Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Advances in medical technology and the development of innovative infection control products, such as antimicrobial coatings and advanced sterilization equipment, also propel the market. The growing prevalence of antibiotic-resistant bacteria has heightened the focus on effective infection control strategies. The COVID-19 pandemic further underscored the importance of robust infection prevention protocols, accelerating investments in infection control solutions. The increasing number of surgical procedures and the expanding elderly population, who are more susceptible to infections, contribute to the market's growth. Overall, a combination of regulatory pressures, technological advancements, and heightened awareness drives the robust expansion of the Global Hospital Acquired Infection Control Market.

Key Market Drivers

Rising Incidence of Hospital Acquired Infections

Hospital Acquired Infections (HAIs), also known as nosocomial infections, are infections that patients acquire during their stay in healthcare facilities. The rising incidence of HAIs globally is a significant driver of the HAI control market. The study reported an overall incidence rate of nosocomial infections at 6.6 cases per 1,000 person-days of observation (95% CI: 5.1-8.7) and a prevalence of 8.88%. Over the course of the study, participants were monitored for a cumulative total of 7,984 person-days, with a median observation period of 10 days (IQR: 7-16 days).Factors contributing to this increase include the higher number of invasive procedures, the widespread use of indwelling medical devices like catheters and ventilators, and the prolonged hospital stays of patients with chronic diseases. According to the World Health Organization (WHO), hundreds of millions of patients are affected by HAIs each year, leading to a substantial burden on healthcare systems. This growing prevalence highlights the critical need for effective infection control measures to prevent the spread of these infections, thus driving the demand for HAI control products and services.

Stringent Regulatory Requirements and Guidelines

Regulatory bodies around the world, such as the Centers for Disease Control and Prevention (CDC) in the United States, the European Centre for Disease Prevention and Control (ECDC), and the WHO, have established stringent guidelines and requirements for infection control in healthcare settings. These regulations mandate healthcare facilities to adopt comprehensive infection control practices to ensure patient safety.Compliance with these guidelines often requires significant investment in infection control products and technologies, including sterilization equipment, disinfectants, and personal protective equipment (PPE). Failure to comply with these regulations can result in severe penalties and legal actions, further incentivizing healthcare providers to prioritize infection control. The enforcement of these stringent regulations is a major driver of the HAI control market.

Technological Advancements in Infection Control

The continuous advancements in medical technology play a crucial role in driving the HAI control market. Innovations in infection control include the development of advanced sterilization methods, antimicrobial coatings for medical devices and surfaces, and automated disinfection systems. For instance, ultraviolet (UV) light disinfection robots and hydrogen peroxide vapor systems have shown high efficacy in eliminating pathogens in healthcare environments. The integration of artificial intelligence (AI) and data analytics in infection control systems allows for real-time monitoring and early detection of infection outbreaks. These technological advancements enhance the effectiveness and efficiency of infection control measures, making them more appealing to healthcare providers and boosting market growth.Aging Population and Increased Vulnerability

The aging global population is another significant driver of the HAI control market. By 2030, one in six people globally will be aged 60 or older, with the population in this age group rising from 1 billion in 2020 to 1.4 billion. By 2050, the global population of individuals aged 60 and above is projected to double to 2.1 billion. Furthermore, the number of people aged 80 and older is anticipated to triple during the same period, reaching 426 million.This demographic shift, referred to as population aging, represents a growing concentration of older individuals within a population. While initially prevalent in high-income nations - such as Japan, where 30% of the population is already aged 60 or above - the most significant changes are now occurring in low- and middle-income countries. By 2050, these countries will account for two-thirds of the global population aged 60 and older, reflecting a profound transformation in global demographics.

Elderly individuals are more susceptible to infections due to weakened immune systems and the higher likelihood of having chronic conditions that require frequent medical interventions. As the proportion of elderly individuals in the population increases, so does the number of hospital admissions and the need for invasive procedures, both of which elevate the risk of HAIs. This demographic trend necessitates enhanced infection control measures in healthcare settings to protect this vulnerable population. Consequently, the growing elderly population drives the demand for advanced infection control solutions, contributing to market expansion.

Economic and Health Burden of HAIs

The economic and health burden imposed by HAIs on healthcare systems is a significant driver of the HAI control market. The estimated costs of the Infection Prevention and Control (IPC) Program account for 2-3% of the hospital’s annual budget. In the absence of the IPC Program, the World Health Organization (WHO) projects that the hospital would have recorded 570 healthcare-associated infections (HAIs), representing 15% of inpatients. Through the implementation of the IPC Program, an estimated 310 HAIs were prevented, resulting in a total cost savings of $1,103,577.99.HAIs result in extended hospital stays, increased medical costs, and additional treatments, which place a substantial financial strain on healthcare providers and payers. HAIs can lead to severe complications and higher mortality rates, highlighting the urgent need for effective infection control. Recognizing these challenges, healthcare providers are increasingly investing in infection control measures to reduce the incidence of HAIs and the associated economic and health burden. This focus on cost-effective infection prevention strategies drives the demand for HAI control products and services, propelling market growth.

Key Market Challenges

High Costs of Advanced Infection Control Measures

One of the significant challenges in the Global Hospital Acquired Infection (HAI) Control Market is the high cost associated with advanced infection control measures. Implementing state-of-the-art technologies and maintaining rigorous infection control protocols require substantial financial investments. This includes the cost of purchasing and maintaining sophisticated sterilization equipment, automated disinfection systems, and advanced diagnostic tools. For instance, ultraviolet (UV) disinfection robots and hydrogen peroxide vapor systems, while highly effective, represent a considerable financial burden for many healthcare facilities, especially those in low- and middle-income countries.Ongoing expenses for consumables such as personal protective equipment (PPE), disinfectants, and antimicrobial coatings further strain the budgets of healthcare providers. These costs are exacerbated by the need for continuous training of healthcare staff to ensure they are proficient in using the latest infection control technologies and adhere to updated protocols. Smaller hospitals and clinics with limited financial resources may struggle to afford these investments, resulting in uneven adoption of best practices and technologies across different regions and healthcare facilities. This financial barrier hampers the overall effectiveness of infection control efforts globally and perpetuates disparities in healthcare quality and patient safety.

Inconsistent Compliance with Infection Control Protocols

Ensuring consistent compliance with infection control protocols across various healthcare settings is a critical challenge in the HAI control market. Despite the availability of comprehensive guidelines and best practices, adherence to these protocols can vary significantly among healthcare providers. Factors contributing to inconsistent compliance include lack of training, insufficient staffing, high workload, and varying levels of commitment to infection control practices.In many healthcare facilities, particularly those in resource-limited settings, staff may not receive adequate training on the latest infection control measures. High patient volumes and limited personnel can lead to lapses in protocol adherence, such as improper hand hygiene, inadequate sterilization of medical instruments, and incorrect use of PPE. These lapses can result in the spread of HAIs, undermining efforts to control infections.

The culture within healthcare institutions plays a crucial role in adherence to infection control practices. Facilities that prioritize infection prevention and foster a culture of safety are more likely to achieve higher compliance rates. However, changing organizational culture is a complex and gradual process that requires leadership commitment, continuous education, and the implementation of effective monitoring and feedback mechanisms. Addressing these challenges is essential to improve compliance and enhance the overall effectiveness of infection control programs.

Key Market Trends

Increasing Awareness and Education

Raising awareness about the importance of infection control among healthcare professionals, patients, and the general public is a vital driver of the HAI control market. Educational programs and training sessions aimed at healthcare workers emphasize the implementation of best practices for infection prevention, such as proper hand hygiene, the use of PPE, and the correct sterilization of medical instruments. Public health campaigns and awareness initiatives also play a crucial role in informing patients about the risks of HAIs and the importance of following infection control protocols. This increased awareness and education lead to better adherence to infection control measures, reducing the incidence of HAIs and driving the demand for related products and services.Growing Healthcare Expenditure

The global increase in healthcare expenditure significantly contributes to the growth of the HAI control market. Governments and private sector entities are investing heavily in improving healthcare infrastructure, including infection control measures. This investment is driven by the recognition that preventing HAIs not only improves patient outcomes but also reduces healthcare costs associated with prolonged hospital stays, additional treatments, and legal liabilities. The allocation of substantial budgets for healthcare facilities to upgrade their infection control practices ensures a steady demand for infection control products and technologies. The economic burden of HAIs on healthcare systems motivates further investment in preventive measures, fueling market growth.Segmental Insights

Product Insights

Based on the product, Sterilizers are currently dominating the global Hospital Acquired Infection (HAI) Control Market. This dominance is driven by several factors that make sterilizers an indispensable tool in the fight against HAIs. Sterilizers are essential for ensuring the complete elimination of all forms of microbial life, including bacteria, viruses, fungi, and spores, from medical instruments and surfaces. This level of thoroughness is crucial in preventing the transmission of infections in healthcare settings. Unlike disinfectors, which reduce the number of viable microorganisms to a safe level, sterilizers achieve a level of microbial kill that is necessary for surgical instruments and other critical medical devices that come into direct contact with sterile body tissues or fluids.The broad applicability of sterilizers is another key factor in their market dominance. They are used across various healthcare settings, including hospitals, clinics, and surgical centers, for sterilizing a wide range of instruments, from surgical tools to laboratory equipment. This versatility makes them a fundamental component of infection control protocols in numerous medical environments. The advent of advanced sterilization technologies, such as steam sterilization, ethylene oxide (EO) sterilization, and low-temperature hydrogen peroxide gas plasma, has expanded their applicability and effectiveness, further driving their adoption.

End User Insights

Based on the end user segment, Hospitals stand out as the primary setting dominating the landscape of infection control efforts. This dominance is driven by several factors that highlight the pivotal role hospitals play in mitigating the risk and spread of HAIs. Hospitals serve as the epicenter of healthcare delivery, catering to a diverse range of patients with varying medical needs. Due to the high volume of patients and the complexity of medical procedures performed within hospital walls, the risk of HAIs is inherently elevated. Consequently, hospitals have implemented stringent infection control protocols and invested in state-of-the-art technologies to minimize this risk and uphold patient safety standards.Intensive Care Units (ICUs) within hospitals play a particularly crucial role in infection control due to the vulnerable nature of patients receiving critical care. Patients in ICUs often have compromised immune systems, making them more susceptible to infections. As a result, ICUs prioritize infection prevention measures, such as strict adherence to hand hygiene protocols, rigorous environmental cleaning, and the use of specialized equipment for sterilization and disinfection.

Regional Insights

In North America, countries like the United States and Canada have stringent regulations and guidelines in place to ensure compliance with infection control protocols in healthcare settings. Organizations such as the Centers for Disease Control and Prevention (CDC) in the U.S. and the Public Health Agency of Canada provide comprehensive guidance on infection prevention and control practices, shaping the standard of care across the region. North America is home to some of the world's leading manufacturers of infection control products and technologies. Companies based in this region continually innovate and develop cutting-edge solutions to address the evolving challenges posed by HAIs. These advancements range from novel disinfection methods to sophisticated surveillance systems that enable real-time monitoring of infection rates within healthcare facilities.North America has a strong culture of collaboration and knowledge sharing among healthcare professionals, academic institutions, and industry stakeholders. This collaborative approach fosters innovation and drives continuous improvement in infection control strategies, positioning the region at the forefront of the global fight against HAIs.

Key Market Players

- Becton, Dickinson and Company

- STERIS Plc

- Advanced Sterilization Products Services Inc.

- Getinge AB

- Kimberly-Clark Corporation

- Cantel Medical Corporation

- BioMérieux SA

- Belimed AG

- 3M Company

- Sterigenics International LLC

Report Scope:

In this report, the Global Hospital Acquired Infection Control Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Hospital Acquired Infection Control Market, By Product:

- Sterilizers

- Disinfectors

- Endoscope Reprocessors

- Others

Hospital Acquired Infection Control Market, By Application:

- Disease Testing

- Drug-Resistance Testing

Hospital Acquired Infection Control Market, By Technology:

- Phenotypic Methods

- Genotypic Methods

Hospital Acquired Infection Control Market, By Disease:

- Hospital Acquired Pneumonia

- Bloodstream Infections

- Surgical Site Infections

- Gastrointestinal Infections

- UTI

- Others

Hospital Acquired Infection Control Market, By End User:

- Hospitals

- ICUs

- Ambulatory Surgical

- Diagnostic Centers

- Nursing Homes

- Maternity Centers

- Others

Hospital Acquired Infection Control Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hospital Acquired Infection Control Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Becton, Dickinson and Company

- STERIS Plc

- Advanced Sterilization Products Services Inc.

- Getinge AB

- Kimberly-Clark Corporation

- Cantel Medical Corporation

- BioMérieux SA

- Belimed AG

- 3M Company

- Sterigenics International LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2025 |

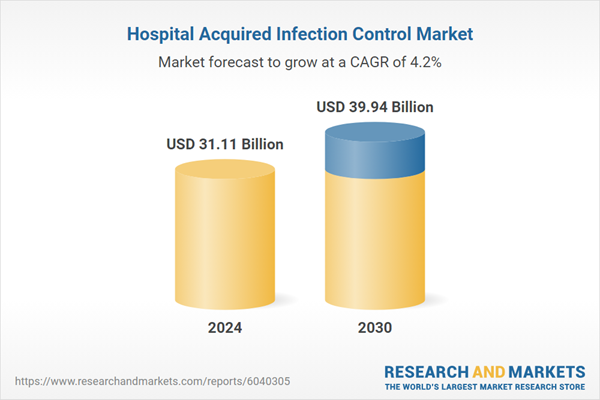

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.11 Billion |

| Forecasted Market Value ( USD | $ 39.94 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |