Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive growth factors, the industry faces substantial hurdles related to procuring raw materials and specialized microelectronics. Volatility within the supply chain frequently disrupts production timelines and complicates the integration of intricate electronic systems. According to the National Defense Industrial Association, 54 percent of defense industry respondents in 2025 identified supply chain disruptions as a major operational difficulty. These logistical constraints significantly restrict the ability of manufacturers to increase production rates to meet the mounting backlog of orders for missile guidance units.

Market Drivers

The expansion of global defense budgets serves as the primary financial catalyst for the missile seekers market, as nations channel capital toward modernizing strategic assets with high-fidelity guidance systems. This fiscal growth allows defense contractors to expedite the development of hardened electronics and multi-spectral sensors required for terminal phase accuracy. According to the Stockholm International Peace Research Institute’s (SIPRI) 'Trends in World Military Expenditure, 2023' Fact Sheet published in April 2024, global military spending rose by 6.8 percent in real terms to reach 2.44 trillion USD in 2023. This increase in funding provides the necessary liquidity to procure complex sub-systems, such as radio-frequency and infrared seekers, ensuring manufacturing lines stay active to satisfy sovereign security needs.Simultaneously, the heightened demand for precision-guided munitions establishes a direct link to increased seeker production volumes. Intense regional conflicts have exhausted national inventories, driving defense ministries to issue urgent contracts for the replenishment of strategic and tactical missiles. Highlighting this robust demand, MBDA reported a total order intake of 9.9 billion EUR in its '2023 Annual Results' press release from March 2024. This volume compels the supply chain to prioritize guidance section output, a trend further supported by long-term procurement strategies; for instance, the U.S. Department of Defense allocated 29.8 billion USD specifically for missiles and munitions in its Fiscal Year 2025 budget request to bolster deterrence capabilities.

Market Challenges

Persistent supply chain volatility, particularly regarding the acquisition of specialized microelectronics, represents a critical impediment to the Global Missile Seekers Market. Because guidance systems rely on highly specific components, manufacturers depend heavily on a small pool of qualified sub-tier suppliers. When these upstream partners face geopolitical restrictions or production bottlenecks, the entire assembly process for missile seekers is effectively stalled. This logistical fragility directly inhibits market growth by increasing lead times and preventing defense contractors from meeting the high volume of orders, which ultimately delays revenue recognition and restricts the industry's capacity to scale operations in line with global demand.The gravity of this sourcing rigidity is emphasized by industry data pointing to the dangers of concentrated supply bases. According to the National Defense Industrial Association, 49 percent of private sector respondents in 2024 pinpointed reliance on sole or single-source suppliers as their most significant supply chain vulnerability. This dependency is especially acute in the missile seeker sector, where a delay from just one provider of niche processors or sensors can arrest the delivery of finished guidance units. As a result, these supply constraints effectively limit the market’s expansion rate, keeping production output below the levels necessary to satisfy the heightened defense modernization objectives of nations globally.

Market Trends

The development of high-performance seekers for hypersonic weapons is rapidly transforming the technological landscape, driven by defense agencies prioritizing munitions capable of maneuvering at speeds exceeding Mach 5. Unlike conventional ballistic systems, hypersonic glide vehicles generate plasma sheaths during atmospheric flight that interfere with standard radio-frequency guidance and communication signals. In response, manufacturers are engineering advanced sensor packages equipped with high-speed processing and hardened window materials to maintain target lock amidst extreme thermal conditions and ionization interference. This focus on next-generation survivability and speed is fueling significant public sector investment; according to USNI News in April 2025, the Pentagon's Fiscal Year 2025 budget request for hypersonic research increased to 6.9 billion USD, underscoring the vital need for these specialized guidance technologies.Concurrently, the industry is witnessing a shift toward multi-mode seeker architectures to address the reliability limitations of single-sensor systems in contested environments. Modern engagement scenarios increasingly require munitions capable of fusing data from millimeter-wave radar, imaging infrared, and semi-active laser sensors to overcome adverse weather like heavy fog or smoke, as well as electronic jamming. This integration ensures that if one guidance mode is neutralized or obscured, the seeker can autonomously switch to an alternative sensor to preserve terminal accuracy. The industrial scale of this trend is illustrated by major procurement actions; for example, Lockheed Martin announced in an August 2025 press release that it secured a 720 million USD contract modification to produce dual-mode Joint Air-to-Ground Missiles, highlighting the operational transition toward multi-spectral guidance solutions.

Key Players Profiled in the Missile Seekers Market

- MBDA France SAS

- Safran S.A.

- Thales S.A.

- BAE Systems PLC

- RTX Corporation

- Leonardo S.p.A.

- Northrop Grumman Corporation

- Analog Devices, Inc.

- Lockheed Martin Corporation

- General Dynamics Corporation

Report Scope

In this report, the Global Missile Seekers Market has been segmented into the following categories:Missile Seekers Market, by Technology Type:

- Active Radar

- Passive Radar

- Semi-Active Radar

- Multi-Mode

Missile Seekers Market, by Launch Mode Type:

- Surface-to-Surface

- Air-to-Surface

- Surface-to-Air

- Air-to-Air

Missile Seekers Market, by End Use Type:

- Military

- Defense Contractors

- Aerospace

Missile Seekers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Missile Seekers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Missile Seekers market report include:- MBDA France SAS

- Safran S.A.

- Thales S.A.

- BAE Systems PLC

- RTX Corporation

- Leonardo S.p.A.

- Northrop Grumman Corporation

- Analog Devices, Inc.

- Lockheed Martin Corporation

- General Dynamics Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

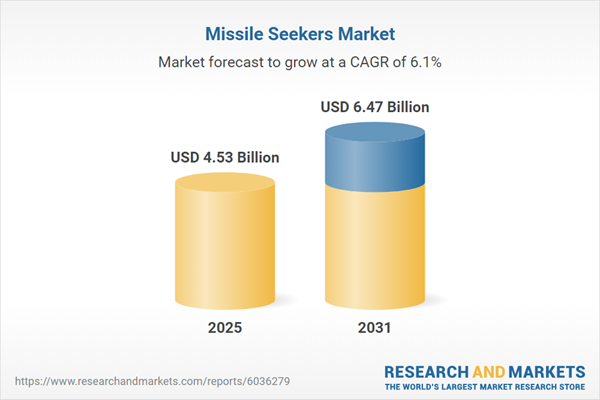

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.53 Billion |

| Forecasted Market Value ( USD | $ 6.47 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |