Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a significant challenge impeding market expansion is the volatility of raw material costs, particularly for titanium and nickel-based alloys which are fundamental to aerospace applications. Supply chain bottlenecks and fluctuating prices for the high energy input required for the forging process further strain operational margins. These constraints can extend production lead times, creating difficulties for manufacturers attempting to align with the aggressive delivery schedules mandated by major original equipment manufacturers.

Market Drivers

The surge in global commercial aircraft manufacturing and deliveries acts as a primary growth engine for the open die forging market, as the process is critical for producing high-strength components like landing gear cylinders and engine shafts. As airlines aggressively modernize fleets to improve fuel efficiency and meet recovering passenger demand, the need for fatigue-resistant forged titanium and superalloy parts has intensified. This heightened production activity is reflected in recent OEM output figures; according to Airbus, the manufacturer delivered 766 commercial aircraft to 86 customers throughout 2024, underscoring the immense pressure on the forging supply chain to support escalating build rates.Simultaneously, escalating defense budgets for military fleet modernization are driving significant demand for specialized open die forgings used in next-generation fighter jets and strategic bombers. Governments worldwide are increasing spending to enhance air superiority capabilities, directly translating into orders for robust airframe structures and propulsion components. According to the Stockholm International Peace Research Institute, global military expenditure rose by 9.4% to reach a record $2.7 trillion in 2024, a surge largely attributed to equipment upgrades and geopolitical tensions. This robust environment is bolstering the financial performance of key suppliers; according to Howmet Aerospace, the company’s Engineered Structures segment reported an 11% year-over-year revenue increase in the third quarter of 2024, highlighting the strong market appetite for advanced aerospace forged products.

Market Challenges

The volatility of raw material costs, particularly for titanium and nickel-based alloys, combined with persistent supply chain bottlenecks, constitutes a significant barrier to the growth of the Global Aircraft Open Die Forging Market. These constraints introduce severe unpredictability into manufacturing operations, where fluctuating prices for high energy inputs and essential metals erode profit margins and complicate the execution of long-term contracts. Furthermore, the scarcity of these critical resources forces manufacturers to extend production lead times, making it increasingly difficult to meet the aggressive delivery schedules mandated by major aerospace original equipment manufacturers.This operational strain restricts the industry's ability to capitalize on rising orders, effectively capping the volume of finished components that can be delivered to the assembly lines. The impact of these delays is evident in the accumulation of unfulfilled orders across the broader aviation sector. According to the International Air Transport Association, the global commercial aircraft backlog reached a historic high of over 17,000 aircraft in 2024, a situation driven largely by these pervasive supply chain disruptions and material shortages. This substantial backlog demonstrates that while demand is robust, the forging market's actual expansion is being mechanically restricted by the inability to secure necessary inputs and maintain efficient production rates.

Market Trends

The strategic modernization of production facilities through the adoption of digital process simulation and automated open die systems is a dominant trend, enabling manufacturers to produce complex geometries with greater precision. Companies are aggressively replacing aging infrastructure with digitized forging lines that utilize real-time sensor data to minimize machining allowances and enhance structural integrity for defense and nuclear applications. This shift toward recapitalization is evident in major facility upgrades designed to secure sovereign manufacturing capabilities. According to The Manufacturer, in December 2024, Sheffield Forgemasters committed £286 million to contracts for its recapitalization program, which includes the construction of the UK's largest automated open-die forging line to replace legacy machinery and improve throughput efficiency.Simultaneously, the implementation of sustainable and energy-efficient manufacturing has become a critical priority as the industry faces pressure to decarbonize energy-intensive thermal processes. Forging houses are actively decoupling production growth from environmental impact by optimizing furnace operations and adopting low-carbon technologies to meet stringent ESG targets. This focus on reducing the carbon footprint of aerospace components is driving measurable operational changes across the supply chain. According to Howmet Aerospace’s 2024 Environmental, Social and Governance Report, the company achieved a 21.7% reduction in greenhouse gas emissions from its operations compared to a 2019 baseline, a milestone realized through strategic improvements in production process efficiency and energy management.

Key Players Profiled in the Aircraft Open Die Forging Market

- Arconic Corporation

- Allegheny Technologies Incorporated

- Precision Castparts Corp.

- PJSC VSMPO-AVISMA Corporation

- Metallus Inc.

- Howmet Aerospace Inc.

- Norsk Titanium AS

- Forgital Italy S.p.A

- Doncasters Limited

- Aubert & Duval

Report Scope

In this report, the Global Aircraft Open Die Forging Market has been segmented into the following categories:Aircraft Open Die Forging Market, by Aircraft Type:

- Commercial Aircraft

- Regional Aircraft

- Helicopter

- Military Aircraft

- General Aviation

Aircraft Open Die Forging Market, by Application Type:

- Airframe

- Engine

Aircraft Open Die Forging Market, by Component Size Type:

- Small Components

- Large Components

Aircraft Open Die Forging Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aircraft Open Die Forging Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Aircraft Open Die Forging market report include:- Arconic Corporation

- Allegheny Technologies Incorporated

- Precision Castparts Corp.

- PJSC VSMPO-AVISMA Corporation

- Metallus Inc.

- Howmet Aerospace Inc.

- Norsk Titanium AS

- Forgital Italy S.p.A

- Doncasters Limited

- Aubert & Duval

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

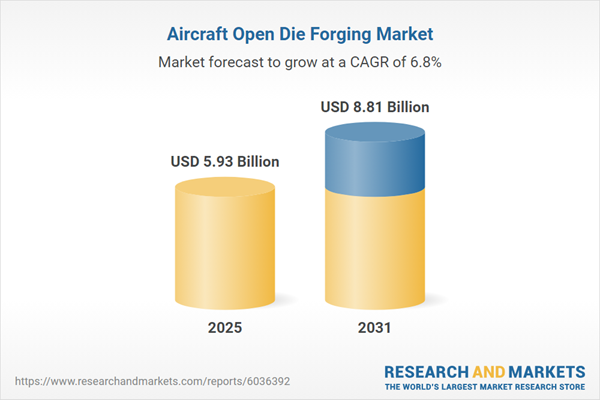

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.93 Billion |

| Forecasted Market Value ( USD | $ 8.81 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |