Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to the 'International Institute for Strategic Studies', global defence spending reached USD 2.46 trillion in 2024, highlighting the substantial fiscal commitment supporting naval procurement strategies. However, the market faces a significant hurdle due to the exorbitant costs associated with shipbuilding and lifecycle maintenance. These high financial burdens often compel navies to scale back procurement volumes or delay critical acquisition schedules, creating a substantial barrier to broader market expansion.

Market Drivers

The Expansion of Global Defense Budgets and Naval Procurement serves as the primary engine for market growth, driven by nations rushing to counter perceived maritime threats and secure territorial interests. As geopolitical friction intensifies, particularly in the Indo-Pacific, governments are allocating record funding to acquire advanced surface combatants and submarines.For instance, according to Channel News Asia in March 2025, China announced a 7.2 percent increase in its annual defense budget to approximately USD 245.6 billion (1.78 trillion yuan), explicitly aiming to accelerate the modernization of the People’s Liberation Army Navy. This surge in capital expenditure triggers reciprocal spending among regional rivals, creating a sustained cycle of high-value naval contracting. Illustrating this reactive procurement trend, according to USNI News in December 2024, the Japanese Cabinet approved a record-breaking defense budget of 8.7 trillion yen (approximately USD 55.1 billion) for Fiscal Year 2025, heavily emphasizing the acquisition of new frigates and Aegis-equipped vessels.

Simultaneously, the Integration of Autonomous and Unmanned Systems is fundamentally reshaping naval architecture and operational doctrines. Navies are increasingly moving away from exclusively manned fleets toward hybrid force structures that utilize unmanned surface and underwater vehicles for dangerous intelligence, surveillance, and reconnaissance missions.

This technological shift reduces risk to personnel while offering a cost-effective multiplier for fleet presence in contested waters. A significant validation of this trend occurred when, according to Naval News in September 2025, the Royal Australian Navy awarded a contract worth AUD 1.7 billion to Anduril Australia to manufacture a fleet of 'Ghost Shark' extra-large autonomous undersea vehicles. Such investments confirm that autonomous platforms are transitioning from experimental prototypes to core acquisition programs, generating a new, high-growth revenue stream within the naval manufacturing sector.

Market Challenges

The exorbitant costs associated with shipbuilding and lifecycle maintenance constitute a substantial barrier to the expansion of the naval vessels sector. Developing modern combat platforms requires the integration of complex structural and electronic systems, significantly driving up unit prices. As these financial demands intensify, defense departments are frequently forced to revise procurement strategies, often resulting in reduced order volumes or the postponement of fleet modernization initiatives. This fiscal pressure limits the addressable market for shipyards, as finite budgets are consumed by fewer, more expensive assets rather than a larger number of new hulls.The impact of these rising expenses is evident in recent valuations. According to the 'U.S. Naval Institute', in '2024', the estimated cost to complete the lead ship of the Constellation-class frigate program rose to approximately USD 1.6 billion. Such cost escalations compel navies to divert capital toward sustaining existing inventory rather than acquiring new vessels. Consequently, the high financial threshold for acquisition and long-term sustainment directly impedes the overall growth trajectory of the market.

Market Trends

The Development and Deployment of Ship-Based Directed Energy Weapons is rapidly gaining traction as navies seek cost-effective solutions to counter saturation attacks from drones and missiles. Unlike traditional kinetic interceptors which are resource-intensive and limited by magazine capacity, high-energy lasers and microwave systems offer a deep magazine with a negligible cost-per-shot ratio. This operational pivot is creating substantial opportunities for defense contractors to integrate power-dense weapon systems onto existing surface combatants, specifically to neutralize aerial threats with greater financial efficiency. Validating this strategic shift, according to the UK Ministry of Defence in November 2025, in the 'DragonFire Laser Contract Announcement', the government awarded a contract worth GBP 316 million to MBDA UK to install these high-power laser weapons on Royal Navy Type 45 destroyers, explicitly aiming to bolster fleet protection against complex aerial targets.Simultaneously, the Transition to Hybrid-Electric and Air-Independent Propulsion Systems is revolutionizing the underwater and surface domains by enhancing acoustic stealth and operational endurance. Navies are increasingly demanding propulsion solutions that reduce thermal and acoustic signatures while extending submerged range, driving manufacturers to innovate in fuel cell and lithium-ion battery technologies. This demand for advanced propulsion capabilities is generating record operational activity for specialized shipbuilders who are modernizing fleets to operate in contested environments without frequent surfacing. For instance, according to thyssenkrupp Marine Systems in May 2025, in the 'Half-Year Financial Report 2024/2025', the company secured a record order backlog of EUR 16.1 billion, largely fueled by contracts for Air-Independent Propulsion equipped submarines such as the Type 212CD and Type 218SG programs.

Key Players Profiled in the Warship and Naval Vessels Market

- BAE Systems PLC

- Mazagon Dock Shipbuilders Limited

- Damen Shipyards Group

- FINCANTIERI S.p.A.

- General Dynamics Corporation

- LARSEN & TOUBRO LIMITED

- Navantia S.A.

- thyssenkrupp Marine Systems GmbH

- Korea Shipbuilding & Offshore Engineering Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

Report Scope

In this report, the Global Warship and Naval Vessels Market has been segmented into the following categories:Warship and Naval Vessels Market, by Operation Type:

- Surface Fleet

- Undersea Fleet

Warship and Naval Vessels Market, by Application Type:

- Defense

- Rescue

- Others

Warship and Naval Vessels Market, by End Use Type:

- Destroyer

- Frigate

Warship and Naval Vessels Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Warship and Naval Vessels Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Warship and Naval Vessels market report include:- BAE Systems PLC

- Mazagon Dock Shipbuilders Limited

- Damen Shipyards Group

- FINCANTIERI S.p.A.

- General Dynamics Corporation

- LARSEN & TOUBRO LIMITED

- Navantia S.A.

- thyssenkrupp Marine Systems GmbH

- Korea Shipbuilding & Offshore Engineering Co., Ltd

- Mitsubishi Heavy Industries, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

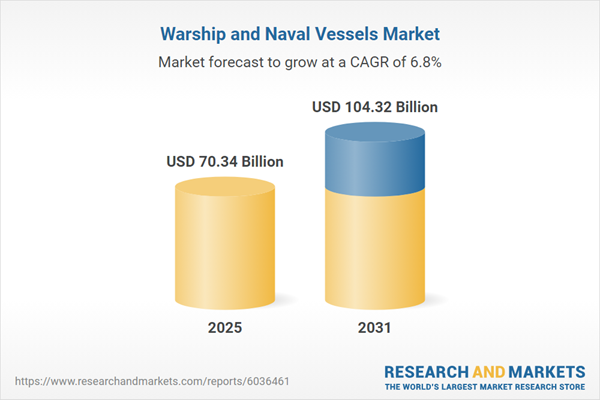

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 70.34 Billion |

| Forecasted Market Value ( USD | $ 104.32 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |