Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion is significantly impeded by high capital requirements and persistent supply chain vulnerabilities that disrupt production schedules. Manufacturers frequently encounter difficulties in obtaining skilled labor and specialized raw materials, resulting in budget overruns and delayed delivery timelines for complex naval programs. These logistical constraints, combined with the technical challenges of integrating advanced digital systems into legacy platforms, create substantial barriers that slow the deployment of essential sea-based defense solutions and limit the overall growth of the market.

Market Drivers

Rising geopolitical tensions and maritime territorial disputes act as the primary catalysts for the acquisition of sea-based defense assets. Nations facing instability in strategic regions, such as the Black Sea and the Indo-Pacific, are prioritizing the deployment of combat-ready fleets to assert sovereignty and secure critical trade routes. This heightened threat perception drives governments to invest heavily in deterrence capabilities, ranging from aircraft carriers to attack submarines. As noted by NATO in June 2024, a record 23 allied nations were expected to meet or exceed the guideline of spending 2% of their GDP on defense, highlighting the urgency to counter regional volatility and accelerating the integration of kinetic and electronic warfare systems to maintain superiority in contested waters.Simultaneously, global increases in defense budgets provide the financial foundation necessary for these fleet expansions. Naval commands are directing substantial capital toward ship production and the modernization of legacy platforms to address high-end maritime warfare requirements. For instance, the U.S. Department of Defense's Fiscal Year 2025 Budget Request included $32.4 billion specifically for Navy shipbuilding and conversion to enhance fleet lethality. This trend is also evident among emerging powers; in 2024, China announced a defense budget of 1.67 trillion yuan ($232 billion), a 7.2% increase aimed largely at strengthening its maritime presence, ensuring a steady demand trajectory for shipbuilders and defense electronics manufacturers worldwide.

Market Challenges

High capital intensity and enduring supply chain vulnerabilities present formidable barriers to the expansion of the Global Sea Based Defense Equipment Market. Constructing modern maritime assets, such as guided-missile destroyers and nuclear-powered submarines, necessitates the precise synchronization of thousands of specialized components, from high-grade steel to advanced microelectronics. When manufacturers face shortages in raw materials or delays in sub-system delivery, the entire integration process stalls. These disruptions are particularly damaging because the fixed costs of maintaining skilled labor and shipyard infrastructure continue to accumulate during downtime, resulting in severe budget overruns that diminish the financial capacity for future fleet modernization.This operational fragility is further compounded by the industry's structural dependence on a complex, multi-tiered supplier base. According to the Aerospace Industries Association, nearly 60 percent of the aerospace and defense workforce was employed directly within the supply chain in 2024. This heavy reliance means that a bottleneck at any lower-tier provider - whether due to workforce attrition or material scarcity - disproportionately impacts a prime contractor's ability to meet delivery schedules. Consequently, even amidst rising global demand, the market's growth is mechanically hampered as manufacturers struggle to convert order backlogs into delivered, operational capabilities.

Market Trends

The integration of Unmanned Maritime Systems is transforming naval structures by shifting reliance toward distributed, autonomous networks. Navies are increasingly deploying Unmanned Surface Vessels to execute dangerous missions, such as mine countermeasures, without risking human crews, allowing commanders to project power at a reduced cost. Reflecting this operational pivot, the U.S. Naval Institute reported in July 2024 that the U.S. Navy's proposed FY2025 budget requested $101.8 million in research and development funding specifically for the Medium Unmanned Surface Vehicle program.Concurrently, the adoption of Directed Energy Weapon Systems is addressing the threat posed by low-cost drone swarms and anti-ship missiles. Unlike finite kinetic interceptors, high-energy lasers offer speed-of-light precision and unlimited magazine depth, altering the economic asymmetry of naval defense by neutralizing threats for a negligible expense. This financial viability was demonstrated by the UK Ministry of Defence in January 2024, which noted that the DragonFire laser system achieved an operational cost of typically less than £10 per shot, proving the feasibility of deploying lasers on warships.

Key Players Profiled in the Sea Based Defense Equipment Market

- Lockheed Martin Corporation

- BAE Systems PLC

- Northrop Grumman Corporation

- General Dynamics Corporation

- Thales S.A.

- RTX Corporation

- L3Harris Technologies, Inc.

- Leonardo SpA

- Saab AB

- Navantia S.A. SM.E

Report Scope

In this report, the Global Sea Based Defense Equipment Market has been segmented into the following categories:Sea Based Defense Equipment Market, by Type:

- Battle Force Ships

- Submarines

Sea Based Defense Equipment Market, by Operation Type:

- Autonomous

- Manual

Sea Based Defense Equipment Market, by Application Type:

- Search and Rescue

- Combat Operations

- MCM Operations

- Coastal Surveillance

Sea Based Defense Equipment Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sea Based Defense Equipment Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Sea Based Defense Equipment market report include:- Lockheed Martin Corporation

- BAE Systems PLC

- Northrop Grumman Corporation

- General Dynamics Corporation

- Thales S.A.

- RTX Corporation

- L3Harris Technologies, Inc

- Leonardo SpA

- Saab AB

- Navantia S.A. SM.E

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

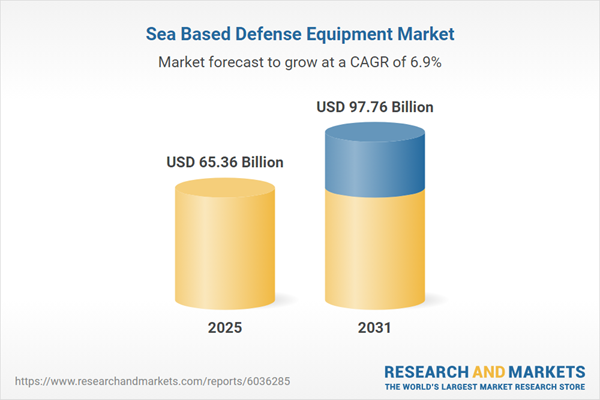

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 65.36 Billion |

| Forecasted Market Value ( USD | $ 97.76 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |