Global Healthcare Finance Solutions Market - Key Trends & Drivers Summarized

Why Are Finance Solutions Crucial for the Modern Healthcare Sector?

In today’ s rapidly evolving healthcare landscape, finance solutions have become a cornerstone for operational sustainability and growth. Healthcare providers are facing increasing financial pressures due to rising patient demands, escalating operational costs, and evolving regulatory requirements. Healthcare finance solutions address these challenges by offering tailored tools and services to optimize financial operations, enhance cash flow, and ensure fiscal stability. One of the most significant trends driving the adoption of healthcare finance solutions is the growing shift toward value-based care. As providers transition from fee-for-service models to outcomes-based care, there is a critical need to align financial strategies with patient outcomes. Finance solutions enable healthcare organizations to manage this transition by integrating revenue cycle management, cost accounting, and predictive financial analytics into a unified platform. Another key factor is the increasing complexity of healthcare payments. With multiple payers, insurance schemes, and reimbursement models in place, finance solutions provide automated billing and coding systems to reduce errors, improve collection rates, and streamline payment processes. Additionally, the need for compliance with stringent regulations such as HIPAA and the Affordable Care Act has made finance solutions indispensable for mitigating financial risks and ensuring adherence to legal standards.How Are Technological Advancements Transforming the Landscape?

The integration of cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and blockchain is revolutionizing healthcare finance solutions. AI-powered systems are enabling real-time analysis of financial data, providing actionable insights to optimize revenue cycles and predict financial outcomes. For instance, machine learning algorithms can detect patterns in billing errors, reducing the risk of claim denials and improving reimbursement timelines. Blockchain technology is emerging as a game-changer, particularly in enhancing transparency and security in healthcare transactions. By creating tamper-proof records of financial activities, blockchain reduces the risks of fraud and ensures accountability across stakeholders. Moreover, it facilitates secure and seamless data sharing between payers, providers, and patients, thereby improving overall financial coordination. Cloud-based finance solutions are gaining significant traction due to their scalability, flexibility, and cost-effectiveness. These platforms allow healthcare organizations to access financial tools and analytics remotely, ensuring business continuity and adaptability in dynamic market conditions. Additionally, the integration of robotic process automation (RPA) is automating repetitive financial tasks such as invoice processing and payment reconciliations, freeing up resources for strategic financial planning.What Is Driving the Demand for Healthcare Finance Solutions Across Segments?

The demand for healthcare finance solutions spans a wide range of applications, with hospitals, clinics, and diagnostic laboratories being the primary adopters. Hospitals, as the largest end-users, require robust financial systems to manage extensive workflows, from patient admissions and billing to supply chain management and payroll. Finance solutions enable hospitals to optimize these processes, reduce overhead costs, and improve financial transparency. Outpatient clinics and diagnostic laboratories are also significant contributors to market growth. These smaller healthcare entities are adopting finance solutions to automate billing, manage patient payments, and ensure regulatory compliance. As the trend toward decentralized healthcare delivery gains momentum, these solutions are becoming essential for maintaining operational efficiency in distributed care models. Geographically, North America remains the leading market for healthcare finance solutions due to its advanced healthcare infrastructure and higher adoption rates of digital technologies. However, emerging economies in Asia-Pacific are witnessing rapid growth, driven by increasing healthcare investments, government-led digitization initiatives, and the rising burden of chronic diseases. As healthcare providers in these regions scale their operations, the demand for integrated finance solutions is expected to surge.What Drives Growth in the Healthcare Finance Solutions Market?

The growth in the Healthcare Finance Solutions market is driven by several factors, including the rising complexity of healthcare payments and the growing adoption of value-based care models. The need to navigate intricate reimbursement processes and manage multiple payer systems has heightened the demand for advanced financial tools. Additionally, the increasing prevalence of chronic diseases and aging populations globally has placed financial strain on healthcare providers, further driving the adoption of solutions that enhance cost efficiency and optimize resource allocation. Technological advancements, such as AI-driven analytics and blockchain-based security systems, are playing a pivotal role in the market’ s growth. These technologies enable healthcare organizations to automate manual financial processes, reduce errors, and gain real-time insights into their fiscal performance. Consumer behavior is another important factor, with patients increasingly expecting transparent billing and flexible payment options. Finance solutions that offer user-friendly patient portals and customizable payment plans are becoming essential for improving patient satisfaction and loyalty. Furthermore, the global push toward healthcare digitization and the integration of electronic health records (EHRs) with financial systems is streamlining financial workflows and enhancing data interoperability. This integration is critical for enabling seamless communication between clinical and financial teams, ensuring that financial strategies are aligned with patient care objectives. These combined drivers underscore the growing importance of healthcare finance solutions in building resilient and efficient healthcare ecosystems.Report Scope

The report analyzes the Healthcare Finance Solutions market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Equipment & Technology Finance Services, Project Finance Solutions, Working Capital Finance Services, Corporate Lending Services).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Equipment & Technology Finance segment, which is expected to reach US$114.6 Billion by 2030 with a CAGR of a 8.3%. The Project Finance Solutions segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $39.5 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $36.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Healthcare Finance Solutions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Healthcare Finance Solutions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Healthcare Finance Solutions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Appinventiv, Aptean, CleverDev Software, Deloitte Touche Tohmatsu Ltd., Elinext IT Solutions Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Healthcare Finance Solutions market report include:

- Commerce Bank

- De Lage Landen International BV

- First Citizens Bancshares, Inc.

- GE Healthcare

- Koninklijke Philips NV

- Oxford Finance LLC

- Siemens AG

- SLR Healthcare ABL

- Stryker Corporation

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Commerce Bank

- De Lage Landen International BV

- First Citizens Bancshares, Inc.

- GE Healthcare

- Koninklijke Philips NV

- Oxford Finance LLC

- Siemens AG

- SLR Healthcare ABL

- Stryker Corporation

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 106 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

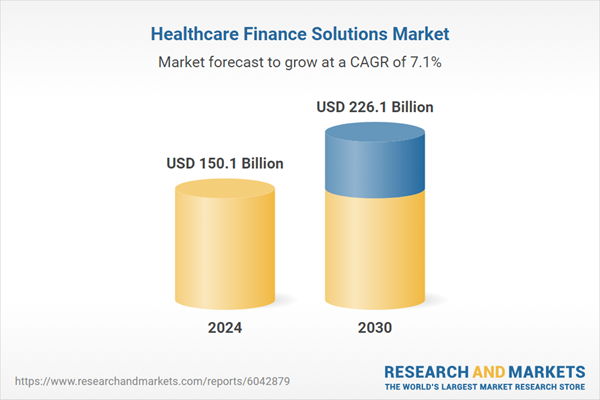

| Estimated Market Value ( USD | $ 150.1 Billion |

| Forecasted Market Value ( USD | $ 226.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |