Global Blockchain in Power Market - Key Trends & Drivers Summarized

How Is Blockchain Revolutionizing Energy Management in the Power Sector?

Blockchain technology is enabling unprecedented transparency and efficiency in the power sector by decentralizing energy management. Its immutable ledger system ensures secure data exchange and real-time tracking, crucial for managing decentralized energy resources. One of the most transformative applications is peer-to-peer (P2P) energy trading, which eliminates the need for intermediaries by directly connecting energy producers and consumers. This is creating a more flexible energy market where smaller players can participate equally, thereby democratizing the industry. Utilities are also using blockchain to improve grid management, ensuring seamless energy distribution while reducing losses caused by inefficiencies. These capabilities are driving blockchain’ s rapid adoption across the energy sector.Moreover, blockchain is playing a vital role in enhancing accountability and compliance in renewable energy certification. The technology provides tamper-proof records of green energy generation and consumption, ensuring transparency for both regulatory bodies and end consumers. This innovation is particularly important as global mandates for sustainability intensify. Blockchain’ s ability to integrate with other advanced technologies, such as artificial intelligence and IoT, further enhances its utility, allowing utilities to predict demand, optimize supply, and minimize downtime. In this way, blockchain is not just improving operational efficiency but also enabling the power sector to align with global sustainability goals.

Why Is Blockchain Becoming Central to Renewable Energy Integration?

The integration of renewable energy sources into traditional power grids poses unique challenges, including intermittency and scalability. Blockchain addresses these issues by facilitating seamless coordination across decentralized energy systems. For example, it can aggregate and distribute energy generated by solar panels or wind turbines across diverse locations, ensuring that supply meets demand efficiently. Blockchain’ s role in energy microgrids is especially notable, as it provides the framework for secure, automated energy transactions between producers and consumers. By eliminating manual processes and ensuring transparency, the technology helps stabilize renewable energy supply chains, making it a key enabler of the green energy transition.Additionally, blockchain supports the concept of virtual power plants (VPPs), where multiple distributed energy resources, including renewable installations and storage units, are aggregated and managed as a single entity. This enhances the ability to optimize energy distribution and respond to grid fluctuations. Blockchain also fosters innovation in renewable energy trading by enabling dynamic pricing and direct transactions, allowing producers to maximize revenue while offering consumers competitive rates. As nations worldwide prioritize renewable energy adoption, blockchain’ s capability to address integration challenges while fostering efficiency and collaboration will ensure its sustained importance.

How Are Evolving Consumer Expectations Shaping the Market?

Consumers are increasingly demanding transparency and sustainability in energy production and consumption, a shift that has accelerated the adoption of blockchain in the power sector. Through blockchain-enabled systems, consumers can trace the origin of their electricity to renewable sources, gaining confidence in their environmental impact. This capability is particularly appealing to eco-conscious consumers, who are willing to pay a premium for green energy. Additionally, the technology is reshaping the relationship between utilities and customers by enabling real-time tracking of energy usage. This transparency empowers consumers to monitor and adjust their consumption patterns, promoting energy efficiency and cost savings.The rise of prosumers - entities that both produce and consume energy - has further driven the need for blockchain-based energy trading platforms. These platforms allow prosumers to sell excess energy directly to other users, bypassing traditional utility companies. Blockchain’ s secure, automated system ensures that transactions are seamless and equitable, fostering greater participation in decentralized energy markets. Similarly, the growing adoption of IoT devices and smart home technologies has amplified the demand for blockchain’ s capabilities in secure energy data management. This shift in consumer expectations underscores the transformative potential of blockchain to reshape energy interactions in a rapidly evolving power landscape.

What Factors Are Driving the Rapid Growth of Blockchain in Power?

The growth in the blockchain in power market is driven by several interconnected factors, including technological advancements, regulatory pressures, and the growing demand for sustainable energy solutions. One of the key drivers is the rising complexity of managing distributed energy resources, which necessitates a secure and efficient platform like blockchain. The technology’ s ability to automate processes through smart contracts is reducing operational inefficiencies while enhancing cost-effectiveness. Furthermore, the proliferation of blockchain-based energy trading platforms is democratizing the energy market by enabling smaller producers to actively participate and monetize their surplus power.Government incentives and policies promoting digital transformation and renewable energy adoption are also significantly boosting the market. As more nations commit to achieving net-zero carbon emissions, blockchain is becoming an indispensable tool for tracking and verifying progress toward these goals. Additionally, the increasing focus on cybersecurity in energy systems has elevated the importance of blockchain, as it offers unparalleled protection against data breaches and fraud. These factors, combined with a growing emphasis on decentralization and decarbonization, are driving the rapid expansion of blockchain applications in the power sector, positioning it as a cornerstone of the industry’ s future.

Report Scope

The report analyzes the Blockchain in Power market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Public Blockchain, Private Blockchain); Application (Peer-to-Peer Transactions Application, Grid Transactions Application, Energy Financing Application, Electric Vehicle Charging Application, Sustainability Attribution Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Public Blockchain segment, which is expected to reach US$9.8 Billion by 2030 with a CAGR of a 40.2%. The Private Blockchain segment is also set to grow at 36.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $596.0 Million in 2024, and China, forecasted to grow at an impressive 36.6% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blockchain in Power Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blockchain in Power Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blockchain in Power Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accenture Plc, Alchemy Insights, Asynclabs, BLOCKCHAIN Power Corporation, ConsenSys Software Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Blockchain in Power market report include:

- BLOCKCHAIN Power Corporation

- ConsenSys Software Inc.

- Enel SpA

- ENGIE SA

- Iberdrola SA

- Power Ledger

- Shell Plc

- Siemens AG

- SILRES Energy Solutions Private Limited

- SunContract

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BLOCKCHAIN Power Corporation

- ConsenSys Software Inc.

- Enel SpA

- ENGIE SA

- Iberdrola SA

- Power Ledger

- Shell Plc

- Siemens AG

- SILRES Energy Solutions Private Limited

- SunContract

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

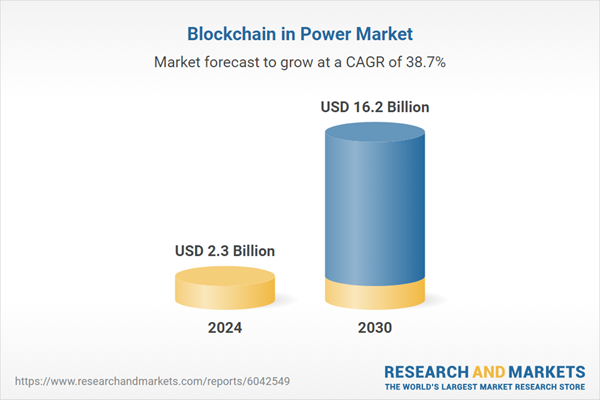

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 16.2 Billion |

| Compound Annual Growth Rate | 38.7% |

| Regions Covered | Global |