Global E-Commerce Footwear Market - Key Trends & Drivers Summarized

What Is Driving the Growth of E-Commerce in Footwear Sales?

The footwear market has seen a significant shift towards e-commerce in recent years, fueled by several key factors. First and foremost, the convenience of online shopping is a major driver of this trend. Consumers now have the ability to browse a vast selection of shoes - from athletic wear to formal shoes, sandals, and boots - without stepping foot in a physical store. Online platforms also allow consumers to compare prices across different brands and retailers, making it easier to find the best deals on their favorite footwear. This level of convenience, combined with faster delivery times and simplified return policies, has made online shopping the preferred choice for footwear purchases.Additionally, the rise of digital marketing, especially through social media platforms like Instagram, Facebook, and Pinterest, has played a pivotal role in driving the growth of e-commerce in the footwear industry. Social media has allowed brands to engage with consumers in a more direct and personalized manner, showcasing new collections, limited-edition releases, and influencer collaborations. Many footwear brands have adopted social commerce models, integrating e-commerce directly into their social media pages. As a result, footwear brands are able to tap into the growing trend of online discovery, reaching younger, more digitally connected consumers who are heavily influenced by trends on social media.

The COVID-19 pandemic further accelerated the trend toward e-commerce, as lockdowns and social distancing measures forced consumers to shop online. Many brick-and-mortar footwear retailers quickly adapted to the digital landscape, offering online ordering and curbside pickup services. Even as physical stores reopened, the convenience of e-commerce and the ease of having products delivered directly to their doorstep has continued to attract shoppers, making online footwear sales a permanent part of the retail landscape.

How Are Consumer Preferences and Changing Buying Behaviors Impacting the E-Commerce Footwear Market?

Consumer preferences are evolving, and these changes are having a direct impact on the e-commerce footwear market. A significant trend is the increasing demand for comfort and functionality in footwear. As more consumers prioritize health and wellness, there has been a surge in demand for performance footwear, such as running shoes, orthotic-friendly sandals, and sneakers designed for long periods of standing or walking. E-commerce platforms are responding to this demand by offering an extensive range of specialized footwear, and brands are increasingly investing in product development to meet the needs of health-conscious consumers.Additionally, the younger generation, particularly Millennials and Generation Z, is driving the demand for fashionable yet functional footwear. These consumers place a high value on both style and comfort, and they are turning to online platforms for footwear that blends the two seamlessly. Online shopping allows them to browse a wider variety of brands and styles, compare options, and even personalize their footwear, whether it’ s through custom designs or color choices. Brands that can cater to this demand for both fashion and comfort are thriving in the e-commerce space.

The rise of sustainability is another factor that is shaping consumer preferences. Many consumers, especially younger buyers, are becoming more conscious of the environmental impact of their purchases. As a result, they are actively seeking out eco-friendly and sustainable footwear options. E-commerce platforms are increasingly featuring brands that prioritize sustainability in their manufacturing processes, whether by using recycled materials, reducing waste, or ensuring ethical production methods. This shift toward sustainable consumer behavior is expected to continue influencing the growth of the e-commerce footwear market, as consumers demand more transparency about the environmental footprint of their purchases.

What Technological Innovations Are Driving the E-Commerce Footwear Experience?

The technological innovations in e-commerce are making it easier for consumers to find, try on, and purchase footwear online. One of the most notable advancements is the use of augmented reality (AR), which is revolutionizing the online footwear shopping experience. With AR, consumers can use their smartphones or computers to virtually try on shoes, enabling them to see how different styles, colors, or designs look on their feet. This technology helps mitigate one of the biggest challenges in online footwear shopping - the inability to physically try on products. Virtual try-ons increase consumer confidence in their purchases and reduce the likelihood of returns.In addition to AR, artificial intelligence (AI) is playing a critical role in enhancing the e-commerce footwear experience. AI algorithms are being used to offer personalized recommendations based on customer preferences, past purchases, and browsing behavior. This not only helps consumers discover new brands and products that align with their tastes but also allows for a more tailored shopping experience. Many footwear e-commerce sites now incorporate AI-powered chatbots that can assist shoppers in real-time, offering product suggestions or answering questions about sizing, materials, and shipping details. These innovations have made the online shopping process more efficient and user-friendly, further encouraging consumers to purchase footwear online.

Another significant technological trend is the integration of machine learning in inventory and supply chain management. By predicting consumer demand more accurately, e-commerce platforms can ensure that popular styles and sizes are always in stock, improving customer satisfaction and reducing out-of-stock situations. Additionally, technologies like 3D printing are gradually being adopted by footwear brands to create customized shoes or on-demand production models, enabling greater personalization and reducing excess inventory. These technologies are not only improving the efficiency of e-commerce platforms but also enhancing the overall footwear shopping experience.

What Are the Key Growth Drivers for E-Commerce Footwear?

The growth in the E-Commerce Footwear market is driven by multiple factors, ranging from changing consumer preferences to technological innovations. The convenience of online shopping is a primary driver, as consumers increasingly prefer the ability to browse a wide selection of footwear at their own pace and have products delivered directly to their doorstep. As the preference for online shopping becomes ingrained in consumer behavior, e-commerce will continue to capture a larger share of the footwear market.Another key growth driver is the increasing demand for comfort, sustainability, and customization. Footwear brands are responding to consumer preferences for comfortable, functional, and eco-friendly options, which are gaining traction among health-conscious and environmentally aware shoppers. E-commerce platforms are capitalizing on these trends by offering a broader range of products, from high-performance running shoes to sustainable materials and custom-designed footwear.

Technological advancements are also playing a crucial role in driving growth. Innovations like virtual try-ons, AI-powered recommendations, and machine learning for inventory management are enhancing the online footwear shopping experience, making it more personalized and efficient. These innovations not only boost consumer satisfaction but also reduce the barriers that have traditionally held back footwear purchases online, such as concerns about fit and returns.

Finally, the continued rise of social media and influencer marketing is propelling the visibility of footwear brands, driving traffic to e-commerce platforms. As social commerce becomes more prevalent, consumers are increasingly discovering and purchasing footwear through digital channels. This, combined with the growing emphasis on sustainability and customization, ensures that the e-commerce footwear market will continue to expand over the coming years.

Report Scope

The report analyzes the E-Commerce Footwear market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Footwear Type (Leather Footwear, Athletic Footwear, Athleisure Footwear, Other Footwear Types); End-Use (Men End-Use, Women End-Use, Children End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Leather Footwear segment, which is expected to reach US$131.1 Billion by 2030 with a CAGR of a 5.9%. The Athletic Footwear segment is also set to grow at 6.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $34.3 Billion in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach $29.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global E-Commerce Footwear Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global E-Commerce Footwear Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

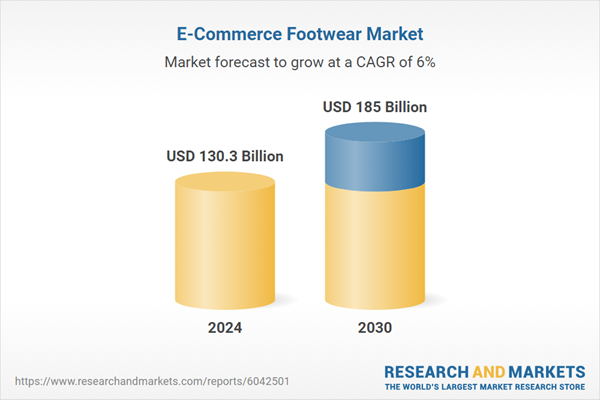

- How is the Global E-Commerce Footwear Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alibaba Group Holding Limited, Amazon.com, Inc., ASOS PLC, Ebay, Inc., H & M Hennes & Mauritz AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this E-Commerce Footwear market report include:

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- ASOS PLC

- Carter's, Inc.

- Ebay, Inc.

- Flipkart Internet Pvt Ltd

- Nordstrom

- Saks Fifth Avenue

- Walmart, Inc.

- Zalando

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- ASOS PLC

- Carter's, Inc.

- Ebay, Inc.

- Flipkart Internet Pvt Ltd

- Nordstrom

- Saks Fifth Avenue

- Walmart, Inc.

- Zalando

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 130.3 Billion |

| Forecasted Market Value ( USD | $ 185 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |