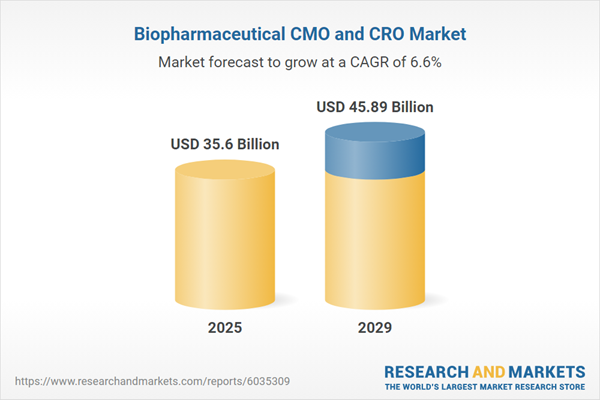

The biopharmaceutical cmo and cro market size has grown strongly in recent years. It will grow from $33.33 billion in 2024 to $35.6 billion in 2025 at a compound annual growth rate (CAGR) of 6.8%. The growth in the historic period can be attributed to increasing investment in biopharmaceutical R&D, growing demand for innovative therapies, expanding biologics pipeline, high growth in biopharmaceutical, and development in outsourcing strategies by pharmaceutical companies.

The biopharmaceutical cmo and cro market size is expected to see strong growth in the next few years. It will grow to $45.89 billion in 2029 at a compound annual growth rate (CAGR) of 6.6%. The growth in the forecast period can be attributed to rising outsourcing of drug development and manufacturing, increasing focus on cost-effective production methods, expanding therapeutic areas and drug pipelines, increasing demand for personalized medicine, and higher investments in biotechnology startups. Major trends in the forecast period include rising adoption of automated and high-throughput technologies, increasing use of advanced analytics and AI in drug development, growth in demand for cell and gene therapies, increasing integration of digital technologies in clinical trials, and rise in outsourcing of complex biopharmaceutical processes.

The biopharmaceutical CMO (Contract Manufacturing Organization) and CRO (Contract Research Organization) market is expected to grow due to increasing investments in research and development. These investments are driven by factors such as the need for innovation, competitive pressures, evolving market demands, and government incentives. Enhanced R&D funding allows CMOs and CROs to develop improved manufacturing techniques and research processes, boosting their capabilities and efficiency. This focus on innovation attracts and retains clients by offering advanced solutions while ensuring regulatory compliance. For example, Eurostat reported in December 2023 that EU expenditure on R&D rose to €352 billion ($384.42 billion) in 2022, a 6.34% increase from €331 billion ($361.48 billion) in the previous year. This growing R&D investment is fueling the expansion of the biopharmaceutical CMO and CRO market.

Leading companies in the biopharmaceutical CMO and CRO market are forming strategic partnerships to improve services, boost efficiencies, and speed up drug development for biopharmaceutical firms. Strategic partnerships involve companies combining their strengths and resources to achieve shared goals and mutual success. For example, in June 2024, Abzena plc, a UK-based biopharmaceutical company, entered into a partnership with Argonaut Manufacturing Services Inc., a US-based contract manufacturing organization (CMO), to offer integrated drug development and manufacturing solutions. This collaboration aims to deliver faster, end-to-end drug development and manufacturing processes, enhancing efficiency, lowering costs, and streamlining biopharmaceutical production for their clients.

In June 2024, Great Point Partners, a US-based investment firm, acquired Lyocontract GmbH for an undisclosed amount. This acquisition enables Great Point Partners to enhance Lyocontract's contract manufacturing capabilities, including aseptic liquid filling, freeze-drying, and injectable medicine packaging. Lyocontract GmbH, based in Germany, is a CDMO specializing in drug product contract development and manufacturing.

Major companies operating in the biopharmaceutical cmo and cro market are Thermo Fisher Scientific Inc., Boehringer Ingelheim International GmbH, Eurofins Scientific SE, Lonza Group AG, Syneos Health Inc., Catalent Inc., Charles River Laboratories International Inc., Parexel International (MA) Corporation, Samsung Biologics Co. Ltd., CELLTRION INC., Medpace Holdings Inc., Fujifilm Diosynth Biotechnologies UK Limited, Almac Group, Pharmaron Beijing Co. Ltd., Worldwide Clinical Trials, KBI Biopharma, Inotiv Inc., Caidya, Rentschler Biopharma SE, Celerion Inc., TFS HEALTHCARE LIMITED.

North America was the largest region in the biopharmaceutical CMO and CRO market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the biopharmaceutical cmo and cro market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biopharmaceutical cmo and cro market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Biopharmaceutical contract manufacturing organizations (CMOs) and contract research organizations (CROs) are companies that offer outsourced services to biopharmaceutical companies. CMOs are responsible for the manufacturing and production of drugs, while CROs focus on research and development activities, including clinical trials and regulatory support. Both types of organizations help biopharmaceutical companies lower costs and accelerate the drug development process.

The primary products offered by biopharmaceutical CMOs and CROs include biologics and biosimilars. Biologics are complex medicines derived from living organisms, used to treat a range of diseases such as cancer, autoimmune disorders, and infectious diseases. These organizations provide various services, including contract manufacturing and contract research, with different methods of production, encompassing both mammalian and non-mammalian sources.

The biopharmaceutical CMO and CRO market research report is one of a series of new reports that provides biopharmaceutical CMO and CRO market statistics, including the biopharmaceutical CMO and CRO industry global market size, regional shares, competitors with the biopharmaceutical CMO and CRO market share, detailed biopharmaceutical CMO and CRO market segments, market trends, and opportunities, and any further data you may need to thrive in the biopharmaceutical CMO and CRO industry. These biopharmaceutical CMO and CRO market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The biopharmaceutical CMO and CRO market includes revenues earned by entities by providing services such as formulation development, quality control and assurance, clinical trial management, data management, and analysis. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included. The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biopharmaceutical CMO and CRO Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biopharmaceutical cmo and cro market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biopharmaceutical cmo and cro ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The biopharmaceutical cmo and cro market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Biologics; Biosimilars2) By Service Type: Contract Manufacturing; Contract Research

3) By Source: Mammalian; Non-Mammalian

Subsegments:

1) By Biologics: Monoclonal Antibodies (mAbs); Vaccines; Recombinant Proteins; Cell and Gene Therapies; Antibody-Drug Conjugates (ADCs); Therapeutic Enzymes2) By Biosimilars: Biosimilar Monoclonal Antibodies; Biosimilar Insulins; Biosimilar Growth Hormones; Biosimilar Erythropoietins; Biosimilar Granulocyte Colony-Stimulating Factors (G-CSFs)

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Boehringer Ingelheim International GmbH; Eurofins Scientific SE; Lonza Group AG; Syneos Health Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Biopharmaceutical CMO and CRO market report include:- Thermo Fisher Scientific Inc.

- Boehringer Ingelheim International GmbH

- Eurofins Scientific SE

- Lonza Group AG

- Syneos Health Inc.

- Catalent Inc.

- Charles River Laboratories International Inc.

- Parexel International (MA) Corporation

- Samsung Biologics Co. Ltd.

- CELLTRION INC.

- Medpace Holdings Inc.

- Fujifilm Diosynth Biotechnologies UK Limited

- Almac Group

- Pharmaron Beijing Co. Ltd.

- Worldwide Clinical Trials

- KBI Biopharma

- Inotiv Inc.

- Caidya

- Rentschler Biopharma SE

- Celerion Inc.

- TFS HEALTHCARE LIMITED

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 35.6 Billion |

| Forecasted Market Value ( USD | $ 45.89 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |