Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The underground High Voltage Cable market refers to the segment of the global cable industry dedicated to the production, distribution, and utilization of specialized high-capacity electrical cables designed for underground installation, typically for the transmission and distribution of electricity at high voltage levels. These cables are engineered to meet the demanding requirements of subterranean environments, where they are often buried beneath the earth's surface for the purpose of efficient and reliable electrical power transmission.

These underground High Voltage Cables are vital components of modern electrical grids, urban infrastructure, and industrial applications. They play a crucial role in ensuring the seamless and safe supply of electricity to residential, commercial, and industrial areas, especially in densely populated urban centers where space constraints and environmental concerns make underground installation the preferred choice.

The market for underground High Voltage Cables is characterized by constant innovation in cable design, materials, and insulation technologies to enhance performance, efficiency, and environmental sustainability. It is influenced by factors such as urbanization, environmental regulations, the expansion of renewable energy projects, and the need for reliable power distribution, making it a dynamic and critical segment within the broader energy infrastructure industry.

For instance, Under Asia-Pacific, As of June 30, 2024, India’s installed renewable energy capacity (including hydro) stood at 203.19 GW, representing 45.5% of the overall installed power capacity. As of June 30, 2024, Solar energy contributed 85.47 GW, followed by 46.65 GW from wind power, 10.35 GW from biomass, 5.00 GW from small hydropower, 0.59 from waste to energy, and 46.93 GW from hydropower.

Key Market Drivers

Grid Modernization and Reliability

The imperative to modernize and enhance the reliability of electrical grids is a crucial driver of the global underground High Voltage Cable market. Aging grid infrastructure, coupled with the need for greater energy efficiency and resilience, has led to significant investments in grid modernization projects around the world.Underground High Voltage Cables play a pivotal role in these efforts by replacing or augmenting existing overhead lines with advanced underground systems. The benefits of underground installation include reduced exposure to weather-related damage, enhanced grid reliability, and minimized transmission losses, all of which contribute to improved overall grid performance.

Smart grid initiatives, which involve the integration of advanced monitoring and control systems, rely on underground High Voltage Cables to transmit data and information alongside electricity. This enables real-time grid management, reduces response times during outages, and enhances energy efficiency.

The installation of underground cables also helps mitigate the risk of power outages caused by natural disasters, such as storms, hurricanes, and wildfires, as underground cables are less vulnerable to external environmental factors.

The growing electrification of various sectors, including transportation and industry, places higher demands on the electrical grid. Underground High Voltage Cables are crucial for accommodating these increased power requirements and supporting the expansion of electric vehicle charging infrastructure, data centers, and industrial facilities.

Governments and regulatory bodies are increasingly emphasizing the need for resilient and efficient electrical grids. This has resulted in policies and investments that promote the use of underground High Voltage Cables as a means to enhance grid reliability and minimize disruptions.

Key Market Challenges

Cost Constraints and Financial Viability

One of the primary challenges confronting the global underground High Voltage Cable market is the issue of cost constraints and the financial viability of underground cable projects. While underground High Voltage Cables offer a multitude of advantages, including enhanced aesthetics, reduced environmental impact, and improved reliability, they tend to be considerably more expensive to install and maintain compared to their overhead counterparts.The upfront capital costs associated with underground High Voltage Cables encompass several factors. Firstly, the cables themselves are technologically advanced, with specialized insulation materials and shielding to ensure safety and efficiency. Additionally, the excavation and trenching required for the installation of underground cables demand substantial investments in labor, equipment, and materials.

The complexities of navigating through urban areas, densely populated regions, or challenging terrains can further escalate installation costs. In some cases, the need for specialized tunneling or directional drilling techniques can substantially inflate project expenses.

The ongoing maintenance and repair of underground High Voltage Cables can be arduous and costly. Locating and addressing faults or failures in underground systems can be time-consuming and may necessitate excavation, resulting in service disruptions and additional expenses.

These elevated costs can deter utility companies, municipalities, and project developers from opting for underground High Voltage Cables, especially when budget constraints are a significant consideration. As a result, the financial viability of underground cable projects becomes a crucial hurdle to overcome.

To address this challenge, stakeholders in the underground High Voltage Cable market must explore innovative cost-saving strategies, such as the development of more cost-effective cable designs, advancements in installation techniques, and the optimization of maintenance processes. Collaboration between governments, utilities, and manufacturers can also lead to financial incentives and subsidies that make underground cable projects more financially attractive.

Technological Advancements and Compatibility

The rapid pace of technological advancements poses another substantial challenge for the global underground High Voltage Cable market. While these advancements bring notable benefits in terms of cable efficiency and performance, they can also introduce compatibility issues, potentially rendering existing underground cable systems obsolete.High Voltage Cable technologies are continually evolving to improve transmission efficiency, reduce energy losses, and enhance overall grid performance. These innovations may include the development of novel materials, such as superconductors, or the integration of smart grid features like real-time monitoring and fault detection.

As new cable technologies emerge, there arises a compatibility concern with existing underground cable systems. Older cable systems may not be able to accommodate or fully leverage the benefits of these technological upgrades, resulting in a mismatch between newly developed cables and the infrastructure they are intended to integrate with.

Compatibility challenges can extend beyond the cables themselves. They may encompass the communication protocols and control systems required for smart grid functionalities. Ensuring seamless integration between new cable technologies and existing grid infrastructure becomes a complex and critical task.

These compatibility issues can hinder the adoption of advanced High Voltage Cables, as utilities and grid operators may be reluctant to invest in new technologies that could disrupt their existing systems or necessitate costly upgrades.

To address this challenge, industry stakeholders must adopt a forward-looking approach that considers the long-term compatibility of cable systems with emerging technologies. This involves the development of standardized interfaces and protocols to facilitate interoperability between different components of the electrical grid. Additionally, utilities and governments should collaborate on comprehensive grid modernization strategies that account for technological advancements and ensure a smooth transition to more advanced underground High Voltage Cable systems.

Key Market Trends

Growing Demand for Renewable Energy Sources Driving Market Growth:

The Global Underground High Voltage Cable Market is witnessing a significant surge in demand, driven primarily by the global shift towards renewable energy sources. With increasing concerns about climate change and the depletion of traditional fossil fuels, governments and industries worldwide are investing heavily in renewable energy infrastructure, including wind and solar power generation. Underground high voltage cables play a crucial role in transmitting electricity generated from renewable sources to urban centers and industrial hubs.One of the key factors contributing to the growing demand for underground high voltage cables is their ability to efficiently transmit electricity over long distances with minimal losses. Unlike overhead transmission lines, underground cables are not affected by weather conditions such as storms or high winds, making them a reliable option for transmitting electricity from remote renewable energy farms to densely populated areas. Moreover, underground cables offer aesthetic advantages as they do not disrupt the visual landscape compared to traditional overhead lines, making them more acceptable in urban and environmentally sensitive areas.

Another driving force behind the increasing adoption of underground high voltage cables is the growing focus on grid modernization and reliability enhancement initiatives. Aging infrastructure, coupled with the need to accommodate the integration of renewable energy sources into the grid, has led to a renewed emphasis on upgrading transmission and distribution networks. Underground cables offer greater reliability and resilience compared to overhead lines, as they are less susceptible to external factors such as weather-related outages, vandalism, or accidental damage.

Advancements in cable technology, such as the development of high-performance insulation materials and improved manufacturing processes, have significantly enhanced the efficiency and reliability of underground high voltage cables. These technological advancements have led to the development of cables capable of transmitting higher power loads over longer distances, thereby addressing the growing demand for electricity transmission infrastructure in remote or offshore locations.

Segmental Insights

Voltage Insights

The 100 kV - 250 kV segment held the largest market share in 2023. One of the primary reasons for the dominance of the 100 kV - 250 kV voltage range is its suitability for urban and suburban applications. In densely populated areas, such as cities and their surrounding suburbs, there is often limited space and a high demand for electricity. Underground High Voltage Cables in the 100 kV - 250 kV range are well-suited for efficiently transmitting power within these urban environments. They can deliver high-capacity electricity while minimizing the visual impact associated with overhead transmission lines, which is essential for maintaining the aesthetics of cityscapes.Underground High Voltage Cables in the 100 kV - 250 kV range strike a balance between aesthetics and performance. While higher voltage categories may offer greater transmission capacity, they can be over-engineered for many urban and suburban applications. Urban planners and local governments often prioritize the preservation of city aesthetics and the reduction of visual clutter caused by electrical infrastructure. This preference makes the 100 kV - 250 kV range an attractive choice, as it provides sufficient capacity for urban areas without the need for bulkier and more visually intrusive higher voltage cables.

The 100 kV - 250 kV voltage category is commonly used in distribution networks that serve residential, commercial, and industrial customers. These networks require reliable and efficient underground cabling solutions to ensure a consistent power supply to a diverse range of end-users. Underground High Voltage Cables in this range are capable of efficiently transmitting electricity over moderate distances, making them ideal for urban and suburban distribution networks where power sources may be located at a reasonable proximity.

Many urban areas are undergoing grid modernization initiatives to improve the efficiency and resilience of their electrical grids. These efforts often involve the replacement or enhancement of existing electrical infrastructure, including the installation of advanced High Voltage Cables. The 100 kV - 250 kV range aligns well with the needs of grid modernization projects in urban areas, as it supports the integration of smart grid technologies, real-time monitoring, and control systems, which are essential for enhancing overall grid performance.

Urban and suburban areas are often subject to stringent environmental regulations and aesthetic concerns. Underground High Voltage Cables in the 100 kV - 250 kV range are favored for their ability to minimize environmental disturbances, preserve landscapes, and reduce visual impacts, thus addressing these concerns effectively.

The 100 kV - 250 kV range strikes a balance between transmission capacity and energy efficiency. Underground High Voltage Cables in this range are designed to minimize energy losses during transmission, ensuring that electricity is delivered efficiently to end-users in urban and suburban areas.

Regional Insights

Asia Pacific held the largest market share in 2023. The Asia Pacific region has emerged as a dominant force in the Global Underground High Voltage Cable Market due to several key factors that underscore its strategic advantage and robust growth trajectory. Here, we delve into the primary reasons behind Asia Pacific's prominence in this dynamic market landscape.Asia Pacific is witnessing unprecedented infrastructure development, driven by rapid urbanization and industrialization across countries like China, India, and Southeast Asian nations. This surge in infrastructure projects necessitates reliable and efficient power transmission systems, thus fueling the demand for underground high voltage cables.

With a burgeoning population and expanding economies, the Asia Pacific region is experiencing a substantial increase in energy consumption. Governments and utilities are investing heavily in upgrading and expanding their electricity grids to meet this escalating demand, driving the adoption of underground high voltage cables for efficient power transmission.

Many countries in Asia Pacific are actively transitioning towards renewable energy sources to reduce carbon emissions and enhance energy security. Underground high voltage cables play a pivotal role in integrating renewable energy generation sources, such as wind and solar farms, into the existing grid infrastructure, thereby fostering their widespread deployment in the region.

The rapid pace of urbanization in Asia Pacific has led to space constraints for traditional overhead power lines. Underground high voltage cables offer a viable solution by minimizing land requirements and reducing visual and environmental impacts, making them increasingly preferred for urban and densely populated areas.

Governments in the Asia Pacific region are implementing supportive policies and incentivizing investments in critical infrastructure projects, including the development of underground power transmission networks. Substantial investments in smart grids and energy infrastructure modernization further bolster the demand for underground high voltage cables.

Key Market Players

- Prysmian S.p.A

- NKT A/S

- Fujikura Ltd

- Southwire Company, LLC

- Sumitomo Electric Industries Ltd

- Hitachi, Ltd.

- Kerlink SA

- Brugg Kabel AG

Report Scope:

In this report, the Global Underground High Voltage Cable Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Underground High Voltage Cable Market, By Voltage:

- 100 kV - 250 kV

- 251 kV - 400 kV

- Above 400 kV

Underground High Voltage Cable Market, By End-User:

- Industrial

- Utility

- Commercial

Underground High Voltage Cable Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Underground High Voltage Cable Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Prysmian S.p.A

- NKT A/S

- Fujikura Ltd

- Southwire Company, LLC

- Sumitomo Electric Industries Ltd

- Hitachi, Ltd.

- Kerlink SA

- Brugg Kabel AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | December 2024 |

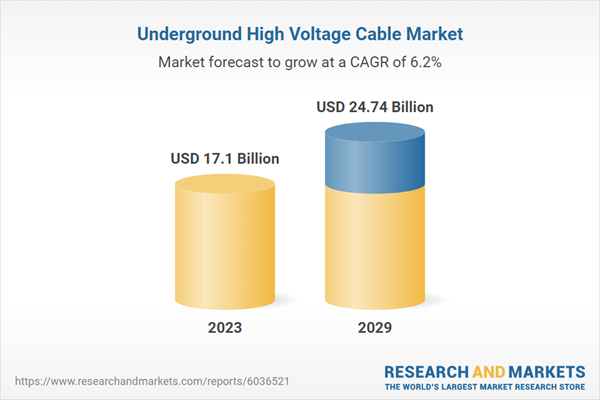

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 17.1 Billion |

| Forecasted Market Value ( USD | $ 24.74 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |