Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is buoyed by several key factors. Environmental regulations are at the forefront, with governments worldwide imposing stringent standards to reduce greenhouse gas emissions and improve fuel efficiency. The aviation industry, which traditionally relies on fossil fuels and complex mechanical systems, faces mounting pressure to adopt cleaner and more sustainable technologies. MEAs, with their reduced reliance on fossil fuels and lower emissions, align well with these regulatory goals, making them an attractive option for airlines and manufacturers seeking to comply with environmental policies.

Technological advancements also play a critical role in the market's growth. Innovations in electric propulsion, energy storage systems, and lightweight materials are driving the development and deployment of more electric aircraft. Electric propulsion systems, including hybrid-electric and fully electric engines, are becoming more viable due to improvements in battery technology and power electronics. These advancements are not only enhancing the performance and range of MEAs but also making them more economically feasible for commercial use.

Cost efficiency is another significant driver. By reducing the reliance on traditional mechanical systems, which often require extensive maintenance and incur high operational costs, MEAs offer potential savings for airlines. The simplification of aircraft systems can lead to lower maintenance costs and improved reliability, further incentivizing the adoption of more electric technologies. As the technology matures and scales, the cost of electric components and systems is expected to decrease, making MEAs more accessible and cost-effective for a broader range of operators.

The market is also influenced by the growing interest and investment from aerospace manufacturers and technology developers. Major aerospace companies are investing in research and development to advance MEA technologies and bring new products to market. This includes partnerships and collaborations aimed at accelerating innovation and overcoming technical challenges associated with electric aircraft.

Key Market Drivers

Environmental Regulations

The drive towards more electric aircraft is significantly fueled by stringent environmental regulations aimed at reducing aviation's carbon footprint. Governments and regulatory bodies worldwide are increasingly enforcing stricter emissions standards to combat climate change and promote sustainability. For instance, the International Civil Aviation Organization (ICAO) and various national agencies have set ambitious targets for reducing greenhouse gas emissions from aircraft. These regulations are compelling airlines and manufacturers to explore and invest in cleaner technologies. More electric aircraft (MEAs) are seen as a viable solution because they minimize reliance on traditional fossil fuels and reduce overall emissions.By integrating electric propulsion and advanced energy systems, MEAs can help meet regulatory requirements for lower emissions, offering a competitive edge in a market that is increasingly prioritizing environmental responsibility. Additionally, regulatory incentives such as tax breaks and subsidies for adopting green technologies further encourage the development and deployment of MEAs. As environmental regulations become more stringent, the demand for MEAs is expected to grow, driving innovation and accelerating their adoption across the aviation industry.

Technological Advancements

Technological advancements are a major driver for the growth of the more electric aircraft market. Innovations in electric propulsion systems, energy storage technologies, and lightweight materials are transforming the feasibility and performance of electric aircraft. Significant progress has been made in battery technology, which now offers higher energy densities and faster charging times, essential for extending the range and operational efficiency of electric aircraft. Developments in power electronics and electric motors are also contributing to improved performance and reliability of MEAs.Moreover, the integration of advanced avionics and control systems enhances the efficiency and safety of electric aircraft operations. These technological breakthroughs are not only making MEAs more viable but also reducing the cost of production and operation. As technology continues to advance, the capabilities of MEAs are expected to improve, leading to broader adoption in both commercial and military aviation. The ongoing research and development in these areas are crucial for overcoming the existing technical challenges and unlocking the full potential of more electric aircraft.

Cost Efficiency

Cost efficiency is a pivotal driver in the adoption of more electric aircraft. Traditional aircraft systems often involve complex mechanical components that require frequent maintenance and incur high operational costs. By shifting to electric systems, MEAs can significantly reduce maintenance requirements and associated costs due to their simpler, fewer-moving-part design. Electric propulsion systems eliminate the need for traditional hydraulic and pneumatic systems, which not only cuts down on maintenance but also reduces the overall weight of the aircraft, leading to improved fuel efficiency.As the technology matures and economies of scale come into play, the costs of electric components and systems are expected to decrease, making MEAs more affordable for a wider range of operators. Furthermore, the long-term operational savings from reduced fuel consumption and maintenance costs make MEAs an attractive investment for airlines looking to optimize their fleet operations. As these cost benefits become more pronounced, the adoption of MEAs is likely to accelerate, driving further growth in the market.

Key Market Challenges

High Initial Investment and Development Cost

One of the significant challenges facing the global more electric aircraft (MEA) market is the high initial investment and development costs associated with electric propulsion technology. The transition from traditional aircraft systems to more electric solutions involves substantial expenditures in research and development, as well as in the production of advanced components. Developing new electric propulsion systems, energy storage solutions, and lightweight materials requires significant capital investment.For many aerospace companies, especially smaller or new entrants, these costs can be a major barrier to entry. Furthermore, the high cost of advanced batteries and electric motors, which are crucial for the performance of MEAs, adds to the financial burden. While these technologies hold the promise of long-term cost savings, the upfront financial commitment required can deter investment and slow the pace of innovation. Consequently, this challenge affects the speed at which MEAs can be developed and brought to market, potentially hindering the broader adoption of more electric technologies in the aviation sector.

Limited Infrastructure and Support Systems

Another challenge for the global MEA market is the current lack of infrastructure and support systems needed to fully integrate electric aircraft into existing aviation ecosystems. The widespread deployment of MEAs necessitates significant changes in ground support infrastructure, including the development of specialized charging stations, maintenance facilities, and supply chains for electric components. Existing airports and maintenance facilities are predominantly equipped for conventional aircraft, and transitioning to support MEAs requires substantial upgrades.The development of such infrastructure involves collaboration between various stakeholders, including airport authorities, airlines, and government agencies, which can be complex and time-consuming. Additionally, the current lack of standardization in charging and maintenance protocols for electric aircraft further complicates the integration process. Without a robust support system in place, the operational efficiency and scalability of MEAs could be compromised, limiting their adoption and growth in the market.

Technical and Safety Challenges

The integration of more electric technologies into aircraft brings with it several technical and safety challenges. Electric propulsion systems and high-energy batteries are still relatively new in aviation, and ensuring their reliability and safety is crucial. Issues such as battery thermal management, electromagnetic interference, and the robustness of electrical systems under various operating conditions need to be thoroughly addressed.The aviation industry has rigorous safety standards, and electric aircraft must meet these standards to gain regulatory approval and market acceptance. Additionally, the development of fail-safe mechanisms and redundancy systems for critical electric components is essential to prevent potential failures and ensure the safety of passengers and crew. As the technology evolves, addressing these technical and safety concerns is vital for the successful deployment of MEAs. Ensuring that these new technologies are as reliable and safe as traditional aircraft is a key challenge that must be overcome to achieve widespread adoption.

Key Market Trends

Increasing Adoption of Hybrid-Electric Propulsion Systems

A prominent trend in the global more electric aircraft (MEA) market is the increasing adoption of hybrid-electric propulsion systems. Hybrid-electric propulsion integrates traditional jet engines with electric motors, offering a balanced approach to transitioning towards full electric aircraft. This hybrid model leverages the benefits of both systems: the efficiency and range of conventional engines and the reduced emissions and operational costs of electric motors. By combining these technologies, hybrid-electric aircraft can operate efficiently over longer distances and with greater flexibility compared to fully electric aircraft, which may face limitations due to current battery technology.Leading aerospace companies and startups are actively developing hybrid-electric prototypes and conducting flight tests to demonstrate their viability. This trend reflects a strategic approach to bridge the gap between existing technology and future fully electric aircraft, allowing for incremental advancements and broader market acceptance. Hybrid-electric systems are expected to play a critical role in the near-term adoption of more electric technologies, contributing to a gradual but significant shift towards more sustainable aviation. For instance, in October 2023, Collins Aerospace unveiled ‘The Grid,’ a $50 million laboratory for electric power systems. Situated in Rockford, Illinois, this 25,000 square foot facility started with an 8MW testing capacity for hybrid-electric propulsion components. The initial projects tested included Collins’ 1MW motor for the RTX hybrid-electric flight demonstrator, the EU’s Clean Aviation SWITCH program, and a 1MW generator for the US Air Force Research Laboratory.

Expansion of Electrification in Regional and Urban Air Mobility

The global MEA market is witnessing a growing trend in the expansion of electrification for regional and urban air mobility solutions. Regional aircraft and urban air mobility (UAM) vehicles, such as electric vertical takeoff and landing (eVTOL) aircraft, are increasingly being developed to address the demand for more efficient, low-emission transportation options. These vehicles aim to provide short-haul flights within cities and between regional hubs, offering reduced travel times and alleviating ground traffic congestion. The electrification of these aircraft supports the goals of reducing urban air pollution and improving connectivity in densely populated areas.Various companies are investing in eVTOL technology and regional electric aircraft, driven by advancements in battery technology and electric propulsion. The rise of urban air mobility as a trend reflects the growing interest in integrating electric aircraft into everyday transportation networks, promising a new era of aviation that complements existing transportation infrastructure while addressing environmental and logistical challenges. For instance, in March 2024, Alaka’i Technologies unveiled its Skai eVTOL, powered by hydrogen fuel cells, advancing the field of more electric aircraft. Unlike battery-electric and hybrid systems, the Skai offers a cleaner, emissions-free solution. Designed to carry four passengers with a range of 200 miles, it represents a major step forward in sustainable air travel.

Growth of Collaborative Partnerships and Ecosystems

A significant trend in the MEA market is the growth of collaborative partnerships and ecosystems involving aerospace manufacturers, technology developers, and governmental bodies. The development and deployment of more electric aircraft require a multi-faceted approach involving expertise from various sectors, including aviation, energy, and materials science. Collaborative efforts are essential for advancing technology, overcoming technical challenges, and establishing the necessary infrastructure for electric aircraft. Partnerships between established aerospace companies and innovative startups are becoming increasingly common, facilitating the sharing of knowledge, resources, and technology.Additionally, government and regulatory agencies are working closely with industry players to create supportive policies and incentives that promote the adoption of electric aviation. These collaborations aim to accelerate research and development, streamline certification processes, and support the creation of infrastructure needed for electric aircraft. The growth of these ecosystems highlights the collective effort required to drive the transition to more electric aviation and reflects the industry's commitment to advancing sustainable and efficient air transport solutions.

Segmental Insights

Aircraft Type Insights

The Global More Electric Aircraft Market is segmented by aircraft type into fixed-wing, rotary-wing, and hybrid configurations. Fixed-wing aircraft are widely recognized for their use in commercial aviation, military operations, and cargo transportation. These aircraft benefit from advancements in electric technology that enhance energy efficiency and reduce reliance on conventional hydraulic and pneumatic systems. The transition toward more electric architectures in fixed-wing designs is driven by the need for lower operating costs, improved performance, and environmental sustainability. The implementation of electric systems in areas such as propulsion, actuation, and power distribution contributes to their increasing adoption.Rotary-wing aircraft, including helicopters, are also witnessing advancements in electrification. These aircraft are often utilized for specialized operations such as search and rescue, medical evacuation, and urban air mobility. Electric technologies in rotary-wing platforms enhance maneuverability and reliability while reducing maintenance requirements. The integration of electric systems in these aircraft supports the goal of achieving quieter and more sustainable operations, which is particularly relevant for urban and densely populated environments. The focus on lightweight and compact electric components aligns with the specific design and operational needs of rotary-wing aircraft.

Hybrid configurations represent a convergence of fixed and rotary-wing characteristics, combining the benefits of both types. These aircraft are often designed for emerging applications such as advanced air mobility and regional transportation. Hybrid designs leverage electric propulsion and distributed energy systems to optimize performance, range, and operational efficiency. These configurations play a critical role in the development of sustainable aviation by addressing challenges related to emissions and fuel consumption. Hybrid aircraft often incorporate innovative technologies that support vertical takeoff and landing (VTOL) capabilities, enabling their use in diverse environments and scenarios.

Across these aircraft types, the shift toward electrification is transforming the aviation industry. Electric systems are not only enhancing the efficiency and sustainability of operations but also paving the way for future innovations. This evolution aligns with the broader goals of reducing the environmental impact of aviation and meeting stringent regulatory standards. The segmentation by aircraft type highlights the diverse applications and opportunities within the More Electric Aircraft Market, driven by advancements in technology and a commitment to sustainable aviation solutions.

Regional Insights

North America emerged as the dominant region in the Global More Electric Aircraft Market in 2023, driven by a robust aviation infrastructure and a strong focus on technological advancements. The region's extensive investment in research and development has facilitated the adoption of more electric technologies across various aircraft types. This adoption is supported by the presence of key aviation stakeholders actively exploring sustainable and efficient solutions. Electric systems have been increasingly integrated into fixed-wing and rotary-wing aircraft, enhancing operational performance and aligning with environmental objectives.The demand for reduced fuel consumption and lower emissions has been a critical driver for the growth of more electric aircraft in North America. Regulatory frameworks promoting cleaner aviation technologies have encouraged manufacturers and operators to shift toward electric systems. These systems, encompassing electric propulsion, power distribution, and advanced actuation, offer improved efficiency and reduced maintenance requirements. The focus on electrification is further supported by initiatives to modernize the aging fleet of aircraft in the region.

Military and defense applications have also played a significant role in advancing the more electric aircraft segment in North America. Armed forces have prioritized the adoption of electric technologies to improve the reliability and sustainability of their aviation operations. Enhanced power systems and reduced dependence on hydraulic and pneumatic components contribute to greater operational flexibility, aligning with strategic objectives for modernized and energy-efficient fleets.

The region's leadership in innovation has fostered collaborations between technology providers, aviation manufacturers, and research institutions. These partnerships have accelerated the development of electric solutions tailored to meet the unique demands of the aviation industry. Infrastructure advancements, such as improved charging systems and energy storage solutions, complement the adoption of more electric aircraft by ensuring operational efficiency and scalability.

North America’s emphasis on sustainability and efficiency positions the region as a leader in the transformation of the aviation industry. The adoption of more electric technologies reflects a commitment to addressing environmental concerns while maintaining high standards of performance and reliability. This ongoing evolution is shaping the future of aviation and establishing North America as a key contributor to the global more electric aircraft movement.

Key Market Players

- The Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Safran SA

- Honeywell International Inc.

- RTX Corporation

- General Electric Company

- Moog Inc.

- Parker-Hannifin Corporation

- Eaton Corporation plc

Report Scope:

In this report, the Global More Electric Aircraft Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:More Electric Aircraft Market, By Aircraft Type:

- Fixed

- Rotary

- Hybrid

More Electric Aircraft Market, By System Type:

- Propulsion

- Airframe

More Electric Aircraft Market, By Application Type:

- Power Distribution

- Passenger Comfort

- Air Pressurization & Conditioning

- Flight Control & Operations

More Electric Aircraft Market, By Region:

- North America

- United State

- Canada

- Mexico

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Australia

- Thailand

- Europe & CIS

- France

- Germany

- Spain

- Italy

- United Kingdom

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global More Electric Aircraft Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- The Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Safran SA

- Honeywell International Inc.

- RTX Corporation

- General Electric Company

- Moog Inc.

- Parker-Hannifin Corporation

- Eaton Corporation plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | December 2024 |

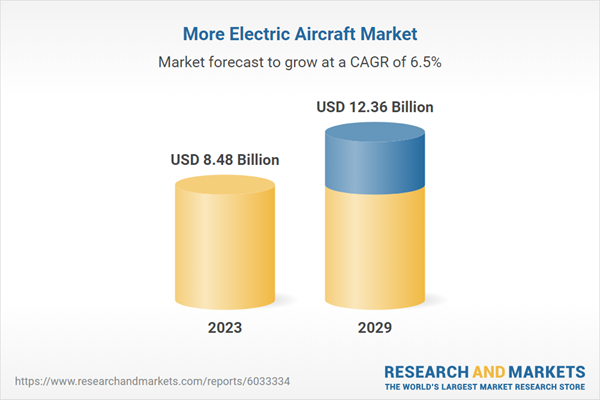

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 8.48 Billion |

| Forecasted Market Value ( USD | $ 12.36 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |