This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

This approach allows consumers whether businesses or individuals to access customized energy solutions without the burden of owning, managing, or maintaining energy infrastructure. Through EaaS, customers gain access to clean energy, energy efficiency improvements, demand-side management, and energy storage solutions, all managed and optimized by third-party service providers.

Unlike traditional energy contracts, which are typically fixed or based on consumption, EaaS offers more dynamic pricing models based on usage patterns, energy needs, and the integration of renewable energy sources. The service provider, often using advanced technologies like IoT, AI, and machine learning, ensures optimal energy performance and cost-efficiency, reducing the need for customers to invest heavily in infrastructure or expertise.

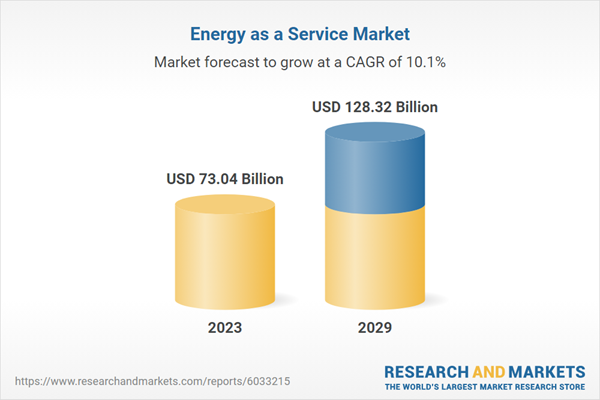

According to the research report, “Global Energy-as-a-Service Market Outlook, 2029” published, the market is anticipated to cross USD 128 Billion by 2029, increasing from USD 73.04 Billion in 2023. The market is expected to grow with a 10.06% CAGR from 2024 to 2029. As the global energy market shifts towards decentralization, businesses and households are looking for solutions that allow them to generate, store, and consume energy locally. Solar power, wind energy, and battery storage are becoming more affordable and accessible, making it easier for customers to produce their own energy and participate in grid systems.

Governments, corporations, and individuals are placing greater emphasis on energy efficiency and sustainability. EaaS helps meet these goals by providing solutions that reduce energy consumption, minimize waste, and facilitate the transition to cleaner energy sources. The evolution of smart meters, sensors, and data analytics allows service providers to offer tailored energy solutions. The ability to monitor energy usage in real time and predict demand fluctuations enables better decision-making and optimization. EaaS offers businesses and households an opportunity to lower upfront capital investment costs.

By eliminating the need for purchasing and maintaining energy infrastructure, consumers can reduce operational costs while accessing more reliable, efficient energy solutions. The Energy-as-a-Service industry is experiencing rapid growth, with a diverse range of players entering the market, from traditional energy providers to startups focusing on innovative energy solutions. The global market for EaaS is expected to continue its expansion as more businesses and consumers recognize the benefits of flexible, sustainable energy management.

Market Drivers

- Corporate Demand for Energy Flexibility and Cost Predictability: As companies become more focused on optimizing operational costs, they are increasingly looking for energy solutions that provide greater flexibility and predictable pricing. EaaS meets this demand by offering customized energy plans based on real-time consumption, historical data, and predictive analytics. This allows businesses to avoid volatile energy prices and optimize their energy consumption in a more cost-efficient manner, which is crucial in industries with fluctuating operational hours or high energy usage.

- Integration of Energy Storage with Distributed Energy Resources (DERs) : The growing adoption of energy storage technologies, like batteries, combined with Distributed Energy Resources (DERs) such as solar panels and wind turbines, is driving the EaaS industry. These technologies allow businesses to generate, store, and consume energy at the local level, decreasing reliance on traditional energy grids. EaaS providers are capitalizing on the opportunity to offer integrated storage solutions alongside renewable generation, helping customers manage energy costs while ensuring resilience during power outages or high-demand periods.

Market Challenges

- Data Security and Privacy Concerns: The EaaS model relies heavily on data-driven solutions, such as smart meters and IoT devices, to optimize energy management. However, the constant flow of sensitive data related to energy consumption raises significant concerns about cybersecurity and data privacy. If EaaS providers do not implement robust security measures, they risk exposing sensitive information to cyberattacks or breaches. Addressing these concerns is crucial to gaining customer trust and ensuring the long-term success of the industry.

- Resistance to Transition from Traditional Energy Models: Despite the growing popularity of EaaS, many businesses and consumers still prefer the traditional energy consumption model due to its familiarity and perceived reliability. Convincing these customers to switch to more flexible, service-based energy solutions can be a challenge, especially in regions where the energy infrastructure is already well-established or subsidized by governments. Overcoming the inertia of traditional energy models and demonstrating the long-term benefits of EaaS remains a significant challenge for providers.

Market Trends

- Blockchain Technology for Transparent Energy Transactions: Blockchain is emerging as a key technology to ensure transparent, secure, and decentralized energy transactions in the EaaS industry. By utilizing blockchain, providers can enable peer-to-peer energy trading, where businesses and households can buy and sell excess energy generated from renewable sources. This trend is empowering consumers to become active participants in energy markets, fostering a more decentralized, transparent, and efficient energy ecosystem.

- Energy-as-a-Service for Electric Vehicle (EV) Charging Networks: The rise of electric vehicles (EVs) is driving demand for smart, efficient, and accessible EV charging solutions. EaaS providers are responding by integrating EV charging into their energy service offerings. This trend includes creating dynamic charging stations powered by renewable energy, where users can pay based on usage, ensuring cost-efficient and sustainable charging options. This integration not only supports the EV market but also contributes to a greener, more efficient energy infrastructure as EVs become a larger part of global transportation.

Energy Supply Services have emerged as the dominant force in the Energy-as-a-Service (EaaS) market because they offer businesses and consumers flexible, on-demand energy solutions that align with both economic and sustainability goals. Unlike traditional energy models, where consumers are locked into rigid pricing structures and centralized grids, Energy Supply Services provide a dynamic, customer-centric approach, tailoring energy consumption based on real-time data and predictive analytics. This flexibility allows businesses to control energy costs more effectively while optimizing efficiency, which is increasingly important in a world where energy prices fluctuate and sustainability is a priority.

Additionally, the integration of renewable energy sources, such as solar, wind, and energy storage, further enhances the value of these services, allowing customers to reduce their dependence on fossil fuels, lower carbon footprints, and gain access to greener alternatives. The ongoing push towards cleaner energy and the growing demand for energy efficiency has made Energy Supply Services an essential component of the EaaS market, as they address both financial concerns and environmental impacts. As the market for clean energy and energy management solutions expands, Energy Supply Services are well-positioned to play a central role in shaping the future of energy consumption.

Services are leading the EaaS market due to their ability to offer comprehensive, scalable solutions that include energy optimization, storage, and management without the need for significant capital investment.

The service-based model in Energy-as-a-Service (EaaS) has taken the lead in the market because it provides businesses and consumers with flexible, all-in-one energy solutions that go beyond simple supply and consumption. EaaS services encompass a broad range of offerings, from energy management and optimization to the integration of renewable energy sources, energy storage systems, and advanced technologies like smart meters and IoT devices. This holistic approach allows customers to tailor their energy usage based on real-time needs, demand response, and predictive analytics.

Importantly, EaaS services eliminate the need for customers to make large, upfront investments in infrastructure like solar panels or energy storage systems, instead offering subscription-based or pay-per-use models that spread costs over time. This makes the adoption of cutting-edge energy solutions more accessible to businesses of all sizes, from large corporations to smaller enterprises.

Furthermore, with the growing emphasis on sustainability, energy efficiency, and regulatory compliance, EaaS services help customers achieve their environmental and cost-saving goals with minimal complexity. The service model's scalability and adaptability to different industry needs, coupled with its potential to deliver sustainable and efficient energy management, have made it the preferred choice in the EaaS market, positioning service providers as key players in shaping the future of energy consumption.

Commercial sectors are leading the EaaS market due to their high energy demands, which drive the need for scalable, cost-effective, and sustainable energy solutions.

The commercial sector is at the forefront of the Energy-as-a-Service (EaaS) market because businesses often face significant energy consumption and rising operational costs. These industries require tailored energy solutions that can handle large, fluctuating demands while simultaneously reducing energy costs and meeting sustainability goals. EaaS models provide businesses with a comprehensive, scalable way to optimize energy use, integrating renewable energy sources, energy storage systems, and real-time monitoring technologies. This allows commercial customers to gain better control over their energy usage, mitigate demand charges, and avoid the volatility of traditional energy pricing models.

Furthermore, with growing pressure from both governments and consumers for companies to adopt more environmentally friendly practices, EaaS allows businesses to meet their sustainability targets by reducing carbon footprints through cleaner energy solutions. The ability to manage energy consumption efficiently while ensuring continuous operations, cutting down on energy waste, and benefiting from predictive analytics has made EaaS particularly attractive to commercial entities. As energy demands continue to increase and the need for green energy solutions intensifies, commercial enterprises are increasingly turning to EaaS to future-proof their energy needs, making the commercial sector a primary driver in the market’s growth.

North America is leading the EaaS market due to its advanced infrastructure, strong focus on sustainability, and favorable regulatory environment that supports the adoption of innovative energy solutions.

North America is at the forefront of the Energy-as-a-Service (EaaS) market primarily because of its well-developed energy infrastructure, which enables seamless integration of advanced technologies like smart grids, renewable energy systems, and energy storage solutions. The region’s progressive stance on sustainability and energy efficiency has driven both public and private sectors to prioritize greener energy solutions, fueling the demand for EaaS. Government incentives, tax credits, and regulatory frameworks in countries like the United States and Canada have made it easier for businesses to invest in and adopt EaaS solutions, encouraging widespread adoption of renewable energy sources and smart energy management systems.

The focus on achieving net-zero emissions and addressing climate change through cleaner energy technologies has further accelerated the shift towards service-based energy models, allowing businesses and consumers to reduce their carbon footprint while managing energy costs more effectively. Additionally, North America’s large commercial and industrial sectors, which account for substantial energy consumption, are increasingly turning to EaaS for cost savings, operational efficiency, and improved energy reliability. With the region's access to cutting-edge technologies, growing green energy initiatives, and supportive regulatory policies, North America continues to lead in the EaaS market, setting the stage for further innovation and expansion in the energy sector.

- August 2023- Teva Pharmaceuticals, a leading generic pharmaceutical company, took proactive measures to reduce its environmental impact by partnering with Honeywell, a technology company. The partnership aimed to reduce Teva’s energy consumption and carbon emissions at its manufacturing facility in Debrecen. Through Honeywell’s innovative ‘Energy as a Service’ (EaaS) model, Teva will be able to implement energy improvement upgrades without the need for a significant capital investment.

- October 2023 - Green Genius, a Lithuanian renewables developer, received funds for an Energy-as-a-Service (EaaS) project. The project will involve an installation of 6.5 MW of solar power and 6 MWh of Battery Energy Storage Systems (BESS) for a Carlsberg A/S brewery in Lithuania.

- September 2023 - Sunnova Energy International, Inc., a leading Energy as a Service (EaaS) provider, entered a USD 3 billion partial loan guarantee agreement with the U.S. Department of Energy’s (DOE) Loan Programs Office (LPO) to support solar loans originated by Sunnova under a new solar loan channel named “Project Hestia”. This will enhance the development of Energy as a Service (EaaS) projects.

- March 2023- Honeywell announced that it had invested in an energy-as-a-service company Redaptive to bring the latter’s capabilities to private sector-owned commercial and industrial buildings.

Considered in this report

- Historic Year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Energy as a Service Market with its value and forecast along with its segments

- Region & country wise Energy as a Service market analysis

- Application wise Energy as a Service distribution

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Service Type

- Energy Supply Services

- Operational and Maintenance Services

- Energy Efficiency and Optimization Services

By Component

- Solution

- Service

By End User

- Commercial

- Industrial

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 73.04 Billion |

| Forecasted Market Value ( USD | $ 128.32 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |