Reactive diluents are low-viscosity compounds added in formulations such as coatings, adhesives, and composites to lower the viscosity of a system with no loss of its function. Unlike traditional solvents, reactive diluents are chemically involved in curing or crosslinking reactions, where they become part of the final product. Examples include epoxy, acrylate, urethane, and vinyl ester-based diluents, which bring improved flow, easier applications, and mechanical properties to the cured material. They are used for many industrial applications to reduce viscosity and enhance processing with a decreased VOC level, which diminishes emissions as an environment-friendly option compared to traditional solvents. Reactive diluents are important for high-performance, environment-friendly applications in automotive, aerospace, and electronics.

Reactive diluents market drivers

Growing demand for High-Performance Coatings and Adhesives

Reactive diluents are low-viscosity compounds added in formulations such as coatings, adhesives, and composites to lower the viscosity of a system without losing its function. Unlike traditional solvents, reactive diluents are chemically involved in curing or crosslinking reactions, where they become part of the final product. Examples include epoxy, acrylate, urethane, and vinyl ester-based diluents, which bring improved flow, easier applications, and mechanical properties to the cured material. They are used in many industrial applications to reduce viscosity and enhance processing with a decreased VOC level, which diminishes emissions as an environment-friendly option compared to traditional solvents.The demand for powder and high-performance coatings for industrial applications also contributed to the growth. In December 2023, compared to December 2022, production in construction increased by 1.9% in the euro area and by 2.4% in the European Union. Reactive diluents have been of great importance for high-performance and environment-friendly applications in the automotive, aerospace, and electronics industries.

The reactive diluents market is segmented into five regions worldwide:

By geography, the reactive diluents market is segmented into North America, South America, Europe, theMiddle East and Africa, and Asia-Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region.Asia-Pacific's reactive diluents market is growing significantly through rapid industrialization, a burgeoning manufacturing sector, and high demand for performance materials in the automotive, electronic, coatings, and building sectors. Countries like China and India are expanding their industrial base, and Japan and South Korea are experiencing rising demand for reactive diluents in resin formulates, coatings, and adhesives. For instance, fixed-asset investment in China's electronic information manufacturing business increased by 9.3 percent year on year in 2023, reflecting the sector's revival, according to government statistics. The Ministry of Industry and Information Technology announced that the increase was 0.3 percentage points more than China's entire industry.

The region also enhances this demand since it focuses on sustainability and compliance with regulatory issues related to the environment. Hence, it is providing a low-VOC and solvent-free alternative compared to reactive diluents that align with a 'green' goal.

North American reactive diluents are gaining strong market growth, driven by strict environmental regulations against VOC emissions in various end-user industries such as automotive, aerospace, coatings, and electronics. Automotive and aerospace are among the driving segments due to a higher demand for corrosion-resistant, lightweight, and durable materials, with the trend toward electric vehicles gaining momentum. In 2023, the aerospace and defense industry in the United States achieved an outstanding milestone, with revenues exceeding $955 billion, a 7.1 percent rise over the previous year.

Technological breakthroughs in resin formulations and advancing green chemistry are enabling better performance and efficiency for reactive diluents. In contrast, a shift toward bio-based solutions follows the emerging growth trend for sustainable solutions. Major players operating in North America, such as Dow, BASF, and Huntsman, are expanding their portfolios, further contributing to the market growth.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The reactive diluents market is segmented and analyzed as follows:

By Type

- Aliphatic

- Aromatic

- Cycloaliphatic

By Application

- Paints & Coatings

- Composites

- Adhesives & Sealants

- Others

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Aditya Birla Advanced Materials

- Olin Epoxy

- SACHEM, Inc.

- Evonik Industries

- Mitsubishi Chemical Group

- Arkema Global

- Cardolite

- Huntsman Corporation

- Kukdo Chemical Co., Ltd.

- Adeka Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | November 2024 |

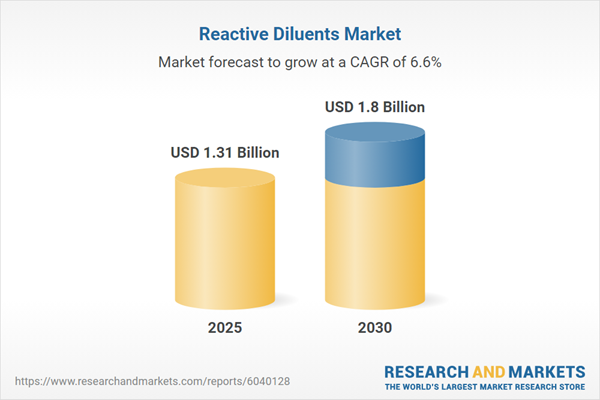

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.31 Billion |

| Forecasted Market Value ( USD | $ 1.8 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |