Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Fiberglass is a versatile, lightweight material made from fine threads of glass. It is produced by drawing molten glass into thin fibers, which are then woven or combined with resins to create various products. These fibers are incredibly strong, yet flexible, and are known for their durability, resistance to corrosion, and thermal insulation properties. Fiberglass is commonly used in a wide range of industries, including construction, automotive, aerospace, and marine applications. In construction, it is used for insulation, roofing, and reinforcing materials. In the automotive and aerospace industries, fiberglass is used to manufacture lightweight, durable components like body panels and structural parts.

It is also utilized in the production of boats, pipes, and tanks due to its resistance to moisture and chemicals. Fiberglass has several advantages, including its high strength-to-weight ratio, fire resistance, and ability to withstand harsh environmental conditions. However, it can be brittle under certain stresses and may pose health risks if the fibers are inhaled in large quantities during manufacturing. Despite these drawbacks, fiberglass remains a popular choice for many applications because of its cost-effectiveness, versatility, and performance in demanding environments.

Key Market Drivers

Renewable Energy and Sustainable Practices

The United Arab Emirates (UAE) is increasingly emphasizing renewable energy and sustainable practices as a means to reduce its carbon footprint and dependence on fossil fuels. This focus on sustainability is a prominent driver for the fiberglass market in the country. Fiberglass, with its excellent mechanical properties, resistance to corrosion, and light weight, is a preferred material for various renewable energy applications, including wind energy and solar power generation.Wind energy has gained significant momentum in the UAE, with the country investing in wind farm projects to harness its ample wind resources. Fiberglass is used in the manufacturing of wind turbine blades due to its high strength, low weight, and durability. As the UAE expands its wind energy capacity, the demand for fiberglass materials for blade production is expected to grow substantially, benefiting manufacturers in the region.

Solar energy is another area where fiberglass plays a pivotal role. Solar panels require durable, weather-resistant materials for their frames and supports, and fiberglass is an ideal choice. With the UAE's aggressive push for solar power, including the construction of large-scale solar farms and installations on residential and commercial rooftops, the demand for fiberglass in the photovoltaic industry is on the rise.

UAE government has introduced sustainability regulations and green building standards, which promote the use of eco-friendly materials like fiberglass for insulation and construction. These regulations create a favorable environment for the growth of the fiberglass market as businesses and individuals increasingly adopt sustainable practices.

The UAE's commitment to renewable energy and sustainability initiatives is a significant driver for the fiberglass market. The demand for fiberglass in wind energy, solar power, and green building applications is expected to increase as the UAE continues its efforts to reduce its carbon emissions and embrace clean energy solutions. The UAE aims to generate 50% of its energy from renewable sources by 2050, as part of its energy diversification strategy. The UAE is a leader in solar energy. The Mohammed bin Rashid Al Maktoum Solar Park in Dubai, one of the largest solar parks in the world, has a planned capacity of 5,000 MW by 2030, with 1,200 MW already installed as of 2024.

Booming Marine and Water Sports Industry

The United Arab Emirates (UAE) is renowned for its coastal attractions, making it a prime location for the flourishing marine and water sports industry. This industry serves as a noteworthy driver for the fiberglass market in the UAE. Fiberglass, with its exceptional properties, has become the material of choice for manufacturing a wide range of marine vessels, watercraft, and accessories.The UAE boasts a vibrant leisure and luxury marine industry, driven by factors such as the country's extensive coastline, favorable climate, and a strong tourism sector. Fiberglass's attributes, including high strength, resistance to corrosion, and lightweight nature, make it an ideal material for constructing boats, yachts, jet skis, and sailboats. The demand for these watercraft, particularly luxury models, has been on the rise, creating a growing market for fiberglass products. In addition to leisure craft, fiberglass is essential in the construction of commercial vessels, such as fishing boats, ferries, and offshore support vessels. These boats require materials that can withstand harsh marine environments and provide longevity, making fiberglass an optimal choice.

The water sports industry in the UAE, which includes activities like paddleboarding, surfing, and kayaking, relies heavily on fiberglass for the production of boards and equipment. The lightweight and durable nature of fiberglass make it an ideal material for these products, attracting water sports enthusiasts and driving up the demand.

The UAE's commitment to hosting international events, such as the America's Cup and the Dubai International Boat Show, further promotes the marine industry and, consequently, the fiberglass market. These events attract global attention and increase the demand for high-quality, innovative fiberglass products.

The booming marine and water sports industry in the UAE is a significant driver for the fiberglass market. Fiberglass's attributes align with the requirements of this sector, ranging from leisure to commercial vessels and water sports equipment. The continued growth of this industry, coupled with the UAE's position as a global hub for marine events, ensures a robust market for fiberglass products in the country.

Key Market Challenges

Intense Competition and Global Market Dynamics

The United Arab Emirates (UAE) fiberglass market faces a significant challenge in the form of intense competition and evolving global market dynamics. This challenge is largely driven by the presence of numerous local and international fiberglass manufacturers and suppliers, all vying for a share of the market. The competition is further exacerbated by the changing economic and trade conditions on a global scale.One of the primary factors contributing to the competitive landscape is the presence of well-established international fiberglass manufacturers. These companies often have vast resources, economies of scale, and established distribution networks, enabling them to offer competitive pricing and advanced product offerings. Local UAE manufacturers, while striving to meet international standards, may find it challenging to compete with the economies of scale and technological advancements of these global competitors.

Another factor is the fluctuation in the global supply chain. The fiberglass market relies on raw materials such as resins, glass fibers, and other chemicals, which are subject to price fluctuations due to factors like oil prices, availability of raw materials, and geopolitical issues. Such fluctuations can impact the cost structure of local manufacturers, making it difficult to maintain competitive prices and stable supply chains.

Additionally, trade dynamics play a pivotal role in shaping competition. Tariffs, trade agreements, and regulatory changes can affect the cost and availability of fiberglass materials. For instance, trade disputes and tariffs can impact the cost of importing raw materials or exporting finished fiberglass products. As the UAE is a significant player in global trade, changes in these dynamics can create uncertainty and challenge the stability of the local fiberglass market.

Addressing this challenge requires local fiberglass manufacturers in the UAE to continuously innovate and invest in research and development to offer unique and high-quality products that can distinguish them from their global competitors. Collaborations with research institutions, government incentives, and strategic partnerships with international manufacturers can help bolster the UAE's position in the global fiberglass market.

The intense competition in the UAE fiberglass market, coupled with global market dynamics, poses a significant challenge. Local manufacturers must adapt to changing conditions, focus on innovation, and explore opportunities for collaboration to maintain a competitive edge in this dynamic and highly competitive environment.

Environmental and Sustainability Regulations

The UAE fiberglass market faces a substantial challenge in the form of environmental and sustainability regulations. With a growing global focus on environmental responsibility and sustainable manufacturing practices, the industry is under increasing pressure to comply with stringent environmental standards, which can impact both production processes and market access.Environmental regulations aim to reduce the environmental footprint of fiberglass manufacturing by addressing issues such as emissions, waste disposal, and resource consumption. In the UAE, as in many countries, regulations are being put in place to ensure that manufacturers minimize their impact on the environment. This may require significant investments in eco-friendly technologies, waste management systems, and energy-efficient manufacturing processes, which can increase production costs.

The international market has been moving towards sustainable products and practices. Many countries and industries are emphasizing the importance of sustainability and eco-friendliness, which has led to the development of green certifications and labels for products. To maintain access to international markets and remain competitive, UAE fiberglass manufacturers must meet these standards and obtain the necessary certifications.

The challenge of environmental and sustainability regulations is further compounded by the fact that fiberglass production often involves the use of chemicals, which can be subject to stringent safety and environmental regulations. Ensuring the safe handling and disposal of these chemicals while maintaining efficiency and product quality is a complex task.

To address this challenge, UAE fiberglass manufacturers must invest in sustainable manufacturing practices, adopt clean technologies, and demonstrate a commitment to reducing their environmental impact. This may involve partnerships with environmental organizations, research institutions, and government bodies to stay informed about and compliant with evolving regulations and sustainability standards.

Environmental and sustainability regulations are a significant challenge for the UAE fiberglass market, requiring manufacturers to make substantial changes in their production processes and adhere to international sustainability standards. Adapting to these regulations is not only essential for compliance but also for maintaining access to global markets and meeting the demands of environmentally conscious consumers.

Key Market Trends

Increasing Adoption of Advanced Composite Materials

The United Arab Emirates (UAE) fiberglass market is experiencing a significant trend marked by the increasing adoption of advanced composite materials. Traditionally, fiberglass reinforced composites have been a dominant material in various industries. However, recent technological advancements and innovations have led to the development and integration of more sophisticated composite materials. These advanced composites combine fiberglass with other materials, such as carbon fiber and aramid, to offer enhanced performance characteristics.One of the driving factors behind this trend is the pursuit of lightweight, high-strength materials. Advanced composite materials are being used in applications where weight reduction is critical, such as aerospace, automotive, and wind energy. In the UAE, the aerospace industry has been expanding, with the establishment of aerospace manufacturing and maintenance facilities. Fiberglass, often in conjunction with advanced composites, is playing a pivotal role in the development of lightweight, fuel-efficient aircraft components.

The automotive sector is also embracing advanced composites to create lighter and more fuel-efficient vehicles. As the UAE seeks to diversify its economy, electric vehicles and sustainable transportation solutions have gained prominence, further driving the demand for advanced composites in the automotive industry.

The wind energy sector is increasingly using advanced composites for the production of longer and more efficient wind turbine blades. These materials offer higher strength-to-weight ratios, which are crucial for capturing wind energy effectively.

To capitalize on this trend, UAE fiberglass manufacturers are investing in research and development to produce innovative advanced composite materials. Collaborations with research institutions and partnerships with global composite material developers are becoming more common. This trend not only fosters technological advancement in the UAE but also positions the country as a hub for advanced composite manufacturing and innovation.

The increasing adoption of advanced composite materials is a noteworthy trend in the UAE fiberglass market, driven by the pursuit of lightweight, high-strength solutions in industries such as aerospace, automotive, and wind energy. This trend presents opportunities for manufacturers to diversify their product offerings and enhance their competitiveness in both local and global markets.

Growth in Sustainable and Eco-Friendly Fiberglass Products

The UAE fiberglass market is witnessing a substantial trend towards the growth of sustainable and eco-friendly fiberglass products. As global awareness of environmental issues and sustainability concerns continues to rise, consumers, industries, and governments are increasingly prioritizing environmentally responsible choices, creating a demand for green and sustainable solutions in fiberglass manufacturing.One key aspect of this trend involves the development and utilization of recycled and bio-based materials in fiberglass production. Manufacturers are exploring the incorporation of recycled glass fibers and resins, as well as bio-based resins derived from renewable sources, to reduce the environmental footprint of fiberglass products. By using these materials, the industry can reduce its reliance on non-renewable resources and decrease waste in the production process.

Fiberglass manufacturers in the UAE are investing in sustainable production methods and energy-efficient technologies. This includes reducing emissions, optimizing energy consumption, and minimizing water usage during manufacturing processes. Companies are increasingly adopting practices that adhere to international environmental standards and certifications, such as ISO 14001, to demonstrate their commitment to sustainability.

Sustainable fiberglass products are finding applications in a wide range of industries, including construction, transportation, and marine. Eco-friendly insulation materials made from fiberglass are increasingly used in building and construction projects to enhance energy efficiency and reduce carbon emissions. In the transportation sector, sustainable fiberglass composites are used in electric vehicles, which align with the UAE's goals of promoting sustainable transportation solutions.

As the UAE continues to attract international events and visitors, sustainability is a crucial aspect of the hospitality and tourism sector. Sustainable fiberglass furniture and fixtures are being incorporated into hotels, resorts, and leisure facilities, aligning with the country's commitment to environmentally responsible tourism.

The trend towards sustainable and eco-friendly fiberglass products is expected to continue as environmental concerns remain at the forefront of global and local agendas. UAE fiberglass manufacturers have the opportunity to lead in this space by adopting and promoting sustainable practices in the industry.

The growth of sustainable and eco-friendly fiberglass products is a significant trend in the UAE fiberglass market, driven by increasing environmental awareness and sustainability concerns. This trend presents opportunities for manufacturers to align with global sustainability goals and meet the growing demand for eco-friendly solutions.

Segmental Insights

Glass Type Insights

The A-Glass segment emerged as the dominating segment in 2023. A-Glass is a general-purpose glass fiber characterized by its excellent electrical insulation properties, good corrosion resistance, and high tensile strength. A-Glass is widely used in electrical and electronic applications due to its excellent electrical insulation properties. It is used to manufacture insulating materials for wiring, cables, and electrical components.A-Glass fibers are employed in construction for reinforcing materials like concrete and composites. It enhances the durability and load-bearing capacity of structures. A-Glass finds applications in the automotive and aerospace industries. It is used for manufacturing lightweight composites in vehicles, aircraft, and spacecraft.

The UAE's extensive infrastructure development, including construction, transportation, and marine projects, drives the demand for A-Glass fiberglass in applications like reinforcing materials and lightweight composites. A-Glass plays a role in wind turbine blade construction, and the UAE's investments in renewable energy projects contribute to its demand. A-Glass manufacturers are increasingly exploring sustainable practices and eco-friendly materials to align with global sustainability trends.

Regional Insights

Dubai emerged as the dominating region in the UAE Fiberglass Market in 2023. Dubai's proximity to the Arabian Gulf has spurred the growth of a thriving marine industry. Fiberglass is extensively used for the construction of luxury yachts, boats, and marine accessories. Dubai is home to aerospace manufacturing and maintenance facilities, and fiberglass is employed in the aerospace sector for producing lightweight and durable components. The industrial sector in Dubai utilizes fiberglass for manufacturing components such as pipes, tanks, and industrial equipment due to its corrosion resistance.Dubai's continuous development and construction of iconic landmarks, such as the Burj Khalifa and the Palm Jumeirah, drive the demand for fiberglass in various construction and architectural applications. Dubai's growing marine and water sports industry, along with its tourism sector, contribute to the demand for fiberglass in boat manufacturing, water sports equipment, and marine infrastructure.

The trend of sustainability in construction and manufacturing materials is prominent in Dubai, leading to the use of eco-friendly fiberglass composites and practices. The use of advanced composite materials, including fiberglass, carbon fiber, and aramid, is increasing in applications like aerospace, driven by the need for lightweight, high-strength materials. Dubai's advanced infrastructure and technological investments are driving the adoption of digital design, automation, and Industry 4.0 technologies in fiberglass production.

Dubai's role in the UAE fiberglass market is significant, with applications ranging from construction to aerospace and marine industries. Market drivers include infrastructure development, a thriving marine and tourism sector, aerospace growth, and renewable energy projects. Dubai's dynamic economic landscape and commitment to innovation make it a vital segment in the UAE fiberglass market.

Key Market Players

- Johns Manville

- Owens Corning

- China Jushi Co. Ltd.

- Saint Gobain Group

- PPG Industries, Inc.

- Nippon Electric Glass Co., Ltd.

- Huntsman International LLC

- Mitsubishi Chemical Group Corporation

Report Scope:

In this report, the UAE Fiberglass Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Fiberglass Market, By Glass Type:

- A-Glass

- C-Glass

- D- Glass

- E-Glass

- S-Glass

- Others

UAE Fiberglass Market, By Product Type:

- Glass Wool

- Direct & Assembled Roving

- Yarn

- Chopped Strand

UAE Fiberglass Market, By Resins:

- Thermoset Resins

- Thermoplastic Resins

UAE Fiberglass Market, By Application:

- Construction & Infrastructure

- Automotive

- Wind Energy

- Electronics

- Manufacturing

- Marine

- Others

UAE Fiberglass Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Fiberglass Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Johns Manville

- Owens Corning

- China Jushi Co. Ltd.

- Saint Gobain Group

- PPG Industries, Inc.

- Nippon Electric Glass Co., Ltd.

- Huntsman International LLC

- Mitsubishi Chemical Group Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | December 2024 |

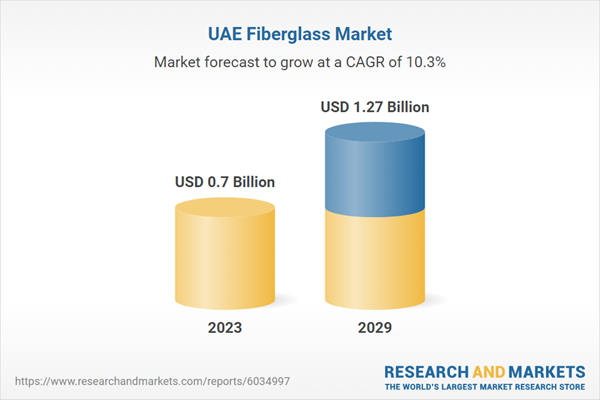

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 0.7 Billion |

| Forecasted Market Value ( USD | $ 1.27 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 8 |