Increasing Need for Environment-Friendly Electronic Components Fuels South & Central America SMT Equipment Market

One of the most significant environmental initiatives in SMT assembly is the transition to lead-free soldering. Traditional solder alloys containing lead pose significant health and environmental risks due to their toxicity. To mitigate these risks, the electronics industry has widely adopted lead-free solder alloys, such as tin-silver-copper (SAC) and tin-copper (SnCu), which are more environmentally friendly and comply with various global regulations. There are various government laws and regulations regarding restricting the use of certain hazardous substances in electrical and electronic equipment.SMT assembly processes, particularly reflow soldering, can be energy-intensive. However, advancements in equipment design and process optimization have led to more energy-efficient SMT assembly lines. Modern reflow ovens and other machinery are designed to minimize energy consumption while maintaining precise process control, reducing the overall environmental footprint of SMT manufacturing. SMT equipment can progress in addressing environmental concerns.

Efforts can be taken to improve sustainability practices further. This includes exploring more eco-friendly materials, implementing closed-loop recycling systems, and adopting renewable energy sources to power SMT assembly lines. Thus, the growing need for environmentally friendly electronic components is expected to create an opportunity for the growth of the South & Central America SMT equipment market.

South & Central America SMT Equipment Market Overview

The South & Central America SMT equipment market is segmented into Brazil, Argentina, and the Rest of South & Central America. The electronics industry in SAM is still developing, and it faces several barriers, such as low levels of innovation, limited access to financing, and dependence on imports. Governments across the region are taking initiatives in the development of the semiconductor chip industry; for example, in February 2024, Brazil's Ministry of Science, Technology and Innovation allocated US$ 20 million in nonrefundable subsidies to local chip firms as part of its Mais Inovação program. The Semiconductors Scheme is intended to stimulate development projects in semiconductor design, production, and testing.It is part of a larger industrial stimulus program that includes 11 subsidy notifications for various industries totaling US$ 400 million. Moreover, the region witnesses the manufacturing of various electronic products such as smartphones and smartwatches. For example, in February 2023, Chinese tech giant Xiaomi established a production base in Tierra del Fuego, Argentina. Xiaomi will produce smartphones in this country.

The establishment of electronic manufacturing facilities across the region creates the need for the growth of SMT equipment. The SMT equipment contributes to the fabrication of sleek and aesthetically pleasing electronic components. Thus, the growing electronic production in the region is propelling the growth of the South & Central America SMT equipment market.

South & Central America SMT Equipment Market Segmentation

The South & Central America SMT equipment market is categorized into component, equipment type, end user, and country.- Based on component, the South & Central America SMT equipment market is bifurcated into passive component and active component. The active component segment held a larger market share in 2023.

- In terms of equipment type, the South & Central America SMT equipment market is categorized into inspection equipment, placement equipment, soldering equipment, screen printing equipment, cleaning equipment, and others. The placement equipment segment held the largest market share in 2023.

- By end user, the South & Central America SMT equipment market is segmented into consumer electronics, telecommunication, aerospace and defense, automotive, industrial, and others . The consumer electronics segment held the largest market share in 2023.

- By country, the South & Central America SMT equipment market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America SMT equipment market share in 2023.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South & Central America SMT equipment market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the South & Central America SMT equipment market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth South & Central America market trends and outlook coupled with the factors driving the South & Central America SMT equipment market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the South & Central America SMT Equipment Market include:- FUJI CORPORATION

- Hitachi High-Tech Corp

- JUKI CORPORATION

- KLA Corp

- Mycronic

- Nordson Corp

- SAKI CORPORATION

- Viscom AG

- Yamaha Motor Co., Ltd,

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 101 |

| Published | November 2024 |

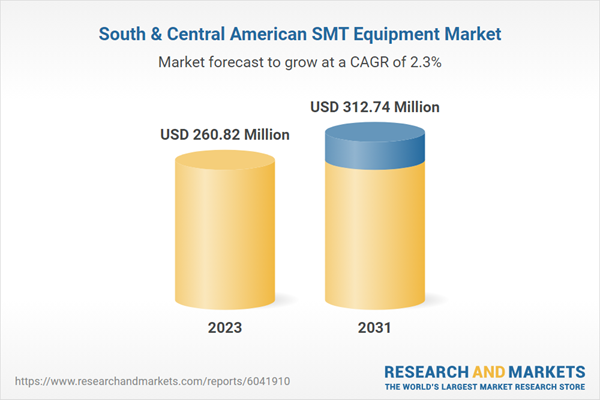

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 260.82 Million |

| Forecasted Market Value ( USD | $ 312.74 Million |

| Compound Annual Growth Rate | 2.3% |

| No. of Companies Mentioned | 10 |