Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is chiefly driven by the urgent necessity to lower operational costs and the demand for seamless collaboration across geographically scattered exploration sites. This strong appetite for digital infrastructure is highlighted by recent industry data; according to DNV, in 2024, 59% of energy professionals expect to increase their investment in digitalization in the year ahead. Such expenditure indicates a strategic shift toward scalable technologies that improve decision-making speeds while minimizing capital outlays on physical hardware.

Despite these promising prospects, the market faces a considerable obstacle regarding data sovereignty and security. Energy corporations manage highly sensitive operational and geological data, creating a reluctance to migrate to hybrid or public cloud environments due to the risks associated with cyber espionage and stringent national data residency laws. These concerns regarding the protection and control of intellectual property frequently retard the adoption rate among leading industry players, who often prioritize the security of their proprietary assets over the operational agility provided by cloud platforms.

Market Drivers

The convergence of Big Data Analytics and Artificial Intelligence acts as a major catalyst for the market, fundamentally transforming how operators analyze complex operational and subsurface datasets. Cloud-hosted AI platforms enable companies to process immense seismic libraries and sensor streams in real-time, facilitating automated decision-making and predictive maintenance capabilities that were previously unattainable with on-premise infrastructure. This technological shift is quickly gaining momentum; according to DNV, August 2024, in the 'Leading a data-driven transition' report, 47% of energy professionals say their organization will use AI-driven applications in their operations in the year ahead. Adopting these tools allows firms to remotely optimize reservoir management and drilling parameters, thereby reducing human risk and improving asset recovery rates through enhanced data agility.Simultaneously, the escalating demand for operational efficiency and cost optimization is propelling the migration to cloud architectures, as businesses seek to convert fixed capital costs into flexible operational expenditures. By utilizing scalable cloud resources, organizations can dynamically align computing power with project requirements, eliminating the expense of maintaining underused data centers while boosting sustainability metrics through better resource utilization. According to Aspen Technology, January 2024, in the 'Advanced digital solutions help upstream oil & gas companies increase productivity and profitability' article, a simulation model of a producing field can reduce CO2 emissions and energy use by 10-15%. This financial and operational discipline is reflected in significant corporate investment; according to Infosys, in 2024, energy companies spend on average $37 million annually for cloud services, underscoring the sector's commitment to digital efficiency.

Market Challenges

The Global Oil and Gas Cloud Applications Market faces a significant barrier regarding data sovereignty and security. Energy companies possess highly proprietary assets, such as reservoir models and seismic surveys, which constitute their core competitive advantage. Transferring this sensitive information to public cloud environments increases the perceived risk of intellectual property theft and industrial espionage. Furthermore, strict data residency regulations in numerous oil-producing nations require that operational data remain within national borders. This regulatory fragmentation complicates the deployment of unified global cloud architectures and compels firms to rely on siloed, on-premise infrastructure rather than adopting scalable, cloud-native solutions.These security liabilities directly restrict market growth by stalling digital transformation initiatives. The reluctance to entrust critical operational technology to third-party platforms often results in prolonged pilot phases or a preference for private clouds, which lack the full agility of broader market offerings. This apprehension is substantiated by the growing threat landscape facing the sector. According to the International Energy Agency, in 2025, the frequency of cyberattacks against energy organizations was reported to have tripled over the past four years. Consequently, major industry players often limit their cloud investments to mitigate exposure, directly dampening the revenue potential of the market.

Market Trends

The advancement of Cloud-Based Digital Twin Technology is progressing from static 3D models to dynamic, real-time asset replicas that integrate complex Information Technology (IT) and Operational Technology (OT) data. This trend allows operators to view facilities holistically and optimize performance through industrial knowledge graphs rather than isolated dashboards, facilitating the enterprise-scale deployment of autonomous operations. The tangible return on investment from these virtual environments is driving significant adoption; according to Cognite, January 2025, in the 'Cognite's Impact in 2024' report, the company identified over $1 billion in customer value delivered across operations productivity and asset reliability through its digital twin and AI solutions. This shift indicates a market maturation where digital twins are no longer experimental pilots but core components of the operational strategy for major industrial producers.At the same time, the Expansion of Advanced Analytics and Cognitive Computing is demonstrated by the substantial financial commitment operators are making towards integrated digital platforms. Companies are increasingly consolidating their digital infrastructure onto unified cloud-native systems that support autonomous workflows and advanced subsurface characterization, effectively treating data as a high-value commodity. This robust spending environment is quantified by leading industry service providers; according to Schlumberger (SLB), January 2025, in the 'Fourth Quarter and Full Year 2024 Results' announcement, the company's Digital & Integration revenue reached $2.44 billion for the year, driven by a 20% growth in digital sales. This surge underscores a broader industry pivot where scalable digital revenue streams and cognitive computing capabilities are becoming as critical to business performance as physical asset services.

Key Players Profiled in the Oil and Gas Cloud Applications Market

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Salesforce, Inc.

- Aspen Technology, Inc.

- Bentley Systems, Incorporated

- Dassault Systemes S.E.

- Hewlett Packard Enterprise Company

- ABB Ltd.

Report Scope

In this report, the Global Oil and Gas Cloud Applications Market has been segmented into the following categories:Oil and Gas Cloud Applications Market, by Component:

- Solution

- Service

Oil and Gas Cloud Applications Market, by Organization Size:

- Large Enterprise

- Small & Medium-Sized Enterprise

Oil and Gas Cloud Applications Market, by Operation:

- Upstream

- Midstream

- Downstream

Oil and Gas Cloud Applications Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Oil and Gas Cloud Applications Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Oil and Gas Cloud Applications market report include:- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Salesforce, Inc.

- Aspen Technology, Inc.

- Bentley Systems, Incorporated

- Dassault Systemes S.E.

- Hewlett Packard Enterprise Company

- ABB Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

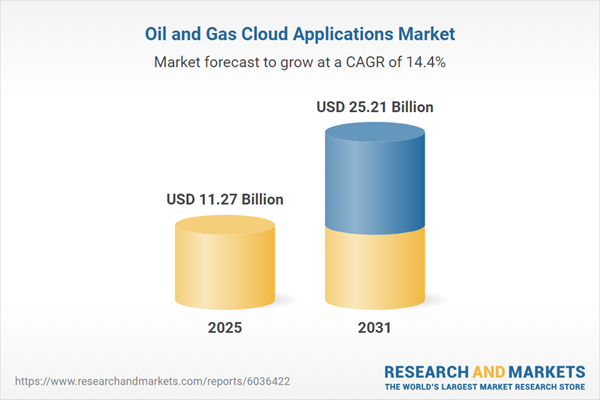

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 11.27 Billion |

| Forecasted Market Value ( USD | $ 25.21 Billion |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |