The Asia Pacific segment witnessed 44% revenue share in the market in 2023. The regional market is driven by its leadership in consumer electronics and semiconductor manufacturing, with countries like China, Japan, South Korea, and Taiwan playing pivotal roles. The region's strong smartphone production capabilities, increasing adoption of smart home technologies, and rapid advancements in automotive electronics are key contributors to market growth.

The rapid global adoption of smartphones continues to drive the demand for advanced imaging solutions, with these sensors at the core of modern mobile photography. According to the International Telecommunication Union (ITU), over 5.3 billion people worldwide owned mobile phones in 2022, a figure expected to exceed 7.5 billion by 2026. By 2023, 78% of the global population aged 10 and older owned a mobile phone, highlighting the ubiquitous nature of these devices. Hence, as smartphone adoption continues to grow, with over three-quarters of the global population already owning mobile phones, the demand for CMOS sensors is set to expand.

Additionally, the ever-increasing focus on safety and security in various settings, including residential, commercial, and public spaces, has fueled the widespread adoption of these sensors in modern surveillance systems. With urbanization accelerating across the globe, cities are becoming densely populated hubs, leading to heightened concerns about crime, vandalism, and public safety. Thus, as security concerns continue to rise globally, the reliance on CMOS technology in surveillance systems is set to expand, playing a vital role in shaping safer communities and smarter cities worldwide.

However, The production of advanced CMOS image sensors involves intricate fabrication processes and cutting-edge technology, which significantly drive-up manufacturing costs. These sensors often require specialized materials, equipment, and rigorous quality control to ensure optimal performance, all of which add to their expense. As a result, the high production costs are reflected in the final price of the sensors, making them less affordable, especially in price-sensitive markets. Hence, high production costs and competition from CCD technology pose significant challenges to the growth of this market.

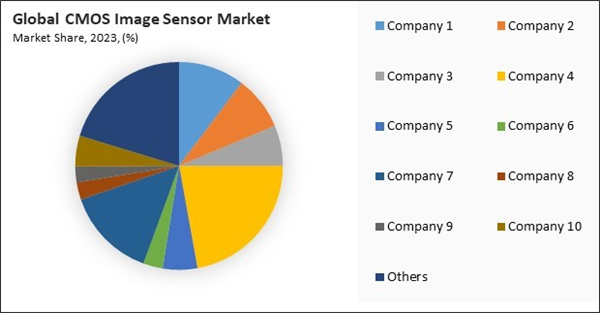

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Rising Demand For Smartphones

- Proliferation Of Security And Surveillance Systems

- Rapid Pace Of Technological Advancements

Restraints

- High Manufacturing Costs And Competition From CCD Technology

- Image Quality And Integration Limitations

Opportunities

- Demand For AR/VR And Gaming Applications

- Government Initiatives And Investments

Challenges

- Substantial Power Consumption Concerns

- Demand For Significant R&D Investments

Processing Technology Outlook

On the basis of processing technology, the market is classified into 3D and 2D. The 2D segment recorded 48% revenue share in the market in 2023. The 2D segment thrives on its widespread use in consumer electronics, including smartphones, laptops, and cameras, where capturing high-resolution images and videos remains a priority. Its cost-effectiveness and simplicity drive its adoption in surveillance, machine vision, and document scanning applications.End Use Outlook

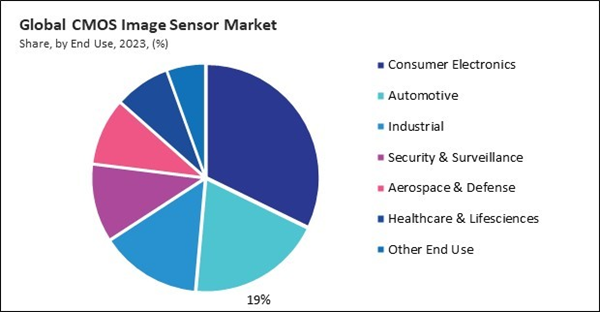

By end use, the market is divided into consumer electronics, automotive, industrial, security & surveillance, aerospace & defense, healthcare & lifesciences, and others. The automotive segment garnered 19% revenue share in the market in 2023. The automotive segment benefits from the increasing incorporation of CMOS sensors in advanced driver assistance systems (ADAS) and autonomous vehicle technologies. These sensors are pivotal for lane detection, collision avoidance, parking assistance, and enhancing vehicle safety and functionality.Resolution Outlook

Based on resolution, the market is segmented into above 16 MP, 5 MP to 12 MP, 12 MP to 16 MP, and up to 5 MP. The 5 MP to 12 MP segment recorded 31% revenue share in the market in 2023. The 5 MP to 12 MP segment thrives on its versatility and cost-effectiveness, making it a popular choice for mid-range smartphones, webcams, and IoT devices. This resolution range offers a balanced combination of quality and affordability, catering to various applications.Spectrum Outlook

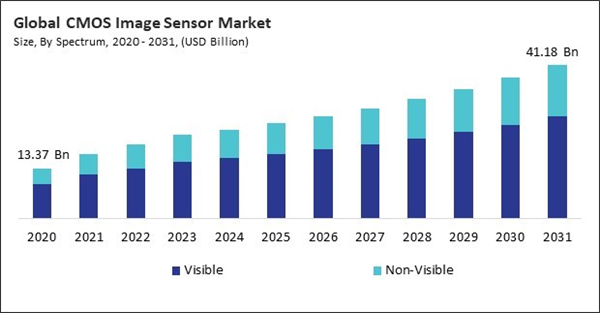

Based on spectrum, the market is bifurcated into visible and non-visible. The non-visible segment procured 32% revenue share in the market in 2023. The non-visible segment is propelled by its expanding applications in specialized fields, such as infrared and thermal imaging for surveillance, healthcare, and industrial monitoring. The growing emphasis on contactless technologies, including facial recognition and temperature screening during the pandemic, has significantly boosted the adoption of non-visible spectrum imaging.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 27% revenue share in the market in 2023. The North American segment's success is attributed to its dedication to innovation and the early incorporation of advanced technologies, particularly in the automotive, healthcare, and security sectors. The growing demand for CMOS sensors in autonomous vehicles, advanced driver assistance systems (ADAS), and medical imaging devices is a major driver in this region.List of Key Companies Profiled

- Panasonic Holdings Corporation

- Canon, Inc.

- OmniVision Technologies, Inc.

- Sony Corporation

- ON Semiconductor Corporation

- ams-OSRAM AG

- Samsung Electronics Co., Ltd. (Samsung Group)

- Hamamatsu Photonics K.K.

- PixArt Imaging, Inc.

- STMicroelectronics N.V.

Market Report Segmentation

By Spectrum

- Visible

- Non-Visible

By Processing Technology

- 3D

- 2D

By End Use

- Consumer Electronics

- Automotive

- Industrial

- Security & Surveillance

- Aerospace & Defense

- Healthcare & Lifesciences

- Other End Use

By Resolution

- Above 16 MP

- 5 MP to 12 MP

- 12 MP to 16 MP

- Up to 5 MP

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Panasonic Holdings Corporation

- Canon, Inc.

- OmniVision Technologies, Inc.

- Sony Corporation

- ON Semiconductor Corporation

- ams-OSRAM AG

- Samsung Electronics Co., Ltd. (Samsung Group)

- Hamamatsu Photonics K.K.

- PixArt Imaging, Inc.

- STMicroelectronics N.V.