Global Automotive Optoelectronics Market - Key Trends and Drivers Summarized

How Is Automotive Optoelectronics Transforming Vehicle Technology?

Automotive optoelectronics has become a vital technology in modern vehicle systems, significantly enhancing safety, communication, and energy efficiency. This field encompasses components like LED headlights, infrared sensors, laser diodes, and optical sensors that perform various functions, such as detecting obstacles, managing lighting systems, and facilitating communication between autonomous vehicles. The demand for optoelectronic devices has surged as automakers focus on integrating advanced driver-assistance systems (ADAS) and developing autonomous vehicles. Innovations in optoelectronic components have also paved the way for energy-efficient lighting solutions, which reduce energy consumption and improve vehicle aesthetics. With global emission standards becoming more stringent, optoelectronics is playing a key role in making vehicles lighter and more efficient, thus aligning with the automotive industry's sustainability goals.Which Segments Are Defining the Automotive Optoelectronics Market?

Key components include light-emitting diodes (LEDs), infrared emitters, laser diodes, photodiodes, and optocouplers. Among these, LEDs hold the largest market share, driven by their use in adaptive lighting systems, dashboard displays, and infotainment panels. Applications of optoelectronics in the automotive sector range from exterior lighting and driver assistance to in-vehicle communication systems. Passenger vehicles account for the majority of demand, but commercial vehicles are also increasingly adopting optoelectronics for enhanced safety and operational efficiency. Geographically, Asia-Pacific leads the market due to high vehicle production rates and rapid technological advancements, followed by North America and Europe, where stringent safety regulations are fueling the adoption of optoelectronic systems. Emerging markets in Latin America and the Middle East are also showing growth potential as automakers expand their footprint.What Trends Are Influencing the Future of Automotive Optoelectronics?

Several trends are shaping the future of automotive optoelectronics. The transition to electric and autonomous vehicles is perhaps the most transformative, requiring sophisticated optical sensors for navigation and environmental awareness. Lidar (light detection and ranging) technology, which uses laser diodes to create high-resolution maps of a vehicle's surroundings, is gaining traction in self-driving cars. The integration of advanced lighting systems, such as matrix LED and laser headlights, is another trend enhancing both vehicle safety and aesthetics. Moreover, the adoption of vehicle-to-everything (V2X) communication systems, which rely on optical sensors for data transmission, is poised to revolutionize how vehicles interact with each other and with infrastructure. The shift toward energy-efficient and eco-friendly technologies has also led to innovations in power-saving optoelectronic components, contributing to the overall sustainability of the automotive sector. Additionally, 3D sensing technologies are being explored for gesture recognition and interior monitoring, further expanding the scope of automotive optoelectronics.What Factors Are Driving the Growth in the Automotive Optoelectronics Market?

The growth in the automotive optoelectronics market is driven by several factors, including the increasing adoption of ADAS, advancements in autonomous vehicle technology, and stringent safety regulations. The demand for optoelectronic components has surged as automakers strive to improve vehicle safety and enable features like collision detection, adaptive cruise control, and night vision. The push toward electric vehicles (EVs) has also fueled the market, as optoelectronics are critical for efficient power management and advanced lighting systems. Technological advancements, such as the development of high-efficiency LEDs and sophisticated lidar sensors, have made optoelectronics more reliable and cost-effective. The rise of smart transportation and connected vehicle ecosystems has created additional opportunities for optoelectronic technologies, particularly in V2X communication. Finally, the growing emphasis on energy efficiency and emission reduction has compelled automakers to adopt lightweight and power-saving optoelectronic components, driving further innovation in this field.Report Scope

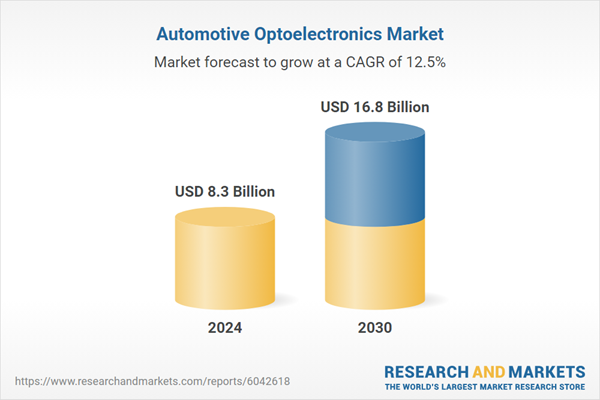

The report analyzes the Automotive Optoelectronics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); End-Use (Passenger Cars End-Use, Light Commercial Vehicles End-Use, Buses End-Use, Trucks End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OEM Distribution Channel segment, which is expected to reach US$11.5 Billion by 2030 with a CAGR of a 12.8%. The Aftermarket Distribution Channel segment is also set to grow at 11.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 16.9% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Optoelectronics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Optoelectronics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Optoelectronics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ams-OSRAM AG, Broadcom, Inc., Excellence Optoelectronics Inc., Grupo Antolin-Irausa SA, Isocom Components 2004 Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Automotive Optoelectronics market report include:

- ams-OSRAM AG

- Broadcom, Inc.

- Excellence Optoelectronics Inc.

- Grupo Antolin-Irausa SA

- Isocom Components 2004 Limited

- Jenoptik AG

- Lite-On Technology Corporation

- Ningbo Foryard Optoelectronics Co., Ltd.

- OSI Optoelectronics

- OSI Systems, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ams-OSRAM AG

- Broadcom, Inc.

- Excellence Optoelectronics Inc.

- Grupo Antolin-Irausa SA

- Isocom Components 2004 Limited

- Jenoptik AG

- Lite-On Technology Corporation

- Ningbo Foryard Optoelectronics Co., Ltd.

- OSI Optoelectronics

- OSI Systems, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 16.8 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Global |