Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In 2022, pork consumption in the United States reached 51.10 pounds per capita, with projections indicating an increase to 52.70 pounds by 2033. Although the USDA initially anticipated a 0.20 percent decline in pork consumption for 2022, the trend remains robust through 2024. Despite fluctuations driven by evolving dietary habits and health considerations, U.S. pork consumption continues to exceed the global average.

In addition to traditional markets, there is growing interest in processed pork products such as sausages, bacon, and ham, which are becoming increasingly popular in both developed and developing regions. This trend is further supported by innovations in packaging and preservation techniques, which help extend shelf life and meet consumer demands for convenience.

Key Market Drivers

Increasing Popularity of Processed Pork Products

The growing demand for processed pork products is another crucial driver of the global pork meat market. As consumers become busier, there is a heightened preference for ready-to-eat or easy-to-prepare foods. Processed pork products such as sausages, bacon, ham, and deli meats have gained popularity due to their convenience, taste, and versatility. These products are easy to store, have a longer shelf life, and cater to the growing demand for on-the-go meals, particularly in Western markets. As of December 2023, data from the Food and Agriculture Organization of the United Nations (FAO) reveals that the United States and Portugal share the highest per capita meat consumption, with an average of 149 kg (327.8 lb) annually per person. This increasing consumption trend contributes significantly to the growth of the global pork meat market.In addition, innovations in food processing and preservation technologies have led to the development of new, premium products. Health-conscious consumers are also demanding lower-fat and organic pork products, prompting producers to offer healthier alternatives in the processed pork segment. These innovations have contributed to the diversification of pork product offerings, enabling producers to cater to a wider array of consumer preferences.

Processed pork products are increasingly popular in developed economies like North America and Europe, where consumers have a long history of incorporating these products into their diets. In emerging markets, such as Latin America and parts of Asia, the processed pork sector is also expanding as people’s taste profiles evolve and they gain more exposure to global food trends.

Therefore, the increasing preference for convenience foods, the demand for diverse product offerings, and innovations in processed pork products have been key contributors to the growth of the pork meat market.

Technological Advancements in Production and Supply Chain

Technological innovations have revolutionized the pork production process, leading to increased efficiency, improved product quality, and cost reductions. Advances in breeding techniques, such as the use of genetic selection and artificial insemination, have resulted in the development of pigs with higher growth rates, better feed conversion ratios, and disease resistance. These advancements have enabled pork producers to meet the growing demand while optimizing production costs.Moreover, innovations in the pork supply chain, including automated slaughtering, processing, and packaging techniques, have further streamlined production and distribution. The use of artificial intelligence, Internet of Things (IoT) technology, and big data analytics has enabled producers to monitor and optimize farming operations, improving productivity and traceability. These technological advancements help minimize waste, reduce environmental impact, and ensure high-quality standards for pork products.

For example, some pork producers are employing smart farming technologies to monitor animal health and welfare, resulting in better pork quality and sustainability. This is especially important as consumers are becoming more conscious of the environmental and ethical practices associated with meat production. By adopting sustainable practices, such as reducing carbon footprints and optimizing water and feed use, the pork industry can address growing concerns about sustainability, which, in turn, helps meet the expectations of environmentally conscious consumers. The implementation of such technologies across the entire pork production chain from farm to fork helps producers scale operations, ensure consistency in quality, and maintain competitive pricing, all of which contribute to the market’s growth.

Key Market Challenges

Disease Outbreaks and Biosecurity Risks

One of the most pressing challenges faced by the global pork meat market is the risk of disease outbreaks, which can severely impact pork production. The most notable example in recent years has been African Swine Fever (ASF), a highly contagious viral disease that affects pigs and has caused significant disruptions in the pork industry, especially in Asia. ASF has led to mass culling of infected pigs, drastically reducing pork production in affected countries, including China, which is the world's largest consumer and producer of pork.Disease outbreaks not only lead to the immediate loss of livestock but can also have long-term effects on the market. Affected regions often experience trade restrictions, with countries imposing import bans on pork from infected areas to prevent the spread of disease. These restrictions can disrupt global supply chains, leading to price volatility and supply shortages. Additionally, countries affected by disease outbreaks may face a decline in consumer confidence, with consumers opting for alternative protein sources out of fear of contamination.

Biosecurity measures are critical to preventing the spread of diseases like ASF, but these measures require significant investment from producers, especially smaller farms. Ensuring that farmers are equipped with the necessary resources to implement biosecurity protocols is essential to minimizing the risk of future outbreaks. However, this adds complexity to the production process and increases costs, which can affect profitability, particularly for smaller-scale producers. As such, disease outbreaks and the constant risk of new diseases pose an ongoing challenge to the stability of the global pork meat market.

Environmental Sustainability Concerns

Environmental sustainability is another major challenge facing the global pork meat market. As global awareness of climate change and environmental issues grows, the pork industry is under increasing pressure to adopt sustainable practices. Pork production, like other forms of livestock farming, contributes significantly to environmental degradation, including deforestation, water pollution, and greenhouse gas emissions. The pork industry is a major emitter of methane, a potent greenhouse gas, and its reliance on large quantities of feed and water further strains natural resources.Governments, international organizations, and consumers are demanding greater transparency and accountability from producers regarding their environmental impact. Many consumers, particularly in developed markets, are increasingly interested in sustainably produced meat, and there is growing concern over the environmental footprint of industrial farming practices. This shift in consumer preferences has led to a rise in demand for organic and ethically sourced pork products, as well as pork from farms that prioritize animal welfare and sustainable farming practices.

Key Market Trends

Adoption of Sustainable and Ethical Production Practices

Sustainability and ethical concerns are becoming increasingly important to consumers, and this is influencing the pork meat market. Environmental and animal welfare issues are at the forefront of consumer minds, leading to a greater demand for sustainably produced pork. This trend is especially prevalent in Europe and North America, where consumers are willing to pay a premium for pork products that are certified as organic, free-range, or raised without antibiotics or hormones.In response to growing demand for transparency and sustainability, pork producers are adopting more eco-friendly practices. These include reducing carbon footprints, managing waste better, and using renewable energy sources to power farms and processing facilities. Pork producers are also working to improve animal welfare standards by providing better living conditions for pigs, ensuring ethical practices throughout the supply chain. For example, many producers are now focusing on reducing the environmental impact of their operations by minimizing water usage, reducing manure runoff, and improving feed efficiency.

Sustainability certifications, such as the Global Animal Partnership (GAP) or the Certified Humane label, are becoming more important as consumers increasingly seek out products that align with their values. Additionally, there is growing interest in alternative protein sources, such as plant-based or lab-grown meat, which offer consumers more sustainable and ethical options. Although these alternatives are not yet a dominant force in the market, they are challenging traditional pork producers to rethink their production methods and to innovate in ways that make their products more environmentally friendly.

Growing Popularity of Pork in Developing Markets

While pork consumption has traditionally been highest in Europe and Asia, a growing trend is the increasing popularity of pork in developing markets. As incomes rise and the middle class expands in emerging economies, demand for animal protein is growing, and pork is becoming a more common dietary staple.In regions such as Sub-Saharan Africa, Latin America, and Southeast Asia, economic growth and urbanization are driving changes in dietary patterns. Rising disposable incomes are allowing consumers to purchase higher-quality proteins, including pork, which is often seen as more affordable than beef or lamb. The growing middle class in these regions is also influencing the types of pork products being consumed, with increasing interest in processed and ready-to-eat pork products that cater to the fast-paced lifestyles of urban populations.

In addition, globalization and the spread of Western food culture are contributing to the growing acceptance of pork in non-traditional pork-consuming countries. In particular, urban centers in countries like India and Nigeria are seeing an increase in demand for pork-based dishes, driven by the influence of global food chains and changing consumer preferences. Pork is being incorporated into traditional cuisines, creating new opportunities for producers to tap into emerging markets.

Segmental Insights

Distribution Channel Insights

The hypermarket/supermarket segment dominated the global pork meat market, driven by the growing preference for large retail outlets offering a wide variety of pork products under one roof. These stores provide consumers with convenience, competitive pricing, and a broad selection of fresh, frozen, and processed pork items. Supermarkets and hypermarkets are key players in the distribution of pork due to their extensive supply chains and ability to reach a large customer base, particularly in developed markets.Additionally, these retail outlets offer value-added pork products such as sausages, bacon, and pre-cooked meals, catering to the rising demand for convenience among consumers. The presence of trusted private labels and brand options also boosts consumer confidence. In emerging markets, the expansion of supermarket chains in urban areas, paired with increasing disposable incomes, is further strengthening their dominance. As a result, hypermarkets and supermarkets continue to lead the global pork meat market in both volume and value.

Regional Insights

The Asia Pacific region was the dominated in the global pork meat market, driven by its high demand and consumption rates, particularly in countries like China, Japan, and South Korea. China, the world's largest producer and consumer of pork, significantly influences the region's market dynamics. The country's preference for pork as a primary protein source, coupled with rising disposable incomes, urbanization, and changing dietary habits, fuels continued growth. In addition, the region benefits from well-established pork production systems and a strong cultural preference for pork-based dishes.The growing middle class in Southeast Asia and other emerging markets within the region is further contributing to increased pork consumption. As these economies expand, more consumers are adopting Western-style diets, increasing the demand for processed and value-added pork products. This combination of economic growth, cultural significance, and rising incomes positions Asia Pacific as the leading region in the global pork meat market.

Key Market Players

- Smithfield Foods, Inc.

- NH Foods Ltd.

- Tyson Foods, Inc.

- JBS SA

- WH Group Limited

- Hormel Foods Corporation

- Cargill, Incorporated

- Marfrig Global Foods SA

- Clemens Food Group, LLC

- BRF S.A. (Sadia)

Report Scope:

In this report, the Global Pork Meat Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Pork Meat Market, By Product Form:

- Fresh/Chilled

- Frozen

- Canned/Preserved

Pork Meat Market, By Distribution Channel:

- Hypermarket/Supermarket

- Convenience Stores

- Online

- Others

Pork Meat Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Indonesia

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- South America

- Argentina

- Colombia

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pork Meat Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Smithfield Foods, Inc.

- NH Foods Ltd.

- Tyson Foods, Inc.

- JBS SA

- WH Group Limited

- Hormel Foods Corporation

- Cargill, Incorporated

- Marfrig Global Foods SA

- Clemens Food Group, LLC

- BRF S.A. (Sadia)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | December 2024 |

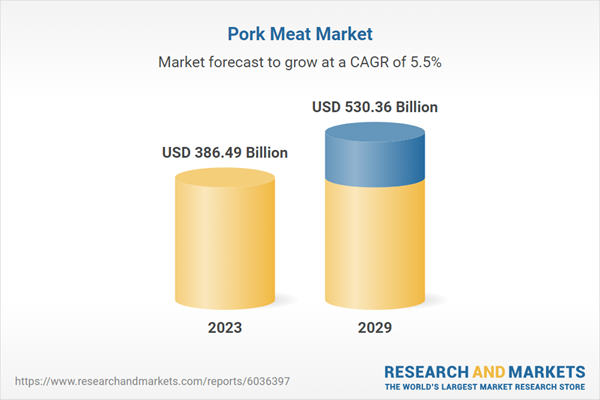

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 386.49 Billion |

| Forecasted Market Value ( USD | $ 530.36 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |