Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces significant headwinds due to the widespread adoption of electronic throttle control systems, known as drive-by-wire. This technology substitutes physical cabling with sensors and actuators to enhance precision and support advanced driver-assistance systems. The transition is accelerated by the rapid electrification of the automotive sector, as electric vehicles inherently rely on electronic management rather than mechanical throttle cables. Consequently, as the industry progressively moves toward electrification and digital control, the addressable market for traditional mechanical throttle components is becoming increasingly constrained.

Market Drivers

The expansion of the global two-wheeler manufacturing sector serves as a crucial catalyst for the throttle cables market, as motorcycles and scooters largely favor mechanical linkages over electronic alternatives to ensure affordability and ease of repair. Unlike the passenger car segment, which is swiftly adopting drive-by-wire technologies, the two-wheeler industry - especially in emerging markets - depends on physical cables for clutch and throttle functions to maintain low production costs. This reliance guarantees substantial demand for traditional components. For example, the Society of Indian Automobile Manufacturers (SIAM) reported in April 2024 that domestic two-wheeler sales in India hit approximately 17.97 million units for the 2023-24 fiscal year, highlighting the immense volume of components needed by this major manufacturing hub.Simultaneously, the market is significantly bolstered by the increasing volume of the global aging vehicle fleet, which requires regular maintenance and replacement of degrading mechanical parts. As vehicle owners keep their cars for longer durations, the incidence of cable stretching, fraying, or snapping rises, thereby fueling revenue growth in the aftermarket. In September 2024, the European Automobile Manufacturers’ Association (ACEA) noted that the average age of passenger cars in the European Union increased to 12.3 years, indicating a persistent trend of vehicle retention. This longevity supports a thriving service market; as evidence, the Auto Care Association stated in June 2024 that the United States light-duty automotive aftermarket was valued at $392 billion in 2023, demonstrating the vast economic scale of replacement part demand.

Market Challenges

The shift toward electronic throttle control systems poses a major limitation to the growth of the mechanical cable sector. Automakers are increasingly substituting physical linkages with sensor-based drive-by-wire technologies to enable seamless integration with modern driver-assistance features. This technological evolution removes the necessity for mechanical cables in an expanding array of vehicle platforms, thereby reducing the volume of components needed for each unit produced. As a result, the total addressable market for traditional throttle cables is shrinking as manufacturers favor electronic interfaces over their mechanical predecessors to achieve greater precision and weight reduction.This constraint is further exacerbated by the rapid growth of the electric vehicle market, which inherently relies on electronic management systems. Because electric powertrains do not utilize mechanical air intake regulation, the demand for throttle cables is inversely related to electrification rates. The International Energy Agency reported that global electric car sales reached nearly 14 million units in 2023. As automotive production increasingly pivots toward these electrically controlled architectures, suppliers of mechanical throttle cables are confronting a structural decline in demand from original equipment manufacturers, particularly within the passenger vehicle segment.

Market Trends

The rise of direct-to-consumer online aftermarket sales is transforming distribution strategies, with vehicle owners increasingly bypassing traditional brick-and-mortar service centers to buy replacement throttle cables via digital platforms. This transition forces manufacturers to refine their supply chains for individual unit fulfillment and emphasize the accuracy of digital catalogs to guarantee correct fitment for do-it-yourself installations. Accordingly, providing high-resolution imagery and comprehensive technical specifications has become essential for suppliers seeking to engage the expanding self-repair demographic. In its '2024 Joint E-commerce Trends and Outlook Forecast' published in November 2024, the Auto Care Association projects that total e-commerce sales for automotive parts and accessories will realize a 6.7% annualized growth rate from 2020 to 2027, underscoring the ongoing shift of revenue to online marketplaces.In parallel, the surge in custom-fabricated assemblies for vehicle modification is fueling demand for specialized throttle cables tailored to non-standard engine setups. Enthusiasts performing engine swaps or fitting aftermarket intake manifolds frequently require cables with specific lengths, braided stainless steel housings, and distinct end fittings that standard OEM replacements cannot offer. This trend highlights the importance of niche fabricators who provide bespoke mechanical solutions to meet the specific aesthetic and performance desires of the tuning community. As reported by the Specialty Equipment Market Association (SEMA) in their June 2024 '2024 SEMA Market Report', sales in the automotive specialty-equipment market reached $52.3 billion in 2023, highlighting the significant economic magnitude of the modification sector driving the need for these customized components.

Key Players Profiled in the Automotive Throttle Cables Market

- Robert Bosch GmbH

- Dorman Products, Inc.

- PHINIA Inc.

- Continental AG

- ZF Friedrichshafen AG

- Aptiv PLC

- Mahle GmbH

- Tata AutoComp System

- Silco Automotive Solutions LLP

- Motion Pro, Inc.

Report Scope

In this report, the Global Automotive Throttle Cables Market has been segmented into the following categories:Automotive Throttle Cables Market, by Type:

- Single Core

- Multi-Core

Automotive Throttle Cables Market, by Vehicle Type:

- Passenger cars

- Commercial Vehicle

Automotive Throttle Cables Market, by Sales Channel Type:

- OEM

- Aftermarket

Automotive Throttle Cables Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Throttle Cables Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Throttle Cables market report include:- Robert Bosch GmbH

- Dorman Products, Inc.

- PHINIA Inc.

- Continental AG

- ZF Friedrichshafen AG

- Aptiv PLC

- Mahle GmbH

- Tata AutoComp System

- Silco Automotive Solutions LLP

- Motion Pro, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

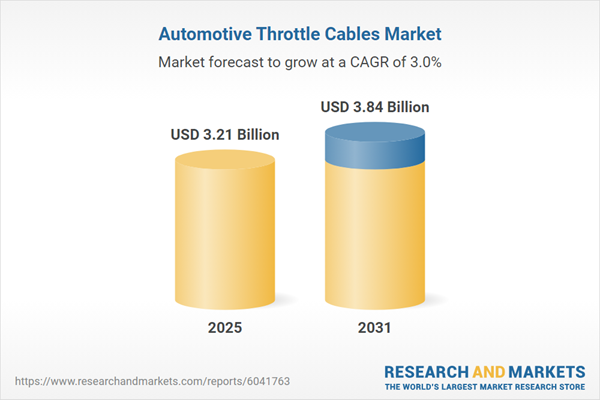

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.21 Billion |

| Forecasted Market Value ( USD | $ 3.84 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |