Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market encounters significant obstacles related to strict regulatory compliance and certification processes. Manufacturers are required to strictly observe safety standards regarding flammability, smoke, and toxicity, often leading to continuous and expensive adjustments in adhesive formulations. This regulatory complexity hinders rapid product development and limits the capacity of suppliers to quickly introduce new chemical technologies into the global supply chain, effectively acting as a barrier to innovation and speed in the market.

Market Drivers

The escalation in global commercial aircraft production and deliveries serves as a primary driver for the aerospace interior adhesives sector. As assembly rates increase, there is a proportional rise in the volume of adhesives needed to install overhead stowage compartments, lavatory modules, and sidewall panels. According to Boeing’s 'Commercial Market Outlook 2024-2043' released in July 2024, the aviation industry is expected to require nearly 44,000 new airplanes through 2043 to support fleet expansion, which directly correlates to higher consumption of structural and non-structural bonding agents. This trajectory is further supported by a robust recovery in travel; the International Air Transport Association reported that total revenue passenger kilometers rose by 7.1 percent in October 2024 compared to the previous year, underscoring the need for a continuously active global fleet.Concurrently, the shift toward lightweight composite interior materials is necessitating the use of advanced adhesive solutions rather than traditional mechanical fasteners. Airlines are increasingly prioritizing weight reduction to decrease fuel consumption, leading to a greater reliance on bonded composite assemblies in seating systems and galleys that require specialized chemical agents for both structural integrity and aesthetic finishes. This trend is driving significant investment in interior retrofits where adhesives are crucial for bonding dissimilar materials. For instance, Emirates announced in a May 2024 press release regarding its 'Retrofit Project' that it had increased its investment to over USD 3 billion to refurbish the interiors of 191 aircraft, highlighting the industry's dependence on high-performance adhesives to integrate advanced materials while adhering to weight constraints.

Market Challenges

The rigorous regulatory compliance and certification framework regarding flammability, smoke, and toxicity standards presents a major hurdle to the expansion of the Global Aerospace Interior Adhesives Market. These strict safety requirements demand continuous and costly formulation adjustments, significantly extending the lead times needed to bring high-performance bonding solutions to a commercially viable state. Since manufacturers must allocate considerable resources to validating compliance rather than scaling production, the industry faces difficulties in rapidly introducing the advanced chemical technologies required for modern cabin outfitting.This difficulty in quickly certifying and deploying compliant materials directly limits the speed at which aircraft interiors can be finished and delivered. As a result, the volume of adhesives used for original equipment installations often lags behind the potential demand suggested by order books. This operational slowdown is evident in recent industry output figures; according to the International Air Transport Association, global aircraft deliveries in 2024 dropped to just 1,254 units, roughly 30% below pre-pandemic levels. This decrease in completed aircraft results in missed revenue opportunities for adhesive suppliers, as theoretical demand remains constrained by certification hurdles and supply chain bottlenecks.

Market Trends

The implementation of automated and robotic adhesive application systems is rapidly transforming the market as manufacturers aim to address labor shortages and improve bond consistency. While manual application can result in variable thickness and defects, robotic systems guarantee precise dispensing that adheres to the strict tolerance levels necessary for composite structures. This transition is being accelerated by the industry's requirement to boost throughput without a proportional increase in workforce, leading to significant capital expenditure on advanced manufacturing technologies. According to the Association for Manufacturing Technology's February 2025 report, 'U.S. Manufacturing Technology Orders,' machinery orders from the aerospace sector surged by nearly 32 percent in 2024 compared to the prior year, signaling an aggressive integration of automated solutions.At the same time, there is a growing demand for customized adhesive solutions designed specifically for business jet interiors, where aesthetic perfection and material compatibility are essential. Unlike commercial cabins, private aviation interiors often incorporate exotic materials like rare veneers and premium leathers, which demand specialized bonding agents that prevent bleed-through and protect delicate surfaces. This niche segment is growing as high-net-worth individuals seek bespoke cabin configurations, requiring a broader range of low-volume, high-performance formulations. As noted in the General Aviation Manufacturers Association's '2024 General Aviation Shipments and Billings' report from March 2025, global business jet deliveries reached 764 units in 2024, a 4.6 percent increase over the previous year, directly driving the need for these specialized finishing products.

Key Players Profiled in the Aerospace Interior Adhesives Market

- 3M Company

- Akzo Nobel N.V.

- Solvay S.A.

- Arkema Group

- Henkel Adhesives Technologies India Private Limited

- Huntsman International LLC.

- AVERY DENNISON CORPORATION.

- Hexcel Corporation

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- PPG Industries, Inc.

Report Scope

In this report, the Global Aerospace Interior Adhesives Market has been segmented into the following categories:Aerospace Interior Adhesives Market, by Technology:

- Waterborne

- Solvent Borne

- Reactive

Aerospace Interior Adhesives Market, by Resin Type:

- Epoxy

- Polyurethane

- Silicone

- Others

Aerospace Interior Adhesives Market, by Function:

- Structural

- Non-Structural

Aerospace Interior Adhesives Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aerospace Interior Adhesives Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Aerospace Interior Adhesives market report include:- 3M Company

- Akzo Nobel N.V.

- Solvay S.A.

- Arkema Group

- Henkel Adhesives Technologies India Private Limited

- Huntsman International LLC.

- AVERY DENNISON CORPORATION.

- Hexcel Corporation

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- PPG Industries, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

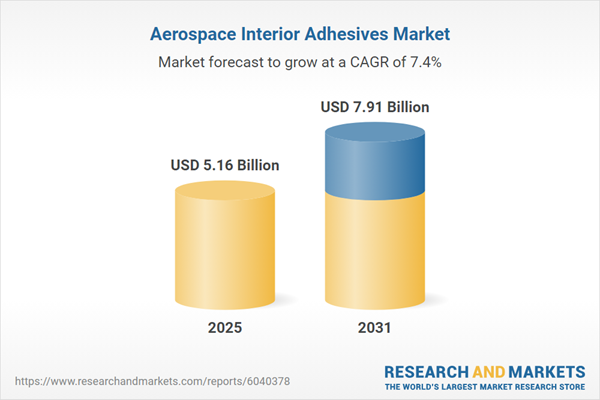

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.16 Billion |

| Forecasted Market Value ( USD | $ 7.91 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |