The presence of major telecom providers like AT&T, Verizon, and T-Mobile, along with leading cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, has fueled the demand for high-capacity optical transport networks. Additionally, the region is witnessing large-scale investments in AI-driven automation, software-defined networking (SDN), and fiber-optic backhaul for 5G. Government initiatives such as the U.S. Broadband Infrastructure Program and Canada’s Universal Broadband Fund further accelerate fiber-optic deployments, making ROADM WSS technology crucial for managing network scalability and spectral efficiency. Thus, the North America segment recorded 36% revenue share in the market in 2023.

The increasing reliance on high-capacity optical networks is driven by the rapid growth of 5G, cloud computing, and hyperscale data centers. As data consumption surges across industries, traditional network infrastructures face challenges meeting bandwidth demands. Hence, these factors will drive the growth of the market.

Additionally, Traditional static network infrastructures struggle to keep up with increasing data traffic, cloud computing demands, and the expansion of 5G networks. SDN offers a programmable, flexible, and automated approach to network management, allowing operators to dynamically adjust bandwidth, reroute traffic, and optimize network resources in real-time. Thus, as the demand for scalable, self-healing optical networks grows, ROADM WSS solutions will play a pivotal role in enabling future-proof, intelligent optical networking.

However, the implementation of ROADM WSS technology demands significant financial commitment, making it a substantial barrier to widespread adoption. Optical network providers must invest in cutting-edge equipment, including advanced switching components, optical amplifiers, and monitoring systems, all of which come at a high cost. Hence, these factors may hamper the growth of the market.

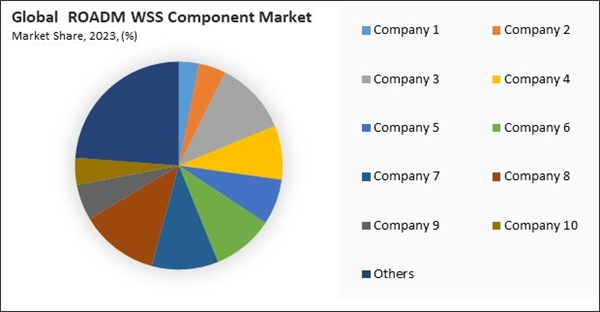

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Rising Demand for High-Capacity Optical Networks

- Demand for Dynamic and Software-Defined Networking (SDN)

- Expansion of 5G and IoT Infrastructure

Restraints

- High Initial Investment & Deployment Costs

- Complexity in Network Integration with Existing Optical Networks

Opportunities

- Adoption of Coherent Optical Technologies

- Supportive Government Initiatives and Regulations

Challenges

- Limited Awareness & Adoption in Developing Regions

- High Power Consumption & Heat Dissipation Issues

Type Outlook

By type, the market is divided into wavelength selective switches (WSS), edge ROADMs, blocker-based, and PLC-based. The edge ROADMs segment garnered 25% revenue share in the market in 2023. As service providers expand their metro and regional optical networks, edge ROADMs are increasingly deployed to optimize bandwidth, improve network resilience, and enable cost-effective traffic management.Application Outlook

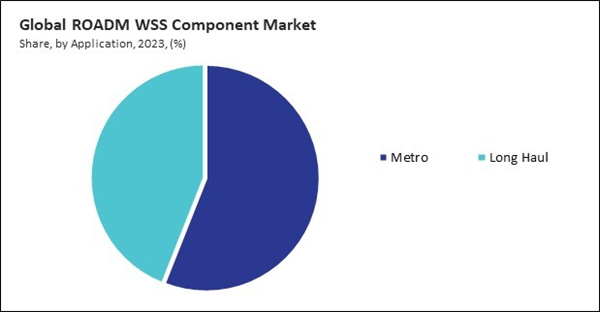

Based on application, the market is segmented into metro and long haul. The metro segment procured 56% revenue share in the market in 2023. The rising demand for high-speed, low-latency connectivity in urban and regional networks primarily drives the metro segment. With the expansion of 5G infrastructure, smart cities, and enterprise cloud services, telecom operators are increasingly investing in metro optical networks to manage growing data traffic efficiently.Node Outlook

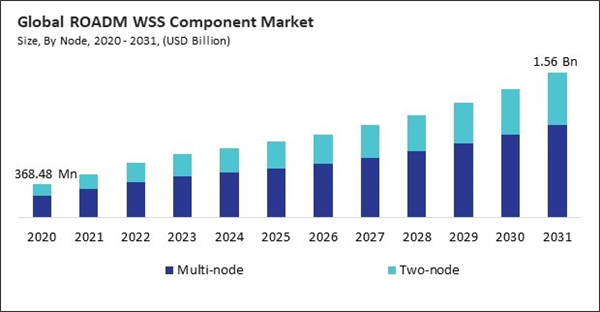

Based on node, the market is bifurcated into multi-node and two-node. The multi-node segment garnered 66% revenue share in the market in 2023. Network operators require flexible and dynamic wavelength management solutions as global data traffic surges due to the expansion of 5G, IoT, AI-driven applications, and hyperscale data centers.End Use Outlook

On the basis of end use, the market is classified into communication and others. The others segment recorded 25% revenue share in the market in 2023. Many industries outside traditional telecommunications leverage ROADM WSS technology for secure and high-bandwidth optical communications, particularly in mission-critical environments such as military communication networks and high-performance computing (HPC) data centers.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed 32% revenue share in the market in 2023. Countries like Germany, the U.K., and France invest heavily in fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) networks, supported by government programs such as the EU’s Digital Decade Strategy.List of Key Companies Profiled

- AC Photonics, Inc.

- Agiltron Inc.

- Cisco Systems, Inc.

- Coherent Corp.

- Fujitsu Limited

- NEC Corporation

- Corning Incorporated

- Ciena Corporation

- Molex, LLC (Koch Industries, Inc.)

- Keysight Technologies, Inc.

Market Report Segmentation

By Node

- Multi-node

- Two-node

By End Use

- Communication

- Other End Use

By Type

- Wavelength Selective Switches (WSS)

- Edge ROADMs

- Blocker-based

- PLC-based

By Application

- Metro

- Long Haul

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- AC Photonics, Inc.

- Agiltron Inc.

- Cisco Systems, Inc.

- Coherent Corp.

- Fujitsu Limited

- NEC Corporation

- Corning Incorporated

- Ciena Corporation

- Molex, LLC (Koch Industries, Inc.)

- Keysight Technologies, Inc.