Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive demand signals, the market faces significant hurdles due to strict environmental regulations concerning Volatile Organic Compounds (VOCs) and chemical toxicity. Manufacturers are under mounting pressure to remove hazardous components, a process that requires complex and expensive product reformulations to meet shifting global standards. This regulatory tightening, coupled with fluctuating raw material costs, poses a considerable challenge that threatens to squeeze operational margins. Consequently, these financial and compliance pressures could impede the industry's ability to expand effectively into cost-sensitive emerging markets.

Market Drivers

A primary catalyst for the Global Automotive Appearance Chemicals Market is the rise in global vehicle production and overall fleet size. As manufacturing output stabilizes, the continuous stream of new inventory expands the total surface area requiring protective coatings and cleaning agents. New vehicle owners are increasingly prioritizing aesthetic preservation to protect their investments, creating steady demand for specialized interior and exterior formulations. This growth in the vehicle fleet sustains positive market momentum; for instance, the European Automobile Manufacturers' Association (ACEA) reported in January 2025 that new passenger car registrations in the EU rose by 0.8% to reach 10.6 million units in 2024. Additionally, the growing car parc supports the professional service sector, as evidenced by Mister Car Wash’s October 2024 financial results, which showed a 7% increase in net revenues to $743.6 million year-to-date, reflecting strong commercial demand for appearance products.Further accelerating industry growth is the expansion of the pre-owned vehicle market and the associated need for refurbishment. Unlike new models, aging vehicles necessitate restorative solutions such as specialized compounds, polishes, and degreasers to correct aesthetic imperfections and maximize resale value. Professional reconditioning centers depend heavily on these high-performance chemicals to revitalize used inventory for budget-conscious buyers. The magnitude of this demand is significant; according to CarMax's April 2024 fiscal year results, the company retailed 765,572 used vehicles, a volume that drives substantial consumption of reconditioning products to prepare this extensive fleet for sale.

Market Challenges

The central challenge obstructing the Global Automotive Appearance Chemicals Market is the enforcement of rigorous environmental regulations regarding Volatile Organic Compounds (VOCs) and chemical toxicity. Adherence to these shifting standards compels manufacturers to undertake intricate product reformulations, requiring the elimination of hazardous yet effective traditional ingredients. This transition necessitates substantial investment in research and development to discover compliant, eco-friendly alternatives that maintain performance levels. Consequently, the costs associated with these reformulations, combined with the instability of raw material prices, squeeze operational margins and restrict the capital available for broader business growth.These regulatory pressures directly hinder expansion by complicating manufacturers' ability to price products competitively, especially in cost-sensitive emerging markets where affordability is essential for adoption. The difficulty in absorbing these increased compliance costs leads to diminished production agility and impedes the industry's capacity to leverage rising vehicle ownership rates in developing regions. According to the American Chemistry Council, production volumes for specialty chemicals - the category including automotive appearance formulations - fell by 3.2% in 2024 due to these prevailing industrial and operational headwinds. This contraction illustrates how the combination of strict regulations and associated cost burdens effectively limits the sector's potential for robust global growth.

Market Trends

The widespread adoption of ceramic and graphene nanocoatings is fundamentally transforming the product landscape of the Global Automotive Appearance Chemicals Market. Both consumers and professionals are increasingly moving away from traditional wax-based applications in favor of these advanced formulations, which deliver superior hydrophobicity, heat resistance, and long-lasting durability. This transition is prompting manufacturers to broaden their portfolios of protective films and liquid coatings to satisfy the demand for high-performance surface preservation. The commercial success of these technologies is reflected in the financial results of key industry players; for example, XPEL, Inc. reported in February 2025 that its fourth-quarter revenue, excluding the Chinese market, rose by 10.5% in 2024, underscoring the strong and growing adoption of its protective solutions.Concurrently, the shift toward direct-to-consumer and subscription-based e-commerce models is establishing consistent revenue streams and modifying chemical consumption patterns. Automotive care providers are utilizing subscription memberships to secure customer loyalty and guarantee recurring usage of cleaning formulations, thereby shielding the market from the volatility associated with one-off service demand. This model fosters a steady volume of chemical consumption through frequent, unlimited wash privileges managed via digital platforms. The impact of this trend is significant within the professional sector; according to Mister Car Wash’s February 2025 report, sales from its Unlimited Wash Club subscription program comprised 75% of total wash sales in 2024, highlighting the dominance of the subscription economy in driving industry turnover.

Key Players Profiled in the Automotive Appearance Chemicals Market

- SONAX GmbH

- Dow Chemical Company

- General Chemical Corp.

- Illinois Tool Works Inc.

- Guangzhou Biaobang Car Care Industry Co. Ltd.

- LIQUI MOLY GmbH

- Niteo Products, Inc.

- Nuvite Chemical Compounds

- 3M Company

- Turtle Wax, Inc.

Report Scope

In this report, the Global Automotive Appearance Chemicals Market has been segmented into the following categories:Automotive Appearance Chemicals Market, by Product Type:

- Waxes

- Polishes

- Protectants

- Wheel and Tire Cleaners

- Windshield Washer Fluids

- Leather Care Products

- Others

Automotive Appearance Chemicals Market, by Vehicle Type:

- Commercial Vehicle

- Passenger Cars

Automotive Appearance Chemicals Market, by Sales Channel:

- Online

- Offline

Automotive Appearance Chemicals Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Appearance Chemicals Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Appearance Chemicals market report include:- SONAX GmbH

- Dow Chemical Company

- General Chemical Corp.

- Illinois Tool Works Inc

- Guangzhou Biaobang Car Care Industry Co. Ltd

- LIQUI MOLY GmbH

- Niteo Products, Inc.

- Nuvite Chemical Compounds

- 3M Company

- Turtle Wax, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

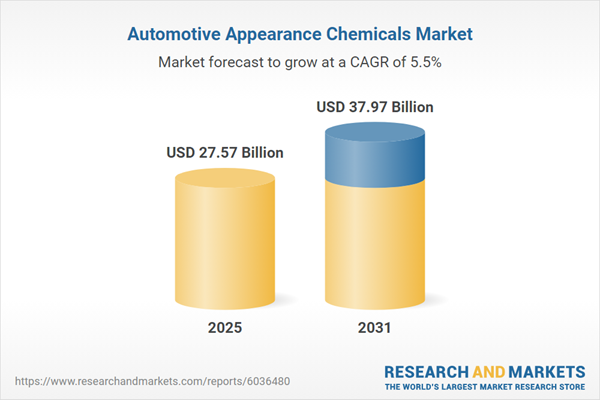

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 27.57 Billion |

| Forecasted Market Value ( USD | $ 37.97 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |