Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market encounters a significant hurdle due to the automotive industry's shift toward electrification. The rapid adoption of electric vehicles (EVs) markedly lowers the dependency on traditional engine belts, as EV powertrains utilize fewer mechanical auxiliaries and lack the intricate belt configurations characteristic of internal combustion engines. This structural evolution in vehicle architecture presents a long-term barrier to volume expansion for conventional engine belt manufacturers.

Market Drivers

The growth of global automotive production acts as a primary catalyst for the engine belt market, directly stimulating demand for original equipment manufacturer (OEM) components. As automakers increase manufacturing output to satisfy recovering consumer interest, the procurement of timing and accessory drive belts rises in proportion to vehicle assembly rates, a trend particularly visible in major industrial hubs. For example, the China Association of Automobile Manufacturers (CAAM) reported in January 2025 that the country reached a cumulative annual automobile production of 31.28 million units in 2024, highlighting the immense volume of powertrain components necessary for new vehicle assemblies.Concurrently, an expanding and aging global vehicle fleet is essential for sustaining the aftermarket segment, which frequently offers higher margins than OEM sales. As vehicles remain in operation for longer periods, the inevitable wear on rubber components requires the periodic replacement of serpentine and timing belts to prevent engine failure, thereby broadening the addressable market and protecting suppliers from cyclical downturns in new car production. This resilience is illustrated by Gates Industrial Corporation, which reported third-quarter net sales of $855.7 million in October 2025, bolstered by robust growth in the automotive replacement channel. Similarly, Continental AG announced in November 2025 that its consolidated third-quarter sales reached €5.0 billion, driven partially by strong demand in the replacement business despite challenges in the original equipment sector.

Market Challenges

The central obstacle impeding the growth of the Global Automotive Engine Belt Market is the accelerating transition toward vehicle electrification, which fundamentally alters the mechanical architecture of modern automobiles. Unlike internal combustion engines that depend on an intricate network of serpentine and timing belts to synchronize the crankshaft with auxiliary systems, battery electric vehicles employ electric motors to directly power components such as air conditioning compressors and water pumps. This elimination of mechanical drive mechanisms drastically lowers the number of belts required per vehicle, consequently reducing the addressable market size across both the original equipment and aftermarket segments.The magnitude of this shift is underscored by the significant volume of vehicles entering the market with minimal engine belt requirements. According to the China Association of Automobile Manufacturers, sales of new energy vehicles reached 12.87 million units in 2024. As these vehicles secure a larger portion of global production, belt manufacturers confront a structural decline in unit demand. This transition constitutes a persistent barrier to volume growth as the industry progressively moves away from the combustion technologies that traditionally sustain the market.

Market Trends

The development of specialized belts for 48V mild hybrid systems is emerging as a critical trend, effectively offsetting the volume reduction associated with full electrification. Unlike battery electric vehicles that discard traditional drive belts, mild hybrid architectures employ Belt-Alternator-Starter (BAS) systems that demand high-performance, reinforced belts to handle torque boosts and frequent start-stop cycles. This technology bridges the gap between internal combustion and electric powertrains, ensuring medium-term demand for advanced belt solutions. Highlighting this growth, the European Automobile Manufacturers’ Association (ACEA) reported in January 2025 that hybrid electric vehicle (HEV) registrations in the European Union surged by 33.1% in December, indicating a rapidly expanding install base for these specialized components.Simultaneously, the adoption of Belt-in-Oil (BiO) timing technologies is gaining considerable momentum, particularly as these systems transition from niche original equipment applications to the broader aftermarket. BiO systems replace traditional chains and dry belts to lower friction and emissions, yet they require specialized materials capable of enduring chemical exposure and continuous oil immersion. This shift opens a lucrative revenue stream for suppliers able to provide complex, chemically resistant replacement parts. For instance, Dayco announced in a November 2025 press release that it had launched its Belt-in-Oil program for the North American aftermarket, offering coverage for over 2 million Ford and Lincoln vehicles equipped with these advanced drive systems.

Key Players Profiled in the Automotive Engine Belt Market

- Continental AG

- Gates Industrial Corporation PLC

- Bando Chemical Industries, Ltd.

- Mitsuboshi Belting Ltd.

- Dayco Incorporated

- AB SKF

- Tsubakimoto Chain Co.

- Optibelt GmbH

- HUTCHINSON SA

- Schaeffler AG

Report Scope

In this report, the Global Automotive Engine Belt Market has been segmented into the following categories:Automotive Engine Belt Market, by Service Type:

- Ride Hailing

- Car Sharing

- Bike Sharing

- Scooter Sharing

- Micro Mobility Solutions

Automotive Engine Belt Market, by Vehicle Type:

- Cars

- Bicycles

- Scooters

- Electric Vehicles

- Hybrid Vehicles

Automotive Engine Belt Market, by User Demographics:

- Consumer

- Corporate

- Tourist

Automotive Engine Belt Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Engine Belt Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Engine Belt market report include:- Continental AG

- Gates Industrial Corporation PLC

- Bando Chemical Industries, Ltd

- Mitsuboshi Belting Ltd

- Dayco Incorporated

- AB SKF

- Tsubakimoto Chain Co.

- Optibelt GmbH

- HUTCHINSON SA

- Schaeffler AG

Table Information

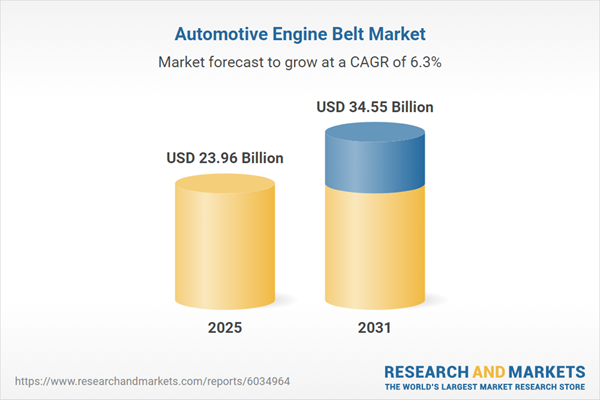

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 23.96 Billion |

| Forecasted Market Value ( USD | $ 34.55 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |