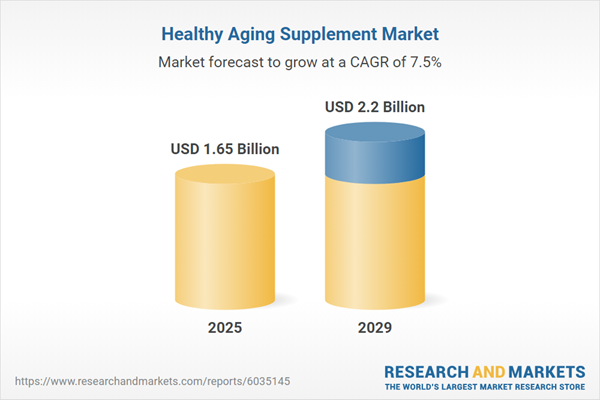

The healthy aging supplement market size has grown strongly in recent years. It will grow from $1.53 billion in 2024 to $1.65 billion in 2025 at a compound annual growth rate (CAGR) of 7.8%. The growth in the historic period can be attributed to increase in the prevalence of heart diseases, growing awareness of preventive health, changes in dietary habits, rising interest in holistic wellness, and growing popularity of online retailers.

The healthy aging supplement market size is expected to see strong growth in the next few years. It will grow to $2.2 billion in 2029 at a compound annual growth rate (CAGR) of 7.5%. The growth in the forecast period can be attributed to increasing longevity, rising health consciousness, growing geriatric population, growing popularity of online retailers, and increasing middle-class population. Major trends in the forecast period include innovations in personalized supplements, expansion of gut health formulations, advanced bioavailability technologies, innovations in natural and organic ingredients, and the development of innovative anti-aging products.

The growing health consciousness is expected to drive the expansion of the healthy aging supplements market in the future. Health consciousness involves an awareness and active pursuit of maintaining and improving personal health through lifestyle choices, diet, and regular exercise. This rise in health consciousness can be attributed to advancements in medical research, higher levels of health education, increasing healthcare costs, the impact of lifestyle-related diseases, and a greater focus on mental well-being. Healthy aging supplements contribute to health consciousness by addressing aging-related concerns and promoting proactive health management and informed lifestyle choices. For example, a survey conducted in May 2022 by the International Food Information Council, a US-based non-profit, found that around 52% of 1,005 American adults aged 18-80 and Gen Z consumers aged 18-24 followed a specific diet or eating pattern, up from 39% in 2021. The most popular choices were clean eating (16%), mindful eating (14%), and calorie counting (13%). Thus, the increasing health consciousness is fueling the growth of the healthy aging supplements market.

Major companies in the healthy aging supplements market are concentrating on developing innovative solutions such as olive polyphenols to promote longevity and wellness. Olive polyphenols are antioxidants derived from olives used in supplements to support heart health and reduce inflammation. For example, in July 2024, Bayer AG, a Germany-based pharmaceutical company, introduced a new product to its multivitamin and supplement range called One A Day Age Factor Cell Defense. This product is designed to address cellular aging from within, focusing on the challenges cells encounter over time, particularly in managing daily stressors. The supplement contains olive polyphenols, antioxidants from olive fruit extract that help protect against oxidative stress, a key factor in cellular aging. The formula also includes Omega-3 fatty acids, resveratrol, astaxanthin, vitamins C and D, and niacin (Vitamin B3), all of which work together to enhance cell resilience and support overall cell health.

In January 2022, Wellbeam Consumer Health LLC, a US-based company specializing in dietary supplements and wellness products, acquired BioTRUST Nutrition LLC for an undisclosed amount. This acquisition is intended to bolster Wellbeam Consumer Health LLC's eCommerce leadership and expertise in consumer wellness by incorporating BioTRUST, thereby expanding its direct-to-consumer platform and reinforcing its position in the healthy aging and nutritional powders markets. BioTRUST Nutrition LLC, also based in the US, is an e-commerce nutrition brand that offers healthy aging supplements and other wellness products.

Major companies operating in the healthy aging supplement market are Nestle SA, Bayer AG, Beiersdorf AG, Kerry Group PLC, Amway Corporation, Glanbia PLC, Otsuka Pharmaceutical Co. Ltd., Nature's Bounty Co., Dr Reddy's Laboratories, GNC Holdings LLC, Blackmores Limited, Life Extension, MegaFood, Natrol Inc., HUM Nutrition Inc., Thorne HealthTech, BioTech USA LLC, NeoCell Corporation, Healthy Life Pharma Private Limited, Cureveda LLC, HealthyCell, Nutrova, Wellbeam Consumer Health LLC.

North America was the largest region in the healthy aging supplement market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the healthy aging supplement market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the healthy aging supplement market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Healthy aging supplements are dietary supplements designed to support and promote the natural aging process, helping maintain overall health, vitality, and well-being as people age. These supplements typically contain vitamins, minerals, antioxidants, and other bioactive compounds that target specific aspects of aging, such as cognitive function, bone health, joint mobility, skin health, and immune support.

The main product types of healthy aging supplements are minerals, vitamins, coenzyme q10, collagen, biotin, hyaluronic acid, and others. Minerals are essential nutrients that support various bodily functions, including bone health, muscle function, and cellular processes. The various forms include tablets, powder, liquid, and capsules. These are distributed through various distribution channels such as store-based retailing, drug stores, pharmacies, health and wellness stores, and others.

The healthy aging supplements market research report is one of a series of new reports that provides healthy aging supplements market statistics, including healthy aging supplements industry global market size, regional shares, competitors with a healthy aging supplements market share, detailed healthy aging supplements market segments, market trends, and opportunities, and any further data you may need to thrive in the healthy aging supplements industry. This healthy aging supplements market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The healthy aging supplement market consists of sales of omega-3 fatty acids, turmeric, probiotics, and joint health formulas. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Healthy Aging Supplement Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on healthy aging supplement market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for healthy aging supplement ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The healthy aging supplement market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Minerals; Vitamins; Coenzyme Q10; Collagen; Biotin; Hyaluronic Acid; Other Products2) By Form: Tablets; Powder; Liquid; Capsules

3) By Distribution Channel: Stored Based Retailing; Drug Stores and Pharmacies; Health and Wellness Stores; Other Retailers

Subsegments:

1) By Minerals: Magnesium; Calcium; Zinc2) By Vitamins: Vitamin D; Vitamin C; Vitamin E

3) By Coenzyme Q10: Ubiquinone Form; Ubiquinol Form

4) By Collagen: Marine Collagen; Bovine Collagen; Plant-Based Collagen Alternatives

5) By Biotin: Biotin for Hair Health; Biotin for Nail Strength

6) By Hyaluronic Acid: Oral Hyaluronic Acid Supplements; Topical Hyaluronic Acid Products

7) By Other Products: Omega-3 Fatty Acids; Antioxidants; Adaptogens

Key Companies Mentioned: Nestle SA; Bayer AG; Beiersdorf AG; Kerry Group PLC; Amway Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Healthy Aging Supplement market report include:- Nestle SA

- Bayer AG

- Beiersdorf AG

- Kerry Group PLC

- Amway Corporation

- Glanbia PLC

- Otsuka Pharmaceutical Co. Ltd.

- Nature's Bounty Co.

- Dr Reddy's Laboratories

- GNC Holdings LLC

- Blackmores Limited

- Life Extension

- MegaFood

- Natrol Inc.

- HUM Nutrition Inc.

- Thorne HealthTech

- BioTech USA LLC

- NeoCell Corporation

- Healthy Life Pharma Private Limited

- Cureveda LLC

- HealthyCell

- Nutrova

- Wellbeam Consumer Health LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.65 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |