Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the substantial costs associated with installation and continuous maintenance pose a major obstacle to market growth. This financial burden often discourages the adoption of arresting systems at smaller airports where budget constraints are tight. Consequently, facilities with limited funding may delay or forego these safety enhancements, despite their critical role in operational safety.

Market Drivers

Rising global defense budgets and military modernization initiatives serve as the primary catalyst for the aircraft arresting system market. As geopolitical tensions escalate, nations are aggressively upgrading airbases to accommodate heavier, faster fourth and fifth-generation combat aircraft. This modernization necessitates the installation of advanced energy-absorbing systems capable of managing higher engagement speeds and protecting high-value assets during emergency recovery operations. According to the Stockholm International Peace Research Institute, April 2024, in the 'Trends in World Military Expenditure, 2023' Fact Sheet, global military spending grew by 6.8 percent in real terms to reach $2.44 trillion in 2023, providing the fiscal support necessary for procuring essential fixed and mobile arresting gear.The mandatory implementation of strict runway safety area standards further propels market demand, particularly within the civil aviation sector. Regulatory bodies increasingly enforce the installation of Engineered Materials Arresting Systems (EMAS) to prevent catastrophic overruns at land-constrained airports. According to Allianz Commercial, July 2024, in the 'Aviation Risk, Claims and Insurance Outlook' report, collision and crash incidents - including runway excursions - accounted for 63 percent of the value of all aviation insurance claims over the past five years, driving operators to invest in passive deceleration technologies. Furthermore, Boeing's 'Commercial Market Outlook 2024', released in July 2024, projects a need for nearly 44,000 new airplanes through 2043, creating sustained demand for upgraded safety mechanisms globally.

Market Challenges

The significant expenses linked to installing and maintaining aircraft arresting systems represent a major hurdle to market progression. These mechanical assemblies and engineered materials require substantial upfront capital for site preparation, specialized construction, and raw materials. Furthermore, facility operators face long-term financial commitments for rigorous routine inspections, weather-dependent repairs, and component replacements to maintain safety compliance. For regional and smaller airports with limited budgets, these accumulated costs often force the deferral of arresting system projects in favor of more immediate operational infrastructure requirements.Rising general airport infrastructure development costs further compound this financial strain, reducing the budget available for specialized safety upgrades. As capital expenses increase, operators find it increasingly difficult to fund safety enhancements that do not generate revenue. According to Airports Council International (ACI) World in 2024, global airport capital costs rose by 4 percent to $40 billion in the previous fiscal year, while revenues failed to return to pre-pandemic levels. This economic gap limits the financial agility of operators, impeding their ability to allocate funds for the procurement and maintenance of these deceleration systems, which directly slows market expansion.

Market Trends

The sector is being reshaped by the deployment of mobile arresting systems designed for expeditionary operations, aligning with a shift in defense strategies toward dispersed combat aviation. To support concepts like Agile Combat Employment, military forces are prioritizing portable, rapidly deployable recovery mechanisms that operate effectively on austere or damaged runways lacking fixed infrastructure. This capability supports force survivability and operational continuity by enabling tactical aircraft to land in unpredictable environments. According to SAM.gov, September 2025, in the 'Award Notice FA8534-25-D-0014', Hydraulics International Inc. was awarded a contract valued at approximately $245.9 million to supply Mobile Aircraft Arresting Systems (MAAS) specifically designed to meet these critical expeditionary recovery requirements.Concurrently, naval aviation is undergoing a fundamental technological transition from legacy hydraulic units to electromagnetic aircraft arresting gear. Unlike traditional mechanical systems, these digital architectures employ software-controlled energy absorbers to deliver precise deceleration for a wide variety of airframes, ranging from lightweight unmanned aerial vehicles to heavy strike fighters, while significantly reducing lifecycle maintenance requirements. This shift toward electrification resolves the limitations hydraulic gears face in managing the varying weights and speeds of mixed carrier air wings. According to the U.S. Department of Defense, December 2025, in the 'Contracts For Dec. 22, 2025' release, General Atomics received a $149.9 million contract to provide engineering and logistics support for the electromagnetic Advanced Arresting Gear and launch systems on Ford-class carriers.

Key Players Profiled in the Aircraft Arresting System Market

- General Atomics

- Runway Safe Group AB

- Scandinavian Manufacturing SCAMA AB

- The Boeing Company

- Safran SA

- The QinetiQ Group

- Curtiss-Wright Corporation

- Sojitz Aerospace Corporation

- Honeywell International Inc.

- MacTaggart, Scott and Company Limited

Report Scope

In this report, the Global Aircraft Arresting System Market has been segmented into the following categories:Aircraft Arresting System Market, by Type:

- Mobile Aircraft Arresting System (MAAS)

- Net Barrier

- Cable

- Aircraft Carrier Arresting System

- Engineered Material Arresting System (EMAS)

Aircraft Arresting System Market, by Platform Type:

- Ship-based

- Ground-based

Aircraft Arresting System Market, by System Type:

- Portable System

- Fixed System

Aircraft Arresting System Market, by End Use Type:

- Commercial Aircraft

- Aircraft Carrier

- Military Airbase

Aircraft Arresting System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aircraft Arresting System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Aircraft Arresting System market report include:- General Atomics

- Runway Safe Group AB

- Scandinavian Manufacturing SCAMA AB

- The Boeing Company

- Safran SA

- The QinetiQ Group

- Curtiss-Wright Corporation

- Sojitz Aerospace Corporation

- Honeywell International Inc.

- MacTaggart, Scott and Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

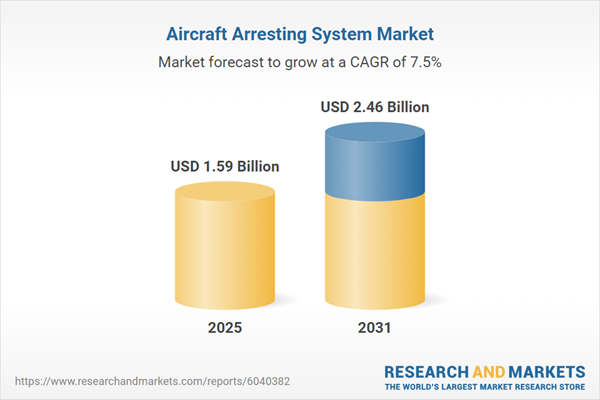

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.59 Billion |

| Forecasted Market Value ( USD | $ 2.46 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |