Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A major obstacle hindering broader market development is the escalating risk of cybersecurity threats, as expanded connectivity increases the vulnerability of critical infrastructure. The challenge of protecting extensive networks against data breaches often prolongs deployment timelines and inflates implementation costs. Underscoring the significant capital commitment in key regions, the Edison Electric Institute reported that United States electric companies invested a record-breaking $178.2 billion in 2024 to render energy grids more secure, robust, and intelligent.

Market Drivers

The compulsory rollout of Advanced Metering Infrastructure (AMI) acts as a primary catalyst for the adoption of smart grid networking technologies. Governments and utility providers are enforcing the replacement of mechanical meters with digital systems that enable two-way communication, thereby enhancing billing accuracy and reducing operational inefficiencies. This transition demands a scalable, robust network layer capable of transmitting high-frequency data from millions of endpoints to central utility management systems, necessitating significant upgrades to bandwidth and data handling capacities. According to the Press Information Bureau of India's 'Year End Review of the Ministry of Power' in March 2024, the country successfully installed over 10 million smart meters under its national distribution sector scheme to improve operational viability.Concurrently, the growth of electric vehicle (EV) charging infrastructure establishes a critical reliance on intelligent networking to handle rising load volatility. As the density of charging stations increases, utilities must utilize real-time monitoring and demand response mechanisms to prevent distribution transformers from overloading during peak usage.

This integration necessitates low-latency communication networks that can effectively coordinate energy flow between the grid and EV supply equipment. The International Energy Agency's 'Global EV Outlook 2024', released in April 2024, noted a greater than 40% rise in public charging points globally in 2023, creating urgent pressure for digitalization. Furthermore, the IEA projects that global electricity grid investment will reach USD 400 billion in 2024, largely targeting the integration of renewable assets and digital technologies.

Market Challenges

The intensifying risk of cybersecurity threats poses a significant barrier to the rapid progression of the Global Smart Grid Networking Market. As utilities shift from closed, analog systems to interconnected, IP-based digital networks, they unintentionally expose critical infrastructure to sophisticated malicious actors. This broadened attack surface demands rigorous and expensive defensive measures, which substantially increase the total cost of ownership for smart grid deployments. Consequently, utility operators frequently divert substantial capital intended for network expansion and modernization toward regulatory compliance and system hardening, thereby slowing the overall pace of market growth.The severity of this operational bottleneck is confirmed by recent industry data regarding the escalating threat landscape. According to the International Energy Agency, it was reported in 2024 that the frequency of cyberattacks targeting energy utilities had tripled over the previous four years. This exponential rise in threat activity creates a climate of caution, causing decision-makers to postpone the integration of advanced bidirectional communication technologies until security assurances can be guaranteed. Thus, the imperative to secure vast, complex networks acts as a direct restraint on the scalable deployment of smart grid solutions.

Market Trends

The widespread implementation of Private 5G Networks is fundamentally transforming utility communications by allowing operators to establish dedicated, high-speed infrastructure that bypasses the congestion and security risks associated with public cellular networks. This trend enables utilities to ensure ultra-low-latency connectivity for mission-critical applications, such as remote infrastructure inspection and real-time distribution automation, which were previously limited by legacy systems. The magnitude of this shift toward private cellular ecosystems is evidenced by significant capital commitments from major utilities securing proprietary spectrum; for instance, Anterix Inc. reported in its 'Full Fiscal Year 2025 Results' in June 2025 that it executed spectrum sale agreements totaling $116 million, including a pivotal $102.5 million contract with Oncor Electric Delivery to deploy a private wireless broadband network across its extensive service territory.Simultaneously, the utilization of AI-Driven Network Analytics is revolutionizing grid management by embedding machine learning algorithms directly into operational software to facilitate dynamic fault isolation and predictive maintenance. Instead of relying on reactive repairs, utilities are increasingly using these analytics to process massive amounts of sensor data, enabling them to anticipate equipment failures and optimize load balancing across distributed energy resources. Highlighting the industry's financial dedication to these intelligent technologies, the press release 'National Grid Partners commits $100 million to invest in AI startups advancing the future of energy' from March 2025 revealed that the utility's venture arm allocated $100 million specifically to fund artificial intelligence innovations designed to enhance grid efficiency and resilience.

Key Players Profiled in the Smart Grid Networking Market

- Trilliant Holdings, Inc.

- Mitsubishi Electric Corporation

- ABB Ltd.

- Schneider Electric SE

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Siemens AG

- Itron, Inc.

- Cisco Systems, Inc.

- General Electric Company

Report Scope

In this report, the Global Smart Grid Networking Market has been segmented into the following categories:Smart Grid Networking Market, by Hardware:

- Cables

- Controllers

- Routers

- Smart Meter

- Switches

Smart Grid Networking Market, by Software:

- Network Performance Monitoring Management

- IP Address Management

- Network Traffic Management

- Network Device Management

- Network Configuration Management

- Network Security Management

Smart Grid Networking Market, by Services:

- Consulting

- Network Planning

- Design & Integration

- Network Risk & Security Assessment

- Network Maintenance & Support

Smart Grid Networking Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Smart Grid Networking Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Smart Grid Networking market report include:- Trilliant Holdings, Inc.

- Mitsubishi Electric Corporation

- ABB Ltd.

- Schneider Electric SE

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Siemens AG

- Itron, Inc.

- Cisco Systems, Inc.

- General Electric Company

Table Information

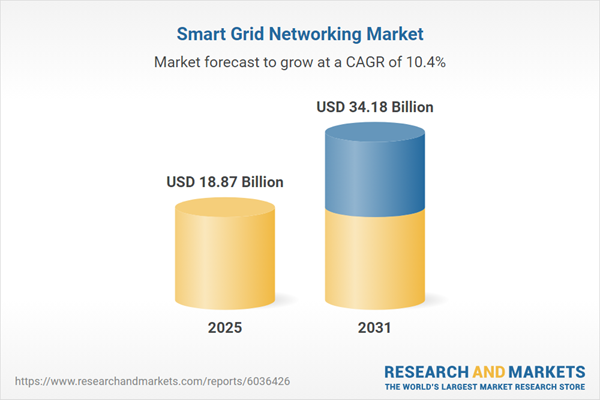

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 18.87 Billion |

| Forecasted Market Value ( USD | $ 34.18 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |