Global Four Wheel Drive (4WD) Vehicles Market - Key Trends and Drivers Summarized

Why Are Four Wheel Drive (4WD) Vehicles Becoming More Popular?

Four Wheel Drive (4WD) vehicles have gained significant popularity in recent years, thanks to their enhanced off-road capabilities and superior traction. These vehicles distribute power to all four wheels simultaneously, making them ideal for challenging terrains and adverse weather conditions. While traditionally favored by off-road enthusiasts and those living in rural areas, 4WD vehicles have entered mainstream markets as urban consumers recognize their versatility and reliability. The advent of advanced driver-assistance systems (ADAS) and integrated technologies in 4WD models has further fueled demand. Automakers are also expanding their offerings, introducing more fuel-efficient and eco-friendly 4WD vehicles to appeal to environmentally conscious buyers. With their unique ability to navigate snow, mud, and rocky landscapes, 4WD vehicles have become a must-have for adventure seekers and drivers in unpredictable climates.Which Segments Are Driving the Four Wheel Drive (4WD) Market?

Vehicle types include SUVs, trucks, and luxury vehicles, with SUVs dominating the market due to their rising popularity among families and young professionals. Pickup trucks are also a significant segment, especially in North America, where they are valued for both work and leisure purposes. Drivetrain technologies vary between part-time 4WD, which allows drivers to switch between two-wheel and four-wheel modes, and full-time 4WD, which continuously powers all wheels. Part-time 4WD systems are preferred for their fuel efficiency, while full-time 4WD systems offer enhanced stability and control. Applications range from off-road adventures to utility and emergency services. The growing demand for adventure tourism and the rise in recreational activities have further propelled the market for off-road-capable vehicles.What Are the Emerging Trends in 4WD Technology?

Several technological advancements and market trends are reshaping the 4WD vehicle industry. The integration of hybrid and electric drivetrains in 4WD systems is a significant trend, addressing the growing demand for eco-friendly vehicles. Automakers are developing electric 4WD models that offer the same rugged performance as traditional vehicles while reducing carbon emissions. Another trend is the use of lightweight materials, such as aluminum and high-strength steel, to improve vehicle fuel efficiency without compromising durability. Advanced traction control systems and torque vectoring technologies are also being integrated to enhance vehicle stability and safety. The use of AI and machine learning in predictive maintenance and terrain response systems is transforming how drivers interact with 4WD vehicles, making off-roading safer and more intuitive. Furthermore, the rise of smart infotainment systems and connectivity features has made 4WD vehicles more appealing to tech-savvy consumers.What Factors Are Driving the Growth in the Four Wheel Drive (4WD) Vehicles Market?

The growth in the 4WD vehicle market is driven by several factors, including advancements in drivetrain technology, increasing consumer preference for SUVs, and the expansion of adventure tourism. One of the main drivers is the growing demand for versatile vehicles that can perform well in both urban and off-road environments. The rising awareness of safety features has also contributed to market growth, as 4WD vehicles offer enhanced stability and control. Technological innovations, such as the development of hybrid and electric 4WD models, have made these vehicles more attractive to eco-conscious buyers. The surge in outdoor recreational activities, fueled by a global trend toward adventure and exploration, has further boosted sales of off-road-capable vehicles. Additionally, the construction and agriculture sectors continue to rely heavily on 4WD trucks and utility vehicles, driving demand in these industries. Lastly, government incentives for cleaner and more efficient vehicles have encouraged automakers to invest in advanced 4WD technologies.Report Scope

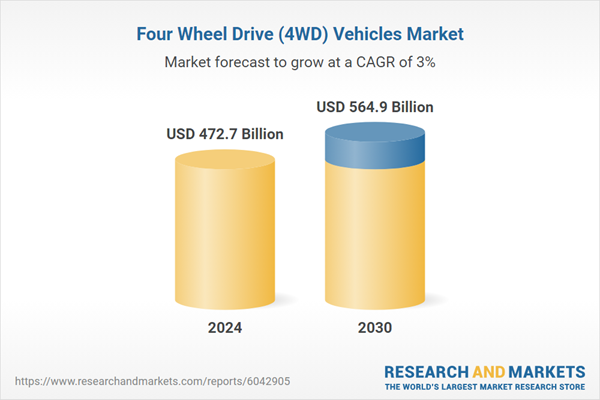

The report analyzes the Four Wheel Drive (4WD) Vehicles market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (SUVs & Crossovers, Pickup Trucks, Premium & Luxury Sedans).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the SUVs & Crossovers segment, which is expected to reach US$288.4 Billion by 2030 with a CAGR of a 3.3%. The Pickup Trucks segment is also set to grow at 2.9% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Four Wheel Drive (4WD) Vehicles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Four Wheel Drive (4WD) Vehicles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Four Wheel Drive (4WD) Vehicles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BMW Group (Bayerische Motoren Werke AG), Force Motors Ltd., Ford Motor Co., Hyundai Motor Company, Isuzu Motors Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 49 companies featured in this Four Wheel Drive (4WD) Vehicles market report include:

- BMW Group (Bayerische Motoren Werke AG)

- Force Motors Ltd.

- Ford Motor Co.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Jaguar Land Rover Automotive PLC

- Mahindra & Mahindra Ltd.

- Mitsubishi Motors Corporation

- Toyota Motor Corporation

- Volkswagen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BMW Group (Bayerische Motoren Werke AG)

- Force Motors Ltd.

- Ford Motor Co.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Jaguar Land Rover Automotive PLC

- Mahindra & Mahindra Ltd.

- Mitsubishi Motors Corporation

- Toyota Motor Corporation

- Volkswagen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 472.7 Billion |

| Forecasted Market Value ( USD | $ 564.9 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |