Global Finance Lease Market - Key Trends & Drivers Summarized

What Defines the Finance Lease Market and Its Role in Modern Economies?

A finance lease, commonly referred to as a capital lease, has become an indispensable component of modern financial ecosystems by offering businesses an alternative to direct asset ownership. This leasing arrangement allows companies to access the use of high-value assets, such as equipment, machinery, or vehicles, without significant upfront capital investment. Instead of depleting cash reserves or taking on substantial loans, businesses can optimize their liquidity while maintaining operational efficiency. This model is particularly advantageous for industries reliant on expensive equipment or technology, where rapid innovation can render outright purchases less economically viable. Furthermore, finance leases provide lessees with potential tax advantages, as lease payments are often tax-deductible. These arrangements also facilitate more predictable financial planning, as costs are spread across the asset's lifespan in fixed installments. The market’ s growth has been buoyed by the increasing adoption of asset-light operational strategies, particularly among small and medium enterprises (SMEs), which leverage finance leasing to compete effectively with larger corporations. As global economies continue to evolve, the demand for flexible financial solutions that align with modern business needs has firmly established the finance lease market as a cornerstone of enterprise operations across diverse sectors.How Are Technological Advancements Reshaping Finance Leasing?

The finance lease market is undergoing a transformative shift as innovative technologies revolutionize its traditional mechanisms. Fintech innovations have streamlined leasing processes, making them faster, more efficient, and more user-centric. Platforms powered by artificial intelligence (AI) and machine learning (ML) now enable lenders to assess creditworthiness and asset viability with remarkable accuracy, significantly reducing approval times while mitigating risk. These advancements not only enhance customer experiences but also expand market accessibility for businesses previously excluded due to stringent credit requirements. Additionally, the digitization of lease management is simplifying the tracking and administration of assets. Integrated software solutions now allow lessors and lessees to monitor asset performance, track depreciation, and manage contract terms in real time, ensuring transparency and operational efficiency. Blockchain technology is also making inroads into finance leasing, offering secure, tamper-proof digital contracts that enhance trust and compliance. These technological innovations are fostering confidence in the leasing ecosystem, encouraging greater participation by small enterprises and global corporations alike. Moreover, as data analytics becomes increasingly integrated into leasing decisions, stakeholders can better align lease terms with market trends, asset demand, and long-term strategic goals, ensuring the sustained growth and evolution of the finance lease market.What Role Do Consumer Behavior and Economic Trends Play?

Shifting consumer preferences and global economic dynamics are profoundly influencing the trajectory of the finance lease market. Businesses today are prioritizing agility and scalability, gravitating toward financial models that offer operational flexibility without significant upfront costs. This has driven a surge in the adoption of leasing solutions over traditional purchasing, particularly in industries such as manufacturing, healthcare, and transportation, where the cost of capital assets can be prohibitively high. Furthermore, the increasing popularity of subscription-based models has shifted consumer behavior toward valuing access over ownership, a trend that aligns seamlessly with the core principles of finance leasing. Economic uncertainties, including fluctuating interest rates and unpredictable market conditions, have further incentivized businesses to pursue leasing arrangements as a risk-averse alternative to large-scale investments. Another critical factor shaping this market is the global push for sustainability. Companies are increasingly leasing energy-efficient and eco-friendly equipment, reducing their carbon footprints while avoiding the financial risks associated with technological obsolescence. Governments worldwide are also incentivizing sustainable practices, prompting businesses to transition to greener operations through leasing agreements. These interconnected consumer and economic trends are reshaping the leasing landscape, fostering a culture of financial prudence and environmental responsibility among businesses of all sizes.What Are the Key Growth Drivers Behind the Market’ s Expansion?

The growth in the finance lease market is driven by several interrelated factors that reflect the evolving needs of businesses and the opportunities presented by technological advancements. One of the most significant drivers is the rising adoption of leasing models in industries with high capital expenditure requirements, such as construction, aviation, logistics, and renewable energy. These sectors rely heavily on advanced equipment and infrastructure that often require substantial investment, making finance leasing an attractive option to optimize resources. Additionally, digital tools have democratized access to finance leasing, enabling small and medium enterprises (SMEs) to benefit from customized leasing solutions previously available only to larger corporations. Cross-border leasing is another critical growth avenue, fueled by increasing globalization and international trade. This trend allows businesses to access global resources and expand their operations without being constrained by regional financial limitations. Changing regulatory landscapes, such as the implementation of IFRS 16, have also played a pivotal role in driving the market. These regulations emphasize greater transparency in lease reporting, prompting businesses to adopt finance leases as a financially prudent and compliant strategy. Lastly, the growing integration of sustainability goals into corporate strategies has encouraged companies to lease eco-friendly assets, aligning financial efficiency with environmental stewardship. As these growth drivers converge, the finance lease market is expected to continue its robust expansion, underpinned by innovation, adaptability, and a deep understanding of evolving business needs.Report Scope

The report analyzes the Finance Lease market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Business Type (Domestic Business, International Business); Provider (Bank Providers, Non-Bank Providers); Application (IT & Telecom Application, Transportation Application, Construction Equipment Application, Industrial Machinery Application, Medical Devices Application, Energy & Environment Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Domestic Business segment, which is expected to reach US$229.5 Billion by 2030 with a CAGR of a 4.1%. The International Business segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $69.5 Billion in 2024, and China, forecasted to grow at an impressive 4.6% CAGR to reach $56.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Finance Lease Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Finance Lease Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Finance Lease Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ahlstrom-Munksjö, Alfa Laval AB, Andritz AG, Camfil AB, Clarcor Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Finance Lease market report include:

- ACCA

- Bajaj Finserv

- Commerce Bancshares, Inc.

- Funding Options Ltd.

- ORIX Auto Infrastructure Services Ltd.

- Poonawalla Fincorp Ltd.

- Reed Smith

- Sumitomo Mitsui Finance and Leasing Co., Ltd.

- Visual Lease

- Wells Fargo

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACCA

- Bajaj Finserv

- Commerce Bancshares, Inc.

- Funding Options Ltd.

- ORIX Auto Infrastructure Services Ltd.

- Poonawalla Fincorp Ltd.

- Reed Smith

- Sumitomo Mitsui Finance and Leasing Co., Ltd.

- Visual Lease

- Wells Fargo

Table Information

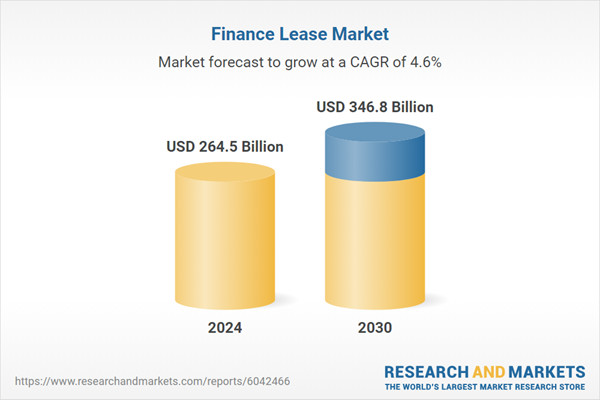

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 264.5 Billion |

| Forecasted Market Value ( USD | $ 346.8 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |