Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This transition not only mitigates the environmental footprint of agricultural operations but also delivers long-term cost savings for farmers. Embracing alternative fuels in tractors yields manifold benefits. It curtails greenhouse gas emissions, fostering a cleaner and healthier ecosystem. Alternative fuel options like biofuels foster agricultural diversification and bolster local economies by establishing new markets for fuel-producing farmers. Leveraging alternative fuels enhances energy security by diminishing reliance on conventional fossil fuels.

The Australian government has been actively supporting the transition to cleaner energy in the agricultural sector. According to the Department of Agriculture, Fisheries and Forestry (DAFF), Australia has committed to reducing greenhouse gas emissions by 43% by 2030, with sustainable farming practices playing a key role in achieving this target. Tractors using biofuels and other renewable energy sources help meet these goals by curbing emissions while delivering long-term cost efficiencies for farmers. This shift is also supported by local biofuel production, which diversifies agricultural activities and creates new income streams for fuel-producing farmers.

The Australian Agricultural Machinery Market is poised for significant expansion in the foreseeable future. Fueled by technological advancements, a paradigm shift towards sustainable methodologies, and burgeoning demand for agricultural products, the market is on an upward trajectory. With increased investments pouring into this sector, it is anticipated that further breakthroughs will revolutionize farming techniques and bolster the sustainability and profitability of the agricultural domain.

Key Market Drivers

Growing Demand for Precision Agriculture Solutions

Precision farming, also referred to as precision agriculture, represents an advanced methodology utilizing cutting-edge technology and machinery to optimize the efficiency and productivity of agricultural activities. It encompasses the integration of GPS technology, automated systems, and other state-of-the-art equipment, empowering farmers to execute tasks with unprecedented precision and efficacy.A pivotal component of precision farming lies in the utilization of tractors, which serve as essential assets facilitating precision farming techniques. These robust machines are indispensable for a multitude of farming operations, providing the requisite power and adaptability necessary for contemporary agricultural practices. The burgeoning demand for tractors within the Australian equipment market underscores the pivotal role and relevance of precision farming methodologies.

The proliferation of automation within agriculture is a significant catalyst propelling the growth of the farm equipment market. The emergence of autonomous farming solutions has revolutionized traditional farming techniques, spanning from semi-automated technologies requiring minimal operator intervention to fully autonomous systems capable of operating autonomously. This spectrum of automation solutions offers farmers enhanced flexibility and efficiency in their operations, driving further innovation in the agricultural domain.

The convergence of emerging technologies is reshaping the agricultural landscape, driving economic expansion and transforming age-old farming practices. With the rapid ascent of precision farming, Australia's farm equipment market is poised for sustained growth, catering to the evolving requirements of farmers and fostering sustainable and efficient agricultural methodologies.

Surge in Technological Advancements

Technological advancements are fundamentally transforming the agricultural landscape, ushering in a new era of farming techniques and enhanced equipment. A recent breakthrough in Australian agriculture is the capability for farmers to remotely access and download machine & production data gathered by their equipment. This advancement empowers farmers to monitor and oversee their operations with greater efficiency, leading to more informed decision-making and heightened yields.These technological strides have spurred the evolution of precision agriculture systems. Leveraging sensors, satellite imagery, and data analytics, these systems optimize farming methodologies. By scrutinizing real-time data on soil moisture levels, nutrient compositions, and crop vitality, farmers can enact data-driven strategies to maximize productivity while minimizing ecological impact. This fusion of technology with agriculture not only bolsters operational efficiency but also fosters sustainable practices.

Market expansion is fueled by escalating labor expenses in the region. As labor costs soar, there's a burgeoning demand for automated and efficient farm equipment. This encompasses robotic solutions for tasks like planting, harvesting, and crop management, alongside sophisticated machinery for irrigation and fertilization. By diminishing reliance on manual labor, farmers can mitigate costs while amplifying overall productivity.

The Australian Bureau of Statistics reported that in 2021-22, Australia imported a record $2.1 billion worth of agricultural machinery, marking a 46% increase from the previous three-year average. This surge in imports reflects the growing demand for advanced farm equipment, driven by technological advancements and the need for enhanced efficiency in agricultural operations.

Key Market Challenges

High Dependence on Commodity Prices

Commodity prices wield significant influence within the agricultural sector, profoundly impacting the gross value of Australia's primary agricultural commodities. During periods of price escalation, farmers capitalize on the opportunity to optimize their production through investment in advanced farm equipment. Downturns in prices precipitate a notable downturn in the farm equipment market as farmers curtail expenditure to navigate the downturn.Agricultural commodity prices have exhibited an upward trajectory in recent years, propelled by robust global import demand. The market remains vulnerable to fluctuations, with apprehensions surrounding the prospect of deceleration in global growth leading to a marginal easing of most commodity prices. This introduces an element of uncertainty into market dynamics.

Countries heavily reliant on export commodities contend with a plethora of challenges, including subpar productivity, diminished income levels, and overvalued currencies. For Australia, endowed with a substantial agricultural sector, these challenges pose significant ramifications for the farm equipment market. The imposition of elevated tariffs on crucial Australian exports presents further impediments, suppressing prices and amplifying global price volatility. Such trade barriers have the potential to curtail Australian exports' access to international markets, thereby impacting the agricultural sector's profitability and, consequently, the demand for farm equipment.

Key Market Trends

Growing Focus on Sustainable and Efficient Solutions

The Australian farm equipment market is experiencing a significant shift towards sustainable and efficient solutions, driven by both environmental imperatives and economic considerations. Australian agriculture accounts for 55% of the nation's land use, encompassing 426 million hectares as of December 2023. This extensive land area underscores the critical need for sustainable farming practices to preserve soil health, water resources, and biodiversity.In response to these challenges, Australian farmers are increasingly adopting precision agriculture technologies, including advanced machinery and sensor systems. These innovations enable more precise application of inputs such as water, fertilizers, and pesticides, thereby reducing waste and environmental impact. For instance, the On Farm Connectivity Program, launched by the Australian Government, allocated USD 33 million over two years (2023-2025) to assist primary producers in integrating connected machinery and sensor technology.

The adoption of sustainable practices is further evidenced by the Australian Agricultural Sustainability Framework (AASF), developed by the National Farmers’ Federation in 2020. The AASF establishes clear sustainability objectives, focusing on environmental stewardship, economic resilience, and social responsibility. This framework encourages farmers to implement practices that enhance productivity while minimizing environmental footprints.

Economically, the shift towards sustainable farming is driven by the need to maintain market access and meet consumer demand for ethically produced food. International markets are increasingly favoring sustainably produced agricultural products, and Australian farmers are aligning with these preferences to remain competitive. The integration of sustainable practices not only opens new market opportunities but also contributes to long-term profitability by improving resource efficiency and resilience to climate variability.

Integration of Automation and Robotics

The integration of automation and robotics in the Australia farm equipment market is rapidly transforming agricultural practices, driven by the need for greater efficiency and sustainability. Australian farmers are increasingly adopting advanced technologies to tackle labor shortages, improve productivity, and optimize resource use. Robotics and automation technologies, such as autonomous tractors, drones for crop monitoring, and automated harvesters, are becoming common in large-scale farming operations. These technologies enhance precision farming by allowing for real-time data collection, automated planting, irrigation, and harvesting processes, reducing human labor and minimizing errors.The Australian government’s support for innovation in agriculture, through initiatives like the National Agriculture Innovation Agenda, has accelerated the uptake of automation and robotics. This agenda promotes sustainable farming practices and the use of digital technologies to boost productivity. In addition, Australian agribusinesses are investing in robotic technologies that can perform repetitive tasks with precision, such as seeding, spraying, and even milking in dairy farms. The introduction of these systems allows farmers to manage large-scale operations more effectively while reducing costs associated with labor and operational inefficiencies.

The rise in automation is also driven by environmental concerns, with farmers looking for ways to reduce water usage, minimize pesticide application, and optimize energy consumption. Robotics systems offer tailored solutions for these issues by ensuring inputs are used only when and where needed, which aligns with Australia’s push for sustainable farming practices. As the technology becomes more affordable and accessible, the trend of integrating automation and robotics in farm equipment is expected to grow significantly, revolutionizing the agricultural landscape in Australia.

Segmental Insights

Application Insights

The land development & seed bed preparation segment is projected to experience rapid growth during the forecast period. Apart from the scarcity of labor, Australian agriculture faces notable challenges due to climate fluctuations and increased competition in key export markets. These obstacles demand innovative approaches to strengthen the sector's resilience and competitive edge. Efficient land development and seed bed preparation stand out as pivotal strategies to address these challenges effectively.Given the unpredictability of climate patterns, marked by irregular rainfall, prolonged droughts, and extreme weather occurrences, the prompt and effective preparation of land and seed beds becomes essential for farmers. Through optimizing these preparatory activities, farmers can alleviate the negative effects of climate variability on crop yields and overall farm productivity.

Regional Insights

Australia Capital Territory & New South Wales emerged as the dominant player in the Australia Farm Equipment Market in 2023, holding the largest market share in terms of value. The favorable climate and fertile soil in these regions are key factors driving the high concentration of agricultural activities. Specifically, the New South Wales (NSW) region is esteemed for its expansive agricultural terrain, which supports a diverse array of farming endeavors.From the verdant fields of crop cultivation to the extensive pastures for livestock husbandry, NSW boasts a vibrant agricultural sector characterized by its multifaceted farming practices. This diverse agricultural landscape not only underpins the region's agricultural prosperity but also generates significant demand for various types of farm equipment, tailored to meet the distinct requirements of each farming activity.

Key Market Players

- Farm Tech Machinery Pty Ltd

- AF Gason Pty Ltd

- Briggs & Stratton Australia Pty Limited

- PFG Australia Pty Ltd

- Silvan Australia Pty Ltd

- AGCO Australia

- John Deere Australia

- Kubota Australia Pty Ltd

- CNH Industrial Australia Pty Limited

- Kuhn Australia Pty Ltd

Report Scope:

In this report, the Australia Farm Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Farm Equipment Market, By Type:

- Tractors

- Harvesters

- Planting Equipment

- Spraying Equipment

- Others

Australia Farm Equipment Market, By Application:

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Others

Australia Farm Equipment Market, By Region:

- Victoria & Tasmania

- Queensland

- Western Australia

- Northern Territory & Southern Australia

- Australia Capital Territory & New South Wales

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Farm Equipment Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Farm Tech Machinery Pty Ltd

- AF Gason Pty Ltd

- Briggs & Stratton Australia Pty Limited

- PFG Australia Pty Ltd

- Silvan Australia Pty Ltd

- AGCO Australia

- John Deere Australia

- Kubota Australia Pty Ltd

- CNH Industrial Australia Pty Limited

- Kuhn Australia Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | December 2024 |

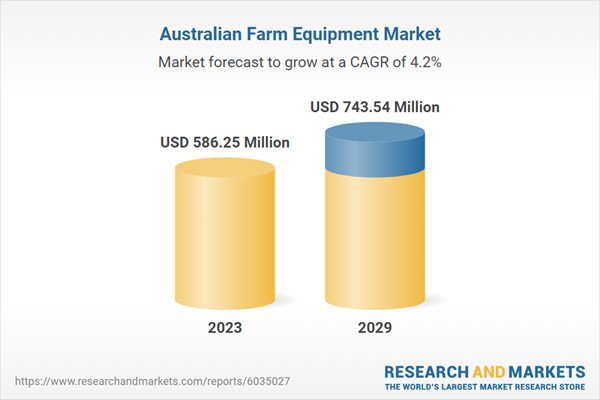

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 586.25 Million |

| Forecasted Market Value ( USD | $ 743.54 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |