Europe's considerable revenue share in the stevia beverages market is a result of the region's stringent sugar content regulations and the growing demand for natural, plant-based beverages among consumers. Countries like Germany, the UK, and France have witnessed a surge in health-conscious consumers opting for stevia-based soft drinks, RTD teas, and functional beverages. Therefore, the Europe segment acquired 32% revenue share in the market in 2023. The European Food Safety Authority (EFSA) has significantly promoted sugar reduction initiatives, encouraging manufacturers to use stevia and other natural sweeteners. Additionally, the growth of European organic and premium beverage markets is fueling demand for clean-label, low-calorie beverage options, making stevia an attractive choice.

Regulatory approvals from international health and safety organizations have further validated the safety and effectiveness of stevia as a sugar substitute. Stevia has been certified for use in food and beverages by institutions such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the World Health Organization (WHO), which has further solidified its credibility and market acceptance. These endorsements have encouraged beverage companies to invest in stevia-based formulations, expanding their zero-sugar and diet beverage portfolios. Thus, the stevia beverages market is witnessing significant growth with increasing regulatory pressure on sugar reduction and the growing preference for natural, clean-label sweeteners. Additionally, rising e-commerce sales and enhanced retail availability have been instrumental in driving the growth of the stevia beverages market. Consumers now have unprecedented access to various stevia-infused drinks, aligning with their preferences for healthier, low-calorie options. Therefore, as digital and physical retail channels continue to evolve, the market for stevia beverages is poised for sustained expansion, meeting the demands of an increasingly health-conscious global population.

However, the challenge for beverage manufacturers lies in creating formulations that maintain the sweetness of stevia while masking or minimizing its undesirable aftertaste. However, achieving this balance can be difficult without incorporating additional sweeteners or taste enhancers. Many brands blend stevia with erythritol, monk fruit extract, or sugar alcohol to improve taste and mimic the mouthfeel of traditional sugar. Sometimes, artificial flavoring agents or botanical extracts are added to mask the bitterness, contradicting the clean-label trend many health-conscious consumers prefer. Furthermore, the aftertaste challenge is more pronounced in carbonated and dairy-based drinks, where stevia interacts differently with the acidity or fat content. Hence, these factors may hamper the growth of the market.

Driving and Restraining Factors

Drivers

- Rising Health Consciousness and Sugar Reduction Trends

- Favorable Government Regulations and Sugar Taxes

- Increasing E-commerce and Retail Availability

Restraints

- Issues Pertaining to Distinct Taste and Aftertaste

- Limited Consumer Awareness Regarding the Benefits of Stevia

Opportunities

- Technological Advancements in Stevia Extraction and Formulation

- Growth of Vegan and Plant-Based Diet Trends

Challenges

- Competition from Other Sweeteners

- Formulation Challenges in Carbonated and Dairy Beverages

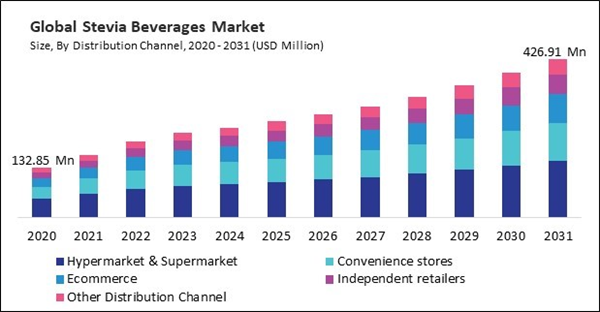

Distribution Channel Outlook

Based on distribution channel, the market is classified into hypermarket & supermarket, convenience stores, ecommerce, independent retailers, and others. The hypermarket & supermarket segment garnered 37% revenue share in the market in 2023. The segment dominates the stevia beverages market due to its widespread accessibility, extensive product variety, and promotional discounts that attract bulk buyers. Consumers prefer these large retail formats as they provide a one-stop shopping experience, allowing them to compare multiple brands and product types in a single visit. Additionally, strategic product placement in dedicated health sections and in-store promotions further drive consumer awareness and impulse purchases of stevia-based beverages.Application Outlook

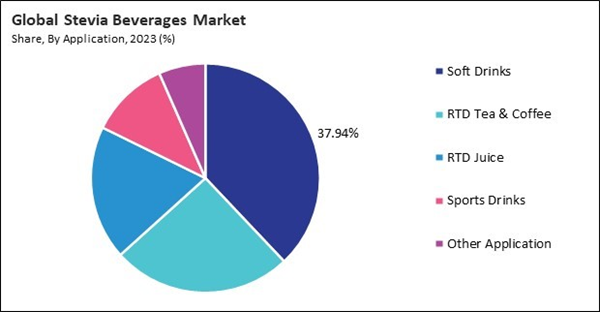

On the basis of application, the market is divided into soft drinks, RTD tea & coffee, RTD juice, sports drinks, and others. The RTD tea & coffee segment recorded 25% revenue share in the market in 2023. Consumers seeking natural, clean-label drinks are drawn to stevia-sweetened iced teas, herbal infusions, and cold brews, as they offer reduced sugar content without compromising taste. The growing popularity of organic and wellness-focused beverages has increased stevia-infused green teas, matcha drinks, and botanical-infused RTD teas. Additionally, stevia-based RTD coffee products, such as sugar-free lattes and iced mochas, have gained momentum among health-conscious and keto-friendly consumers, further boosting market demand.Type Outlook

By type, the market is segmented into powder, liquid, and others. The powder segment witnessed 45% revenue share in the market in 2023. The powder segment is growing due to its high concentration of sweetness, cost-effectiveness, and extended shelf life, which make it a preferred choice for both consumers and beverage manufacturers. Powdered stevia is easy to store, transport, and blend into dry beverage formulations, such as instant teas, powdered drink mixes, and coffee sweeteners. Additionally, it is widely used in bulk beverage production because of its stability and ability to maintain sweetness without altering texture. The increasing adoption of stevia powder for home use in coffee, tea, and homemade health drinks further strengthens its dominance in the market.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 35% revenue share in the market in 2023. Consumers in the U.S. and Canada actively shift toward low-calorie and sugar-free beverage options, driving demand for stevia-sweetened sodas, energy drinks, and RTD teas. Additionally, government regulations and sugar taxes have encouraged beverage manufacturers to adopt natural alternatives like stevia in their formulations. The well-developed retail infrastructure, presence of major beverage brands, and growing awareness of clean-label products further contribute to the market's growth in this region.List of Key Companies Profiled

- PepsiCo, Inc.

- STEAZ

- The Coca Cola Company

- Zevia, LLC

- Nestle S.A.

- AriZona Beverages Company LLC

- Hint Water, Inc.

- Polar Beverages, Inc.

- Green Cola

Market Report Segmentation

By Distribution Channel

- Hypermarket & Supermarket

- Convenience stores

- Ecommerce

- Independent retailers

- Other Distribution Channel

By Application

- Soft Drinks

- RTD Tea & Coffee

- RTD Juice

- Sports Drinks

- Other Application

By Type

- Powder

- Liquid

- Other Type

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- PepsiCo, Inc.

- STEAZ

- The Coca Cola Company

- Zevia, LLC

- Nestle S.A.

- AriZona Beverages Company LLC

- Hint Water, Inc.

- Polar Beverages, Inc.

- Green Cola