Cloud robotics is used in healthcare for surgical assistance, patient monitoring, rehabilitation, and hospital logistics. Cloud-based systems enable medical robots to access vast amounts of data, collaborate with other robots, and provide real-time insights to healthcare professionals, improving the quality of care and patient outcomes. Therefore, the healthcare segment held 18% revenue share in the market in 2023. The healthcare sector’s adoption of cloud robotics is growing as it embraces digital transformation and seeks innovative ways to enhance operational efficiency and patient care.

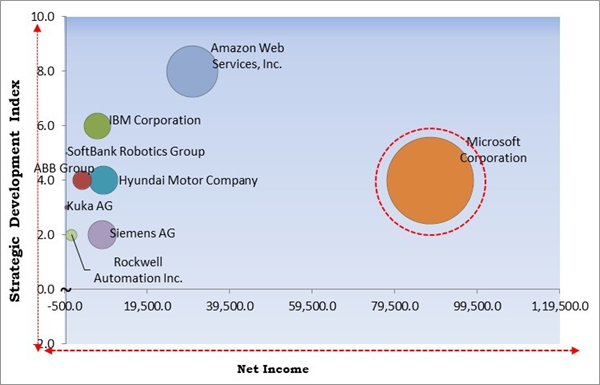

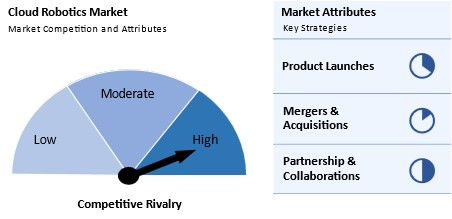

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2023, Siemens AG came to partnership with IBM, a US-based multinational technology corporation. Through this partnership, Siemens would aim to create an integrated software solution that combines their capabilities in systems engineering, service lifecycle management, and asset management. Additionally, In October, 2023, SoftBank Robotics Group formed a partnership with Shenzhen Pudu Technology Co., Ltd., a worldwide-leading robotics company. Under this partnership, the companies elevated the commercial service robotics industry, combining SoftBank Robotic's expertise in the Japanese market with Pudu's product and technology advantages in delivery robot and cleaning robot.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunner in the Market. In March, 2023, Microsoft Corporation partnered with RV Technology, a Hong Kong-based robotic applications and systems developer, to launch ARCS, Hong Kong’s first centralized cloud robotic platform. Powered by Microsoft Azure’s scalable cloud technology, ARCS enables centralized management and control of robots across brands and functions, enhancing efficiency in sectors such as healthcare, logistics, and smart cities. The platform addresses societal challenges like workforce gaps and sustainability, providing innovative robotic solutions for rehabilitation and autonomous services. Companies such as Amazon Web Services, Inc., Siemens AG and Hyundai Motor Company are some of the key innovators in Cloud Robotics Market.Market Growth Factors

As businesses face growing competition and pressure to innovate, the need for automation will only increase. Cloud robotics provides a flexible, cost-effective solution for achieving automation at scale. Industries such as logistics, agriculture, and healthcare are turning to robotics to improve productivity, and cloud computing is enabling these systems to function more effectively and intelligently. As the need for automation grows, cloud robotics will continue to be a major driver in transforming how industries operate, fostering a more productive, efficient, and scalable future. Therefore, increased demand for automation across industries drives the market's growth.Remote control capabilities can reduce operational costs by allowing companies to centralize management and support. This shift makes it more convenient for operators and extends the lifespan of robotic systems through continuous monitoring. By detecting issues early, companies can perform preventive maintenance, ensuring that robots remain functional and efficient. As industries continue to grow in complexity, the ability to manage robotic systems remotely will be a key advantage, driving further adoption of cloud robotics. Thus, remote monitoring and control capabilities are propelling the market's growth.

Market Restraining Factors

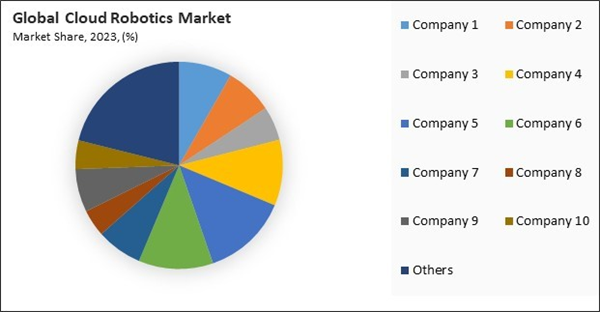

Despite these challenges, businesses that can overcome the initial setup costs often experience long-term savings and operational benefits. However, the high initial costs remain a significant barrier, especially for companies in developing economies or sectors that are not yet ready to invest heavily in digital transformation. The development of more affordable cloud robotics solutions and financing options will be essential in addressing this restraint and enabling broader adoption across different industries. Hence, high initial setup costs for cloud integration is impeding the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers- Increased Demand for Automation Across Industries

- Remote Monitoring and Control Capabilities

- Rapid Growth of the Logistics and E-commerce Industries

- High Initial Setup Costs for Cloud Integration

- Reliability and Latency Issues in Cloud Communication

- Expansion of Smart Cities and Infrastructure Projects

- Increased Investment and Funding in Robotics Startups

- Energy Consumption and Sustainability Concerns

- Data Privacy and Security Concerns

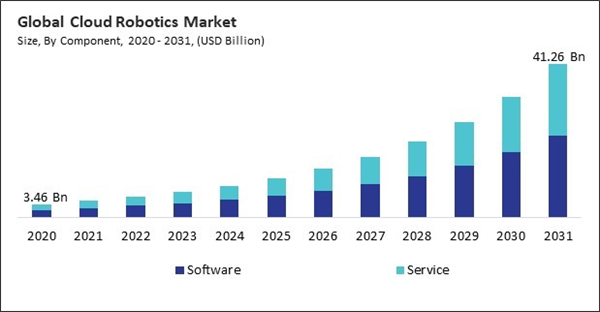

Component Outlook

Based on component, the market is divided into software and service. In 2023, the software segment garnered 56% revenue share in the market. This segment’s prominence can be attributed to software's critical role in the functionality and efficiency of cloud robotics. Software in cloud robotics encompasses a wide range of applications, including cloud-based control systems, data analytics, artificial intelligence, machine learning, and integration platforms. These software solutions enable robots to leverage the cloud's computational power and storage capacity, facilitating complex data processing, real-time decision-making, and seamless collaboration among multiple robots.Robot Type Outlook

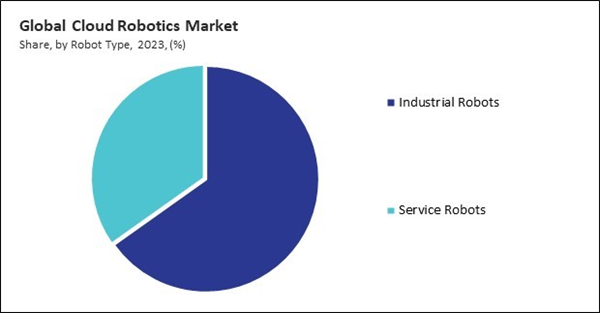

On the basis of robot type, the market is segmented into industrial robots and service robots. In 2023, the service robots segment attained 35% revenue share in the market. These robots perform delivery, cleaning, patient care, and customer service tasks, benefiting from cloud connectivity for data processing, machine learning, and real-time decision-making. The growing adoption of service robots in various sectors is driven by the need for enhanced efficiency, convenience, and the ability to handle complex tasks that require significant computational resources provided by cloud technologies.Enterprise Size Outlook

Based on enterprise size, the market is categorized into large enterprises and SMEs. In 2023, the large enterprises segment registered 66% revenue share in the market. Large enterprises often have the resources and infrastructure to adopt and integrate advanced cloud robotics solutions on a significant scale. These organizations utilize cloud robotics to streamline operations, enhance productivity, and achieve higher levels of automation and precision. The extensive adoption in large-scale manufacturing, logistics, and other industrial applications drives the substantial market share of this segment.Service Model Outlook

By service model, the market is divided into SaaS, PaaS, and IaaS. The PaaS segment procured 34% revenue share in the market in 2023. PaaS in cloud robotics offers a development and deployment environment in the cloud, enabling organizations to build, test, and deploy robotics applications without worrying about the underlying infrastructure. This service model supports customization and integration, allowing businesses to develop tailored robotics solutions that meet specific operational needs. PaaS provides tools and frameworks that facilitate the creation of complex robotics applications, enhancing flexibility and innovation.Vertical Outlook

Based on vertical, the market is divided into manufacturing, logistics, healthcare, aerospace & defense, media & entertainment, and others. The manufacturing segment attained 31% revenue share in the market in 2023. The need for automation, efficiency, and precision in industrial processes drives the extensive use of cloud robotics in manufacturing. Cloud robotics enables real-time monitoring, predictive maintenance, quality control, and optimization of production lines, contributing to enhanced productivity and reduced operational costs. The manufacturing sector’s adoption of cloud robotics is further fueled by its ability to integrate with other smart technologies, such as IoT, to create more agile and responsive manufacturing systems.Market Competition and Attributes

The Cloud Robotics market is intensely competitive, driven by advancements in AI, IoT, and cloud computing. Market participants prioritize integrating cloud technologies to enhance robot functionality, scalability, and real-time data processing. Collaborative ecosystems involving cloud providers, robotics manufacturers, and enterprises are key to innovation and deployment. Competition is fueled by demand for cloud-enabled robotics across industries like manufacturing, healthcare, logistics, and agriculture. The market's growth is shaped by the push for automation, operational efficiency, and the adoption of AI-driven robotic solutions.

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 37% revenue share in the cloud robotics market in 2023. North America, particularly the United States, is a key player in adopting advanced robotics and cloud technologies. The region’s strong industrial base, technological advancements, and high levels of investment in automation and AI have fueled the growth of cloud robotics. Industries such as manufacturing, logistics, and healthcare in North America increasingly leverage cloud robotics to optimize operations, enhance efficiency, and improve decision-making processes.Recent Strategies Deployed in the Market

- Jun-2023: Amazon Web Services, Inc. unveiled the AWS Generative AI Innovation Center, a fresh initiative aimed at aiding customers in the effective development and implementation of generative artificial intelligence (AI) solutions.

- May-2023: Kuka AG unveiled the KMP 600-S diffDrive AGV, featuring speeds up to 2 m/s, 600 kg payload capacity, and advanced safety with laser scanners and 3D object detection. Paired with the KR IONTEC robot, it offers efficient, flexible automation for palletizing and depalletizing consumer goods.

- May-2023: Rockwell Automation, Inc. came into partnership with Autonox Robotics, a German Based Automation Machinery Manufacturing company. Through this partnership, Rockwell would aim to empower businesses in North America, Europe, the Middle East, and Africa to unlock fresh manufacturing opportunities with comprehensive robot control solutions.

- Nov-2022: Amazon Web Services, Inc. launched IoT RoboRunner, a cloud service for managing multivendor robot fleets. The platform simplifies robot data processing, facilitates interoperability, and enhances efficiency for manufacturers. With features like Fleet Manager System Gateway and Shared Space Management, RoboRunner reduces operational costs and the need for custom software, streamlining robot fleet management and improving productivity.

- Oct-2022: SoftBank Robotics Group unveiled the "Robot Integrator (RI). The new product entails delivering comprehensive services to both robot manufacturers and diverse industries exploring robotics solutions.

List of Key Companies Profiled

- Kuka AG (Midea Group Co., Ltd.)

- Hyundai Motor Company

- SoftBank Robotics Group (SoftBank Group Corporation)

- ABB Group

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Microsoft Corporation

- Siemens AG

- CloudMinds Technology Inc.

- IBM Corporation

- Rockwell Automation Inc.

Market Report Segmentation

By Component- Software

- Service

- Industrial Robots

- Service Robots

- Large Enterprises

- SMEs

- SaaS

- PaaS

- IaaS

- Manufacturing

- Logistics

- Healthcare

- Aerospace & Defense

- Media & Entertainment

- Other Vertical

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Kuka AG (Midea Group Co., Ltd.)

- Hyundai Motor Company

- SoftBank Robotics Group (SoftBank Group Corporation)

- ABB Group

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Microsoft Corporation

- Siemens AG

- CloudMinds Technology Inc.

- IBM Corporation

- Rockwell Automation Inc.