Global Automotive Oxygen Sensors Market - Key Trends and Drivers Summarized

What Are Automotive Oxygen Sensors, and Why Are They Crucial for Modern Engines?

Automotive oxygen sensors, often referred to as O2 sensors, are critical components in a vehicle's emissions control and engine management systems. Located in the exhaust system, these sensors monitor the concentration of oxygen in the exhaust gases to provide real-time feedback to the engine control unit (ECU). By analyzing the oxygen levels in exhaust gases, the ECU can adjust the air-to-fuel ratio in the combustion process, optimizing engine performance, fuel efficiency, and emissions output. The presence of too much oxygen, indicating a lean mixture, can lead to higher nitrogen oxide emissions and potential engine damage, while too little oxygen, indicating a rich mixture, causes higher levels of carbon monoxide and unburned hydrocarbons. Oxygen sensors enable precise control over this balance, ensuring that the engine operates at an optimal air-fuel mixture. Without accurate oxygen sensors, engines would produce excessive emissions, consume more fuel, and potentially suffer from performance issues, making these sensors essential for compliance with modern environmental standards and for achieving peak engine efficiency.How Do Oxygen Sensors Work, and What Types Are Commonly Used?

Oxygen sensors function by generating a voltage signal based on the oxygen content in the exhaust gases, which the ECU interprets to adjust fuel delivery. The most common types of oxygen sensors are zirconia and titania sensors, each with distinct characteristics and applications. Zirconia sensors are the most widely used and consist of a zirconium dioxide ceramic element coated with platinum electrodes, creating a sensor that generates a voltage based on the oxygen difference between exhaust gases and ambient air. As the exhaust oxygen level changes, the sensor's output voltage fluctuates, signaling the ECU to adjust the air-fuel ratio accordingly. Zirconia sensors are often referred to as “narrowband” sensors because they detect whether the mixture is lean or rich but do not measure precise oxygen levels. In contrast, “wideband” oxygen sensors, an advancement in zirconia technology, can measure the exact air-fuel ratio across a wider range, providing greater accuracy in modern vehicles that require precise fuel control. Titania oxygen sensors work on a different principle, changing their electrical resistance based on the oxygen content. Unlike zirconia sensors, which generate voltage, titania sensors vary resistance in response to oxygen levels, which the ECU then interprets. While titania sensors are less common than zirconia sensors, they offer quick response times and are often used in specific high-performance or high-temperature applications. Wideband sensors have become the industry standard in recent years, especially in vehicles with strict emission standards or advanced engine management systems, as they provide accurate readings across a broader spectrum, enabling the ECU to make fine-tuned adjustments to optimize performance and reduce emissions more effectively.What Role Do Oxygen Sensors Play in Emissions Control and Fuel Efficiency?

Oxygen sensors are indispensable in reducing vehicle emissions and improving fuel economy, two essential goals in modern automotive engineering. By continuously monitoring and regulating the air-fuel mixture, oxygen sensors help maintain combustion efficiency, minimizing the production of harmful pollutants like carbon monoxide (CO), hydrocarbons (HC), and nitrogen oxides (NOx). In vehicles equipped with catalytic converters, oxygen sensors play an even more critical role. Positioned both upstream (before) and downstream (after) the catalytic converter, these sensors ensure that the catalytic converter is working efficiently by monitoring oxygen levels at multiple points. The upstream sensor provides data on the exhaust gases exiting the engine, helping the ECU control the combustion process, while the downstream sensor monitors the gases leaving the catalytic converter to assess its performance. This dual-sensor configuration allows the ECU to detect when the catalytic converter needs maintenance or replacement, contributing to better emissions control. Moreover, oxygen sensors significantly impact fuel efficiency. A properly calibrated air-fuel mixture leads to complete combustion, which uses fuel more effectively and reduces waste. Vehicles with faulty or worn oxygen sensors can experience symptoms like increased fuel consumption, rough idling, or reduced power, as the ECU compensates for inaccurate data by delivering an excess or deficit of fuel. As vehicles age, oxygen sensors can wear down and become less responsive, gradually affecting fuel economy and emissions. Replacing old or failing oxygen sensors has been shown to improve fuel economy by as much as 15%, making these sensors not only a key component for emissions control but also an important factor in reducing fuel costs for drivers. In hybrid and electric vehicles that use a combustion engine component, oxygen sensors are also essential, helping manage the air-fuel ratio in a way that complements the efficiency of electric propulsion and maximizes overall fuel economy.What Are the Key Growth Drivers in the Automotive Oxygen Sensor Market?

The automotive oxygen sensor market is experiencing steady growth, driven by several trends and regulatory pressures aimed at reducing vehicle emissions and improving fuel efficiency. Increasingly stringent global emissions standards, such as the Euro 6 regulations in Europe and the Corporate Average Fuel Economy (CAFE) standards in the United States, are pushing automakers to adopt advanced engine management systems that rely heavily on accurate oxygen sensor data. As countries continue to implement and tighten emissions regulations, the demand for high-quality oxygen sensors has risen, as these sensors are essential for achieving compliance. Additionally, the shift toward hybrid and alternative-fuel vehicles is propelling market growth, as these vehicles require advanced oxygen sensors to manage their unique combustion processes effectively. Another significant factor driving growth in this market is the increasing focus on vehicle diagnostics and onboard monitoring systems. Modern vehicles are equipped with onboard diagnostic systems (OBD) that rely on oxygen sensors to monitor emissions performance in real-time, alerting drivers to any issues with the emissions system, such as a failing catalytic converter or a malfunctioning oxygen sensor. This trend towards real-time diagnostics is supported by the integration of more advanced wideband oxygen sensors, which provide the ECU with precise air-fuel ratio data, allowing for proactive maintenance and compliance with emissions standards. Additionally, the rise in vehicle longevity and the growing aftermarket demand for replacement parts are contributing to market expansion. As vehicle owners seek to maintain performance and meet emissions standards, the replacement of worn or outdated oxygen sensors has become a common and necessary part of vehicle maintenance, especially in regions with emissions testing requirements. Together, these factors underscore the importance of oxygen sensors in today's automotive industry and highlight the ongoing innovations in sensor technology aimed at meeting the demands of modern, efficient, and environmentally compliant vehicles.Report Scope

The report analyzes the Automotive Oxygen Sensors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Passenger Cars End-Use, Commercial Vehicles End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

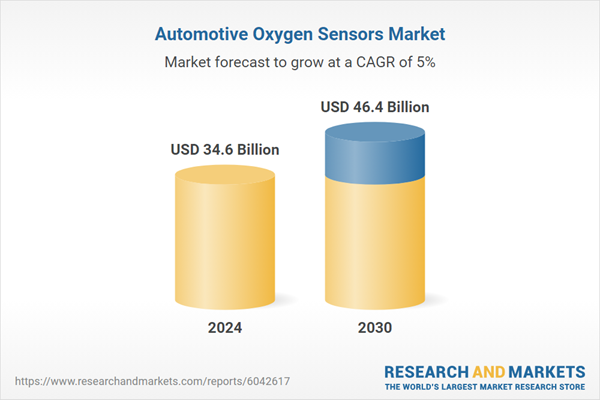

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach US$34.4 Billion by 2030 with a CAGR of a 5.2%. The Commercial Vehicles End-Use segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.2 Billion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $7.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Oxygen Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Oxygen Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Oxygen Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Applied Sensing Technologies, Inc., BBT Automotive Components GmbH, Bosch Auto Parts, Ceradex Corporation, Continental Aftermarket & Services GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Automotive Oxygen Sensors market report include:

- Applied Sensing Technologies, Inc.

- BBT Automotive Components GmbH

- Bosch Auto Parts

- Ceradex Corporation

- Continental Aftermarket & Services GmbH

- Cubic Sensor and Instrument Co.,Ltd

- DENSO Auto Parts

- Denso Corporation

- FACET, S.r.l.

- FAE-Francisco Albero SAU

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Applied Sensing Technologies, Inc.

- BBT Automotive Components GmbH

- Bosch Auto Parts

- Ceradex Corporation

- Continental Aftermarket & Services GmbH

- Cubic Sensor and Instrument Co.,Ltd

- DENSO Auto Parts

- Denso Corporation

- FACET, S.r.l.

- FAE-Francisco Albero SAU

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 127 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.6 Billion |

| Forecasted Market Value ( USD | $ 46.4 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |