Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Aging Population

Spain is undergoing a significant demographic shift, with the proportion of its population aged 65 and above steadily increasing. According to the Spanish National Institute of Statistics (INE), the share of people aged 65 or older was approximately 20.5% in 2023, and this is expected to rise to 30% by 2050. This aging population creates unique challenges and opportunities, particularly in the Spain Clinical Nutrition Market, as older adults are more susceptible to chronic diseases, malnutrition, and conditions like dysphagia that require specialized nutritional support. Clinical nutrition plays a crucial role in addressing these needs by providing tailored solutions to improve health and quality of life for seniors.As individuals age, their nutritional requirements change. Factors like reduced appetite, decreased absorption of nutrients, and changes in metabolism often lead to nutritional deficiencies. Clinical nutrition products, such as oral supplements and enteral nutrition formulas, bridge these gaps by providing essential nutrients to support overall health and manage age-related conditions such as osteoporosis and sarcopenia. Additionally, the elderly frequently face conditions like dementia, diabetes, and cardiovascular diseases, where proper nutrition helps manage symptoms and slow disease progression.

Post-surgical recovery is another critical area, with many elderly individuals requiring nutritional support during healing. Clinical nutrition, including enteral and parenteral nutrition, aids in healing and minimizes complications, especially after orthopedic surgeries or gastrointestinal procedures. Clinical nutrition promotes independence and enhances the quality of life by ensuring that elderly individuals receive proper nutrition to remain active and self-reliant, thereby reducing the burden on healthcare systems and caregivers.

Rising Prevalence of Chronic Diseases

Chronic diseases are becoming increasingly prevalent in Spain, with conditions such as diabetes, cardiovascular diseases, and cancer on the rise. According to the Spanish Ministry of Health, nearly 6 million people in Spain are living with diabetes, and cardiovascular diseases are responsible for around 30% of all deaths in the country. These chronic conditions often require long-term management and are driving the demand for clinical nutrition solutions tailored to specific health needs. For instance, patients with diabetes benefit from specialized diets that help regulate blood sugar levels, while those with cardiovascular issues may need heart-healthy or low-sodium nutrition.Cancer is another significant challenge, with the Spanish Society of Medical Oncology estimating that around 277,000 new cancer cases will be diagnosed in Spain in 2024. Malnutrition, common among cancer patients, can worsen treatment outcomes, but clinical nutrition - such as enteral or oral supplements - plays a key role in mitigating this. Additionally, the rising obesity rate in Spain, affecting about 17% of the adult population, contributes to an increase in chronic diseases like diabetes and hypertension. Clinical nutrition can aid in weight management and disease prevention, reducing the burden on healthcare systems.

Awareness and Education

Awareness and education are powerful catalysts for change. In the realm of healthcare and nutrition, increased knowledge and understanding can have a transformative effect on an individual's choices and well-being. This is especially true in Spain, where a growing emphasis on nutrition's role in health has significantly boosted the Clinical Nutrition Market.As the saying goes, "you are what you eat." The Spanish population is increasingly recognizing that nutrition plays a pivotal role in their overall health and well-being. Awareness campaigns, educational initiatives, and a wealth of information available through various media have all contributed to this shift in perspective. People now understand that what they eat can impact not only their physical health but also their mental well-being.

Public health campaigns and educational efforts have aimed to promote healthier dietary choices among the Spanish population. With a greater emphasis on disease prevention, people are becoming more proactive in maintaining their health. The clinical nutrition market benefits from this trend as individuals seek out nutritionally-sound products and services to support their wellness journey.

Awareness and education have led to a better understanding of the role of clinical nutrition in managing chronic diseases. People are increasingly aware of the relationship between their dietary choices and conditions such as diabetes, cardiovascular disease, and obesity. As a result, there is a growing demand for clinical nutrition solutions that cater to the specific needs of those living with these conditions.

The Spanish population is becoming more informed about specialized diets tailored to various health goals and conditions. Whether it's adopting a gluten-free diet for celiac disease or adhering to a low-sodium diet for hypertension, people are seeking out clinical nutrition products and services that cater to their unique dietary requirements.

The use of nutritional supplements, such as vitamins and minerals, has gained popularity in Spain due to increased awareness of their potential benefits. People are turning to these supplements as a means to address nutritional gaps in their diets, and this has positively impacted the clinical nutrition market.

Education and awareness have led to a greater understanding of personalized nutrition. The concept of tailoring dietary plans to meet individual needs based on health conditions, age, and preferences is becoming more common. As a result, individuals are looking for clinical nutrition solutions that provide them with personalized guidance and support.

Key Market Challenges

Healthcare Budget Constraints

A significant challenge in the Spain Clinical Nutrition Market is healthcare budget constraints, which impact the availability and accessibility of clinical nutrition products and services. Spain’s healthcare system, despite being one of the best in Europe, faces financial pressures due to rising costs associated with an aging population, increasing prevalence of chronic diseases, and the ongoing economic strain. As the government continues to prioritize essential healthcare services, funding for specialized areas like clinical nutrition can become limited, potentially affecting the quality and reach of care.Healthcare budget constraints often result in reduced reimbursement rates for clinical nutrition treatments, making it harder for patients, particularly those in lower-income groups or with chronic conditions, to access necessary nutritional interventions. Additionally, hospitals and healthcare providers may face difficulties in allocating resources to invest in the latest nutrition therapies or technologies.

This budgetary pressure can also impact the ability to implement personalized nutrition plans or invest in preventive care, which could otherwise help reduce long-term healthcare costs by preventing complications from chronic conditions. As a result, the clinical nutrition market in Spain must navigate these financial limitations while striving to meet the growing demand for specialized nutritional support. The ongoing need for cost-effective solutions and greater government support will be crucial to sustaining market growth.

Reimbursement Policies

One of the key challenges facing the Spain Clinical Nutrition Market is the complexity of reimbursement policies. In Spain, clinical nutrition products, especially those used in specialized treatments like enteral nutrition or for chronic disease management, are often subject to stringent reimbursement regulations. The reimbursement process can be slow and inconsistent, with varying coverage across regions and healthcare providers. While some clinical nutrition products may be covered under the national health insurance system, others, particularly those used for preventive care or in non-hospital settings, may not be reimbursed or could face significant out-of-pocket costs for patients.This disparity in reimbursement policies can create a barrier for patients, particularly those with chronic conditions or elderly individuals requiring long-term nutritional support. Moreover, the lack of uniformity in reimbursement processes can result in delays in product access, affecting treatment outcomes and increasing healthcare costs.

Additionally, ongoing budget constraints in the public healthcare system further limit the scope of coverage for clinical nutrition products, forcing healthcare providers to prioritize essential treatments. For companies in the clinical nutrition sector, navigating these complex reimbursement frameworks presents a significant challenge, impacting market access, product adoption, and overall market growth. More streamlined and consistent reimbursement policies are essential to improve access and affordability for patients.

Key Market Trends

Personalized Nutrition

Personalized nutrition is a key emerging trend in the Spain Clinical Nutrition Market, reflecting the growing shift toward tailored healthcare solutions. As the healthcare sector increasingly focuses on individual patient needs, personalized nutrition provides customized dietary plans that cater to a patient’s specific health conditions, genetics, and lifestyle. This approach helps manage chronic diseases such as diabetes, cardiovascular conditions, and obesity, as it considers unique dietary restrictions, preferences, and metabolic responses to food.The rise in chronic diseases, coupled with Spain’s aging population, is accelerating demand for personalized clinical nutrition. Patients now seek solutions that go beyond general nutrition to address their individual health challenges. Advancements in technology, such as genetic testing and wearable health devices, enable more precise nutrition plans that can be continually adjusted based on real-time data and health monitoring.

Furthermore, the growing awareness of the importance of nutrition in disease prevention and management has encouraged a shift towards more personalized nutrition interventions, particularly in hospitals, homecare settings, and wellness programs. Spain’s health authorities have recognized this trend, with initiatives supporting the integration of personalized nutrition into national health systems. The trend towards personalized clinical nutrition is not only improving patient outcomes but also driving market growth, as more consumers and healthcare providers embrace this individualized approach.

Plant-Based Clinical Nutrition

The Spain Clinical Nutrition Market is witnessing a growing trend towards plant-based clinical nutrition, driven by increasing consumer demand for plant-based diets and sustainable food sources. As awareness about the environmental impact of animal-based products rises, plant-based alternatives are gaining popularity in clinical nutrition formulations. Plant-based clinical nutrition products, such as those containing pea protein, soy protein, and other plant-derived nutrients, are being incorporated into supplements and enteral nutrition formulas, offering a viable option for individuals with dietary restrictions, including vegans, vegetarians, and those with lactose intolerance or dairy allergies.The shift towards plant-based nutrition is also influenced by the growing interest in preventive healthcare, with many consumers seeking natural, plant-based solutions to support overall health. This is particularly relevant in the management of chronic conditions such as diabetes, cardiovascular diseases, and obesity, where plant-based diets are increasingly recognized for their health benefits.

In response, manufacturers in Spain are expanding their product lines to include plant-based clinical nutrition options, emphasizing clean-label ingredients and sustainability. The Spanish government's support for sustainable food systems further boosts this trend, making plant-based clinical nutrition an essential part of the country’s healthcare and wellness strategies. This movement is expected to continue growing as the demand for eco-friendly and health-conscious nutrition solutions rises.

Segmental Insights

Nutrition Type Insights

Based on Nutrition Type, Enteral Nutrition was poised to dominated the Clinical Nutrition Market in Spain. It offers a cost-effective and efficient solution for patients who require nutritional support, particularly in clinical settings. With the rising healthcare costs in Spain, healthcare providers are increasingly looking for budget-friendly options without compromising on patient care.Enteral Nutrition meets this demand by providing essential nutrients directly to the gastrointestinal tract, minimizing the need for expensive intravenous interventions. Likewise, as the aging population continues to grow, the demand for clinical nutrition solutions is expected to rise, and Enteral Nutrition aligns perfectly with the dietary needs of this demographic. Its ease of administration and reduced risk of complications make it a preferred choice among healthcare professionals.

End User Insights

Based on End User, Infant & Child nutrition was poised to dominate the Clinical Nutrition Market in Spain. The importance of early childhood nutrition is widely recognized, and parents are increasingly seeking high-quality nutritional solutions for their infants and children. This growing awareness and emphasis on the early years of a child's development drive demand for specialized infant and child clinical nutrition products.Advancements in pediatric healthcare and a focus on preventing nutrition-related disorders further contribute to the prominence of this segment. The trust and confidence parents place in established brands that offer scientifically formulated products for infants and children reinforce the dominance of Infant & Child as the end user in the Spanish Clinical Nutrition Market. As a result, this market segment is expected to continue to expand and maintain a strong foothold in the industry.

Regional Insights

The Central Region of North Spain emerged as the dominated in the Spain Clinical Nutrition Market. This is due to its robust healthcare infrastructure and high concentration of medical facilities. This region is home to numerous leading hospitals, medical centers, and healthcare providers, driving significant demand for clinical nutrition products. Additionally, the Central Region benefits from a well-established healthcare system and higher levels of healthcare spending compared to other regions in Spain. The proximity of this area to major pharmaceutical and biotechnology companies further enhances the availability and distribution of clinical nutrition products. The region also has a large population with a higher proportion of elderly individuals, increasing the demand for specialized nutrition in managing age-related conditions. Moreover, regional health policies emphasizing the importance of preventive care and disease management contribute to the strong demand for clinical nutrition in hospitals and homecare settings, reinforcing the Central Region’s position as the largest market in 2023.Key Market Players

- Nestlé España

- Danone SA/Spain

- Abbott Nutrition

- Fresenius SE & Co. KGaA

- Otsuka Pharmaceutical S.A.

- Baxter International Inc.

- B. Braun Medical, S.A.

- Meiji Pharma Spain, S.A.

- BASF Española S.L.

- Pfizer, SLU

Report Scope:

In this report, the Spain Clinical Nutrition Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Spain Clinical Nutrition Market, By Route of Administration:

- Oral

- Intravenous

Spain Clinical Nutrition Market, By Nutrition Type:

- Enteral Nutrition

- Oral Nutrition Supplements

- Tube Feeding

- Parenteral Nutrition

- Supplemental Parenteral nutrition

- Total Parenteral Nutrition

- All-in-one system

- Multiple bottle system

Spain Clinical Nutrition Market, By Application:

- Metabolic Disorders

- Eating Disorders

- Stages of Development and Recovery

- Others

Spain Clinical Nutrition Market, By End User:

- Infant & Child

- Adults

- Geriatrics

Spain Clinical Nutrition Market, By Substrates:

- Energy

- Carbohydrates

- Lipids

- Proteins & amino acids

- Water & electrolyte

- Dietary fiber

- Antioxidants

Spain Clinical Nutrition Market, By Region:

- Central Region North Spain

- Aragon & Catalonia

- Andalusia, Murcia & Valencia

- Madrid, Extremadura & Castilla

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Spain Clinical Nutrition Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nestlé España

- Danone SA/Spain

- Abbott Nutrition

- Fresenius SE & Co. KGaA

- Otsuka Pharmaceutical S.A.

- Baxter International Inc.

- B. Braun Medical, S.A.

- Meiji Pharma Spain, S.A.

- BASF Española S.L.

- Pfizer, SLU

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 87 |

| Published | December 2024 |

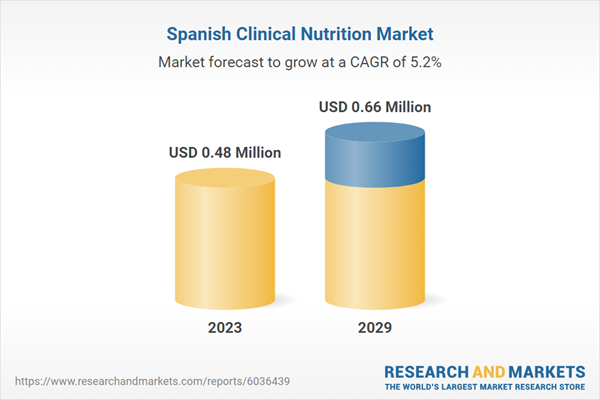

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 0.48 Million |

| Forecasted Market Value ( USD | $ 0.66 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Spain |

| No. of Companies Mentioned | 10 |