Modern factories rely on real-time data processing, automation, and digital supply chain management, making uninterrupted power supply crucial for operational efficiency. Power disruptions can lead to equipment malfunctions, production downtime, and financial losses, making UPS solutions essential for ensuring process continuity and machine protection. The increasing integration of predictive maintenance, AI-driven analytics, and cloud-based manufacturing management is further fueling the need for advanced UPS systems with redundancy and high-power efficiency. Thus, the manufacturing segment garnered 15% revenue share in the market in 2023.

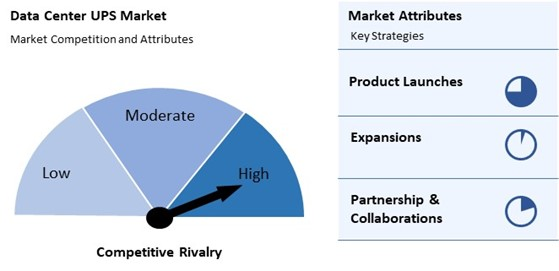

The major strategies followed by the market participants are Product Launch as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December, 2024, Schneider Electric SE unveiled the Galaxy VXL UPS, a modular system offering 500-1250kW capacity and up to 99% efficiency in eConversion mode. With a 52% smaller footprint and compatibility with Lithium-ion and VRLA batteries, it supports AI, data center, and industrial applications, ensuring reliability and peak load management. Additionally, In December, 2024, Vertiv Group Corp. launched the PowerUPS 9000, a compact, energy-efficient UPS system designed for high-density IT applications, offering up to 97.5% efficiency. With modular design, reduced footprint, and advanced features like hot-swappable components, it ensures reliable, continuous power protection. It supports AI applications and integrates with Vertiv’s predictive maintenance solutions.

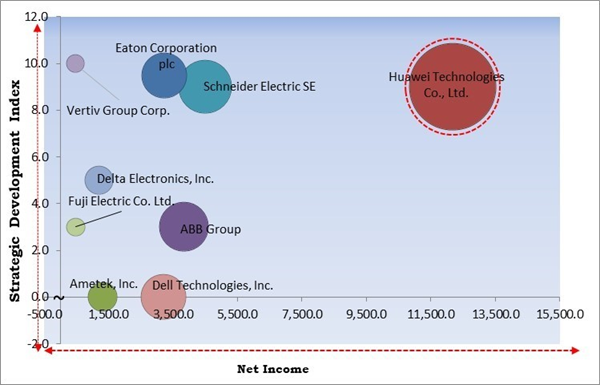

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Huawei Technologies Co., Ltd. is the forerunners in the Data Center UPS Market. In November, 2022, Huawei Technologies Co., Ltd unveiled two new solutions at FusionModule2000 6.0, a modular data center for small/medium-sized applications, and UPS2000-H, a compact UPS using SmartLi Mini. These innovations aim to enhance channel partners' competitiveness while promoting cost-effective, green digitalization for businesses in various sectors.Market Growth Factors

The global data center industry is expanding at an unprecedented pace, fueled by the rapid adoption of cloud computing, IoT, artificial intelligence (AI), and big data analytics. As businesses embrace data-driven decision-making, automation, and real-time analytics, the demand for reliable and scalable data center infrastructure has surged. Hence, with the exponential growth in AI computing, high-density workloads, and cloud adoption, the demand for next-generation, power-efficient data centers will continue to rise.Additionally, the increasing frequency of power outages, voltage fluctuations, and grid failures across various regions has significantly impacted industries reliant on uninterrupted power supply. As digital transformation accelerates, businesses, data centers, and IT infrastructure demand consistent power availability to prevent data loss, system crashes, and operational downtime. Thus, as the global digital economy expands, ensuring seamless and stable power supply through advanced UPS systems will remain a critical priority for industries worldwide.

Market Restraining Factors

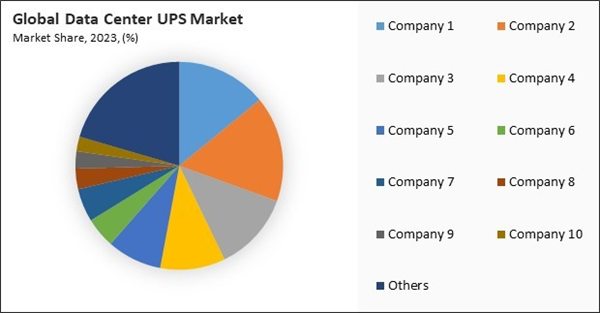

The procurement of high-capacity UPS units, along with associated infrastructure such as cooling systems, power distribution units (PDUs), and backup generators, requires large-scale financial commitments. These costs are further amplified by the need for customized installation based on the specific power requirements of data centers. Hence, high upfront costs, recurring maintenance expenses, and battery lifecycle limitations make UPS adoption challenging for businesses.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater to demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Increasing Demand for Data Centers

- Rising Power Outages & Grid Instability

- Rapid Advancements in UPS Technology

Restraints

- High Initial Investment and Maintenance Costs

- Limited Energy Efficiency and High Power Consumption

Opportunities

- Expansion of Edge Computing

- Rise in Colocation and Hyperscale Data Centers

Challenges

- Integration Challenges with Emerging Technologies

- Substantial Reliability and Performance Concerns

Data Center Size Outlook

By data center size, the market is divided into small data centers (20 kVA to 200 kVA), medium data centers (200.1 kVA to 500 kVA), and large data centers (more than 500 kVA). The small data centers (20 kVA to 200 kVA) segment witnessed 42% revenue share in the market in 2023. As businesses seek cost-effective and scalable solutions to support their IT needs, small data centers provide an ideal balance of performance and affordability.Setup Outlook

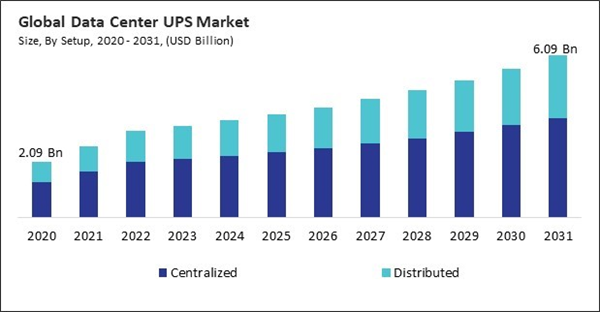

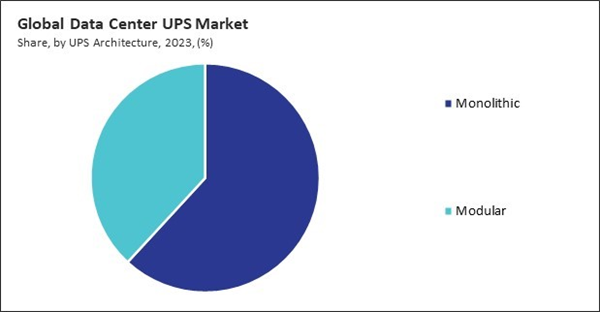

On the basis of UPS architecture, the market is classified into monolithic and modular. The modular segment recorded 38% revenue share in the market in 2023. With the increasing adoption of edge computing, hybrid cloud environments, and decentralized IT infrastructures, businesses require power solutions that dynamically adapt to changing workloads.UPS Architecture Outlook

On the basis of UPS architecture, the market is classified into monolithic and modular. The modular segment recorded 38% revenue share in the market in 2023. With the increasing adoption of edge computing, hybrid cloud environments, and decentralized IT infrastructures, businesses require power solutions that dynamically adapt to changing workloads.Product Outlook

Based on product, the market is segmented into double conversion, life interactive, and standby. The life interactive segment acquired 33% revenue share in the market in 2023. These systems are widely adopted in medium-sized data centers, colocation facilities, and edge computing environments, providing reliable backup power and improved battery efficiency.End Use Outlook

On the basis of end use, the market is classified into IT & telecommunications, energy, manufacturing, media & entertainment, government, BFSI, healthcare, and others. The IT & telecommunications segment recorded 22% revenue share in the market in 2023. Particularly with the proliferation of 5G networks and hyperscale data centers, the IT & telecommunications sector is being propelled by the growing demand for high-speed internet services, cloud computing, and data storage.Market Competition and Attributes

The Data Center UPS market is highly competitive, driven by the growing demand for reliable power backup solutions to ensure uninterrupted data center operations. Key players focus on innovations, offering energy-efficient and scalable solutions to address diverse customer needs. Market competition intensifies with advancements in modular UPS systems and the integration of smart technologies for real-time monitoring and management. Regional players also challenge established companies, catering to localized requirements. Overall, the market thrives on technological upgrades and customization to maintain competitiveness.

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment recorded 32% revenue share in the market in 2023. The regional market is driven by stringent energy efficiency regulations, growing investments in cloud infrastructure, and the expansion of data centers in key markets such as Germany, the UK, and France.Recent Strategies Deployed in the Market

- Jun-2024: Vertiv Group Corp. announced the partnership with Ballard Power Systems to demonstrate a hydrogen-powered fuel cell backup solution for data centers, scalable from 200kW to multiple MWs. The proof of concept, combining Ballard’s fuel cells with Vertiv’s UPS system, offers zero-emission, cost-effective, and scalable power for data center sustainability and growth.

- Dec-2023: Eaton Corporation plc unveiled the compact 93T UPS, offering stable power for mission-critical applications like server rooms and small data centers. With a 15 kVA to 80 kVA power rating, it integrates with Eaton Brightlayer digital solutions, enhancing performance and efficiency. The UPS offers a smaller footprint, higher efficiency, and reduced costs.

- Aug-2023: Eaton Corporation plc unveiled a 6 kVA lithium-ion version of its 9PX UPS. Targeted at Edge environments like education and retail, it’s 40% lighter than lead-acid models. The UPS boasts a lifespan of 8-10 years, extendable with additional batteries, and integrates with HCI and virtualization platforms.

- Jul-2023: ABB Group launched the MegaFlex DPA UPS, a sustainable, high-efficiency solution designed for data centers. Part of the ABB EcoSolutions portfolio offers compact design, up to 1.6 MW power, and 97.4% efficiency. It supports scalability, redundancy, and sustainability, aligning with India’s growing data center demands and digital infrastructure.

- Jul-2023: Schneider Electric SE unveiled Easy UPS 3-Phase Modular, a scalable, energy-efficient solution offering 50-250 kW capacity. With N+1 configuration, third-party verified Live Swap, intelligent battery management, and EcoStruxure support, it ensures reliability and protection for critical loads in data centers, commercial, and industrial applications while minimizing environmental impact.

List of Key Companies Profiled

- ABB Group

- Schneider Electric SE

- Eaton Corporation plc

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Delta Electronics, Inc.

- Altron a.s.

- Vertiv Group Corp.

- Dell Technologies, Inc.

- Ametek, Inc.

- Fuji Electric Co. Ltd.

Market Report Segmentation

By Setup

- Centralized

- Distributed

By UPS Architecture

- Monolithic

- Modular

By Data Center Size

- Small Data Centers (20 kVA to 200 kVA)

- Medium Data Centers (200.1 kVA to 500 kVA)

- Large Data Centers (More than 500 kVA)

By Product

- Double Conversion

- Line Interactive

- Standby

By End Use

- IT & Telecommunications

- Energy

- Manufacturing

- Media & Entertainment

- Government

- BFSI

- Healthcare

- Other End Use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- ABB Group

- Schneider Electric SE

- Eaton Corporation plc

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Delta Electronics, Inc.

- Altron a.s.

- Vertiv Group Corp.

- Dell Technologies, Inc.

- Ametek, Inc.

- Fuji Electric Co. Ltd.