Global Bus Transmission Systems (BTS) Market - Key Trends & Drivers Summarized

What Are Bus Transmission Systems and Why Are They Integral to Public Transportation?

Bus Transmission Systems (BTS) are essential components that transfer power from a bus's engine to its wheels, allowing smooth and efficient operation in varied driving conditions. These systems are responsible for managing the vehicle's speed and torque, enabling buses to navigate urban environments, handle heavy passenger loads, and maintain fuel efficiency. BTS are available in various configurations, including manual, automatic, and semi-automatic systems, each catering to different operational needs. Manual transmissions are traditionally known for durability and cost-effectiveness, while automatic transmissions are favored for their ease of operation and reduced driver fatigue, especially in congested urban areas.In public transportation, reliability and efficiency are paramount, making transmission systems a critical focus for bus manufacturers and fleet operators. As cities expand and public transportation becomes more central to mobility solutions, buses equipped with advanced transmission systems offer a smoother and safer ride, enhancing the overall passenger experience. Additionally, modern transmission systems play a role in reducing fuel consumption and emissions, aligning with the increasing push for eco-friendly public transportation. Whether in urban transit buses, intercity coaches, or electric buses, high-performance transmission systems ensure consistent performance, reduced maintenance, and optimized fuel efficiency, making them an integral part of the bus industry.

How Are Technological Advancements Impacting the Bus Transmission Systems Market?

Technological advancements are revolutionizing Bus Transmission Systems, making them more efficient, durable, and environmentally friendly. One of the major trends in BTS is the shift towards automatic and semi-automatic transmissions, especially in buses operating in urban environments with frequent stops and starts. Automatic transmissions with advanced torque converters enable smoother acceleration and seamless gear shifts, which are crucial for reducing driver fatigue and improving passenger comfort. Additionally, electronically controlled transmission systems allow for precise and adaptive control, adjusting gear shifts based on load, road conditions, and driving patterns to maximize fuel efficiency and engine life.Hybrid and electric buses have further influenced BTS technology, as these buses require unique transmission configurations to manage electric motors and regenerative braking systems. Electric buses often utilize single-speed or multi-speed transmissions tailored to optimize battery life and power delivery. In hybrid buses, transmissions are designed to coordinate with both internal combustion engines and electric motors, balancing power and efficiency. The integration of regenerative braking systems in these transmissions helps capture and reuse energy, increasing the overall range and efficiency of hybrid and electric buses. With the global transition towards low-emission and zero-emission vehicles, BTS technology is evolving to accommodate these requirements, contributing to more sustainable public transportation systems.

Digital integration and predictive maintenance are also enhancing BTS technology. Many modern transmissions now feature sensor-equipped systems that continuously monitor transmission health, performance, and wear. Real-time data collected from these systems is transmitted to fleet operators, enabling predictive maintenance and reducing unexpected breakdowns. Advanced diagnostics can alert operators to issues such as overheating, wear, or fluid leaks, allowing proactive maintenance that reduces costs and downtime. This trend towards smart, connected BTS aligns with the broader digital transformation in transportation, where data-driven insights help optimize operations and improve fleet reliability. Together, these technological advancements are pushing the boundaries of BTS capabilities, making buses more efficient, comfortable, and adaptable to the needs of modern public transportation.

What Factors Are Driving Demand for Bus Transmission Systems?

The demand for Bus Transmission Systems is driven by the expansion of urban public transportation, increasing focus on driver comfort, and rising environmental awareness. As cities grow and urban populations rise, public transportation networks are expanding to meet the mobility needs of residents. This urbanization trend has led to an increase in bus fleets worldwide, especially in rapidly growing regions such as Asia-Pacific and Latin America. Urban buses typically operate under demanding conditions, with frequent stops, high passenger loads, and heavy traffic, creating a need for transmission systems that are reliable, efficient, and capable of handling these requirements. Automatic and semi-automatic transmissions have become particularly popular in urban fleets due to their ease of use, making them essential for ensuring smooth operations in busy cities.Driver comfort is another significant factor influencing demand for modern BTS, as public transportation operators prioritize reducing driver fatigue and enhancing job satisfaction. Automatic transmissions are increasingly favored for city buses as they eliminate the need for frequent gear shifting in stop-and-go traffic, providing a more comfortable experience for drivers. Improved driver comfort translates to increased safety and productivity, as drivers can focus on the road without the distraction of manual gear changes. This trend aligns with the industry's focus on driver-centric design, recognizing that ergonomic and user-friendly transmission systems play a crucial role in attracting and retaining drivers in the transportation sector.

Environmental concerns and emissions regulations are also key drivers for the BTS market, particularly in regions with stringent pollution controls. Governments around the world are implementing policies to reduce emissions, pushing public transportation operators to invest in fuel-efficient and low-emission buses. Transmission systems play a significant role in achieving these goals by optimizing fuel use, reducing energy loss, and supporting eco-friendly bus designs. The adoption of hybrid and electric buses, which often require specialized transmissions, has further boosted demand for advanced BTS that cater to alternative energy sources. As environmental regulations become more rigorous, the need for efficient and adaptable transmission systems in buses continues to grow, encouraging manufacturers to innovate and develop BTS solutions that support sustainable urban mobility.

What Factors Are Driving Growth in the Bus Transmission Systems Market?

The growth in the Bus Transmission Systems market is driven by technological innovations, regulatory compliance, urbanization trends, and the shift towards electric and hybrid buses. Innovations in transmission technology, such as the adoption of automated transmissions and the development of hybrid-specific transmissions, have enhanced the performance and adaptability of BTS. Automatic transmissions with advanced control systems and smart diagnostics have become increasingly popular as they allow for better fuel efficiency, lower emissions, and easier handling in urban areas. This trend towards advanced transmission technology has expanded the market's reach, as both new buses and older fleets can benefit from transmission upgrades that improve performance and reduce environmental impact.Compliance with emissions and fuel efficiency regulations is also a strong growth driver for the BTS market. Many countries, particularly in Europe and North America, are imposing stringent emissions standards that require bus operators to adopt cleaner technologies. Transmission systems optimized for fuel efficiency and low emissions are essential to meet these regulatory requirements, as they reduce the environmental impact of large bus fleets. Additionally, government incentives for adopting low-emission vehicles have led to increased investment in hybrid and electric buses, further driving demand for specialized transmission systems that support alternative fuel sources. As regulatory standards continue to evolve, the demand for compliant, eco-friendly transmission systems is expected to remain robust.

Finally, the transition to electric and hybrid buses has opened new growth opportunities for BTS. Electric buses require innovative transmission solutions that maximize battery efficiency and optimize power delivery, especially in hilly or high-load scenarios. For hybrid buses, transmissions must balance the use of both the internal combustion engine and electric motor, ensuring seamless transitions between the two power sources. This shift towards electric and hybrid vehicles is reshaping the transmission market, as manufacturers focus on developing systems that support sustainable public transportation. Together, these factors - technological advancements, regulatory compliance, urban expansion, and the adoption of electric buses - are driving growth in the Bus Transmission Systems market, supporting the evolution of modern, eco-friendly, and efficient public transportation networks.

Report Scope

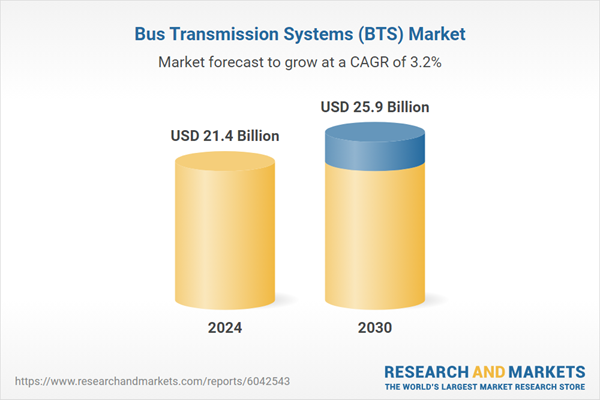

The report analyzes the Bus Transmission Systems (BTS) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: System Type (Automatic Systems, Manual Systems); Wheel Drive Type (Front Wheel Drive, Rear Wheel Drive).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $5.8 Billion in 2024, and China, forecasted to grow at an impressive 6.3% CAGR to reach $5.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bus Transmission Systems (BTS) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bus Transmission Systems (BTS) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bus Transmission Systems (BTS) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aartech Solonics Ltd., Aisin Corporation, Allison Transmission, Inc., BorgWarner, Inc., Bosch Rexroth AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 45 companies featured in this Bus Transmission Systems (BTS) market report include:

- Aartech Solonics Ltd.

- Aisin Corporation

- Allison Transmission, Inc.

- BorgWarner, Inc.

- Bosch Rexroth AG

- Dynamic Manufacturing

- Eaton Corporation Plc

- JATCO Ltd.

- Magna International, Inc.

- Man Truck & Bus SE

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aartech Solonics Ltd.

- Aisin Corporation

- Allison Transmission, Inc.

- BorgWarner, Inc.

- Bosch Rexroth AG

- Dynamic Manufacturing

- Eaton Corporation Plc

- JATCO Ltd.

- Magna International, Inc.

- Man Truck & Bus SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.4 Billion |

| Forecasted Market Value ( USD | $ 25.9 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |