This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Some of the major tasks carried out by this system is baggage sortation, baggage counting, weight checking, balance loading, screening baggage for security purposes and transportation of baggage with the help of conveyors and destination coded vehicles (DCV) by reading information present on the bag. Baggage handling systems are designed to manage the transfer of luggage from the check-in counter to the aircraft and vice versa. These systems include conveyors, sorting systems, automated tag readers, and baggage storage areas. The key goals of baggage handling are to ensure that bags are transported quickly, safely, and accurately, minimizing delays and preventing lost luggage.

Modern systems use a variety of technologies, such as RFID (Radio Frequency Identification) tags, to track the progress of bags throughout the airport. This technology allows airport staff and passengers to track luggage in real time, providing enhanced transparency and improving the overall customer experience. Furthermore, an airport's baggage handling system is a complex network of devices and procedures intended to move travelers' bags through the facility quickly and easily. Ensuring that every bag is accurately routed from check-in, through security screening, if necessary, to the appropriate aircraft, and finally to baggage reclaim at the destination is the main objective of a airport baggage handling system.

For instance, in July 2021, the worldwide air transport IT supplier, announced the takeover of Safety Line S.A.S., a Paris-based start-up focusing on digital solutions of aviation safety and efficiency. This takeover will expand SITA's Digital Day during Operation offering, assisting airlines in driving greater economies and fuel savings on the aircraft whilst taking instant and long-term efforts to minimize their carbon impact.

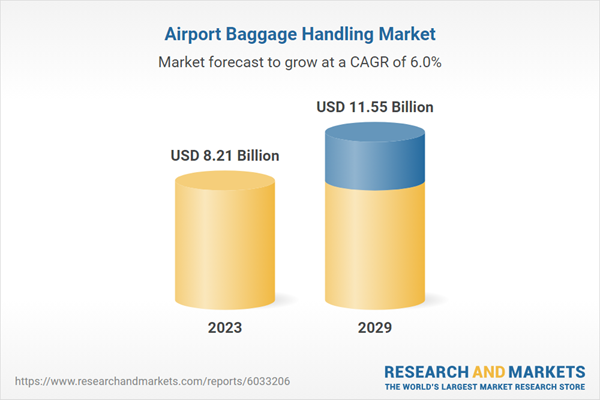

According to the research report, “Global Airport Baggage Handling Market Outlook, 2029” published, the market is anticipated to cross USD 11 Billion by 2029, increasing from USD 8.21 Billion in 2023. The market is expected to grow with a 5.97% CAGR from 2024 to 2029. One of the most notable trends in the baggage handling industry is the growing adoption of automation and robotics. Automated baggage handling systems (ABHS) can significantly reduce human error, speed up the luggage transfer process, and reduce labor costs. Robotic systems are being developed to handle tasks such as bag loading, sorting, and delivery, further enhancing efficiency.

Airports and baggage handling service providers are increasingly focused on sustainability. This includes using energy-efficient equipment, reducing waste, and exploring eco-friendly materials. Airlines and airports are also investing in greener technologies such as electric baggage carts and solar-powered systems, aligning with global efforts to reduce carbon footprints. Artificial Intelligence (AI) and machine learning are beginning to be integrated into baggage handling systems. These technologies help predict peak travel times, improve bag tracking, and optimize baggage delivery. Data analytics also enable airports to identify bottlenecks in the baggage handling process and improve operational efficiency.

The rise of self-service kiosks and mobile applications has influenced the baggage handling industry. Passengers can now check in their bags, track their luggage, and even request delivery to their destination without significant human intervention. This shift towards digitalization not only improves the passenger experience but also reduces congestion at check-in counters. Advanced communication technologies are utilized by defense and aerospace telemetry systems to guarantee secure and dependable data transfer over extended distances and in difficult conditions. Since the data being communicated frequently contains sensitive and classified information, these systems are subject to strict security requirements.

Telemetry solutions are become more complex as technology advances, providing increased data rates, better accuracy, and stronger encryption to satisfy the aerospace and defense industries' rising needs. For instance, in January 2023, Siemens Logistics was responsible for the provision and implementation of a state-of-the-art baggage handling system (BHS) at Austin-Bergstrom international airport in the U.S. This project represents a significant upgrade to the airport's infrastructure, aimed at enhancing operational efficiency and meeting the evolving needs of modern air travel.

Market Drivers

- Increased Air Travel Demand: The ongoing growth in global air traffic, fueled by rising middle-class populations and expanding tourism, is one of the major drivers for the airport baggage handling industry. As more passengers travel, the volume of luggage increases, pushing airports to upgrade their baggage handling systems to accommodate the rising demand for efficiency and speed. This growth in demand requires more sophisticated systems to handle larger volumes of baggage without compromising safety or operational efficiency.

- Technological Advancements: Innovations such as automation, artificial intelligence (AI), and the Internet of Things (IoT) are revolutionizing baggage handling. These technologies streamline operations, reduce human errors, and improve tracking and efficiency. For example, RFID (Radio Frequency Identification) technology is now widely used to track luggage in real time, ensuring better customer service and reducing mishandling of bags. As technological solutions become more advanced and affordable, airports are increasingly investing in automated systems to meet operational demands and enhance the passenger experience.

Market Challenges

- Security Regulations and Compliance: With increasing global security threats, airports are under constant pressure to ensure that baggage handling complies with strict security protocols. This includes advanced screening and scanning of luggage, which can cause delays in the baggage handling process. Balancing security with the need for speed and efficiency remains one of the primary challenges for the industry. Failure to meet security standards can lead to operational setbacks and increased costs.

- Operational Inefficiencies and Delays: Despite advancements in technology, baggage handling systems can still face significant operational challenges, such as system breakdowns, congestion, or misrouting of luggage. Delays can result from unexpected events like weather disruptions, technical failures, or overburdened infrastructure. These inefficiencies not only harm customer satisfaction but can also lead to financial losses for airlines and airports due to compensation claims, rerouting, and labor costs.

Market Trends

- Automation and Robotics: The trend of integrating automation and robotics into baggage handling systems is reshaping the industry. Automated Baggage Handling Systems (ABHS) use conveyors, robotic arms, and AI to streamline the handling of luggage, minimizing human error and speeding up processes. Robotics are particularly useful for tasks like sorting and transporting bags, reducing the need for manual labor and enhancing operational speed.

- Sustainability and Green Technologies: There is a growing emphasis on sustainability within the airport baggage handling industry. Airports and baggage handlers are adopting energy-efficient technologies, such as electric baggage carts and solar-powered systems, as well as recycling initiatives. This trend is driven by both environmental concerns and the need for airports to reduce operational costs. Additionally, eco-friendly materials are being used in baggage handling equipment, aligning with global sustainability goals and making operations greener.

Conveyor systems are integral to the industrial fasteners market because they play a vital role in streamlining the assembly line and production processes, improving efficiency, and reducing manual labor. In industries where fasteners are a key component, such as automotive, construction, and aerospace, conveyors are used to transport materials, parts, and fasteners across various stages of production, enabling continuous, automated handling. This automation significantly reduces the chances of errors, such as misplacement or damage, which can occur with manual handling. Additionally, conveyors facilitate quicker processing times, allowing manufacturers to meet high production demands while ensuring quality standards are maintained.

The integration of conveyor systems in these industries also leads to better inventory management and enhanced safety on the factory floor, as it reduces the need for workers to move heavy components manually, thus minimizing workplace injuries. Furthermore, advancements in conveyor technology, such as smart conveyors with sensors and AI-driven optimization, have added an extra layer of efficiency, allowing manufacturers to track materials in real time and improve overall throughput. As manufacturers continue to prioritize automation for cost-effectiveness and scalability, the demand for conveyors within the industrial fasteners market remains strong, making them a key driver of market growth.

The demand for industrial fasteners above 40 million is leading in the market due to the growing need for high-volume production in industries like automotive, construction, and aerospace.

The preference for industrial fasteners in quantities exceeding 40 million is primarily driven by the increasing demand for mass production across key industries such as automotive, construction, and aerospace. These sectors require a vast number of fasteners to ensure the structural integrity and functionality of their products, from vehicles and machinery to large-scale infrastructure projects. In the automotive industry, for example, modern vehicles consist of thousands of fasteners, all of which must be produced in large quantities to maintain supply chain efficiency and meet production schedules.

Similarly, in the construction sector, fasteners are essential for building durable and reliable structures, and the need for bulk orders often exceeds 40 million units due to the scale of large projects. The aerospace industry also contributes significantly to this demand, with manufacturers relying on millions of fasteners for the assembly of aircraft, ensuring safety and performance standards. As these industries continue to grow and evolve, the demand for high-volume fasteners becomes even more critical, pushing manufacturers to scale up production and logistics to meet the demands of such large-scale operations.

Additionally, the growing trend toward automation and precision manufacturing has increased the need for standardized, high-quality fasteners that are produced in large quantities, ensuring both cost-effectiveness and operational consistency. This trend highlights the essential role of industrial fasteners in supporting global manufacturing and infrastructure development, further solidifying their dominance in the market.

Automation is leading in the Industrial Fasteners Market due to its ability to increase production efficiency, reduce costs, and ensure consistent quality in manufacturing processes.

Automation has become a dominant force in the industrial fasteners market because it addresses several critical needs in modern manufacturing, including the demand for higher production volumes, cost reduction, and consistent quality. In industries such as automotive, aerospace, and construction, where the production of fasteners is crucial, automated systems are employed to streamline operations and minimize human error. Automated machinery, such as robotic arms, CNC machines, and automated sorting systems, can produce fasteners at a much faster rate compared to manual labor, significantly increasing production capacity.

This high-speed production not only helps meet the growing demand for fasteners but also reduces labor costs and minimizes downtime, both of which are essential for maintaining profitability. Furthermore, automation ensures that fasteners meet precise specifications and quality standards, which is especially important in industries where safety and durability are paramount, such as in automotive or aerospace manufacturing. The integration of automated technologies also improves consistency in fastener manufacturing, ensuring that each part is identical in shape, size, and performance.

As manufacturing processes become more complex and global competition intensifies, companies are increasingly relying on automation to stay competitive, reduce operational risks, and achieve greater scalability. Additionally, advancements in smart manufacturing technologies, such as IoT-enabled machines and real-time data monitoring, have further enhanced the benefits of automation, allowing manufacturers to optimize their processes and maintain a high level of quality control. Consequently, automation continues to lead the industrial fasteners market, revolutionizing how fasteners are produced and distributed across industries.

Barcodes are leading in the Industrial Fasteners Market due to their ability to enhance inventory management, traceability, and operational efficiency.

Barcodes have become a key component in the industrial fasteners market because they provide an efficient and cost-effective way to manage large inventories, track fasteners through the production and distribution process, and improve overall operational efficiency. In industries that rely on a high volume of fasteners, such as automotive, construction, and manufacturing, the ability to quickly scan and track fasteners from raw material to final product is essential. Barcodes enable manufacturers and suppliers to manage stock levels accurately, reduce the risk of errors, and minimize delays in production.

With barcodes, fasteners can be easily identified, sorted, and retrieved in real time, streamlining the entire supply chain and enhancing productivity. Furthermore, barcodes improve traceability by providing a digital record of every fastener’s movement, which is crucial for quality control, regulatory compliance, and inventory audits. This traceability is particularly important in sectors like aerospace and automotive, where fasteners must meet strict standards for safety and performance. By enabling real-time tracking, barcodes also help to reduce misplacement or theft of fasteners, ensuring a more secure supply chain.

In addition, the integration of barcode scanning with advanced software systems allows for automated data collection, reducing the need for manual input and making it easier to forecast demand, optimize stock levels, and manage orders efficiently. Overall, barcodes have transformed the industrial fasteners market by simplifying processes, increasing accuracy, and supporting scalability in a fast-paced, high-demand environment.

North America is leading in the Industrial Fasteners Market due to its strong manufacturing base, technological advancements, and high demand from key industries like automotive, aerospace, and construction.

North America has established itself as a leader in the industrial fasteners market due to its robust and diversified manufacturing sector, technological innovations, and the demand for fasteners across key industries. The United States, in particular, is home to a significant portion of global manufacturing, including automotive, aerospace, defense, and construction, all of which require high volumes of fasteners to ensure the functionality, safety, and durability of their products. The automotive and aerospace sectors, for example, depend heavily on industrial fasteners for assembling vehicles and aircraft, which drives substantial demand for high-quality, precision-engineered fasteners.

Additionally, North America's advanced manufacturing technologies, such as automation, robotics, and smart manufacturing solutions, enable faster, more efficient production of fasteners at scale. These innovations help meet the high standards of industries in the region, ensuring consistent quality and minimizing costs. Furthermore, North American manufacturers are increasingly adopting advanced materials, such as corrosion-resistant and high-strength fasteners, to cater to the growing needs of industries that require specialized components.

The presence of established supply chains, a skilled workforce, and a favorable business environment further bolster North America's position in the market. As a result, the region continues to lead in industrial fastener production, driven by both demand from critical industries and the ability to leverage technological advancements for greater operational efficiency.

- In March 2024, Southwest Airlines recently awarded Leonardo a US$ 27 Million contract to provide a new baggage handling solution with cross-belt sorter technology for its transfer bag facility at Denver International Airport. According to Airport Business reports, the Leonardo solution will eliminate a labor-intensive, manual sorting and tail-to-tail transfer bag method. By revamping its baggage handling system, the airline seeks to ensure faster connection times, accommodate tight flight schedules, and increase capacity to manage future passenger volume growth.

- In January 2024, Centralny Port Komunikacyjny has launched a tender for the design, delivery, and implementation of the Baggage Handling System (BHS) for CPK airport. The purpose of this competitive dialogue process is to examine the conceptual design of the BHS, focusing on how the system design will be implemented, and to refine the tender description in collaboration with potential operators. Additionally, it aims to confirm the key terms of the contract.

- In March 2023, Alstef Group signed a contract worth US$ 11 Million with Sofia Airport in Bulgaria to supply, install, and maintain a new baggage handling system (BHS). The airport served nearly 6 million passengers in 2022.

Considered in this report

- Historic Year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Airport Baggage Handling Market with its value and forecast along with its segments

- Region & country wise Airport Baggage Handling market analysis

- Application wise Airport Baggage Handling distribution

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type

- Destination-coded Vehicle (DCV)

- Conveyors

- Sorters

- Self-bag Drop (SBD)

By Airport Capacity

- Up to 15 million

- 15-25 million

- 25-40 million

- Above 40 million

By Mode of Operation

- Automated

- Manual

By Technology

- Barcode

- RFID (Radio Frequency Identification)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 8.21 Billion |

| Forecasted Market Value ( USD | $ 11.55 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |