Global Auto Electronics Market - Key Trends & Drivers Summarized

What Are Auto Electronics and Why Are They Essential for Modern Vehicles?

Auto electronics refer to electronic systems and components integrated within vehicles to enhance safety, performance, convenience, and connectivity. These electronics include advanced driver-assistance systems (ADAS), infotainment units, engine control modules, electronic braking systems, and sensors that monitor vehicle operations. Auto electronics are essential for modern vehicles, enabling functions like collision avoidance, adaptive cruise control, in-car entertainment, and efficient engine management. With the integration of these systems, vehicles have transformed into sophisticated, digitally connected machines that support safer, smarter, and more enjoyable driving experiences.The importance of auto electronics extends beyond enhancing convenience; they are foundational to vehicle safety and environmental performance. Advanced safety systems, powered by electronics, help prevent accidents and protect passengers by detecting potential hazards and assisting drivers in real-time. For instance, ADAS uses a network of cameras, radars, and sensors to monitor road conditions, alert drivers, and, in some cases, autonomously manage braking and steering. Additionally, auto electronics contribute to environmental sustainability by optimizing engine performance, reducing fuel consumption, and managing emissions. Electronic control units (ECUs) monitor and adjust engine operations, maximizing fuel efficiency and ensuring compliance with emission standards.

Auto electronics also play a critical role in the growing trend toward electric and autonomous vehicles. Electric vehicles (EVs) rely on electronic systems for battery management, regenerative braking, and charging control, making electronics crucial for EV performance and efficiency. Similarly, autonomous vehicles depend heavily on electronics for navigation, obstacle detection, and decision-making. As automotive technology advances, electronics have become indispensable for both traditional and next-generation vehicles, driving a fundamental shift in the automotive industry and establishing electronics as a core component of modern vehicle design.

How Are Technological Advancements and Consumer Demands Shaping the Auto Electronics Market?

Technological advancements in artificial intelligence, connectivity, and miniaturization are transforming the auto electronics market, enabling more powerful, efficient, and versatile electronic systems for vehicles. Artificial intelligence (AI) is playing a critical role in advancing autonomous driving and driver-assistance systems. AI algorithms process vast amounts of data from sensors and cameras, enabling vehicles to identify objects, predict driver behaviors, and make split-second decisions. This capability is essential for autonomous vehicles, as well as for ADAS features like lane-keeping, pedestrian detection, and automatic emergency braking. AI also enhances in-car voice recognition and personalized infotainment, creating more intuitive and user-friendly interfaces.Connectivity advancements, such as 5G, are enabling real-time vehicle-to-everything (V2X) communication, allowing vehicles to interact with each other, infrastructure, and pedestrians. This connectivity supports enhanced safety features, as vehicles can receive real-time traffic updates, detect nearby vehicles, and adapt driving strategies accordingly. V2X technology is crucial for autonomous and semi-autonomous driving, allowing vehicles to anticipate and respond to road conditions proactively. Additionally, connected vehicles offer cloud-based features, enabling remote diagnostics, software updates, and personalized driver settings. This level of connectivity aligns with the growing demand for “smart” vehicles and offers consumers a seamless driving experience that integrates with their digital lifestyles.

The trend toward miniaturization and increased energy efficiency in electronics is further shaping the market, as smaller, more efficient components allow automakers to integrate sophisticated features without adding significant weight or power consumption. Miniaturized sensors, lightweight ECUs, and energy-efficient processors are making auto electronics more compact and cost-effective, supporting the development of lightweight and fuel-efficient vehicles. These advancements are particularly relevant for electric vehicles, where battery efficiency and weight management are critical. Miniaturized electronics not only improve vehicle efficiency but also enable more streamlined and aesthetically pleasing interior designs by reducing the space occupied by hardware. Together, advancements in AI, connectivity, and miniaturization are driving the evolution of auto electronics, enabling cutting-edge features and transforming vehicle functionality to meet modern consumer demands.

Where Are Auto Electronics Making the Greatest Impact Across Vehicle Segments?

Auto electronics have a significant impact across various vehicle segments, including passenger cars, commercial vehicles, electric vehicles, and luxury vehicles, each benefiting from the integration of advanced electronic systems. In the passenger car segment, electronics are essential for enhancing safety, comfort, and entertainment, with features like ADAS, in-car infotainment, and climate control becoming standard. For safety, features like blind-spot detection, forward collision warning, and lane departure alerts help reduce accidents and improve driver confidence. Infotainment systems that integrate with smartphones and support voice commands offer a connected, personalized driving experience. As consumers increasingly seek safety and convenience, auto electronics have become integral to passenger car design, attracting drivers who prioritize technology and modern features.In commercial vehicles, auto electronics play a crucial role in fleet management, safety, and efficiency. Fleet operators rely on telematics systems to monitor vehicle location, fuel consumption, driver behavior, and maintenance needs, which are critical for optimizing logistics and reducing operational costs. Electronic systems also support advanced safety features like collision avoidance, lane-keeping assist, and driver fatigue monitoring, enhancing safety for both drivers and cargo. With the rise of e-commerce and last-mile delivery, commercial vehicles equipped with auto electronics help companies improve delivery speed, reduce downtime, and ensure regulatory compliance. In this segment, the integration of electronics translates directly into operational efficiencies, making it essential for modern fleet operations.

In the electric vehicle (EV) segment, auto electronics are central to vehicle functionality, powering everything from battery management systems to regenerative braking and power distribution. Electronics ensure that EVs achieve optimal energy efficiency, performance, and battery life, which are key to consumer adoption. Battery management systems (BMS) monitor and control battery health, charging, and temperature, maximizing range and battery longevity. Regenerative braking, a feature enabled by electronics, allows EVs to recover and store energy, improving efficiency. As the EV market expands, the demand for advanced auto electronics will continue to grow, supporting the unique needs of electric powertrains and enhancing the adoption of sustainable transportation.

In luxury vehicles, auto electronics enhance the driving experience with high-end infotainment systems, advanced ADAS, and comfort features. Luxury brands are at the forefront of electronic innovation, integrating premium features like adaptive cruise control, autonomous parking, heads-up displays, and customizable ambient lighting. These features not only enhance convenience but also emphasize luxury, comfort, and exclusivity. Many luxury vehicles offer personalized settings, where seat position, climate control, and infotainment preferences are automatically adjusted based on driver profiles. Electronics play a central role in defining the luxury vehicle experience, differentiating premium brands by offering state-of-the-art technology that aligns with consumer expectations for performance and sophistication.

What Are the Key Drivers Fueling Growth in the Auto Electronics Market?

The growth in the auto electronics market is driven by several key factors, including increasing consumer demand for safety and convenience features, the rise of electric and autonomous vehicles, and regulatory requirements for emissions and safety. Consumer demand for advanced safety and convenience features is a primary driver, as buyers increasingly expect vehicles to be equipped with ADAS, infotainment systems, and connectivity features. Safety systems that detect and prevent collisions, such as automatic emergency braking, lane-keeping assist, and adaptive headlights, have become crucial for drivers who prioritize safety. Infotainment and connectivity options, which allow drivers to integrate smartphones, access GPS navigation, and stream media, have also become standard expectations. This demand is especially strong in developed markets where consumers view advanced electronics as essential to the driving experience.The rise of electric and autonomous vehicles is another significant driver, as these vehicles rely on sophisticated electronic systems for core functionalities. Electric vehicles require specialized electronics for battery management, energy storage, and motor control to maximize efficiency and range. Autonomous vehicles depend heavily on electronic systems for perception, navigation, and decision-making, using sensors, cameras, and AI algorithms to operate safely without driver intervention. As the shift toward electric and autonomous vehicles accelerates, the demand for advanced, reliable auto electronics will grow, supporting the transition to sustainable and autonomous transportation.

Regulatory requirements for emissions and safety are also propelling the auto electronics market. Emission standards, such as Euro 6 in Europe and CAFE standards in the United States, require automakers to reduce fuel consumption and lower greenhouse gas emissions, driving the adoption of electronic control systems that optimize engine performance. Additionally, safety regulations mandate features like electronic stability control, airbags, and backup cameras, making certain electronic systems mandatory in many markets. As regulations become more stringent globally, automakers are integrating advanced electronics to ensure compliance and enhance vehicle safety. The impact of these regulations on the auto electronics market is significant, as compliance requires ongoing innovation in emissions and safety technology.

Together, these drivers - consumer demand for advanced features, the rise of electric and autonomous vehicles, and regulatory requirements - are fueling growth in the auto electronics market. As the automotive industry evolves, electronics will play an increasingly central role, shaping the future of vehicle performance, safety, and sustainability across global markets.

Report Scope

The report analyzes the Auto Electronics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Current Carrying Devices, Electronic Control Unit, Sensors, Other Types); Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); Application (Infotainment Application, Body Electronics Application, Powertrain Application, Safety Systems Application, ADAS Application, Other Applications).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Auto Electronics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Auto Electronics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Auto Electronics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aptiv PLC, Broadcom, Inc., Continental AG, Delta Electronics, Inc., Denso Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Auto Electronics market report include:

- Aptiv PLC

- Broadcom, Inc.

- Continental AG

- Delta Electronics, Inc.

- Denso Corporation

- EDIBON

- Henkel Corporation

- Hitachi Astemo Ltd.

- Infineon Technologies AG

- Keetronics (India) Pvt., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aptiv PLC

- Broadcom, Inc.

- Continental AG

- Delta Electronics, Inc.

- Denso Corporation

- EDIBON

- Henkel Corporation

- Hitachi Astemo Ltd.

- Infineon Technologies AG

- Keetronics (India) Pvt., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | February 2026 |

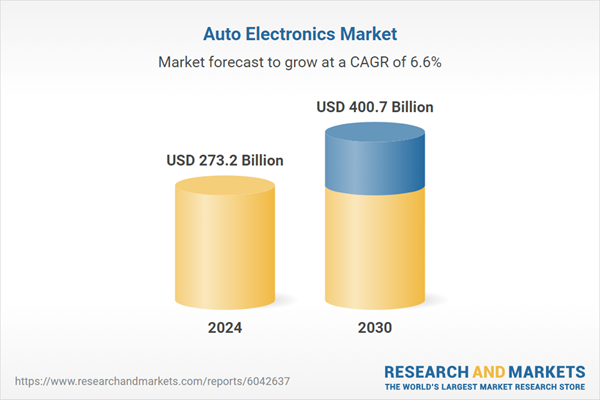

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 273.2 Billion |

| Forecasted Market Value ( USD | $ 400.7 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |