Phthalic Anhydride is a significant chemical intermediate in the production of major chemicals such as phthalate Plasticize, copper Phthalocyanine (CPC), di-ethyl Phthalate (DEP), unsaturated Polyester Resin (UPR), etc. This is one of the major driving factors for the increased demand for phthalic anhydride. Apart from that, phthalic anhydride is utilized in the production of various other industries, such as pharmaceuticals, leather, paper, dyes, saccharine, etc.

- In 2023, the top importers of phthalic anhydride were the Netherlands for the quantity of 66,265,400 Kg, followed by India with 84,825,100 Kg, Turkey with 66,808,800 Kg, Indonesia with 58,978,000 Kg, and the European Union with 42,591,600 Kg, according to WITS (World Integrated Trade Solution).

- The top exporters of phthalic anhydride were China with 131,856,000 Kg, followed by Belgium with 85,828,800 Kg, Japan, and Austria with 27,855,000 Kg in 2023, according to this WITS (World Integrated Trade Solution).

Phthalic anhydride market drivers

Rising usage of electronic devices

The growth of electronic devices is attributed to multiple factors, such as rising Internet use, digital media usage, increasing cloud computing activities, and demand for artificial intelligence devices. In 2022, the U.S. imported US$629.87 billion worth of electronic devices, a significant rise from the previous year, according to the United States International Trade Commission. The expansion of electronics leads to the demand for phthalic anhydride for the manufacturing of electronic devices.Phthalic anhydride market geographical outlook

The phthalic anhydride market is segmented into five regions worldwide:

By geography, the phthalic anhydride market is segmented into North America, South America, Europe, theMiddle East and Africa, and Asia-Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.The Asia-Pacific region is expected to grow significantly in the phthalic anhydride market due to its increasing consumer electronics and automotive applications. Indian passenger car market is expected to reach a value of US$54.84 billion by 2027 while registering a CAGR of over 9% between 2022-27. In FY24, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was 28,434,742 units.

North America is expected to have a significant market share for phthalic anhydride products due to its major utilization in the electronic and coatings industry. The construction industry in the United States has been increasing steadily and is a major part of the country's economy. The construction spending in the United States was 2,122,229 (million USD) in January 2024, which had been 1,932,302 in 2022.

Phthalic anhydride market challenges:

- Phthalic anhydride is toxic in the body. Phthalic anhydride is irritating to the eyes, respiratory tract, and skin in humans. Due to this, it is difficult to handle and store. Tests showed exposure to phthalic anhydride to have moderate acute toxicity.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others):

The Phthalic Anhydride Market is segmented and analyzed as below:

By Application

- Plasticizers

- Alkyd Resins

- Unsaturated Polyester Resins

- Others

By End-use Industry

- Automotive

- Electrical And Electronics

- Paints And Coatings

- Plastics

- Others

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- AEKYUNG CHEMICAL Co. Ltd

- BASF SE

- Exxon Mobil Corporation

- I G Petrochemicals Ltd.

- Koppers Inc.

- LANXESS

- MITSUBISHI GAS CHEMICAL COMPANY INC.

- NAN YA PLASTICS CORPORATION

- Polynt Group

- Stepan Company

- Merck KGaA

- EMCO Dyestuff

- Perstorp

- Thirumalai Chemicals Ltd

- KLJ Group

- UPC (MiTAC-Synnex Group)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | November 2024 |

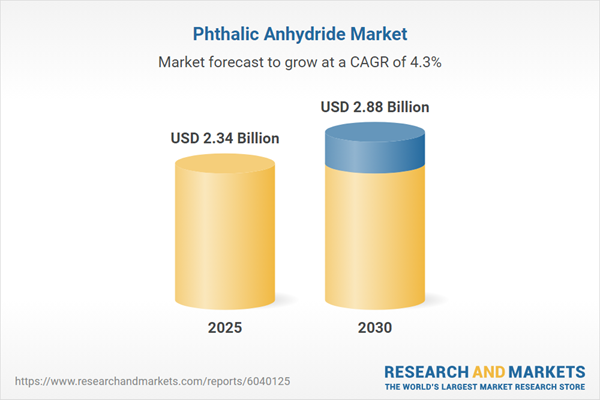

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 2.34 Billion |

| Forecasted Market Value ( USD | $ 2.88 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |