DPaaS Market is being driven by an increasing need for secure, scalable, and cost-efficient solutions to protect sensitive data, meet compliance needs and deal with cybersecurity threats such as ransomware. Based on DPaaS, cloud-based storage, hybrid cloud setups, AI-powered threat detection, and zero-trust architectures decide that DPaaS is an indispensable tool for industries such as healthcare, finance, and retail. These factors have further made it crucial to ensure operational continuity and disaster recovery, especially considering that there has been a surge in remote work and the process of digital transformation.

Despite these, the market harbors challenges like lack of professional experts, increasing costs, and loss of control concerns because data is entrusted with third-party vendors. Complications in the integration process, low awareness of DPaaS benefits, and misconceptions related to shared liability models also hinder the adaptation process. Because of the reliance on egress fees, these are termed 'hidden costs', and vendor unreliability uncertainty fuels organizations' skepticism. Overcoming these challenges will be essential for the DPaaS industry through highlighting transparency, proposing custom solutions to SMEs and enterprises, and educating business about its benefits. Such measures will lead to increased adoption of DPaaS, which will be translated into sustained growth depending on the growing needs for data security and compliance.

By Deployment Mode, Public Cloud accounts for a larger market size during the forecast period

Public cloud is mainly known as the least cost, most elastic, and most capable provider of DPaaS offerings for modern business needs. It doesn't require expensive infrastructure in the on-premises setup; therefore, it is the best bet for small and medium-sized businesses to secure their data with providers like AWS and Microsoft Azure. Its unmatched scalability feature lets businesses change resources during peak periods or scale down when demand drops, such as what Netflix does in using AWS to handle fluctuating data volume. Public cloud provides international accessibility which makes distributed teams access and protect data from any place in the world; verticals like Healthcare rely on public cloud for security of EHRs, telemedicine, and AI-assisted diagnostic facilities that include ones such as Cerner and Teladoc Health provide strong and scalable data management.By region, Asia-Pacific accounts for the highest CAGR during the forecast period.

The Asia Pacific region is expected to gain the highest CAGR in the DPaaS market due to rapid digital transformation, increasing cyber threats, and government regulations that are expected to drive demand for cloud-based solutions. Business adoption of public cloud platforms, especially by SMEs, is accelerating more rapidly, just like how startups in India and Vietnam are using scalable DPaaS services to manage customer data.Government regulations, including Singapore's data protection law and India's Personal Data Protection Bill, force organizations to adopt compliant solutions for data protection. Unsophisticated and high-profile breaches of personal data have made both recognition and adoption of advanced DPaaS features including encryption and real-time monitoring grow. For instance, in healthcare, e-commerce, and financial sectors, significant growth will come from the DPaaS as implemented in sensitive data protection, attestation, and compliance at hospitals like Apollo in India and banks such as DBS in Singapore. Demand will increasingly be driven by rising dependency on IoT, 5G, and telemedicine.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: C-level Executives - 30%, Directors - 35%, and Others - 35%

- By Region: North America - 15%, Europe - 25%, Asia Pacific - 30%, Latin America - 20% and Middle East & Africa - 10%

Research Coverage

The report segments the DPaaS market by service type, deployment mode, organization size, vertical, and region.t forecasts its size by service type (Backup as a Service, Storage as a Service, Disaster Recovery as a Service, Data Archiving, Other Services), By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (SMEs and Large Enterprises), By Vertical (BFSI, Government, Healthcare, Retail and E-Commerce, Telecommunications, IT &ITeS, Energy and Utilities, Manufacturing and Other), By Region (North America, Europe, Asia Pacific, Middle East and Africa, Latin America).The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the DPaaS market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.The report provides insights on the following pointers:

- Analysis of key drivers, such as (Growing data volumes growing data volumes are driving DPaaS adoption, Rising cybersecurity threats, Maximizing Cost Efficiency with adoption to DPaaS); Restraints (Loss of Control as a barrier in DPaaS adoption, Navigating vendor lock-in strategies to enhance flexibility in DPaas); Opportunities (Growth driven by Business Continuity and Disaster Recovery (BCDR) solutions, Growth in digitalization fueling the DPaaS market, Cloud technologies by SMEs, The integration of AI /ML and automation in data protection) and Challenges (Lack of skilled professionals, Integration complexities).

- Product Development/Innovation: Detailed insights on upcoming technologies, research development activities, new products, and service launches in the DPaaS market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the DPaaS market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the DPaaS market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players AWS(US), Microsoft (US), IBM (US), Oracle (US), DELL Technologies (US), Quantum Corporation (US), Huawei (China), HPE (US), Veritas (US), Hitachi Vantara (US), Veeam (US), Cohesity (US), 11:11 Systems (US), Acronis (Switzerland), Druva (US), Cloud4C (Singapore), Cyfuture (India) among others, in the DPaaS market strategies.

Table of Contents

Companies Mentioned

- AWS

- Microsoft

- IBM

- Oracle

- Dell Technologies

- Quantum Corporation

- Huawei

- Hpe

- Veritas

- Hitachi Vantara

- Veeam

- Cohesity

- 11:11 Systems

- Acronis

- Druva

- Cloud4C

- Cyfuture

- Tierpoint

- Quest Technology Management

- Nxtgen Datacenter & Cloud Technologies

- Secure Agility

- Infrascale

- Asigra

- Cloudian

- Hycu

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | December 2024 |

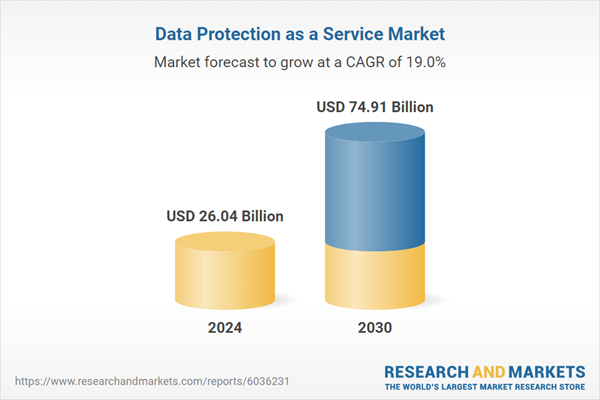

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 26.04 Billion |

| Forecasted Market Value ( USD | $ 74.91 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |