Global Electric Fuses Market - Key Trends & Drivers Summarized

What Are Electric Fuses and Why Are They Essential in Electrical Systems?

Electric fuses are protective devices used in electrical systems to prevent overcurrent and short circuits by breaking the circuit when current flow exceeds a safe level. Fuses contain a metal wire or strip that melts when excessive current flows through it, effectively interrupting the electrical path and protecting devices and users from damage and hazards such as fires and electric shocks. Available in various types, including cartridge, blade, and high-voltage fuses, they are essential across multiple sectors, including industrial, residential, automotive, and commercial applications. By safeguarding circuits, equipment, and even human lives, fuses play a critical role in maintaining the safety and reliability of electrical systems.Fuses are indispensable in various electrical and electronic systems because they ensure stability and resilience against unexpected electrical surges. In industrial settings, where machinery operates at high voltages, fuses protect sensitive equipment from power fluctuations and short circuits, minimizing the risk of costly downtime or damage. In residential and commercial buildings, fuses prevent electrical fires and safeguard home appliances, lighting, and other critical devices, contributing to occupant safety. Fuses also play a crucial role in automotive applications, where they protect vehicles' electrical systems and electronic components, ensuring reliable performance. Their broad usage across these domains highlights the essential nature of fuses in safeguarding electrical systems, making them a foundational component of electrical safety and reliability.

In addition to safety, electric fuses contribute to energy efficiency and cost savings by protecting equipment and preventing energy wastage. Modern fuses are designed to respond quickly to electrical faults, ensuring minimal energy loss during power surges. This efficiency is particularly important in industries with high energy consumption, where operational costs can escalate without proper protection. Furthermore, by preventing equipment damage, fuses reduce the need for frequent repairs and replacements, enhancing the longevity of electrical systems. This combination of protection, efficiency, and cost savings underscores the value of fuses in today's electrical systems, supporting both economic and operational objectives across diverse industries.

How Are Technological Advancements and Sustainability Trends Shaping the Electric Fuses Market?

Technological advancements in materials, design, and automation are transforming the electric fuses market, making them more efficient, reliable, and adaptable to modern electrical systems. New materials, such as advanced polymers and ceramic compounds, enhance the durability and performance of fuses, especially in high-temperature and high-voltage applications. These materials ensure that fuses can handle more intense electrical demands without degrading, supporting their use in environments with heavy machinery, industrial automation, and renewable energy systems. Additionally, developments in precision engineering have led to smaller, more compact fuses that provide the same level of protection while occupying less space, which is crucial for modern electronic devices and densely packed electrical panels.Smart and self-resetting fuses are emerging as innovations within the market, aligning with the growing demand for automated, intelligent safety solutions. Smart fuses incorporate sensors and real-time monitoring to detect overcurrent conditions before they cause equipment damage, offering an advanced level of protection. These fuses can communicate with central systems, allowing operators to monitor circuit health remotely and anticipate faults before they occur. Self-resetting fuses, often based on polymeric positive temperature coefficient (PPTC) technology, can reset themselves after the fault is cleared, eliminating the need for manual replacement and minimizing downtime. This type of fuse is particularly beneficial in applications requiring consistent power availability, such as telecommunications, computing, and automotive electronics.

Sustainability trends are also influencing the electric fuses market, as both manufacturers and consumers seek eco-friendly solutions that reduce material waste and improve energy efficiency. The transition toward renewable energy sources, such as wind and solar, has increased demand for fuses that can protect the unique configurations and high-voltage conditions of renewable power systems. Fuses designed for renewable applications are built to handle fluctuations in energy production, ensuring stable operation and enhancing the safety and longevity of renewable installations. Additionally, as the push for sustainable practices intensifies, manufacturers are developing recyclable fuses and eco-friendly production processes to minimize their environmental impact. These innovations align with global environmental goals, appealing to consumers and industries that prioritize sustainability in their operations. Together, technological advancements and sustainability trends are driving the evolution of electric fuses, supporting their adaptability to modern demands and environmental considerations.

Where Are Electric Fuses Making the Greatest Impact Across Industry Segments?

Electric fuses have a significant impact across various industry segments, including industrial manufacturing, automotive, energy, and electronics, each of which has specific protection and safety requirements. In industrial manufacturing, fuses are essential for safeguarding heavy-duty machinery, motors, transformers, and control systems that operate under high power loads. These fuses prevent equipment damage and production downtime by protecting against electrical faults, ensuring that operations can continue smoothly and safely. In sectors such as manufacturing, fuses with high breaking capacity are used to handle large currents, providing robust protection that meets the demands of intensive operations. Industrial automation and robotics also rely on specialized fuses to protect sensitive electronic components, enhancing system reliability and reducing maintenance needs.In the automotive industry, fuses play a crucial role in protecting a vehicle's electrical and electronic systems, from engine components and lighting to infotainment and safety features. Modern vehicles, including electric and hybrid cars, are equipped with a growing number of electronic systems, increasing the demand for reliable automotive fuses. These fuses protect against electrical surges and short circuits, which can compromise vehicle safety and performance. High-voltage fuses designed for electric vehicles (EVs) protect battery packs, power inverters, and charging systems, ensuring that these critical components operate safely. With the rise of electric mobility, the automotive segment's demand for advanced fuses that can handle high-voltage applications is expected to grow, underscoring fuses' importance in the future of transportation.

In the energy sector, fuses are essential for protecting the electrical infrastructure in power generation, transmission, and distribution. They are widely used in transformers, substations, and circuit breakers, where they provide protection against overcurrent conditions that can disrupt power supply or cause extensive damage. Renewable energy installations, such as wind farms and solar power plants, also require specialized fuses to manage the unique electrical demands of variable energy sources. Fuses used in these applications must be able to handle high voltage fluctuations and intermittent power, ensuring consistent performance and protecting expensive equipment. As the energy industry increasingly adopts renewable technologies, the demand for high-performance fuses tailored to these applications is growing, highlighting the role of fuses in supporting safe, sustainable energy production.

In the electronics segment, fuses are integral to protecting consumer devices, telecommunications infrastructure, and data centers. Small, compact fuses are used in a range of electronic devices, from smartphones and laptops to home appliances, safeguarding against electrical surges that could damage sensitive components. Telecommunications infrastructure, including base stations and data centers, relies on fuses to ensure uninterrupted service and protect expensive equipment from power surges. Data centers, which house vast amounts of digital information, require reliable power protection to prevent data loss and equipment failure. In this sector, fuses contribute to maintaining uptime and data integrity, reinforcing their critical role in protecting electronics and ensuring service continuity.

What Are the Key Drivers Fueling Growth in the Electric Fuses Market?

The growth in the electric fuses market is driven by several key factors, including the expansion of renewable energy infrastructure, the rising adoption of electric vehicles (EVs), and increasing investment in industrial automation. The global push toward renewable energy, including wind, solar, and hydropower, is a primary driver, as these installations require robust protective components to handle the unique electrical characteristics of renewable energy sources. High-performance fuses capable of managing variable power inputs are essential for protecting the integrity and safety of renewable energy systems. As countries invest in renewable infrastructure to meet climate goals and energy needs, the demand for specialized fuses in this sector is expected to grow significantly, supporting the transition to sustainable energy.The rising adoption of electric vehicles is another significant driver of the electric fuses market, as EVs contain complex electrical systems that require reliable protection. EV components such as battery packs, power inverters, and charging equipment are highly sensitive to power fluctuations and short circuits, necessitating the use of specialized high-voltage fuses. As the EV market expands, driven by government incentives, environmental regulations, and consumer demand, the need for fuses that ensure the safe and efficient operation of these vehicles is increasing. In addition to EVs, the growth of charging infrastructure also demands advanced fuses to protect high-capacity chargers, further boosting the market for automotive and high-voltage fuses.

Increasing investment in industrial automation and smart manufacturing is further fueling growth in the electric fuses market. Industries such as automotive, pharmaceuticals, electronics, and logistics are adopting automation to enhance productivity, quality, and efficiency. Automated machinery and robotic systems require dependable circuit protection to avoid costly downtime and equipment damage. Smart factories, which integrate connected devices and data-driven processes, depend on reliable power management solutions that include intelligent fuse systems. These systems allow manufacturers to monitor fuse performance in real time, anticipate potential failures, and conduct predictive maintenance, improving operational efficiency. As industrial automation continues to advance, the demand for fuses that support high-efficiency, high-performance manufacturing environments will increase, driving growth in the market.

Together, these drivers - expansion of renewable energy, growth in electric vehicles, and investment in automation - are propelling the electric fuses market, positioning fuses as indispensable components in modern energy, transportation, and industrial infrastructure. As industries evolve and prioritize safety, efficiency, and sustainability, the importance of electric fuses in protecting and optimizing electrical systems will only continue to grow.

Report Scope

The report analyzes the Electric Fuses market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Voltage (High Voltage, Medium Voltage, Low Voltage); End-Use (Residential End-Use, Commercial End-Use, Industrial End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the High Voltage Fuses segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 3.9%. The Medium Voltage Fuses segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 7% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Fuses Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Fuses Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Fuses Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bel Fuse, Inc., Conquer Electronics Co., Ltd., D & F Liquidators Inc., Demesne Electrical Sales Ltd., DENCO Fuses, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Electric Fuses market report include:

- Bel Fuse, Inc.

- Conquer Electronics Co., Ltd.

- D & F Liquidators Inc.

- Demesne Electrical Sales Ltd.

- DENCO Fuses, Inc.

- Eaton Corporation Plc

- Fuji Electric Co., Ltd.

- Legrand Group

- Littelfuse, Inc.

- MERSEN India

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bel Fuse, Inc.

- Conquer Electronics Co., Ltd.

- D & F Liquidators Inc.

- Demesne Electrical Sales Ltd.

- DENCO Fuses, Inc.

- Eaton Corporation Plc

- Fuji Electric Co., Ltd.

- Legrand Group

- Littelfuse, Inc.

- MERSEN India

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

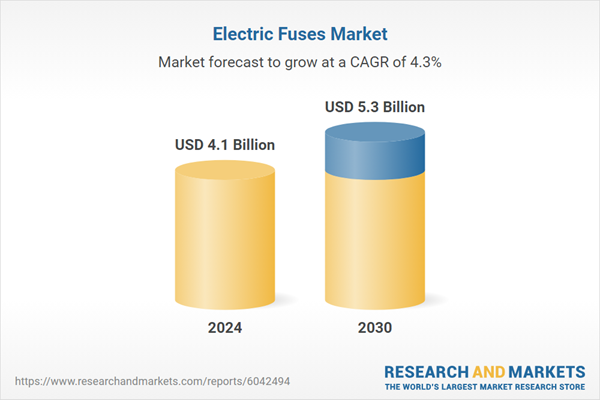

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 5.3 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |