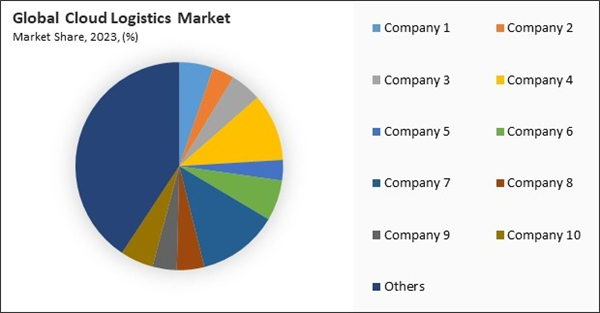

While cloud logistics solutions provide long-term benefits, the initial investment and operational costs can be significant. Small and medium-sized logistics companies may find the upfront expenses of cloud software, infrastructure upgrades, and system integration prohibitive. The transition from traditional systems to cloud platforms requires financial resources for deployment, staff training, and maintenance, which may be challenging for companies with limited budgets. Thus, cloud logistics solutions' high initial investment and operational costs hamper the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Increased adoption of cloud-based solutions in logistics for streamlined operations

- Rising demand for real-time data access and analytics in supply chain management

- Expansion of e-commerce and growth in online retail driving logistics efficiency

Restraints

- High Initial Investment and Operational Costs of Cloud Logistics Solutions

- Concerns over data security and privacy in cloud-based logistics platforms

Opportunities

- Government regulations and initiatives encouraging digitalization of the logistics sector

- Increase in cross-border trade and global supply chain integration

Challenges

- Potential downtime and service disruptions in cloud platforms

- Uncertainty regarding long-term vendor stability and cloud service pricing

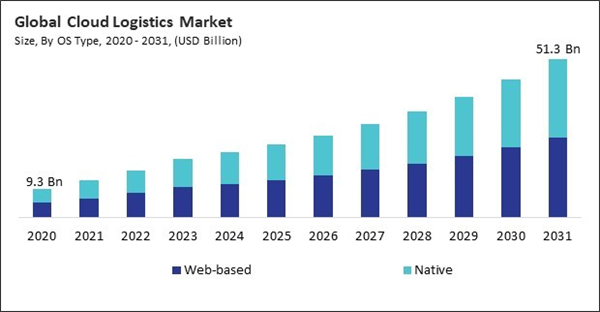

OS Type Outlook

Based on OS type, the market is divided into web-based and native. The native segment held 48% revenue share in the market in 2023. Native cloud solutions are typically built specifically for the cloud environment and often provide more tailored, integrated features for logistics management.Enterprise Size Outlook

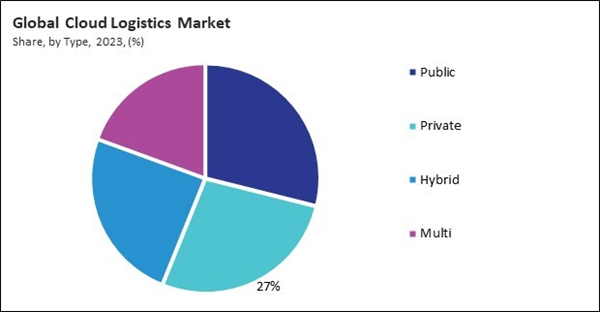

On the basis of enterprise size, the market is segmented into large enterprises and SMEs. In 2023, the SMEs segment attained 34% revenue share in the market. Small and medium-sized enterprises (SMEs) gradually embrace cloud logistics solutions to improve their supply chain efficiency despite having fewer resources than large enterprises.Type Outlook

Based on type, the market is categorized into public, private, hybrid, and multi. In 2023, the public segment registered 29% revenue share in the cloud logistics market. Public cloud solutions are widely adopted for their cost-effectiveness, scalability, and flexibility.Industrial Vertical Outlook

By Industry Vertical, the market is divided into retail, healthcare, food & beverage, consumer electronics, automotive, and others. In 2023, the food & beverage segment held 17% revenue share in the market. The food and beverage industry is highly dependent on efficient logistics to ensure the timely and safe delivery of products, particularly perishable ones.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 28% revenue share in the market in 2023. The Asia Pacific region is seeing rapid growth in cloud logistics adoption, driven by the expanding e-commerce sector, manufacturing industries, and the need for efficient supply chain solutions in countries like China, India, and Japan.Market Competition and Attributes

The market is highly competitive, driven by the rising adoption of digital technologies and the demand for streamlined supply chain management. Key attributes include scalability, real-time visibility, and seamless integration with existing systems. Providers focus on offering flexible, cost-effective solutions that enhance operational efficiency and decision-making. Advanced analytics, IoT connectivity, and AI-powered automation are significant differentiators. The competition intensifies as businesses prioritize sustainability and agility, leveraging cloud-based platforms to optimize resource usage and adapt to dynamic market conditions.

Recent Strategies Deployed in the Market

- Aug-2024: Blue Yonder Group, Inc. announced the acquisition of One Network Enterprises, a digital supply chain platform Company. This deal enables Blue Yonder’s customers to seamlessly collaborate and share real-time data, including inventory and materials movement, across their entire supply chain network.

- Jul-2024: Blue Yonder Group, Inc. announced the partnership with Avon, a logistics technology firm to integrate AI into its supply chain, enhancing agility and sustainability. We're excited to support Avon's digital transformation, reflecting our shared values of inclusion, women empowerment, and equity. This partnership ensures Avon stays adaptable and competitive in a dynamic market.

- Jun-2024: SAP SE announced the acquisition of WalkMe Ltd., a digital adoption platform. This acquisition strengthens SAP's commitment to enhancing user support, enabling faster adoption of new solutions and features, and maximizing the value of IT investments for end users.

- Apr-2024: SAP SE unveiled AI advancements in its supply chain solutions, enhancing productivity, efficiency, and precision in manufacturing. AI-driven real-time insights will optimize supply chain decisions, streamline product development, and boost manufacturing efficiency. Enhanced machine data and AI visual inspection will significantly improve quality through automation.

- Apr-2024: Advantech Co., Ltd. teamed up with Phison (8299TT), a top provider of NAND controllers and storage solutions, to create GenAI computing platforms for edge and industrial use. This collaboration supports global industries in deploying intelligent applications, enhancing smart factories, healthcare, and logistics with advanced GenAI solutions.

List of Key Companies Profiled

- Cognizant Technology Solutions Corporation

- Softlink Global (Constellation Software, Inc.)

- Blue Yonder Group, Inc. (Panasonic Holdings Corporation)

- SAP SE

- Advantech Co., Ltd.

- Oracle Corporation

- IBM Corporation

- Siemens AG

- Bristlecone (Mahindra Group)

- Honeywell International, Inc.

Market Report Segmentation

By OS Type

- Web-based

- Native

By Enterprise Size

- Large Enterprises

- SMEs

By Type

- Public

- Private

- Hybrid

- Multi

By Industry Vertical

- Retail

- Healthcare

- Food & Beverage

- Consumer Electronics

- Automotive

- Other Industry Vertical

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Cognizant Technology Solutions Corporation

- Softlink Global (Constellation Software, Inc.)

- Blue Yonder Group, Inc. (Panasonic Holdings Corporation)

- SAP SE

- Advantech Co., Ltd.

- Oracle Corporation

- IBM Corporation

- Siemens AG

- Bristlecone (Mahindra Group)

- Honeywell International, Inc.