Global Generative Artificial Intelligence in Fintech Market - Key Trends & Drivers Summarized

How Is Generative AI Reshaping the Fintech Landscape?

Generative Artificial Intelligence (AI) is revolutionizing the fintech landscape by enabling financial institutions and tech-driven companies to deliver faster, smarter, and more tailored services. The use of generative AI in fintech spans a wide range of applications, from streamlining fraud detection systems to optimizing investment strategies. For instance, generative AI models analyze massive volumes of transactional and behavioral data to identify anomalies, flagging potential fraud with greater accuracy than traditional systems. In wealth management, robo-advisors equipped with generative AI dynamically adjust portfolios based on real-time market trends and user-specific goals, democratizing access to sophisticated investment tools for retail investors. Additionally, generative AI enhances customer engagement by powering intelligent chatbots and virtual assistants capable of understanding natural language, resolving queries, and providing financial advice. These systems adapt over time, delivering increasingly personalized and precise responses. Fintech companies are also leveraging AI to automate complex back-office functions such as reconciliation, compliance reporting, and underwriting. This combination of enhanced operational efficiency and customer-centric innovation is transforming the fintech sector, making financial services more accessible, secure, and adaptive to the needs of modern consumers.What Technological Advancements Are Driving AI Adoption in Fintech?

The rapid adoption of generative AI in fintech is underpinned by groundbreaking technological advancements that have expanded the capabilities of artificial intelligence. Transformer-based architectures, such as GPT, and advanced neural networks have made it possible for generative AI to process vast datasets and produce insightful predictions and models with exceptional precision. Cloud computing has played a critical role in scaling AI deployment, allowing fintech firms to access powerful AI tools without requiring significant investments in on-premise infrastructure. Moreover, blockchain technology, in tandem with generative AI, is enhancing the transparency and security of financial systems, revolutionizing areas such as smart contracts, digital asset management, and decentralized finance (DeFi). High-performance computing (HPC) has also enabled real-time processing of financial data, which is essential for activities such as algorithmic trading and dynamic pricing. Additionally, advancements in natural language processing (NLP) are enabling AI systems to interpret and generate complex financial documents, regulatory filings, and customer communications with human-like fluency. These technological breakthroughs are not just reshaping operational capabilities but also enabling fintech companies to innovate at an unprecedented pace, redefining the future of financial services.How Is Generative AI Shaping Industry Practices and Customer Experiences?

Generative AI is transforming industry practices in fintech by automating manual processes, enhancing decision-making, and delivering hyper-personalized customer experiences. In the payments sector, AI is optimizing transaction security, reducing fraud risks, and enabling real-time processing of large volumes of payments, benefiting both businesses and consumers. In lending, generative AI is revolutionizing credit scoring and underwriting by analyzing diverse datasets, including non-traditional metrics such as social and behavioral data, to assess creditworthiness with greater accuracy. This capability is expanding financial inclusion by enabling access to loans for underserved populations. Wealth management is also undergoing a transformation as AI-driven tools generate tailored investment strategies, analyze market data, and provide continuous portfolio optimization. Moreover, generative AI is streamlining compliance processes, automating the generation of regulatory reports and ensuring adherence to complex financial regulations across multiple jurisdictions. The introduction of personalized financial advisory services, powered by generative AI, is empowering customers with actionable insights and intuitive user experiences. These applications demonstrate how generative AI is not only enhancing operational efficiency but also reshaping the way customers interact with financial services, fostering trust, loyalty, and satisfaction.What Are the Key Growth Drivers Behind the Market’ s Expansion?

The growth in the generative artificial intelligence in fintech market is driven by a confluence of technological innovation, market demands, and shifting consumer behaviors. One of the primary drivers is the increasing need for personalized financial solutions, with consumers expecting services tailored to their specific needs and circumstances. Generative AI’ s ability to analyze behavioral and transactional data is enabling fintech firms to meet these expectations with precision. Additionally, the growing sophistication of cyber threats has made AI-driven fraud detection and prevention tools indispensable, as they can simulate attack scenarios and provide proactive risk mitigation. Regulatory compliance requirements are also spurring AI adoption, with generative AI streamlining complex processes like Anti-Money Laundering (AML) and Know Your Customer (KYC) checks. The rise of digital-first banking, mobile financial platforms, and decentralized finance (DeFi) is further accelerating demand for secure, scalable, and intelligent AI-powered systems. Consumer trends such as the preference for real-time transactions and self-service platforms are compelling fintech companies to innovate continuously. Collectively, these drivers highlight the transformative role of generative AI in fintech, positioning the market for robust growth and a redefinition of financial services in the coming years.Report Scope

The report analyzes the Generative Artificial Intelligence in Fintech market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Fintech Software, Fintech Services); Deployment (On-Premise Deployment, Cloud-based Deployment); Application (Compliance & Fraud Detection Application, Predictive Analysis Application, Asset Management Application, Insurance Application, Personal Assistants Application, Business Analytics & Reporting Application, Other Applications); End-Use (Investment Banking End-Use, Retail Banking End-Use, Stock Trading Firms End-Use, Hedge Funds End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$7.5 Billion by 2030 with a CAGR of a 34.6%. The Services Component segment is also set to grow at 37% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $515.6 Million in 2024, and China, forecasted to grow at an impressive 33.7% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Generative Artificial Intelligence in Fintech Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Generative Artificial Intelligence in Fintech Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Generative Artificial Intelligence in Fintech Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alphasense Inc., Amazon Web Services, Inc., DataRobot, Inc., Ernst & Young Global Ltd., Google Cloud and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 25 companies featured in this Generative Artificial Intelligence in Fintech market report include:

- Azilen Technologies

- Coherent Solutions

- Genie AI

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Mostly AI

- OpenAI

- Rishabh Software

- Salesforce, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Azilen Technologies

- Coherent Solutions

- Genie AI

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Mostly AI

- OpenAI

- Rishabh Software

- Salesforce, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

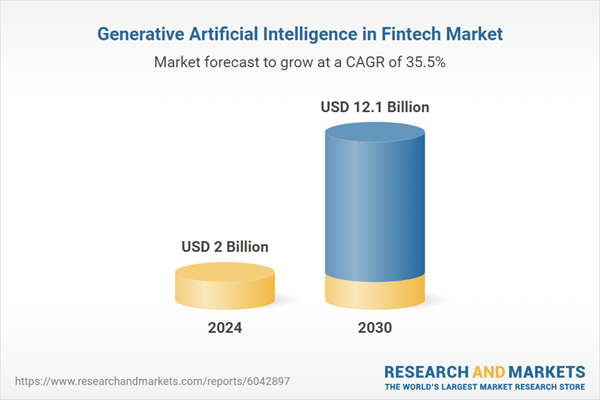

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 12.1 Billion |

| Compound Annual Growth Rate | 35.5% |

| Regions Covered | Global |