Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As sustainability becomes more important to consumers and builders, fiberglass windows, made from recyclable materials, are increasingly preferred for green building certifications and eco-friendly construction. Additionally, the rising demand for construction and renovation activities worldwide, particularly in emerging markets, further fuels market growth. The aesthetic appeal of fiberglass windows, which can be customized to various styles and sizes, also contributes to their popularity. Though they come with a higher upfront cost, their long-term benefits, such as lower energy bills and fewer repairs, make them a cost-effective choice. Technological advancements and regulatory support for energy-efficient solutions continue to bolster the fiberglass window market’s expansion.

Key Market Drivers

Energy Efficiency and Sustainability

Energy efficiency is one of the most significant drivers for the growth of the global fiberglass window market. As energy costs continue to rise, consumers and businesses are increasingly focusing on reducing their energy consumption. Fiberglass windows are highly effective in providing thermal insulation, which helps reduce heating and cooling requirements in buildings. The material's low thermal conductivity prevents the transfer of heat, ensuring that homes and offices stay warm in the winter and cool in the summer, thereby reducing reliance on air conditioning and heating systems. This energy efficiency results in lower energy bills, making fiberglass windows a cost-effective choice for long-term savings.Beyond just insulation, fiberglass windows play an essential role in reducing the carbon footprint of buildings. Their superior insulation properties help to minimize the use of artificial heating and cooling systems, thus lowering energy consumption. As the global demand for energy-efficient and environmentally sustainable products grows, fiberglass windows are increasingly recognized as a key component in green building practices. The increasing trend toward eco-friendly construction materials is influenced by both consumer preferences and government regulations aimed at reducing greenhouse gas emissions and promoting energy-efficient infrastructure.

Governments worldwide are introducing stricter building codes and energy-efficiency standards to address the climate crisis. These regulations often include mandates for higher energy performance in buildings, which directly drives the demand for energy-efficient products like fiberglass windows. Fiberglass windows, being compliant with these stringent building codes, are highly favored by builders and architects involved in sustainable construction projects. Furthermore, the use of fiberglass windows contributes to achieving green certifications such as LEED (Leadership in Energy and Environmental Design), further enhancing their appeal among environmentally conscious consumers and businesses.

The sustainable nature of fiberglass windows also plays a crucial role in reducing the need for repairs and replacements. Their resistance to extreme weather conditions and their durability against wear and tear mean that they typically last longer than windows made from other materials like wood or vinyl. This contributes to reducing waste in landfills, making fiberglass windows a more sustainable option compared to alternatives that may require frequent replacements. As the demand for energy-efficient homes and green construction continues to rise, the role of fiberglass windows as a critical part of sustainable building practices will only become more prominent. The International Energy Agency (IEA) reports that global energy efficiency improvements have been around 1.5% annually on average since 2010, but this is still not sufficient to meet climate targets.

Durability, Low Maintenance, and Long-Term Cost Efficiency

Durability and low maintenance requirements are key market drivers for the global fiberglass window market. Unlike traditional materials such as wood or aluminum, fiberglass is highly resistant to weather extremes, including rain, humidity, UV rays, and temperature fluctuations. This makes fiberglass windows ideal for use in regions with extreme climates, where other window materials might warp, rot, or corrode over time. Fiberglass windows can withstand the elements without deteriorating, ensuring that they maintain their structural integrity and aesthetic appearance for many years. This level of durability significantly extends the lifespan of windows, reducing the frequency of replacements and repairs.In addition to weather resistance, fiberglass windows are also resistant to pest damage, such as rot from termites or wood-eating insects. This further increases their appeal, particularly in regions where pest infestations are common. The material’s inherent strength means that it can endure impact and pressure, making it a safer option in locations prone to extreme weather events, such as hurricanes or heavy storms. As a result, fiberglass windows provide added security and peace of mind to homeowners and businesses alike.

The low-maintenance nature of fiberglass windows is another significant driver in their popularity. Unlike wood windows, which require regular painting and sealing to prevent rot and decay, fiberglass windows require very little upkeep. They do not need to be repainted or resealed, which not only saves time and money but also reduces the need for harmful chemicals and paints, contributing to a more sustainable lifestyle. The minimal maintenance requirements of fiberglass windows make them particularly attractive to homeowners and property managers looking for hassle-free solutions that do not demand constant attention.

The long-term cost efficiency of fiberglass windows also adds to their market appeal. While the initial cost of fiberglass windows may be higher than that of other materials such as vinyl or aluminum, the overall value over time is significantly greater. The durability, energy efficiency, and low maintenance of fiberglass windows reduce long-term operational costs, including energy bills, repair expenses, and replacement costs.

In comparison to cheaper alternatives that may need frequent repairs or replacements, fiberglass windows provide a better return on investment in the long run. For builders and homeowners looking for cost-effective, high-performance window solutions, fiberglass windows offer an excellent combination of durability, efficiency, and minimal maintenance requirements. As the demand for long-lasting, low-maintenance construction materials continues to grow, fiberglass windows are well-positioned to maintain their dominance in the market.

Key Market Challenges

High Initial Cost and Price Sensitivity

One of the primary challenges facing the global fiberglass window market is the relatively high initial cost of fiberglass windows compared to other window materials such as vinyl, wood, or aluminum. Fiberglass windows are manufactured through complex processes that require specialized materials and technology, making them more expensive than traditional alternatives. While they offer long-term savings through energy efficiency and durability, the higher upfront cost can be a deterrent for many consumers, particularly in price-sensitive markets or regions where cost is a significant factor in purchasing decisions.For homeowners and businesses on tight budgets, the price difference between fiberglass windows and other options may make it difficult to justify the higher initial investment. In many cases, consumers may opt for more affordable materials, such as vinyl, which, while less durable and energy-efficient, come at a much lower price point. This cost-sensitive mindset can slow the adoption of fiberglass windows, especially in developing countries where construction budgets are often constrained. Even though fiberglass windows are cost-effective in the long run due to their energy efficiency and reduced maintenance needs, the upfront cost remains a significant barrier to widespread adoption.

Moreover, the price sensitivity in the construction and renovation sectors can have a direct impact on the market. Builders and developers often work within strict budget constraints, which can influence their decision to choose lower-cost alternatives to fiberglass windows. The preference for cheaper options in mass construction and renovation projects can hinder the penetration of fiberglass windows, particularly in cost-competitive markets. As the demand for affordable housing and commercial properties rises globally, the challenge of balancing quality and cost continues to impact the fiberglass window market’s growth.

To overcome this challenge, manufacturers must focus on driving down production costs and improving the efficiency of the manufacturing process to make fiberglass windows more affordable. Additionally, offering financing options, rebates, or government incentives for energy-efficient windows could help reduce the price barrier for consumers and builders, thereby promoting the adoption of fiberglass windows in more price-sensitive markets.

Competition from Alternative Window Materials

The global fiberglass window market faces significant competition from other window materials such as vinyl, wood, and aluminum, which are more established in the market and often come at lower costs. Vinyl, in particular, is a strong competitor due to its affordability, ease of installation, and relatively good energy efficiency properties. Vinyl windows are widely available and are commonly used in residential and commercial buildings, especially in markets where cost is a primary concern. Despite offering lower durability and performance compared to fiberglass, vinyl windows continue to dominate in many regions due to their lower price and familiarity among consumers and builders.Wooden windows are another competing product, offering natural aesthetics and insulating properties. While wooden windows require more maintenance than fiberglass, they remain a popular choice due to their classic appeal, especially in heritage and luxury buildings. In some markets, the appeal of traditional wood windows, with their timeless design, outweighs the advantages of fiberglass in terms of energy efficiency and durability. The market for wooden windows also benefits from a strong presence in high-end construction and renovation projects where consumers are willing to pay a premium for the aesthetic appeal and craftsmanship of wood.

Aluminum windows, while not as energy-efficient as fiberglass, are another competitor, especially in commercial buildings and areas where durability and low maintenance are important. Aluminum windows offer strength and resistance to weathering, and their sleek, modern look is often favored in contemporary architectural designs. Though aluminum windows have a higher thermal conductivity compared to fiberglass, their affordability and longevity make them a strong contender in the market.

The challenge of competing with these alternative materials lies in convincing consumers and builders of the long-term value that fiberglass windows offer in terms of energy savings, durability, and minimal maintenance. Manufacturers of fiberglass windows need to effectively communicate the unique benefits of fiberglass, such as superior insulation, resistance to extreme weather conditions, and the low maintenance required, to differentiate their products from the competition. Furthermore, continuous innovation to improve the performance, aesthetics, and affordability of fiberglass windows will be essential for maintaining a competitive edge in the market. As alternative materials continue to dominate price-sensitive markets, fiberglass window manufacturers must find ways to overcome the perceived value gap and demonstrate the long-term cost benefits to potential customers.

Key Market Trends

Growing Demand for Sustainable and Energy-Efficient Products

One of the most prominent trends in the global fiberglass window market is the increasing demand for sustainable and energy-efficient building materials. As climate change concerns intensify, governments, consumers, and the construction industry are placing greater emphasis on reducing energy consumption and promoting eco-friendly practices. Fiberglass windows are inherently energy-efficient due to their low thermal conductivity, which reduces heat transfer and helps maintain a comfortable indoor climate throughout the year. This energy efficiency directly leads to lower heating and cooling costs, making fiberglass windows an attractive option for both residential and commercial buildings.The rise of green building certifications, such as Leadership in Energy and Environmental Design (LEED) and Building Research Establishment Environmental Assessment Method (BREEAM), has further driven the demand for energy-efficient products. Fiberglass windows play a key role in helping buildings achieve these certifications by meeting stringent energy performance standards. Additionally, fiberglass windows' durability and low maintenance contribute to sustainability efforts by reducing the need for frequent replacements and minimizing waste. As the construction industry increasingly adopts sustainable practices, fiberglass windows are becoming a preferred choice in green building projects, as they offer long-term environmental and economic benefits.

The shift toward energy-efficient and sustainable products is also fueled by rising consumer awareness about environmental issues and the desire to reduce carbon footprints. Homeowners and businesses are more inclined to invest in products that align with their environmental values, and fiberglass windows meet these expectations. Manufacturers in the fiberglass window market are responding to this trend by focusing on innovations that enhance the energy-saving capabilities of their products, such as the use of low-emissivity (low-E) coatings, which improve insulation and reduce solar heat gain. Additionally, there is an increasing emphasis on recyclable materials in the production of fiberglass windows, further aligning with sustainability trends and consumer preferences for eco-friendly products.

As energy efficiency continues to be a priority in both new construction and renovation projects, the global fiberglass window market is expected to grow in response to these trends. The continued demand for energy-efficient, low-maintenance, and environmentally friendly building materials is likely to drive innovation and competition in the fiberglass window market, making it a key player in the broader construction industry.

Technological Advancements and Product Innovation

Another significant trend in the global fiberglass window market is the rapid pace of technological advancements and product innovation. Manufacturers are continuously improving the performance, aesthetics, and functionality of fiberglass windows to meet the evolving needs of consumers and the construction industry. Innovations in manufacturing techniques, materials, and design are making fiberglass windows more versatile and appealing to a broader range of customers.One of the most notable advancements in fiberglass window technology is the development of high-performance coatings and glazing options that improve insulation, noise reduction, and solar heat gain control. Low-emissivity (low-E) coatings, which reflect heat while allowing natural light to pass through, are becoming increasingly popular in fiberglass windows. These coatings enhance the energy efficiency of the windows by reducing the need for heating and cooling, thus lowering energy bills. Additionally, advancements in glazing technology, such as triple glazing and insulated glass units (IGUs), are improving the thermal performance of fiberglass windows, making them even more effective at reducing heat transfer and increasing soundproofing.

Manufacturers are also focusing on enhancing the aesthetic appeal of fiberglass windows through new design options and finishes. Fiberglass windows are highly customizable, offering a variety of colors, textures, and styles to suit different architectural designs. This trend is driven by the growing demand for windows that not only perform well but also complement the overall aesthetic of a building. Customization options allow homeowners, architects, and builders to choose windows that align with the specific design goals of a project, whether for modern, traditional, or eco-friendly buildings.

The use of advanced manufacturing technologies, such as computer-aided design (CAD) and automated production systems is also contributing to the innovation in fiberglass window products. These technologies allow for precise, high-quality production, ensuring that fiberglass windows meet stringent performance standards and are available in a wider range of shapes, sizes, and configurations. As a result, fiberglass windows are increasingly being used in a variety of building types, from residential homes to commercial and industrial properties.

Furthermore, advancements in smart window technology are beginning to make their way into the fiberglass window market. Smart windows can be equipped with sensors and actuators to automatically adjust light levels, temperature, and even privacy. These innovations not only enhance the functionality of fiberglass windows but also align with the growing trend of incorporating smart technologies into buildings for improved energy management and occupant comfort.

As these technological advancements continue to reshape the fiberglass window market, manufacturers will be able to offer more high-performance, aesthetically pleasing, and innovative products to meet the changing demands of consumers and the construction industry. The trend of continuous product innovation will likely propel the market forward, creating new opportunities for growth and differentiation. Advanced energy-efficient windows, including those with low-emissivity (Low-E) coatings, insulated glazing, and triple glazing, can reduce heat loss by up to 50% compared to standard single-glazed windows.

Segmental Insights

End user Insights

Residential segment dominated the Fiberglass Window market in 2024 and maintain its dominance throughout the forecast period. Increasing consumer awareness about energy efficiency and sustainability is driving the demand for fiberglass windows in residential buildings. Homeowners are increasingly seeking windows that offer superior insulation properties, reducing energy costs for heating and cooling.Fiberglass windows are highly efficient in this regard, providing better thermal performance than alternatives like vinyl and wood, making them particularly appealing in regions with extreme climates. Additionally, the growing trend towards green building practices and eco-friendly home improvements is further boosting the adoption of fiberglass windows. These windows are made from recyclable materials and contribute to higher energy efficiency, helping homeowners achieve certifications like LEED.

Moreover, the long-term cost savings associated with fiberglass windows, including lower maintenance requirements and increased durability, make them an attractive investment for homeowners looking to reduce long-term expenses. As residential construction continues to grow globally, particularly in emerging markets, the demand for high-quality, energy-efficient building materials like fiberglass windows is expected to rise. Innovations in design and aesthetics are also increasing the appeal of fiberglass windows for residential applications, allowing homeowners to match their windows with various architectural styles. With these advantages, the residential sector is set to remain the dominant driver of the fiberglass window market in the coming years.

Regional Insights

North America dominated the Fiberglass Window market in 2024 and maintain its leadership throughout the forecast period. The region's growing focus on energy efficiency and sustainability is driving the demand for fiberglass windows, which are known for their superior insulation properties. With rising energy costs and increased awareness of the environmental impact of construction materials, homeowners and businesses in North America are increasingly opting for energy-efficient solutions like fiberglass windows. These windows provide excellent thermal performance, helping to reduce heating and cooling costs, which is a major selling point in both residential and commercial sectors.Additionally, North America has strong regulations and incentives promoting energy-efficient building practices, which further boost the adoption of fiberglass windows. Programs such as tax rebates and green building certifications encourage the use of sustainable materials in construction. The region's mature construction market, coupled with the increasing trend of home renovation and energy-efficient retrofits, also plays a crucial role in the demand for fiberglass windows. Moreover, technological advancements in window design and manufacturing are making fiberglass windows more affordable and aesthetically versatile, further contributing to their popularity. As a result, North America is expected to remain a dominant player in the fiberglass window market, driven by demand for energy-efficient, durable, and sustainable building solutions.

Key Market Players

- Assa Abloy AB

- Bayer Built Woodworks Inc.

- ETO Doors Corp.

- JELD-WEN Inc.

- Milgard Manufacturing LLC

- Pella Corporation

- Stanley Black & Decker Inc.

- Trinity Glass International, Inc.

- Weather Shield Mfg., Inc.

Report Scope:

In this report, the Global Fiberglass Window Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Fiberglass Window Market, By Application:

- New Construction

- Replacement

Fiberglass Window Market, By Window Style:

- Awning Windows

- Bay and Bow Windows

- Casement Windows

Fiberglass Window Market, By End User:

- Residential

- Non-residential

Fiberglass Window Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Belgium

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- South America

- Brazil

- Colombia

- Argentina

- Chile

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fiberglass Window Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Assa Abloy AB

- Bayer Built Woodworks Inc.

- ETO Doors Corp.

- JELD-WEN Inc.

- Milgard Manufacturing LLC

- Pella Corporation

- Stanley Black & Decker Inc.

- Trinity Glass International, Inc.

- Weather Shield Mfg., Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2025 |

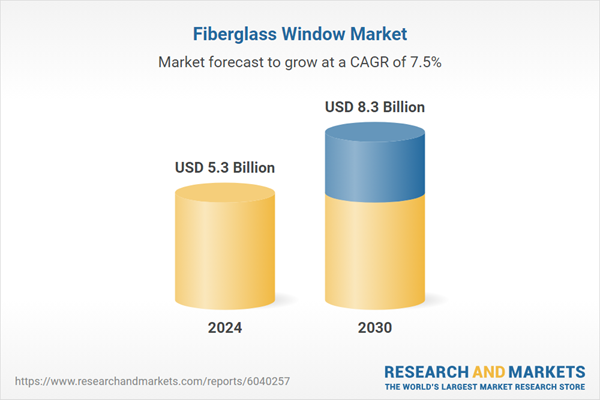

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 8.3 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |