Global Identity and Access Management (IAM) in Healthcare Market - Key Trends & Drivers Summarized

How Is IAM Revolutionizing Security in Healthcare?

Identity and Access Management (IAM) is transforming healthcare security by addressing critical challenges related to data privacy, patient information security, and regulatory compliance. The healthcare sector handles vast amounts of sensitive data, including patient records, treatment histories, and billing information, making it a prime target for cyberattacks. IAM solutions play a vital role in safeguarding this data by ensuring that only authorized personnel can access it. These systems use multifactor authentication, role-based access control, and advanced encryption to protect sensitive information and prevent unauthorized access.IAM also streamlines the onboarding and offboarding of healthcare staff, reducing the risk of security breaches caused by improper handling of access credentials. With single sign-on (SSO) capabilities, healthcare professionals can access multiple applications securely without compromising efficiency. Moreover, IAM systems enhance interoperability by enabling secure sharing of patient information across healthcare networks. This not only improves care coordination but also ensures compliance with stringent data protection regulations, such as HIPAA and GDPR. As cyber threats in healthcare continue to evolve, IAM solutions are becoming indispensable for maintaining data integrity and trust.

Why Are Healthcare Providers Adopting IAM at an Accelerated Pace?

The adoption of IAM solutions in healthcare is accelerating due to the growing need for secure, efficient, and scalable access management systems. With the increasing digitization of healthcare services, including telemedicine and electronic health records (EHRs), healthcare providers are seeking IAM solutions to manage access across multiple platforms. These systems enable seamless user experiences while maintaining robust security measures, ensuring that healthcare organizations can operate efficiently in a digital-first environment.IAM also addresses the complexities of managing third-party access, such as contractors, vendors, and researchers, who require limited yet secure access to healthcare systems. By providing granular control over permissions and access levels, IAM solutions reduce the risk of data breaches and ensure that external parties only access the information necessary for their roles. Additionally, IAM systems support compliance audits by providing detailed logs and reports on access activities, simplifying the process of demonstrating adherence to regulatory requirements. These benefits highlight why IAM is becoming a cornerstone of modern healthcare IT infrastructure.

How Is Technology Enhancing the Capabilities of IAM Solutions?

Technological advancements are significantly enhancing the capabilities of IAM solutions in healthcare. Artificial intelligence (AI) and machine learning (ML) are being integrated into IAM systems to enable real-time threat detection and predictive analytics. These technologies can identify unusual access patterns, flag potential security breaches, and recommend corrective actions, adding an additional layer of security to healthcare networks.Blockchain technology is also making inroads into IAM by providing decentralized and tamper-proof identity verification systems. This ensures that patient identities are securely managed and reduces the risk of identity theft. Biometric authentication methods, such as fingerprint and facial recognition, are further improving the security and user experience of IAM systems. These technologies eliminate the need for passwords, which are often vulnerable to phishing and hacking attempts. Moreover, the adoption of cloud-based IAM solutions is enabling healthcare organizations to scale their security systems easily, ensuring that they can accommodate growing user bases and expanding IT ecosystems. These technological advancements are positioning IAM as a dynamic and future-proof solution for healthcare security.

What Factors Are Driving the Growth of the IAM in Healthcare Market?

The growth in the Identity and Access Management (IAM) in Healthcare market is driven by several factors, including the increasing frequency of cyberattacks, stringent data protection regulations, and the rapid digitization of healthcare services. The rise in telemedicine and remote patient monitoring has necessitated secure and seamless access to healthcare systems, further propelling the demand for IAM solutions. Healthcare providers are also adopting IAM to improve interoperability and ensure compliance with regulations such as HIPAA, GDPR, and CCPA.The growing adoption of EHRs and the need for secure data sharing across healthcare networks are significant drivers of IAM adoption. Additionally, advancements in IAM technologies, such as AI-powered threat detection, blockchain-based identity management, and biometric authentication, are making these solutions more effective and appealing to healthcare organizations. The emphasis on improving patient trust and safeguarding sensitive information has further fueled the adoption of IAM systems. As healthcare continues to embrace digital transformation, the role of IAM in ensuring security, efficiency, and compliance will only grow stronger.

Report Scope

The report analyzes the Identity and Access Management (IAM) in Healthcare market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Software Component, Services Component); Deployment (Cloud-based Deployment, On-Premise Deployment); End-Use (Hospitals & Clinics End-Use, Healthcare Payers End-Use, Life Sciences Companies End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$3.0 Billion by 2030 with a CAGR of a 16.7%. The Services Component segment is also set to grow at 20.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $462.6 Million in 2024, and China, forecasted to grow at an impressive 17.1% CAGR to reach $734.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Identity and Access Management (IAM) in Healthcare Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Identity and Access Management (IAM) in Healthcare Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Identity and Access Management (IAM) in Healthcare Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bauer Hockey, Brian's Custom Sports, CCM Hockey, Easton Hockey, Fischer Sports GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Identity and Access Management (IAM) in Healthcare market report include:

- CyberArk Software Ltd.

- Delinea

- Evidian SA

- Fortra

- Imprivata, Inc.

- LexisNexis Risk Solutions Group

- Okta, Inc.

- Ping Identity Corporation

- SailPoint Technologies Holdings, Inc.

- Veritis Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- CyberArk Software Ltd.

- Delinea

- Evidian SA

- Fortra

- Imprivata, Inc.

- LexisNexis Risk Solutions Group

- Okta, Inc.

- Ping Identity Corporation

- SailPoint Technologies Holdings, Inc.

- Veritis Group

Table Information

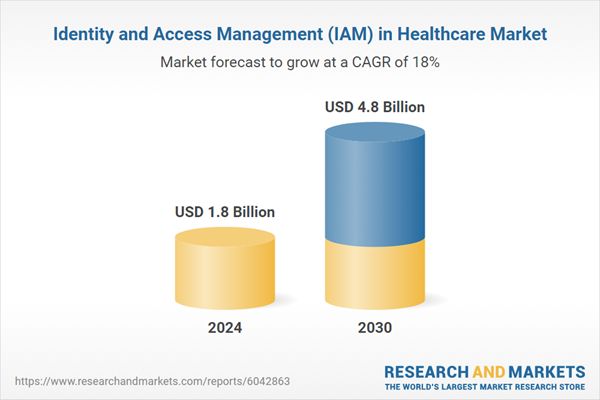

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 4.8 Billion |

| Compound Annual Growth Rate | 18.0% |

| Regions Covered | Global |