Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Compact, maneuverable trucks are being developed for cities with narrow streets, while automated systems like side loaders enhance safety and efficiency. Emphasis is also growing on waste segregation and recycling, with vehicles designed to separate recyclable materials. Despite challenges like high cost, the focus on sustainability is driving market growth.

For instance, The European Commission set new recycling targets under the Packaging and Packaging Waste Directive. By December 31, 2025, at least 65% of packaging waste must be recycled, with the target rising to 70% by 2030. Starting January 1, 2030, certain single-use plastic packaging will be banned. Additionally, by 2029, separate collection of 90% of single-use plastic and metal beverage containers (up to three liters) will be required. These measures aim to significantly reduce waste and promote sustainability across the region.

Key Market Drivers

Rising Urbanization and Population Growth

The rapid pace of urbanization and population growth, particularly in developing countries, is a key driver of the Global Garbage Collection Vehicle Market. As cities expand, there is a significant increase in the volume of waste generated, putting immense pressure on waste management systems. Growing urban populations require more advanced, efficient waste disposal solutions to maintain public health and environmental cleanliness. In densely populated urban areas, the demand for garbage collection vehicles intensifies, as municipalities seek to keep up with the higher waste volumes.These vehicles are essential for ensuring timely and effective waste collection and disposal, preventing overcrowding of landfills and avoiding sanitation-related health risks. Urbanization often leads to smaller and more congested streets, prompting the need for compact, maneuverable garbage trucks. As cities continue to grow, the importance of reliable and efficient garbage collection vehicles will only increase, driving market growth.

In 2024, China plans to increase its urban household waste recycling rate to 60% by 2025, up from 50% in 2024. This follows challenges in meeting previous waste management targets set for 2016-2020. The country is facing growing waste management difficulties, fueled by rising urban populations and increased consumption, while many major cities struggle with landfill accumulation. This goal highlights China's ongoing efforts to improve waste handling and sustainability.

Environmental Regulations and Sustainability Initiatives

Environmental regulations and a growing commitment to sustainability are key factors driving the adoption of eco-friendly garbage collection vehicles. Governments worldwide have introduced stricter emissions standards for the waste management industry to reduce the environmental impact of traditional garbage trucks, which are often powered by diesel engines.In response, municipalities and waste management companies are increasingly turning to electric and hybrid vehicles to meet these regulations and reduce their carbon footprints. Electric garbage trucks, in particular, offer the advantage of zero emissions, which is crucial for cities aiming to combat air pollution and promote green initiatives. These eco-friendly vehicles also help reduce noise pollution, making them more suitable for use in residential areas. As the emphasis on sustainability grows, the demand for cleaner, greener waste management solutions will continue to rise, pushing the market towards more advanced, environmentally conscious technologies and innovations in garbage collection vehicles.

Technological Advancements in Waste Management

Technological advancements are revolutionizing the Global Garbage Collection Vehicle Market, enhancing operational efficiency and improving waste management processes. The integration of telematics, GPS systems, and sensor technologies has enabled waste collection vehicles to operate more effectively, with real-time route optimization, fleet tracking, and monitoring capabilities. These technologies help municipalities reduce fuel consumption, decrease operating cost, and increase the efficiency of waste collection operations.Smart waste management solutions powered by data analytics allow waste management companies to better plan collection routes, monitor vehicle performance, and predict maintenance needs, leading to more sustainable operations. In addition, sensor technologies are increasingly being used to monitor waste levels in bins, helping optimize collection schedules and prevent overflowing. These technological innovations are not only improving the efficiency of garbage collection but also contributing to reducing the environmental impact of waste management operations, making them a crucial factor in the market's growth.

Key Market Challenges

Infrastructure Limitations

A major challenge hindering the growth of the Global Garbage Collection Vehicle Market is the insufficient waste management infrastructure in various regions, especially in developing countries. Many areas struggle with a lack of basic facilities like designated waste collection points, recycling centers, and landfill sites, making the effective deployment of garbage collection vehicles difficult.Without proper infrastructure in place, managing waste becomes increasingly complex, as garbage trucks may not have access to efficient disposal sites. The absence of such facilities leads to logistical challenges, such as extended collection routes and inefficiencies in waste processing. Inadequate waste management infrastructure also hampers the recycling process, limiting the ability of garbage trucks to support sustainable waste practices. To address these issues, significant investments in the development of waste management infrastructure are required, which can strain budgets and delay the improvement of waste collection systems in underserved areas.

High Initial Cost and Budget Constraints

One of the key obstacles in the adoption of advanced garbage collection vehicles is the high initial cost associated with modern, environmentally friendly technologies. Electric and hybrid garbage trucks, while offering long-term cost savings and environmental benefits, come with a steep upfront price tag. For many municipalities and waste management authorities, budget constraints limit the ability to invest in these high-tech vehicles. Governments often face pressure to balance their budgets, and allocating significant funds for fleet upgrades can be a challenge when other infrastructure needs are also competing for resources. These high cost deter many cities from transitioning to eco-friendly trucks, slowing the overall adoption of greener technologies. While operational savings and environmental benefits are clear, the capital expenditure required for purchasing advanced garbage collection vehicles remains a significant barrier to faster market growth.Technological Obsolescence

The rapid pace of technological advancements in the waste management sector creates a significant challenge for municipalities and waste management companies regarding technological obsolescence. As newer, more advanced features are continuously introduced such as enhanced sensors, AI-powered systems, and electric drivetrains older garbage collection vehicles may become outdated quickly.This forces waste management authorities to make continuous investments in upgrading or replacing their fleets to stay competitive and compliant with evolving environmental regulations. The risk of obsolescence can strain municipal budgets and create operational disruptions as companies attempt to keep their fleets up-to-date with the latest industry standards. As a result, waste management authorities face the challenge of balancing the implementation of innovative technologies with the need for cost-effective solutions. This ongoing cycle of technological innovation and fleet upgrading presents both a financial burden and an operational challenge for the market.

Key Market Trends

Transition to Electric and Hybrid Vehicles

A key trend driving the Global Garbage Collection Vehicle Market is the shift toward electric and hybrid vehicles. As municipalities and waste management companies strive to reduce carbon emissions and promote sustainability, the adoption of electric garbage trucks has gained significant momentum. Electric vehicles (EVs), in particular, offer the advantage of zero emissions, making them ideal for urban waste collection, where air pollution and noise levels are significant concerns.Hybrid garbage trucks, which combine electric and conventional combustion engines, offer a balanced solution by reducing fuel consumption and emissions while maintaining the necessary power for heavy-duty operations. This transition aligns with global efforts to combat climate change and improve environmental sustainability, as governments and organizations push for cleaner, greener alternatives in all sectors, including waste management. As the technology matures and operational costs decrease, the shift towards electric and hybrid garbage collection vehicles is expected to accelerate, contributing to a cleaner future.

Integration of Advanced Telematics and IoT Solutions

The integration of advanced telematics and Internet of Things (IoT) solutions is transforming the way garbage collection vehicles operate. Telematics systems enable real-time monitoring of vehicle location, performance, and operational metrics, providing valuable data for route optimization and maintenance scheduling. These systems also allow waste management companies to track the fuel efficiency of their fleets and ensure that vehicles are operating at peak performance.IoT solutions, including sensors in waste containers, offer additional insights, such as fill levels and waste types, helping companies to plan more efficient routes and allocate resources effectively. By collecting and analyzing this data, municipalities can make informed decisions to improve waste collection efficiency, reduce operational costs, and minimize fuel consumption. The rise of these smart, connected technologies is streamlining operations, improving service quality, and supporting the broader goals of sustainability in the waste management sector.

Optimization of Route Planning and Collection Processes

Optimizing route planning and collection processes is becoming an essential focus for the Global Garbage Collection Vehicle Market. Waste management companies are increasingly utilizing advanced technologies, such as automated route planning software and real-time data from IoT sensors, to streamline operations. By analyzing the fill levels of waste containers and considering traffic patterns, waste management authorities can dynamically adjust routes, reducing fuel consumption and operational expenses. This improved route planning not only boosts efficiency but also minimizes the environmental footprint of garbage collection, contributing to sustainability goals. Automation and data-driven decision-making help reduce human error and enhance the accuracy of waste collection schedules. This trend reflects a broader push within the industry to utilize technological advancements to improve resource utilization, minimize waste, and ensure that garbage collection processes are carried out in the most efficient and environmentally conscious way possible.Segmental Insights

Type Insights

The medium duty segment dominated the Global Garbage Collection Vehicle Market due to its balanced combination of power, efficiency, and versatility. Medium duty garbage trucks are particularly well-suited for urban environments, where waste collection requires a vehicle capable of navigating narrow streets and handling moderate waste volumes. These trucks provide a practical solution for municipalities that need a vehicle that is neither too large for tight spaces nor too small for the demands of waste management.Another key factor contributing to the dominance of the medium-duty segment is its adaptability. These trucks can be customized with various body styles, such as rear loaders, side loaders, and automated systems, making them versatile enough to meet the needs of both residential and commercial waste collection. They are also more fuel-efficient and cost-effective compared to heavy duty trucks, offering municipalities a more budget-friendly option without sacrificing performance.

The medium duty segment is also benefiting from advancements in technology, such as electric and hybrid vehicles, which are becoming more prevalent in urban waste collection. These environmentally friendly vehicles offer reduced emissions and lower operating costs, further increasing their appeal in regions with stringent environmental regulations.

Medium duty garbage trucks typically offer a lower total cost of ownership compared to heavy duty vehicles, making them an attractive option for waste management companies and municipalities looking to modernize their fleets while keeping expenses under control. This combination of operational efficiency, versatility, and cost-effectiveness ensures the continued dominance of the medium-duty segment in the garbage collection vehicle market.

Regional Insights

Europe & CIS dominated the Global Garbage Collection Vehicle Market due to several key factors, including stringent environmental regulations, a strong focus on sustainability, and advanced infrastructure. The region’s commitment to environmental sustainability drives the adoption of eco-friendly technologies, such as electric and hybrid garbage trucks. With many European countries aiming to reduce carbon emissions and meet ambitious climate goals, the demand for zero-emission waste management solutions has surged. The European Union’s rigorous environmental policies, including strict emissions standards for vehicles, have further accelerated the shift towards greener garbage collection fleets.The region benefits from well-established waste management systems and infrastructure, which support the widespread deployment of advanced garbage collection vehicles. Municipalities in Europe & CIS countries have the financial and technological resources to invest in modern waste collection fleets, including vehicles equipped with telematics and IoT solutions for route optimization and operational efficiency. These technologies help reduce fuel consumption, optimize waste collection processes, and enhance the overall sustainability of waste management operations.

The high level of urbanization in Europe & CIS countries also contributes to the dominance of this region in the market. As cities expand, the demand for efficient and reliable waste collection solutions increases. The compact and maneuverable nature of medium-duty trucks makes them particularly well-suited for European cities, where narrow streets and limited space present logistical challenges.

Europe & CIS is positioned as the market leader due to its commitment to environmental sustainability, advanced infrastructure, and the growing need for efficient waste management solutions in densely populated urban areas.

Key Market Players

- AB Volvo

- Dennis Eagle Limited

- IVECO S.p.A.

- Dulevo International S.p.A.

- FAUN Umwelttechnik GmbH & Co. KG

- Hino Motors, Ltd.

- PACCAR Inc.

- Mack Trucks, Inc.

- Daimler Truck North America LLC

- International Motors, LLC

Report Scope:

In this report, the Global Garbage Collection Vehicle Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Garbage Collection Vehicle Market, By Loader Type:

- Front

- Rear

- Automated Side Loader

- Others

Garbage Collection Vehicle Market, By Technology:

- Manual

- Semi-Automatic

Garbage Collection Vehicle Market, By Type:

- Light

- Medium

- Heavy Duty

Garbage Collection Vehicle Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Thailand

- Australia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Garbage Collection Vehicle Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AB Volvo

- Dennis Eagle Limited

- IVECO S.p.A.

- Dulevo International S.p.A.

- FAUN Umwelttechnik GmbH & Co. KG

- Hino Motors, Ltd.

- PACCAR Inc.

- Mack Trucks, Inc.

- Daimler Truck North America LLC

- International Motors, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2025 |

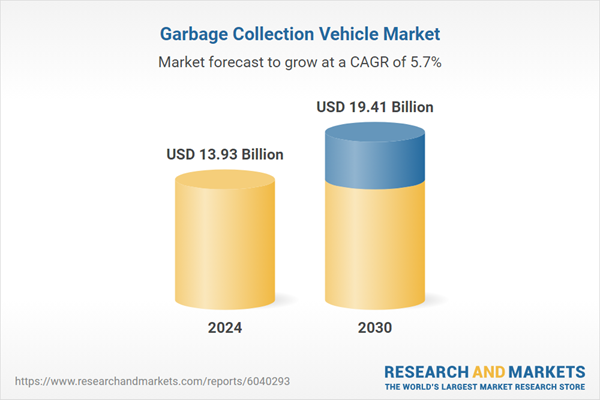

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.93 Billion |

| Forecasted Market Value ( USD | $ 19.41 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |