This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

This includes various forms of security such as firewalls, encryption, intrusion detection systems, and virtual private networks (VPNs), which are used to create secure connections and prevent threats. The network security industry covers a broad spectrum, with solutions tailored to protect corporate, government, and private networks. With businesses relying on cloud computing, the Internet of Things (IoT), and big data, the demand for advanced security measures has skyrocketed.

As a result, network security solutions are more complex, integrating machine learning, artificial intelligence, and behavioral analytics to detect and mitigate potential threats in real-time. As more businesses migrate their data and operations to the cloud, cloud security has become a significant focus within the network security industry. Cloud service providers offer advanced encryption, multi-factor authentication, and other security features to ensure data is protected from breaches.

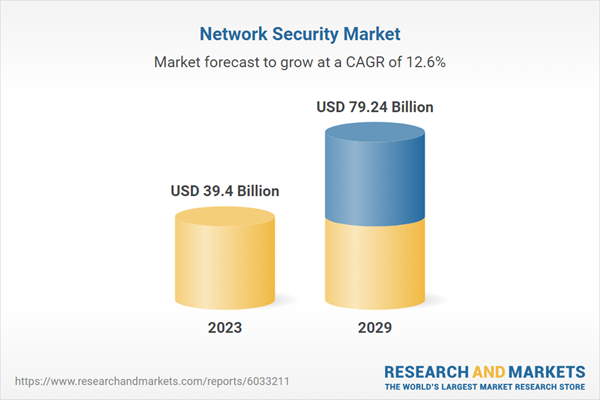

According to the research report, “Global Network Security Market Outlook, 2029” published, the market is anticipated to cross USD 79 Billion by 2029, increasing from USD 39.40 Billion in 2023. The market is expected to grow with a 12.61% CAGR from 2024 to 2029. Traditional security models operated on the assumption that everything inside the network was trustworthy. However, the rise of insider threats and advanced cyberattacks has prompted organizations to adopt a 'zero-trust' model. This approach assumes no one, whether inside or outside the network, should be trusted by default. Continuous verification and least-privilege access are key principles of this model.

AI and machine learning are increasingly being integrated into network security solutions to identify patterns and predict potential security breaches before they occur. Automation is also helping streamline responses to security incidents, reducing the time it takes to mitigate damage and recover from attacks. As cybercriminals develop more sophisticated methods of infiltrating networks, the need for advanced threat protection is critical.

Techniques like intrusion prevention systems (IPS), threat hunting, and endpoint detection and response (EDR) tools help protect networks against zero-day exploits, ransom-ware, and other complex threats. With the rapid adoption of IoT devices across industries, the attack surface for cybercriminals has expanded significantly. These devices often lack adequate security, making them an easy target for hackers. Network security solutions are increasingly incorporating IoT-specific protections to prevent exploitation.

Market Drivers

- Increase in Cybersecurity Threats: One of the primary drivers of growth in the network security industry is the rapid rise in cybersecurity threats. As cyberattacks become more sophisticated, frequent, and damaging, businesses are increasingly investing in advanced security solutions to protect sensitive data, maintain operational continuity, and safeguard their reputations. Ransomware, phishing attacks, and data breaches are driving the demand for stronger network security measures across all sectors.

- Digital Transformation and Remote Work: The widespread adoption of digital technologies, cloud services, and the shift toward remote work are major drivers for the network security industry. Organizations that are transitioning to digital infrastructures need to ensure their networks are protected from external threats and internal vulnerabilities. With employees accessing company systems from various locations and devices, securing these remote access points has become critical, leading to increased investments in network security solutions like VPNs, multi-factor authentication, and endpoint security.

Market Challenges

- Shortage of Skilled Cybersecurity Professionals: A significant challenge facing the network security industry is the shortage of qualified cybersecurity professionals. With the growing complexity of cyber threats, there is an urgent need for skilled professionals to design, implement, and manage security systems. The scarcity of talent exacerbates the difficulty in staying ahead of emerging threats, making it challenging for organizations to secure their networks effectively.

- Evolving and Sophisticated Cyber Threats: Cybercriminals are continually evolving their tactics to bypass traditional security measures. The rise of advanced persistent threats (APTs), zero-day vulnerabilities, and highly targeted attacks poses a significant challenge for the industry. As these threats become more sophisticated, security providers must develop more advanced and proactive security measures to detect and mitigate these attacks before they cause harm.

Market Trends

- Extended Detection and Response (XDR): XDR is a more comprehensive approach to threat detection and response that integrates multiple security solutions, such as endpoint detection and response (EDR), network traffic analysis, and cloud security, into a single platform. XDR offers a more holistic view of an organization’s security posture, allowing for faster detection, investigation, and remediation of threats. As cyber threats become more complex and pervasive, the adoption of XDR solutions is expected to rise, as they provide a unified defense across various layers of the network.

- 5G Network Security: With the rollout of 5G networks, there is a growing need for enhanced security measures to protect these high-speed, ultra-low-latency environments. 5G networks offer many benefits, but they also introduce new vulnerabilities due to their complexity and the increased number of connected devices. As 5G adoption continues to grow, network security providers are focusing on developing solutions to address the unique risks associated with this next-generation technology, such as securing edge computing and ensuring the privacy of data transmitted over 5G networks.

As industries continue to focus on improving the performance, longevity, and reliability of their products, the need for high-quality fasteners has surged. Industrial fasteners are critical components in ensuring the structural integrity and functionality of machinery, vehicles, and infrastructure. Solutions that offer fasteners with advanced materials, coatings, and custom designs are becoming increasingly popular, as they meet the specific needs of industries that require fasteners to withstand extreme conditions such as high temperatures, heavy loads, and exposure to harsh chemicals or corrosive environments.

For example, in the automotive and aerospace sectors, there is a growing preference for fasteners made from lightweight, yet highly durable materials like titanium and high-strength steel, which help reduce overall weight without compromising on strength. Similarly, in construction, fasteners that offer superior corrosion resistance are highly sought after to ensure long-lasting structural stability in environments prone to moisture, salt, or other corrosive elements. As such, the market is shifting toward solution-based offerings where manufacturers not only supply standard fasteners but also provide customized, performance-driven solutions that cater to the unique requirements of various industries, leading to an overall increase in demand for advanced fastening solutions.

The preference for on-premise solutions in the Industrial Fasteners Market is driven by the need for better control over inventory, quality assurance, and customization in manufacturing processes.

On-premise solutions allow manufacturers to maintain full control over the production, storage, and quality of industrial fasteners, which is essential for industries requiring high precision and reliability. By managing their fastener inventory and production processes internally, companies can ensure that they meet the specific standards of their applications, whether it’s for automotive, aerospace, or heavy machinery. This control is particularly critical when industries demand customized fasteners that are tailored to unique design specifications or when products must meet rigorous safety and performance standards.

Furthermore, on-premise solutions enable manufacturers to carry out real-time quality checks and perform immediate adjustments to their processes to address any potential issues with fasteners, ensuring that the final products are of the highest quality. Additionally, managing fastener production on-site reduces the risks associated with supply chain disruptions, enabling companies to respond more quickly to changing demands or material shortages. The ability to handle large orders, maintain inventory efficiently, and ensure the timely delivery of high-quality products makes on-premise solutions highly appealing in the industrial fasteners market, particularly for sectors that require consistent performance and durability in their fastening systems.

Large enterprises are leading the Industrial Fasteners Market due to their ability to invest in advanced manufacturing technologies, maintain extensive supply chains, and meet the high-volume demands of global industries.

Large enterprises dominate the Industrial Fasteners Market because of their considerable financial resources, which enable them to invest in cutting-edge manufacturing technologies that improve production efficiency and quality. These companies have the capacity to deploy automated processes, precision engineering, and advanced material research, allowing them to manufacture a wide range of high-performance fasteners tailored to the specific needs of industries such as automotive, aerospace, construction, and heavy machinery. Their extensive supply chains also provide the ability to source materials at scale, ensuring cost-effectiveness and consistency in supply.

This logistical strength enables large enterprises to meet the high-volume demands of global customers, offering fasteners that are produced in large quantities without compromising on quality or delivery timelines. Moreover, these companies are better equipped to handle the complexities of international standards, certifications, and regulatory compliance, which is crucial for sectors that require stringent safety and quality assurance.

Their significant market presence also allows them to form long-term partnerships with key players in various industries, positioning them as trusted suppliers of high-quality industrial fasteners. As a result, large enterprises continue to lead the market by offering reliable, innovative, and scalable fastening solutions that meet the evolving needs of businesses across the globe.

BSFC (Bolt, Screw, Fastener, and Components) is leading in the Industrial Fasteners Market due to its extensive product portfolio, superior quality control, and strong industry partnerships.

BSFC’s leadership in the Industrial Fasteners Market can be attributed to its comprehensive range of fasteners and related components, which are essential for a variety of industries, including automotive, aerospace, and construction. By offering an extensive portfolio that covers bolts, screws, nuts, washers, and custom fastener solutions, BSFC is able to cater to the specific requirements of different sectors, ensuring that clients receive products suited to their unique application needs.

The company's commitment to superior quality control is another factor that has set it apart in the market, as BSFC employs stringent testing and inspection processes to guarantee that all fasteners meet high standards for performance and reliability, even under demanding conditions. Furthermore, BSFC’s strong relationships with key players in industries that rely on precision fasteners have allowed the company to maintain a consistent and dependable supply chain, positioning it as a preferred supplier for high-volume, long-term contracts. Through its ability to combine product variety, quality assurance, and strategic industry partnerships, BSFC has established itself as a trusted leader, providing innovative and reliable fastening solutions to a diverse customer base globally.

North America is leading the Industrial Fasteners Market due to its advanced manufacturing capabilities, strong industrial base, and high demand for durable, high-performance fasteners in key sectors like automotive, aerospace, and construction.

North America’s dominance in the Industrial Fasteners Market is largely driven by its highly developed manufacturing infrastructure, which supports a wide range of industries that require specialized and high-quality fasteners. The region’s robust industrial base, including major sectors like automotive, aerospace, and construction, creates a consistent demand for fasteners that meet stringent performance and safety standards. Companies in North America often require fasteners that can withstand extreme conditions, such as high temperatures, heavy loads, and exposure to corrosive elements, making durability and reliability top priorities.

The region also benefits from advanced manufacturing technologies, including precision machining and automation, which enable the production of high-performance, custom fasteners designed for specific applications. Additionally, the availability of raw materials, efficient supply chains, and significant investment in research and development allow North American companies to innovate and deliver tailored solutions that meet the evolving needs of industries.

The presence of key players in the fastener manufacturing industry, along with strong relationships between suppliers and manufacturers, further solidifies North America's position as a leader in the global industrial fasteners market. The combination of technological advancements, high demand across various industries, and a well-established industrial ecosystem makes North America the dominant force in the sector.

- In July 2024, SonicWall launched Cloud Secure Edge (CSE), an innovative suite of Zero-Trust Network Access (ZTNA) offerings developed specifically for Managed Service Providers (MSPs). It is a cost-effective and flexible solution which provides remote access and internet access to organizations to connect with their employees and third-party users securely from any device and location.

- In July 2024, Fortinet, Inc. introduced a hardware-as-a-service offering that keep the latest firewall technology updated. The FortiGate-as-a-Service (FGaaS) enables customers to choose the hardware they want and FortiGate next-gen firewalls. The company will manage and configure the device for the customer’s service.

- In July 2024, Cisco Systems, Inc. launched an AI-enabled firewall that autonomously updates and manages itself, focused on streamlining cyber-defense for its enterprise clients.

- In March 2024, Juniper Networks introduced a novel Juniper Partner Advantage (JPA) Program enabled with AI-Native Networking Solutions. This solution will help partners by using AI technology for IT operations to provide networking services for increased agility and reliability.

Considered in this report

- Historic Year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Network Security Market with its value and forecast along with its segments

- Region & country wise Network Security market analysis

- Application wise Network Security distribution

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Component

- Solution

- Services

By Deployment

- On-premise

- Cloud

By Organization Size

- Large Enterprise

- Small and Medium Enterprise

By Industry Vertical

- Banking, Financial Services, And Insurance (BFSI)

- Government

- Information Technology (IT) and Telecommunication

- Aerospace and Defence

- Others

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 39.4 Billion |

| Forecasted Market Value ( USD | $ 79.24 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |