Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Healthcare Industry

The healthcare industry, a dynamic and rapidly evolving sector, plays a pivotal role in improving the quality of human life and well-being. According to data provided by Healthcare Investments in 2024, global sales in the healthcare industry are projected to exceed USD 4 trillion annually. The pharmaceuticals and biotechnology sectors represent the largest and most profitable sub-markets, generating nearly USD 850 billion, while the medical technology and diagnostics market exceeds USD 400 billion. As technological advancements continue to shape medical practices, the demand for safe, sterile, and high-quality medical devices, equipment, and pharmaceuticals has reached new heights.Enter the Global Irradiation Sterilization Services Market - a key enabler in meeting the stringent demands of the booming healthcare landscape. Patient safety stands at the core of the healthcare industry's values. Medical procedures, surgeries, and treatments rely heavily on the use of sterile instruments and devices to prevent infections and complications. With the rise in medical tourism and cross-border healthcare, maintaining consistent sterility across borders becomes crucial. Irradiation sterilization services provide a reliable and effective method to ensure that medical equipment is free from harmful pathogens, contributing to better patient outcomes and global health standards. Patient safety stands at the core of the healthcare industry's values.

Medical procedures, surgeries, and treatments rely heavily on the use of sterile instruments and devices to prevent infections and complications. With the rise in medical tourism and cross-border healthcare, maintaining consistent sterility across borders becomes crucial. Irradiation sterilization services provide a reliable and effective method to ensure that medical equipment is free from harmful pathogens, contributing to better patient outcomes and global health standards. Advancements in medical technology have revolutionized the diagnosis, treatment, and prevention of diseases. The increasing number of complex medical procedures, including surgeries, implants, and diagnostic tests, has amplified the need for sterile instruments and equipment.

From surgical instruments to implantable devices, these products require meticulous sterilization to mitigate the risk of infections and complications. The irradiation sterilization process, which effectively eliminates microorganisms without compromising the integrity of the products, aligns perfectly with the healthcare industry's quest for excellence. The pharmaceutical sector is a linchpin of the healthcare industry, providing life-saving medications and treatments.

As pharmaceutical companies develop a diverse array of products, including vaccines, injectables, and oral medications, ensuring the sterility and integrity of these products becomes paramount. The irradiation sterilization process guarantees that pharmaceutical products are free from contaminants, extending their shelf life and enhancing their efficacy. This is particularly crucial for drugs that require aseptic manufacturing processes and stringent regulatory compliance.

Heightened Awareness Due to Global Health Events

Global health events have a profound ability to reshape societies, economies, and industries. As the world grapples with the challenges presented by pandemics and other health crises, a heightened awareness of the importance of hygiene, safety, and disease prevention has emerged. In this context, the Global Irradiation Sterilization Services Market has found itself in the spotlight, playing a pivotal role in safeguarding products and public health. Global health events, such as the COVID-19 pandemic, have underscored the critical importance of hygiene and safety measures. The transmission of pathogens and microorganisms through everyday products and surfaces has heightened concerns among the public.The Electron Beam Radiation Processing Facility (ARPF) is currently operational at the Devi Ahilya Bai Holkar Fruit and Vegetable Mandi Complex in Indore. This state-of-the-art facility utilizes in-house developed 10 MeV, 6kW electron linear accelerators (linacs). It offers electron beam irradiation services for the terminal sterilization of medical devices and the irradiation of research samples for various applications, including the development of new crop varieties, color modification of gemstones, creation of novel materials, and modification of semiconductor properties. The facility is capable of delivering controlled radiation doses ranging from a few Gray (Gy) to several Mega Gray (MGy), tailored to specific requirements.

The adoption of electron beam irradiation technology is rapidly increasing globally due to its eco-friendly and safe nature, as it eliminates the need for radioisotopes like Cobalt-60 or Cesium-137, which are typically used in gamma radiation sources. The radiation from the electron accelerator can be precisely controlled, with the ability to turn it on and off as needed.

Additionally, the high dose rate of the electron beam facility significantly reduces the product hold time in the irradiation zone, offering a faster alternative to isotope-based facilities. The facility also provides flexibility in customizing product batch sizes to meet user-specific demands. Businesses and industries, recognizing the urgency to provide safe products to consumers, have turned to irradiation sterilization services to ensure the elimination of harmful agents. This reimagining of hygiene standards has fueled the demand for sterilized goods across sectors, propelling the growth of the irradiation sterilization market.

The irradiation sterilization process has emerged as a reliable method to swiftly decontaminate large volumes of essential supplies, addressing supply shortages during health crises. Global health events often lead to public skepticism about the safety of everyday products. Consumers become more conscious of the potential risks associated with contaminated items. Businesses striving to rebuild consumer trust have turned to irradiation sterilization services as a means to reassure their customers. By guaranteeing that products are free from pathogens, businesses can instill confidence in consumers, leading to increased demand for their goods and services.

Key Market Challenges

Public Perception and Misconceptions

Despite the well-documented safety and efficacy of irradiation sterilization, overcoming lingering public perceptions poses a significant challenge. Misconceptions surrounding radiation and its associated risks can foster hesitancy among both consumers and businesses alike. These misconceptions often stem from a lack of understanding about the principles and safeguards underlying the irradiation process.Dispelling these myths and fostering greater awareness about the scientific rigor and stringent safety protocols inherent to irradiation sterilization is paramount to fostering trust and encouraging widespread adoption. Education initiatives aimed at elucidating the benefits of irradiation, as well as addressing common concerns regarding radiation exposure, can play a pivotal role in reshaping public attitudes. Central to this endeavor is emphasizing the extensive research and regulatory oversight that governs the use of irradiation in sterilization applications. Rigorous testing and validation procedures ensure that irradiated products meet stringent safety and quality standards, mitigating any potential risks to consumers or end-users. Highlighting the broader societal benefits of irradiation sterilization, such as its role in safeguarding public health by reducing the risk of foodborne illnesses and preventing the spread of infectious diseases, can help to underscore its importance and dispel unfounded fears.

Initial Investment and Infrastructure

Establishing and sustaining irradiation facilities entails a substantial initial investment. The technology, equipment, and specialized expertise required to guarantee safe and efficient sterilization processes can incur significant costs. From procuring state-of-the-art machinery to employing trained personnel, the financial outlay for such endeavors can be considerable. For smaller businesses and burgeoning markets, accessing these resources poses notable challenges, potentially impeding their participation in the irradiation sterilization services market. Limited financial resources may restrict their ability to invest in the necessary infrastructure and expertise. Navigating regulatory requirements and compliance standards adds another layer of complexity, demanding additional resources in terms of time and money.In emerging markets particularly, where economic conditions may already be constrained, the cost barrier to entry into the irradiation sterilization sector could be even more prohibitive. These regions often grapple with inadequate infrastructure and limited access to capital, exacerbating the challenges of establishing and maintaining irradiation facilities. Ensuring the safety and efficacy of sterilization processes is paramount, necessitating ongoing investments in quality control measures, monitoring systems, and employee training. Without sufficient resources allocated to these areas, businesses may struggle to meet industry standards and regulatory expectations, thereby limiting their market viability and potential for growth.

Key Market Trends

Advanced Technology Integration

The trajectory of irradiation sterilization services is inexorably linked to the integration of advanced technologies. As we move forward, automation, robotics, and artificial intelligence (AI) are poised to revolutionize and elevate the sterilization process to unprecedented levels of efficiency and efficacy. One of the key areas where these technologies will exert their transformative influence is in dose calculation and delivery. Advanced algorithms powered by AI can analyze vast datasets and intricate parameters to precisely determine the optimal irradiation dose for each product, ensuring thorough sterilization while minimizing unnecessary radiation exposure.This level of precision not only enhances the effectiveness of the sterilization process but also contributes to minimizing material degradation and product loss. The gamma irradiation process utilizes Cobalt-60 radiation to eliminate microorganisms on a range of products within a specially designed cell. Gamma radiation is produced through the decay of the Cobalt-60 radioisotope, emitting high-energy photons that effectively sterilize. A distinguishing feature of gamma irradiation is its high penetration capability, enabling the targeted delivery of radiation to denser areas of products.

The advent of robotics in irradiation facilities promises to revolutionize operational workflows. Automated systems equipped with robotic arms can handle intricate tasks such as product loading and unloading, thereby reducing the reliance on manual labor and minimizing the risk of human error. This not only accelerates throughput but also enhances safety by mitigating the potential for accidents or injuries in the workplace. Real-time monitoring capabilities facilitated by AI-driven sensors and data analytics further augment the quality control measures inherent to irradiation sterilization. By continuously monitoring critical parameters such as temperature, humidity, and radiation levels, these technologies enable early detection of anomalies and deviations from optimal conditions, allowing for prompt corrective action and ensuring consistent sterilization outcomes.

Personalized Sterilization Protocols

As industries pivot towards customized solutions, the irradiation sterilization services market is poised to follow suit. The emergence of personalized sterilization protocols tailored to the unique characteristics of individual products and materials represents a significant evolution in sterilization practices. This trend reflects a growing recognition of the diverse requirements and challenges faced by different industries and underscores the importance of precision and flexibility in sterilization processes. Personalized sterilization protocols take into account a multitude of factors to optimize sterilization outcomes.Material composition, for instance, plays a crucial role in determining the appropriate irradiation parameters, as different materials may exhibit varying sensitivities to radiation. Likewise, product geometry influences the distribution of radiation within the product, necessitating adjustments to dosage and exposure times to ensure uniform sterilization throughout. The Radiation Pilot Program is a voluntary initiative designed to enable companies that terminally sterilize single-use medical devices ("sterilization providers") using gamma radiation or ethylene oxide (EO) to submit Master Files when making specific changes to sterilization sites, methods, or processes, as outlined in this notice. Under this program, manufacturers of class III devices requiring premarket approval ("PMA holders") who have been granted a right of reference by a sterilization provider may, upon notification from the FDA, include references to Master Files accepted into the Radiation Pilot Program in post-approval reports detailing these changes to sterilization processes, in place of submitting premarket approval (PMA) supplements for such modifications.

Regulatory requirements and industry standards serve as guiding principles in the development of personalized sterilization protocols. Compliance with stringent regulations governing sterilization practices is paramount to ensure product safety and efficacy. By incorporating regulatory considerations into sterilization protocols, service providers can uphold the highest standards of quality and adhere to legal obligations. The adoption of personalized sterilization protocols represents a paradigm shift towards a more nuanced and tailored approach to sterilization services. By accommodating the specific needs and requirements of each product or material, these protocols offer enhanced efficiency, reliability, and safety. They empower businesses to optimize their sterilization processes, minimize costs, and mitigate risks associated with product degradation or contamination.

Segmental Insights

Application Insights

Based on Application, Medical Instruments have emerged as the fastest growing segment in the Global Irradiation Sterilization Services Market during the forecast period. There are more surgeries needing extremely intense infection prevention and control, and hospital-acquired infections are more prevalent. The growing elderly population and an increase in government awareness initiatives to ensure high levels of infection prevention are the main drivers of the global market. Over the course of the projected period, rising rates of chronic diseases like diabetes, cancer, heart disease, obesity, and respiratory issues are also anticipated to promote market growth.Medical instruments often have complex structures and intricate designs that make them challenging to sterilize using conventional methods such as steam sterilization or chemical disinfection. Irradiation sterilization offers a highly effective and reliable sterilization method for a wide range of medical instruments, regardless of their size, shape, or material composition. This method uses ionizing radiation, such as gamma rays or electron beams, to disrupt the DNA of microorganisms, thereby rendering them unable to replicate and causing their death.

Product Type Insights

In 2024, the global irradiation sterilization services market was dominated by gamma irradiation segment. A key advantage of gamma irradiation is its exceptional penetration capability, which allows it to deliver the required radiation dose to areas of a product that may have higher density. This makes gamma irradiation particularly effective for sterilizing products with complex shapes or varying material thicknesses. Furthermore, gamma irradiation is recognized for its safety, reliability, and efficiency in treating a wide range of products, regardless of their density. Its consistent performance ensures that even the most challenging items can be sterilized effectively, making it a preferred method for a variety of industries requiring precise and reliable sterilization techniques.Regional Insights

The North America region has established itself as the leader in the global irradiation sterilization services market through 2030. North America dominated the market with the highest share in 2024 due to its well-established healthcare infrastructure. Factors such as increasing hospital-acquired infection (HCAI), technological advances in healthcare facilities, higher patient admission rates, strong industry presence, increasing government funding, increasing public awareness of available technologies and the presence of the U.S. market players, all contribute to the dominance of the North America region in the market.Key Market Players

- Steris Plc

- Sterigenics U.S., LLC

- Scapa Group Plc

- Swann-Morton Services Ltd.

- Steritek Inc.

- BGS Beta-Gamma-Service GmbH & Co KG

- Taisei Kako Co Ltd.

- Financiere Ionisos SAS

- E-Beam Services Inc.

- VPT RAD, Inc.

Report Scope:

In this report, the Global Irradiation Sterilization Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Irradiation Sterilization Services Market, By Application:

- Medical Instruments

- Drug

- Food & Laboratory

- Others

Irradiation Sterilization Services Market, By Product Type:

- Gamma Irradiation

- X-ray Irradiation

- E-beam Irradiation

Irradiation Sterilization Services Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Irradiation Sterilization Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Steris Plc

- Sterigenics U.S., LLC

- Scapa Group Plc

- Swann-Morton Services Ltd.

- Steritek Inc.

- BGS Beta-Gamma-Service GmbH & Co KG

- Taisei Kako Co Ltd.

- Financiere Ionisos SAS

- E-Beam Services Inc.

- VPT RAD, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2025 |

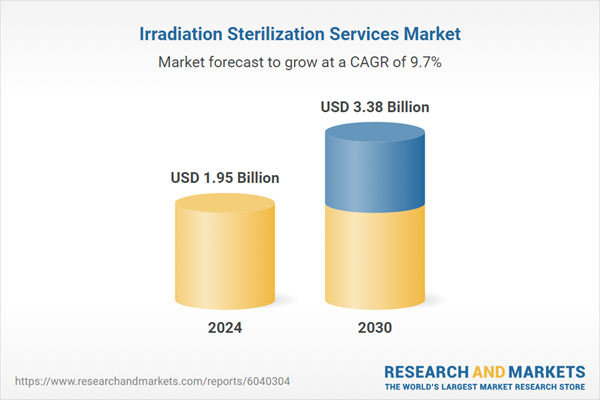

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.95 Billion |

| Forecasted Market Value ( USD | $ 3.38 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |