Global Smart Finance Connectivity Market - Key Trends & Drivers Summarized

How Is Technology Transforming Financial Connectivity?

The emergence of smart finance connectivity is revolutionizing the financial landscape, offering seamless and efficient solutions for consumers and businesses alike. At its core, smart finance connectivity leverages technologies like blockchain, artificial intelligence (AI), and the Internet of Things (IoT) to enable real-time, secure, and interconnected financial systems. With these advancements, traditional financial processes such as banking, payments, and asset management have transitioned into digital-first experiences, allowing users to manage their finances with unprecedented ease and transparency.Blockchain technology has been a particularly transformative force, fostering trust and transparency in financial transactions through decentralized ledgers. AI-powered financial tools are enabling predictive analytics and fraud detection, ensuring smoother operations for financial institutions. Additionally, IoT-enabled devices are driving innovations in connected payment systems, allowing transactions to occur across wearable devices, smart appliances, and even connected vehicles. These technological innovations are not only reshaping user experiences but also driving greater operational efficiency across the financial ecosystem.

Why Are Businesses and Consumers Embracing Smart Financial Systems?

The adoption of smart finance connectivity is growing rapidly as businesses and consumers recognize its potential to simplify complex financial processes. For enterprises, these systems offer real-time financial insights that enhance decision-making and optimize cash flow management. Businesses can streamline supply chain operations through interconnected financial platforms, ensuring faster and more reliable transactions with suppliers and partners. Additionally, smart finance tools are enabling dynamic pricing strategies and personalized financial solutions, helping companies adapt to ever-changing market conditions.For consumers, the appeal of smart finance connectivity lies in its convenience and accessibility. Digital wallets, contactless payment solutions, and AI-driven budgeting tools have become integral to modern lifestyles. The ability to access financial services through mobile apps, wearables, and voice-activated assistants ensures that users can manage their finances anytime and anywhere. Moreover, the rise of peer-to-peer (P2P) lending platforms, powered by smart finance connectivity, has opened new avenues for individuals to access credit outside traditional banking systems. These developments underscore how smart finance connectivity is empowering both businesses and consumers in the digital age.

How Is Regulation Shaping the Future of Smart Finance Connectivity?

Regulation is playing a crucial role in shaping the growth and development of smart finance connectivity, balancing innovation with the need for security and compliance. Governments and financial regulators worldwide are implementing frameworks to ensure the safe and ethical use of emerging technologies in the financial sector. In regions like North America and Europe, stringent data privacy laws such as GDPR and CCPA have led to the adoption of robust encryption and cybersecurity measures within smart finance platforms. These regulations are critical for fostering consumer trust and safeguarding sensitive financial data.Emerging markets, particularly in Asia-Pacific, are witnessing rapid advancements in smart finance connectivity due to supportive government policies and investments in digital infrastructure. Countries like India and China are spearheading initiatives to promote financial inclusion, leveraging smart finance systems to bring banking services to underbanked and unbanked populations. Furthermore, international organizations are collaborating to standardize cross-border payment systems, ensuring smoother global transactions. This regulatory push is enabling the global smart finance connectivity market to expand sustainably while minimizing risks.

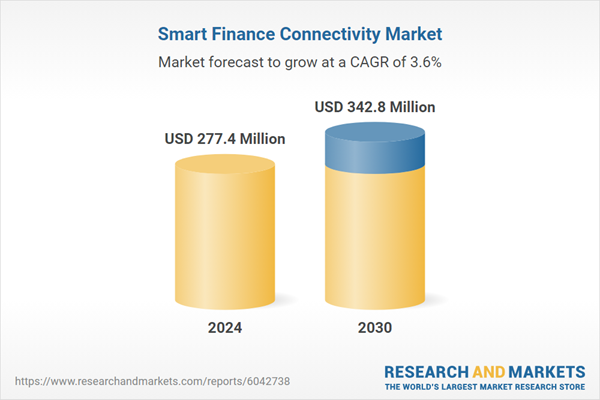

What Is Driving Growth in the Smart Finance Connectivity Market?

The growth in the smart finance connectivity market is driven by several factors, including technological advancements, evolving consumer expectations, and the increasing need for efficient financial solutions. The rapid proliferation of digital payment platforms, fueled by IoT and AI technologies, has been a key driver. As consumers demand faster, more personalized financial services, businesses are investing heavily in connected finance tools to meet these expectations. Additionally, the rise of e-commerce and digital ecosystems has created a need for integrated financial systems that support seamless transactions and enhance customer experiences.The increasing adoption of blockchain technology in financial services is another significant driver, particularly for applications in cross-border payments, trade finance, and asset tokenization. Consumers are also shifting towards mobile-first banking, driven by the growing penetration of smartphones and mobile internet. Regional dynamics further influence the market, with Asia-Pacific leading in digital adoption due to government initiatives and a tech-savvy population. Meanwhile, developed markets like North America and Europe are focusing on innovations in cybersecurity and data analytics to enhance their financial systems. Together, these factors are paving the way for the smart finance connectivity market to grow steadily over the coming years.

Report Scope

The report analyzes the Smart Finance Connectivity market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Connectivity Type (Wireless Connectivity, Wired Connectivity); End-Use (Banks & Financial Institutions End-Use, Independent ATM Deployer End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wireless Connectivity segment, which is expected to reach US$221.3 Million by 2030 with a CAGR of a 3.9%. The Wired Connectivity segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $72.9 Million in 2024, and China, forecasted to grow at an impressive 3.5% CAGR to reach $55.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Finance Connectivity Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Finance Connectivity Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Finance Connectivity Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., GE Vernova, Holley Technology UK Ltd., Honeywell International, Inc., Iskraemeco d.d. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Smart Finance Connectivity market report include:

- BSO SC Limited

- Datablaze

- Diebold Nixdorf

- Digi International, Inc.

- Extreme Networks, Inc.

- IMS Evolve

- InHand Networks

- Milesight Technology Co., Ltd.

- Nupeak IT Solutions LLP

- OptConnect

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BSO SC Limited

- Datablaze

- Diebold Nixdorf

- Digi International, Inc.

- Extreme Networks, Inc.

- IMS Evolve

- InHand Networks

- Milesight Technology Co. , Ltd.

- Nupeak IT Solutions LLP

- OptConnect

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 277.4 Million |

| Forecasted Market Value ( USD | $ 342.8 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |